With Life's Chaos

We Bring Order

So You Can Relax

What sets us apart?

What sets us apart?

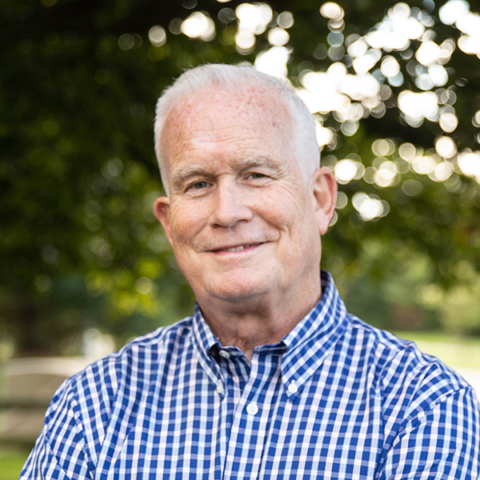

We are an independent Registered Investment Advisory firm led by a partnership of Certified Financial Planners™ held to a fiduciary standard and serve in the best interest of you. We provide comprehensive, expert advice and service, in retirement, tax, investment, insurance, college planning, and estate planning to families and businesses.

[brb_collection id=”2168″]

The Google Reviews shown above were posted by clients and prospective clients that found value in our discussions. There was no cash or non-cash compensation provided in return for these reviews, nor are there any conflicts of interest.

5 key benefits of independent financial advisors

Customized guidance based on your entire financial picture

Independent advisors are not tied to any particular family of funds or investment products. So whether you need help with a tax situation or managing assets at multiple places, independent advisors have the freedom to choose the investment option that’s best for you.

A relationship that’s responsive, attentive, and personal

To offer advice closely aligned with your goals, independent advisors must first build a strong understanding of your situation. As a result, there is a deep focus on building client relationships. And because many of these advisors are entrepreneurs, they hold themselves personally accountable to their clients.

A fee structure that is simple and transparent

Independent advisors typically charge a fee based on a percentage of assets managed. This fee structure is simple, transparent, and easy to understand. It also gives your advisor an incentive to help grow your assets. When you succeed, your advisor succeeds.

A high level of expertise to support your complex financial needs

Independent advisors can help investors address the variety of complex investment needs that arise when you accumulate significant wealth. Some advisors are specialists in certain investment strategies. Others can assist you with comprehensive services, such as estate planning or borrowing, the sale of a business, and intergenerational wealth transfer.

Your money is held by an independent custodian, not the advisor firm

Independent advisors use independent custodians, such as Charles Schwab and others, to hold and safeguard clients’ assets. This provides a reassuring system of checks and balances – your money is not held by the same person who advises you about how to invest it.