-

EQUITY MARKETS MIXED AGAIN THIS WEEK AS TECH NAMES MAKE A BIG JUMP

THE SMALLER-CAPS LAG AND 1Q2023 GDP DISAPPOINTS

- It was another mixed week for equity markets, as the large-cap S&P 500, mega-cap DJIA and tech-laden NASDAQ all finished the final week of April in the green while the smaller-cap Russell 2000 and the developed-international markets (MSCI EAFE) finished in the red

- The biggest news on the week seemed to be related to earnings, as some of the big tech names generally reported favorable results, including Alphabet (Google), Microsoft, Meta Platforms (Facebook), and Amazon

- Google and Amazon declined a bit after their earnings report, mostly on future warnings from company executives, while Microsoft and Meta both jumped dramatically

- There was a decent amount of bank worries this week, as First Republic Bank announced an expected disappointing earnings report that showed their deposits were cut in half

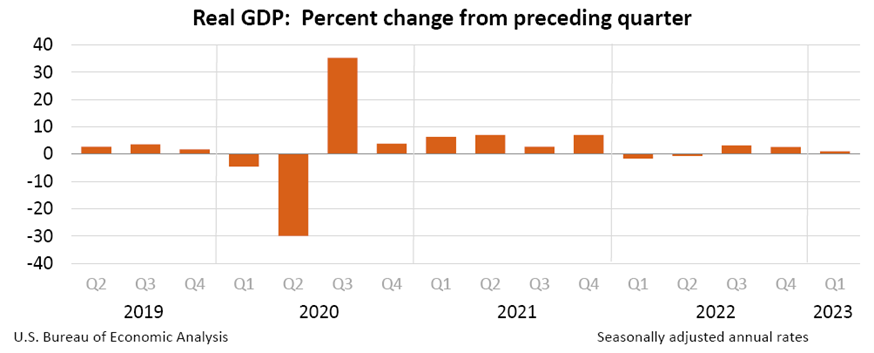

- In economic news, the Q1 Gross Domestic Product report showed real GDP increasing at an annualized rate of 1.1%, much lower than expected

- Of the 11 S&P 500 sectors, five were green, led by Communication Services (+3.8%), Information Technology (+2.4%) and Real Estate (+1.5%)

- Of the six losing sectors, the Utilities (-1.0%) and Industrials (-0.6%) saw the biggest declines

- The 2-year Treasury note fell to 4.06% and the 10-year Treasury note yield fell 13 basis points to 3.42%

- The U.S. Dollar Index closed the week at 101.68, which was relatively flat

Weekly Market Update – April 28, 2023

Close Week YTD DJIA 34,098 +0.9% +2.9% S&P 500 4,169 +0.9% +8.6% NASDAQ 12,227 +1.3% +16.8% Russell 2000 1,769 -1.2% +0.3% MSCI EAFE 2,144 -0.1% +10.3% Bond Index* 2,110.45 +0.11% +3.01% 10-Year Treasury 3.42% -0.13% -0.5% *Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD.

This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results.

Stock Markets Mixed Again This Week to Close out April

Stocks were mixed again this week as the large- and mega-caps outperformed small caps and the tech names outperformed the small, large- and mega-cap indices. It was also one of the busiest earnings week of the season, as about 35% of S&P 500 companies representing about 44% of the S&P 500’s market cap reported this week. And late in the week, it was four of the big tech names that drove markets, as Microsoft, Apple, Amazon, and Meta Platforms (Facebook) accounted for about half of the S&P 500’s gain, driven by Meta’s stunning 14% jump on positive earnings news.But early in the week, the consensus was markedly negative, as there were reports of regional manufacturing activity coming in well below expectations, indications that factories were cutting back on production and then a very negative outlook report on shipping volumes from United Parcel Service, (which shook its stock down 10% on Tuesday alone).

