-

S&P 500 Sector Performance for November 2022

As volatility declined,

all 11 S&P 500 sectors advanced for the monthOver every single time period, sector performance will be driven largely by factors one would expect, such as the overall state of the economy, underlying corporate earnings, current and predicted interest rates, and inflation, among other factors.

Reviewing the sector performance for the month of November (a very short time-period), two things become very clear:

- First, sectors do not move in lock-step with one another and will often provide very divergent returns for investors – depending on timing and the current economic climate and

- Second, November continued to see very real divergence in sector performance, with the spread between the best (+10%) and the worst (+0.11%) being unusually wide.

Sector Highlights Through November 2022

For the month of November, sector performance was excellent, as all 11 sectors advanced healthily. For the month of October, sector performance was very good, as 9 of the 11 sectors were up for the month, with 7 up more than 5%.

It is also interesting to see the difference 11 months can make, as investors were reeling in January when 10 of the 11 sectors were red (with only Energy gaining that month); March saw 10 of the 11 positive; April and May saw a mixed bag; June was all negative; July was overwhelmingly positive; August was mostly negative, September was all negative; October was almost all positive; and November was all positive. That’s volatility.

Here are the sector returns for the month of November and October (two very short time-periods):

S&P 500 Sector Oct. 2022 Nov. 2022 Information Technology +5.66% +4.42% Energy +23.71% +1.25% Health Care +8.05% +4.58% Real Estate +2.92% +6.52% Consumer Staples +6.89% +5.54% Consumer Discretionary -1.64% +0.11% Industrials +12.37% +7.20% Financials +10.57% +6.06% Materials +8.58% +10.51% Communication Services -1.75% +5.05% Utilities +0.00% +5.51% Source: FMR

What Does It Mean for Investors?

At a very basic level, the differences in returns for the 11 S&P 500 sectors support two fundamental principles of financial planning – asset allocation and diversification.

At your next portfolio review, let’s revisit the differences between asset allocation and diversification. And we can discuss how to ensure that your portfolio is consistent with your risk profile and personal goals.

-

The Importance of Having a Business Succession Plan

Regardless of your business, at some point, in order for the business to successfully continue, the owners must decide who will take over future ownership of the business in the event of the retirement, disability, or death of current ownership. This video serves as a primer for making the decision as to whom will become the heir apparent.

-

Savvy Year-End Wealth Management Moves

Make the Most of These December Money Moves

Everyone goes into the year with the best of plans, but December money moves can help you take your wealth management strategy to a new level in the new year. If you want to make sure you’re not leaving money on the table, use this time to examine your financial position so you can make the most of end-of-year opportunities.

Taxes are a part of that strategy but don’t consider them their own separate category. They should always be viewed as a part of your bigger-picture investment and financial plan. If you’re ready to end the year strong, take a look at these savvy December money moves.

Take a Look at Your Losses

Unfortunately, 2022 gave us some record-low numbers in the financial markets. The S&P 500, the Dow, and the NASDAQ all remain down, resulting in a high degree of market loss for some investors. Of course, every investor’s portfolio is unique, and your relative gains or losses could be varied depending on where you’ve invested.

So, for one of your December money moves, take a look at your brokerage statement. Do you notice some unrealized gains or losses? At first glance, it can be disheartening to see negative numbers, but you could parlay that into a positive come tax time. By harvesting those losses, you can rebalance your portfolio and reduce the financial impact.

A few important things to note:

- The IRS individual deduction for capital losses is capped at $3,000 in 2022.

- In order to take advantage of this, you must offset your losers with your winners, or you could end up with a carryforward tax loss, which may not be ideal.

- You can also offset your losses against your gains. For example, if you sell enough to have $5,000 in losses, and then sell enough to have up to $5,000 in gains, then you’ve offset your gains with losses. That means you won’t owe any capital gains tax.

- If you choose to buy back your sold positions within 30 days, then the benefit does not apply.

Be sure to work with your professional investment advisor to ensure you’re making the best moves for you.

Assess Your Investment Portfolio

As 2022 has shown us, market volatility is a very real phenomenon. One of the best ways to make the most of the end of the year is to set aside time to assess and evaluate your investment strategy. Did it withstand the tests of 2022? How strong have your gains been recently? Have your financial goals changed in the months or years since you first set up an investment strategy?

You don’t know what’s going to happen in the markets, but the best thing you can do is make sure your portfolio accurately reflects your risk comfort level and complements your overall financial plan.

Review Your Retirement Plan

It’s never too late to contribute to your retirement account, so your December money moves should also include maxing out your retirement contributions – or at least contributing enough to get your full employer match. If you’ve had a milestone birthday recently, remember that if you happen to be 50 years or older, you can contribute even more than when you were younger.

Boosting your retirement contributions at year-end isn’t just smart for preparing for your golden years. It’s also a sound December money move because it allows you to reduce your taxable income if you contribute pretax money to a traditional retirement plan.