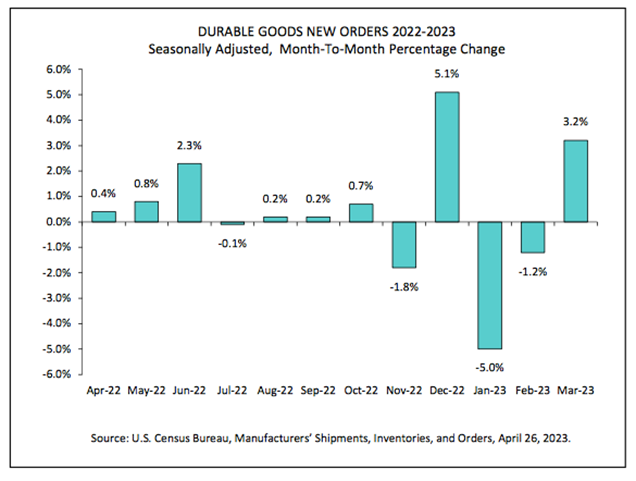

But then on Wednesday, reports of durable goods data surprised on the upside, as March orders rose 3.2%. But that news was tempered because retail inventories rose 0.4% for the month, more than expected and the most since last August.

Then on Thursday, the Commerce Department’s estimate of Gross Domestic Product in the first quarter came in at 1.1%, which was below most predictions of about 2%.

The week also brought renewed worries about the banking sector, as First Republic Bank’s earnings release showed that the bank had suffered more than $100 billion in deposit outflows in the first quarter. The news saw the bank’s stock price get cut in half and trickled into the banking and financial services space throughout the week. Then late Friday, news outlets were reporting that the Federal Deposit Insurance Corporation was planning to take the bank into receivership after markets closed on Friday.

GDP Up 1.1% in 1st Quarter

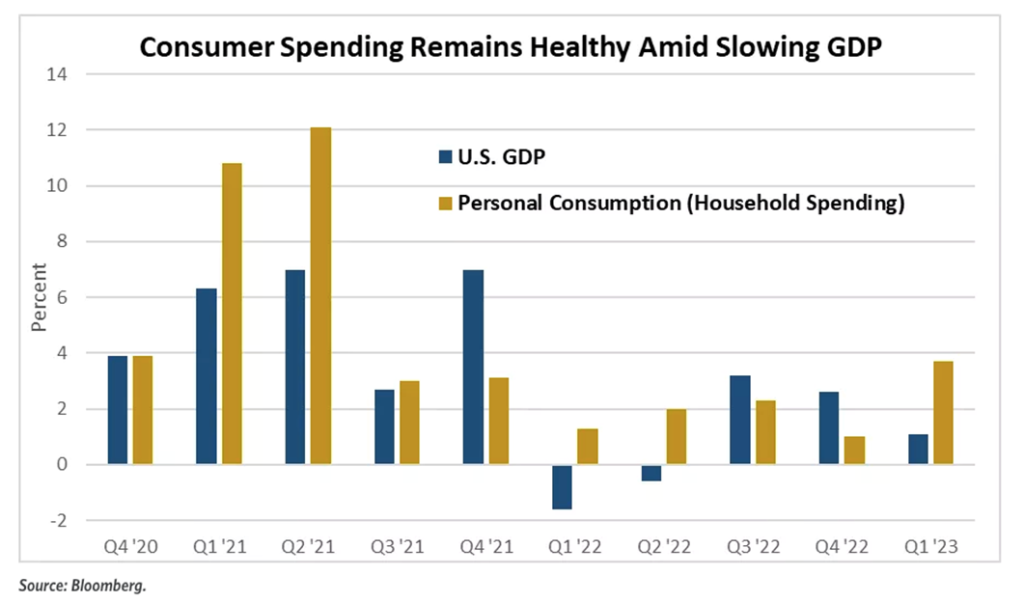

On Friday, the Bureau of Economic Analysis reported that real gross domestic product (GDP) increased at an annual rate of 1.1% in the first quarter of 2023. In the fourth quarter, real GDP increased 2.6%.

The increase in real GDP reflected increases in consumer spending, exports, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by decreases in private inventory investment and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

“The increase in consumer spending reflected increases in both goods and services. Within goods, the leading contributor was motor vehicles and parts. Within services, the increase was led by health care and food services and accommodations. Within exports, an increase in goods (led by consumer goods, except food and automotive) was partly offset by a decrease in services (led by transport). Within federal government spending, the increase was led by nondefense spending. The increase in state and local government spending primarily reflected an increase in compensation of state and local government employees. Within nonresidential fixed investment, increases in structures and intellectual property products were partly offset by a decrease in equipment.

The decrease in private inventory investment was led by wholesale trade (notably, machinery, equipment, and supplies) and manufacturing (led by other transportation equipment as well as petroleum and coal products). Within residential fixed investment, the leading contributor to the decrease was new single-family construction. Within imports, the increase reflected an increase in goods (mainly durable consumer goods and automotive vehicles, engines, and parts).”Personal Income Increases

- Current-dollar personal income increased $278.9 billion in the first quarter, compared with an increase of $398.8 billion in the fourth quarter. The increase in the first quarter primarily reflected increases in compensation (led by private wages and salaries) and government social benefits.

- Disposable personal income increased $571.2 billion, or 12.5%, in the first quarter, compared with an increase of $403.0 billion, or 8.9%, in the fourth quarter. The increase in the first quarter reflected an increase in personal income and a decrease in personal current taxes.

- Real disposable personal income increased 8.0% in the first quarter, compared with an increase of 5.0% in the fourth.

- Personal saving was $946.2 billion in the first quarter, compared with $758.8 billion in the fourth quarter.

- The personal saving rate – personal saving as a percentage of disposable personal income – was 4.8% in the first quarter, compared with 4.0% in the fourth.

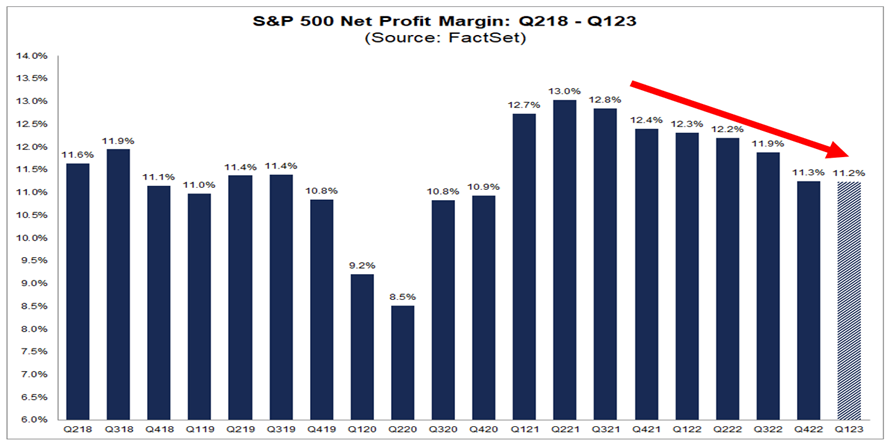

Lower Net Profit Margins For 7th Straight Quarter

Late in the week, research firm FactSet reported that the (blended) net profit margin for the S&P 500 for Q1 2023 was 11.2%, which is below the previous quarter’s net profit margin, below the year-ago net profit margin, and below the 5-year average net profit margin (11.4%).

Further: “If 11.2% is the actual net profit margin for the quarter, it will mark the seventh straight quarter in which the net profit margin for the index has declined quarter-over-quarter. It will also mark the lowest net profit margin reported by the index since Q4 2020 (10.9%).

- At the sector level, three sectors are reporting a year-over-year increase in their net profit margins in Q1 2023 compared to Q1 2022, led by the Energy (11.8% vs. 10.4%) and Consumer Discretionary (6.0% vs. 4.7%) sectors.

- On the other hand, eight sectors are reporting a year-over-year decrease in their net profit margins in Q1 2023 compared to Q1 2022, led by the Materials (9.8% vs. 13.8%) sector.

It is interesting to note that analysts believe net profit margins for the S&P 500 will be higher going forward. As of today, the estimated net profit margins for Q2 2023, Q3 2023, and Q4 2023 are 11.6%, 11.9%, and 11.8%, respectively.”

Durable Goods Orders Up 3.2%On Thursday, the U.S. Census Bureau announced the March advance report on durable goods manufacturers’ shipments, inventories and orders:

New Orders

New orders for manufactured durable goods in March, up following two consecutive monthly decreases, increased $8.6 billion or 3.2% to $276.4 billion. This followed a 1.2% February decrease.

- Excluding transportation, new orders increased 0.3%.

- Excluding defense, new orders increased 3.%.