Consider Roth Conversions

Roth conversions can be a savvy year-end tool for some investors. A Roth conversion is when you withdraw money from a traditional tax-deferred retirement account and transfer it into a Roth IRA. You do have to pay income taxes on the distribution, but the assets you transfer can grow from there and you’ll enjoy tax-free distributions in the future. This can be particularly beneficial as part of your December money moves if you think your tax bracket will be higher in the future than it is today.

Related Article: 7 Year-End Tax Planning Tips

Evaluate Your Health Plan

Every health plan is different, and with insurance getting even more expensive, choosing a different health plan can make a significant difference in the new year. Make one of your December money moves an evaluation of the options available to you. Do you choose a high-deductible option or stick with the more traditional, low-deductible choice?

A high-deductible health plan (HDHP) will be more cost-effective in the short term, but it could end up costing you more if you have any major health issues develop. On the other hand, they offer HSAs, an account into which you can contribute pretax money to pay for qualified health expenses. There’s an additional benefit that can be a plus for your financial plan, too: those funds can be carried forward and invested, which can allow you another avenue to build your wealth long-term.

Don’t Forget Your Distributions

If you’re 72 or older, it’s important to take your required minimum distributions (RMDs) from your employer-sponsored retirement plan, or else you could be facing a steep 50% penalty. Withdrawal amounts have to be calculated each year, and if you have multiple accounts, the amount must be calculated for each. Be sure to work with your financial advisor to ensure you’re meeting your RMD requirement.

Decide on Your Charitable Donations

If you’re charitably inclined, another of your December money moves may be to identify any last-minute giving that could benefit organizations you support – while improving your bottom line, too. Charitable donations are a valuable way to give back and do good in the world, but they are also a smart way to reduce taxable income. Tax benefits from charitable donations vary based on regulations and legislation, which dictate how, and how much, you can deduct. Sometimes, it can be hard to reach the threshold you need to in order to get tax benefits. In that case, bundling your donations in a given year instead of spreading them over many years, can help you sidestep the situation.

Use December Money Moves to Reach Your Current and Future Financial Goals

If you think you would benefit from more savvy December money moves, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. We have been granted a license in perpetuity to publish this article on our website’s blog and share its contents on social media platforms. We have no right to distribute the articles, or any other content provided to our Firm, by Illuminated Advisors in a printed or otherwise non-digital format. We are not permitted to use the content provided to us or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

5 Reasons Women Should Plan for Long-Term Care

Women Face Many Challenges in Retirement and Planning Ahead is Key to Achieve Financial Security

As healthcare costs continue to skyrocket, it’s becoming more and more important for American workers to develop a plan for addressing the costs of long-term care within their overall retirement plans. Failing to do so can pose a significant risk to your financial security, and it’s particularly critical for women, who already face extra challenges when it comes to living comfortably in retirement.

Below we’ll discuss five specific reasons that women should consider the costs of long-term care when planning for retirement.

#1. Women Find Themselves at a Statistical Disadvantage

Despite the substantial progress we’ve made as a nation towards gender equality, women still find themselves at a consistent financial disadvantage compared to their male counterparts. Currently, white women earn 17% less than men on average, with the gap being even larger for women of color. What’s more is that women are more likely to leave the workplace or put their careers on the back burner to care for children or elders, causing them to lose career momentum or to miss out on gaining the crucial experience needed to stay competitive. Additionally, due to a lifetime of socialization and ingrained biases, women are more likely to shy away from salary negotiations with superiors and be overlooked for leadership promotions.

Taken together, these challenges create a unique financial situation for women that puts them at a serious disadvantage when it comes to saving enough for a financially secure retirement. Not only that, but it also means that women have less working capital to put towards necessary things like long-term care expenses.

#2. Women Have Longer Lifespans

According to the latest CDC figures, the average American man will live to age 75, while the average woman in America will live to age 80. There are plenty of theories about why women are more likely to outlive men, some having to do with biology and others with behavior. Whatever the reasons, a longer lifespan for women means a longer retirement and a greater chance of needing long-term care. In fact, women comprise 75% of nursing home residents. So, for women who are planning for life after retirement, incorporating a plan to cover the expenses of long-term care is imperative.

Related Article: Every Woman Needs Her Own Financial Strategy

#3. Women are Disproportionately Impacted by Disabilities and Chronic Health Problems

Another consequence of living longer is that women have a longer window to experience poor health and disability. A study done for the Journal of Women’s Health showed that women report more health concerns in terms of functional limitations and disability than men. It also showed that women report more cases of chronic health problems such as arthritis, hypertension, and poor vision.

Collectively, these statistics indicate that, even though women are living longer lives than men, they’re not necessarily enjoying more active, healthy years. This highlights why it’s so crucial that women have a plan in place for long-term care in their later years.