- Transportation equipment, also up following two consecutive monthly decreases, led the increase, $8.1 billion or 9.1% to $97.4 billion.

Shipments

Shipments of manufactured durable goods in March, up following two consecutive monthly decreases, increased $2.9 billion or 1.1% to $277.0 billion. This followed a 0.8% February decrease.

- Transportation equipment, also up following two consecutive monthly decreases, drove the increase, $3.3 billion or 3.7% to $93.3 billion.

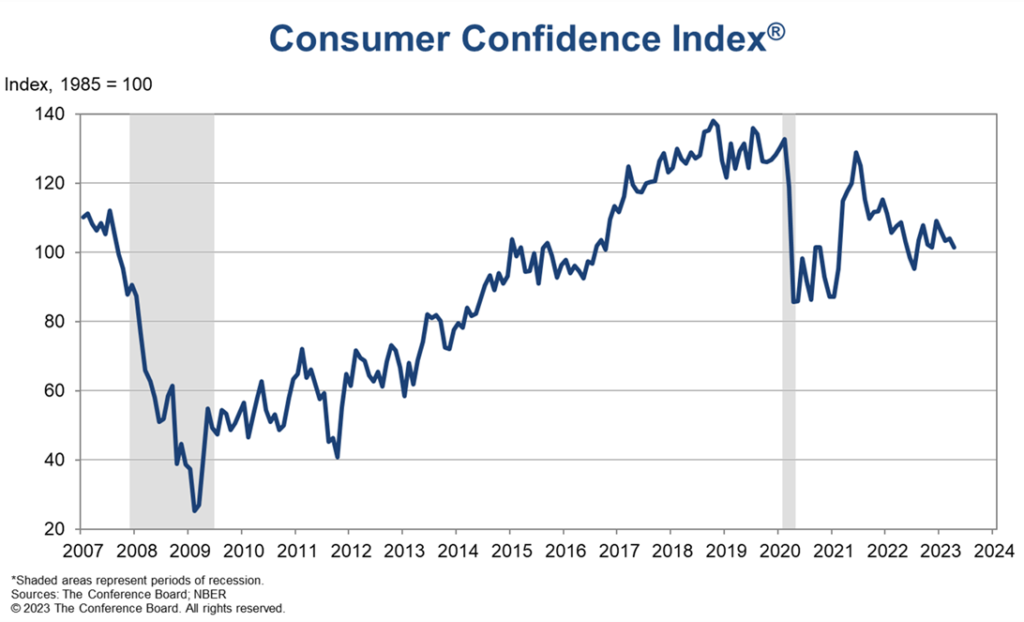

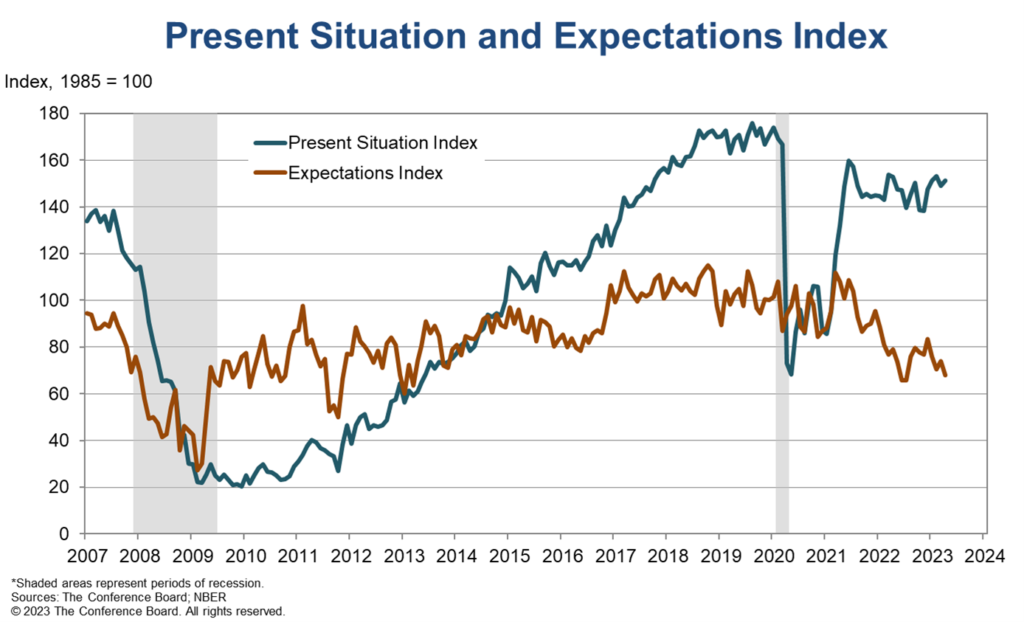

Consumer Confidence Fell in April and Expectations Index Points to a Recession Within the Next Year

The Conference Board Consumer Confidence Index fell in April to 101.3, down from 104.0 in March.

- The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – increased to 151.1 (1985=100) from 148.9 last month.

- The Expectations Index – based on consumers’ short-term outlook for income, business, and labor market conditions – fell to 68.1 (1985=100) from 74.0.

- The Expectations Index has now remained below 80 – the level associated with a recession within the next year – every month since February 2022, with the exception of a brief uptick in December 2022. The survey was fielded from April 3 – about three weeks after the bank failures in the United States – to April 19.

Present Situation

Consumers’ assessment of current business conditions improved somewhat in April.

- 18.8% of consumers said business conditions were “good,” same as last month.

- However, 18.1% said business conditions were “bad,” down from 19.3%.

Consumers’ appraisal of the labor market improved slightly.

- 48.4% of consumers said jobs were “plentiful,” up slightly from 47.9%.

- 11.1% of consumers said jobs were “hard to get,” down slightly from 11.4% last month.

Expectations Six Months Hence

Consumers became more pessimistic about the short-term business conditions outlook in April.

- 13.5% of consumers expect business conditions to improve, down from 16.4%.

- And, 21.5% expect business conditions to worsen, up from 19.2%.

Sources: factset.com; bea.gov; census.gov; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com

- It was another mixed week for equity markets, as the large-cap S&P 500, mega-cap DJIA and tech-laden NASDAQ all finished the final week of April in the green while the smaller-cap Russell 2000 and the developed-international markets (MSCI EAFE) finished in the red