#4. Women Often Live Alone in Their Later Years

Because women tend to live longer than men, they’re more likely to find themselves living alone in their older age. In fact, recent research from Harvard University showed that we can expect the number of people in their 80s and 90s living alone to increase dramatically. In the same report, it was stated that women comprise 74% of solo households aged 80 and over, with that percentage continuing to grow in the next two decades. This means that women are often in need of long-term care that they must pay for rather than being able to depend on their partner or other live-in family members for care.

#5. Women Are More Likely to Be Caregivers

In America today, there are roughly 48 million unpaid or informal caregivers of adults, and women account for approximately 75% of that demographic. While this may not seem to be related to a woman’s need for long-term care, studies show that women who become caregivers are 2.5 times more likely to end up in poverty and five times more likely to depend on Social Security in retirement.

One major reason for this is that women are often forced to take a job with greater flexibility or are forced to leave the workforce completely to take care of their children or elderly family members. Many times, these limitations lead to a troubling impact on earning ability. Such workforce interruptions, compounded by a lifelong pay gap, leave women likely to have earned a cumulative $1,055,000 less than their male counterparts by retirement. Ironically, becoming a caregiver means a woman is less likely to be able to care for herself in her later years.

What Can Women Do to Properly Plan for Long-Term Care?

In the face of these very real challenges, long-term care planning is an integral piece of a woman’s retirement plan. There are various ways you can go about planning for long-term care. Perhaps you want to set up a designated long-term care investment account that will solely be used for future long-term care expenses. Or you may simply want to cut back on current expenses to further increase your retirement savings so that you’ll have more resources to depend on later. Another option could be to purchase long-term care insurance that will cover expenses as needed.

If you think you would benefit from a conversation with one of our Certified Financial Planners® about creating a long-term care plan that works with your retirement plans, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. We have been granted a license in perpetuity to publish this article on our website’s blog and share its contents on social media platforms. We have no right to distribute the articles, or any other content provided to our Firm, by Illuminated Advisors in a printed or otherwise non-digital format. We are not permitted to use the content provided to us or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

Market Insights – Nov. 30, 2022

Home-Price-Gains Continue to Decline Across the United States

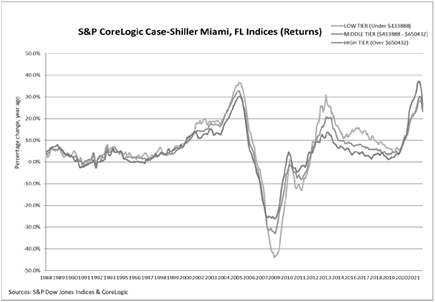

On Tuesday, S&P Dow Jones Indices released the latest results for the S&P CoreLogic Case-Shiller Indices, the leading measure of U.S. home prices. Data released today for September 2022 show that home price gains declined across the United States.

“The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 10.6% annual gain in September, down from 12.9% in the previous month. The 10-City Composite annual increase came in at 9.7%, down from 12.1% in the previous month. The 20-City Composite posted a 10.4% year-over-year gain, down from 13.1% in the previous month.

Miami, Tampa, and Charlotte reported the highest year-over-year gains among the 20 cities in September. Miami led the way with a 24.6% year-over-year price increase, followed by Tampa in second with a 23.8% increase, and Charlotte in third with a 17.8% increase. All 20 cities reported lower price increases in the year ending September 2022 versus the year ending August 2022.”

Month-Over-Month

“Before seasonal adjustment, the U.S. National Index posted a -1.0% month-over-month decrease in September, while the 10-City and 20-City Composites posted decreases of -1.4% and -1.5%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month decrease of -0.8%, and the 10-City and 20-City Composites both posted decreases of -1.2%.

In September, all 20 cities reported declines before and after seasonal adjustments.”

Analysis

“As has been the case for the past several months, our September 2022 report reflects short-term declines and medium-term deceleration in housing prices across the U.S. For example, the National Composite Index fell -1.0% in September, and now stands 10.6% above its year-ago level. We see comparable patterns in our 10- and 20-City Composites, which declined -1.4% and -1.5%, respectively, bringing their year-over-year gains down to 9.7% and 10.4%. For all three composites, year-over-year gains, while still well above their historical medians, peaked roughly six months ago and have decelerated since then.

Despite considerable regional differences, all 20 cities in our September report reflect these trends of short-term decline and medium-term deceleration. Prices declined in every city in September, with a median change of -1.2%. Year-over-year price gains in all 20 cities were lower in September than they had been in August.

The three best-performing cities in August repeated their performance in September. On a year-over- year basis, Miami (+24.6%) edged Tampa (+23.8%) for the top spot with Charlotte (+17.8%) beating Atlanta (+17.1%) for third place. The Southeast (+20.8%) and South (+19.9%) were the strongest regions by far, with gains more than double those of the Northeast, Midwest, and West; the two worst- performing cities were San Francisco (+2.3%) and Seattle (+6.2%).”

More Data Later This Week

More economic data will be released later this week, including GDP and MBA Mortgage Applications on Wednesday; Construction Spending and Jobless Claims on Thursday and Motor Vehicle Sales on Friday.

Sources: spglobal.com