-

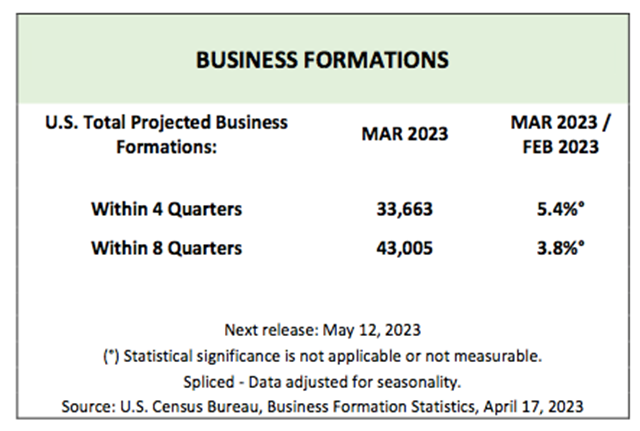

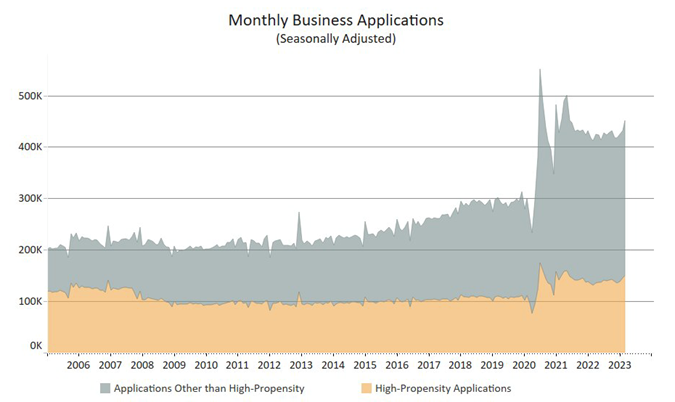

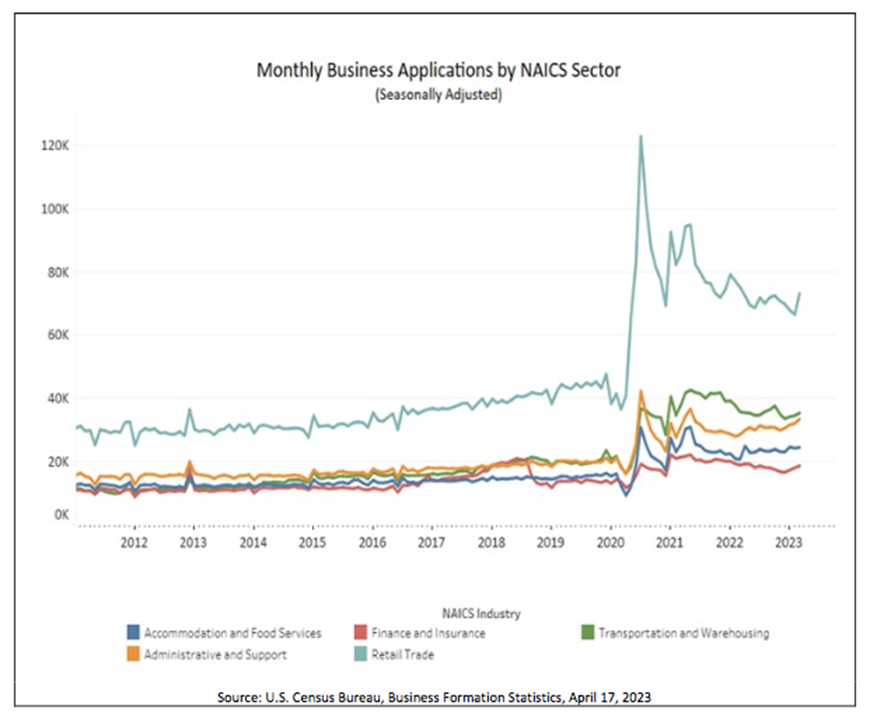

Business Applications Up 4.5% and Business Formations Up 5.4%

The U.S. Census Bureau announced the following seasonally adjusted business application and formation statistics for March 2023. The Business Application Series describe the business applications for tax IDs as indicated by applications for an Employer Identification Number through filings of the IRS Form SS-4. The Business Formation Series describe employer business formations as indicated by the first instance of payroll tax liabilities for the corresponding business applications.

Business Applications

Business Applications for March 2023 were 451,752, an increase of 4.5% compared to February 2023.

Business Formations

Projected Business Formations (within 4 quarters) for March 2023 were 33,663, an increase of 5.4% compared to February 2023. The projected business formations are forward looking, providing an estimate of the number of new business startups that will appear from the cohort of business applications in a given month. It does not provide an estimate of the total number of business startups that appeared within a specific month. In other words, the Census Bureau is projecting that 33,663 new business startups with payroll tax liabilities will form within 4 quarters of application from all the business applications filed during March 2023. The 5.4% increase indicates that for March 2023 there will be 5.4% more businesses projected to form within 4 quarters of application, compared to the analogous projections for February 2023.

More Data Later This Week

More economic data will be released later this week, including MBA Mortgage Applications on Wednesday and Jobless Claims and Existing Home Sales on Thursday.

Sources: census.gov

-

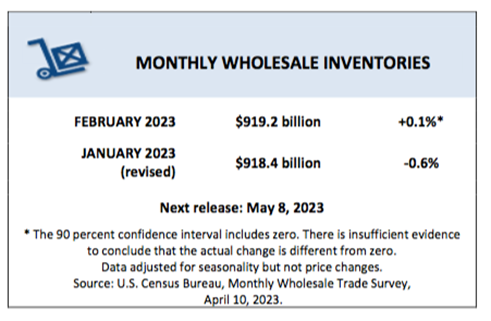

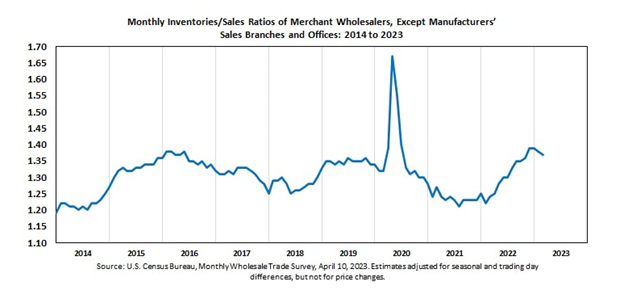

Wholesale Sales Jump in February While Inventories Rise Modestly

Wholesale trade measures the dollar value of sales made and inventories held by merchant wholesalers. It is a component of business sales and inventories.

Wholesale sales and inventory data give investors a hint as to where the consumer economy might be headed as it can be a precursor to consumer trends. For example, by analyzing the ratio of inventories to sales, investors can see how fast production will grow in coming months. Likewise, if unintended inventory accumulation occurs (i.e. sales did not meet expectations), then production will likely slow while those inventories are worked down.

Wholesale Inventories in February On Monday, the U.S. Census Bureau reported the following new wholesale trade statistics for February 2023:

Sales

- February 2023 sales of merchant wholesalers, except manufacturers’ sales branches and offices, were $669.5 billion, up 0.4% from the revised January level.

- This is up 1.3% from the revised February 2022 level.

- The December 2022 to January 2023 percent change was revised from the Monthly Wholesale Annual Revision Report of up 0.9% to up 0.4%.

Inventories

- Total inventories of merchant wholesalers, except manufacturers’ sales branches and offices, were $919.2 billion at the end of February, up 0.1% from the revised January level.

- Total inventories were up 12.0% from the revised February 2022 level.

- The January 2023 to February 2023 percent change was revised from up 0.2% to up 0.1%.

Inventories/Sales Ratio- The February inventories/sales ratio for merchant wholesalers, except manufacturers’ sales branches and offices, was 1.37.

- The February 2022 ratio was 1.24.

More Data Later This Week

More economic data will be released later this week, including CPI and MBA Mortgage Applications on Wednesday; Jobless Claims and PPI-Final Demand on Thursday; and Retail Sales, Business Inventories, Industrial Production and Consumer Sentiment on Friday.

Sources: census.gov

-

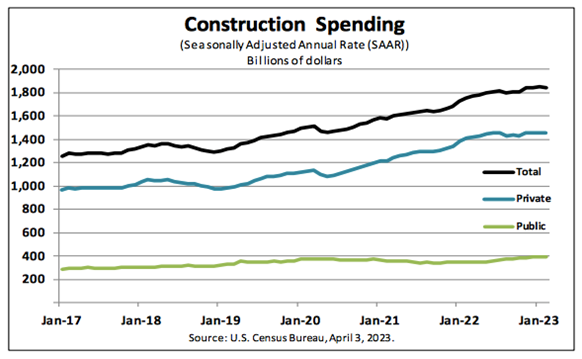

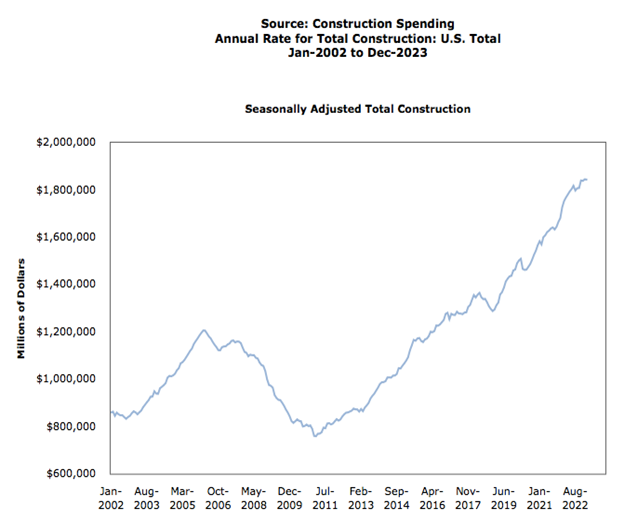

Construction Spending Down in February But Up Year-Over-Year

On Monday, the U.S. Census Bureau reported that construction spending during February 2023 was at an annual rate of $1,844.1 billion, 0.1% below the revised January estimate of $1,845.4 billion.

- The February figure is 5.2% above the February 2022 estimate of $1,753.1 billion.

- During the first two months of this year, construction spending amounted to $260.8 billion, 5.9% above the $246.1 billion for the same period in 2022.

Private Construction

- Spending on private construction was at a seasonally adjusted annual rate of $1,453.2 billion, virtually unchanged from the revised January estimate of $1,453.6 billion.

- Residential construction was at a seasonally adjusted annual rate of $852.1 billion in February, 0.6% below the revised January estimate of $857.0 billion.

- Nonresidential construction was at a seasonally adjusted annual rate of $601.0 billion in February, 0.7% above the revised January estimate of $596.7 billion.

Public Construction

- In February, the estimated seasonally adjusted annual rate of public construction spending was $391.0 billion, 0.2% below the revised January estimate of $391.8 billion.

- Educational construction was at a seasonally adjusted annual rate of $84.6 billion, 0.9% below the revised January estimate of $85.4 billion.

- Highway construction was at a seasonally adjusted annual rate of $120.6 billion, 0.3% above the revised January estimate of $120.3 billion.

Construction Spending Over 20 Years

More Data Later This Week

More economic data will be released later this week, including the ADP Employment Report, MBA Mortgage Applications and ISM Services Index on Wednesday; Jobless Claims on Thursday; and Consumer Credit on Friday.

Sources: census.gov

-

How Inflation Impacts Wealth Management and Investment Strategies

Navigating High Inflationary Periods and Protecting Your Wealth Over Time

Inflation is an economic concept that describes the increase in the cost of goods and services over time. As inflation rises, the purchasing power of your money decreases – which you may feel in your daily life. However, it can also have a significant impact on your long-term wealth management and investment strategies. In this article, we’ll explore how inflation impacts wealth management and investment strategies and provide tips on how to navigate inflationary periods.

Erosion of the Value of Money

Inflation can have a significant impact on the value of your money. As prices rise, the purchasing power of your money decreases, which means you can buy fewer goods and services with the same amount of money. This erosion of value can have a significant impact on your wealth management and investment strategies, regardless of your stage in life. If you’re still working and building a nest egg, it may mean you’re able to save or invest less than you can in periods of lower inflation. If you’re already retired, it may mean you need to adjust your withdrawal strategy to pay the bills, which means your nest egg may not last as long as you had planned.

Investment Returns May Not Keep Pace

Inflation can also have an impact on investment returns and require you to take a closer look at your portfolio. While investments can generate returns over time, those returns may not keep pace with inflation. For example, if inflation is 3% per year, and your investment returns are only 2%, your purchasing power will still decrease over time. If you find yourself in this situation, you’ll want to consider seeking out investments that provide returns that are higher than the rate of inflation in order to better protect your wealth.

Diversification Becomes Even More Critical

Diversification is always a smart option, but it becomes a key strategy for wealth management and investment in inflationary periods. By diversifying your investments across different asset classes, you can spread your risk and reduce the impact of inflation on your overall portfolio. For example, investing in stocks, bonds, and real estate can provide a more balanced portfolio that is less vulnerable than a portfolio that is more heavily weighted toward inflationary shocks.

You Might Consider Inflation-Protected Securities

Inflation-protected securities (IPS) are investments that are specifically designed to protect against inflation. These securities are typically linked to the Consumer Price Index (CPI), which measures inflation, and they provide returns that are adjusted for inflation. IPS can provide a hedge against inflationary periods and can be a valuable tool for wealth management in times of high inflation.

Mitigate Impact with Tax-Efficient Investment Strategies

If you’re not already practicing tax-efficient investment strategies, you’ll want to begin for a number of reasons – not the least of which is that doing so can help mitigate the impact of inflation on your wealth. By investing in tax-efficient vehicles, such as 401(k) plans, IRAs, and municipal bonds, you can reduce the amount of taxes you pay on your investment returns, which can help boost your overall returns and protect your wealth against inflation over the long term.

Would You Like to Learn More About How Inflation Impacts Wealth Management and Investing?

Inflation can have a significant impact on wealth management and investment strategies, and on your day-to-day life, too. By understanding how inflation erodes the value of money, considering diversification and investing in inflation-protected securities, and taking advantage of tax-efficient investment strategies, you can take steps that may help protect your wealth and stay ahead of inflationary periods. With careful planning and a diversified portfolio, you can better navigate inflationary periods and continue building wealth over time.

If you’d like to discuss more about how inflation impacts wealth management, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.