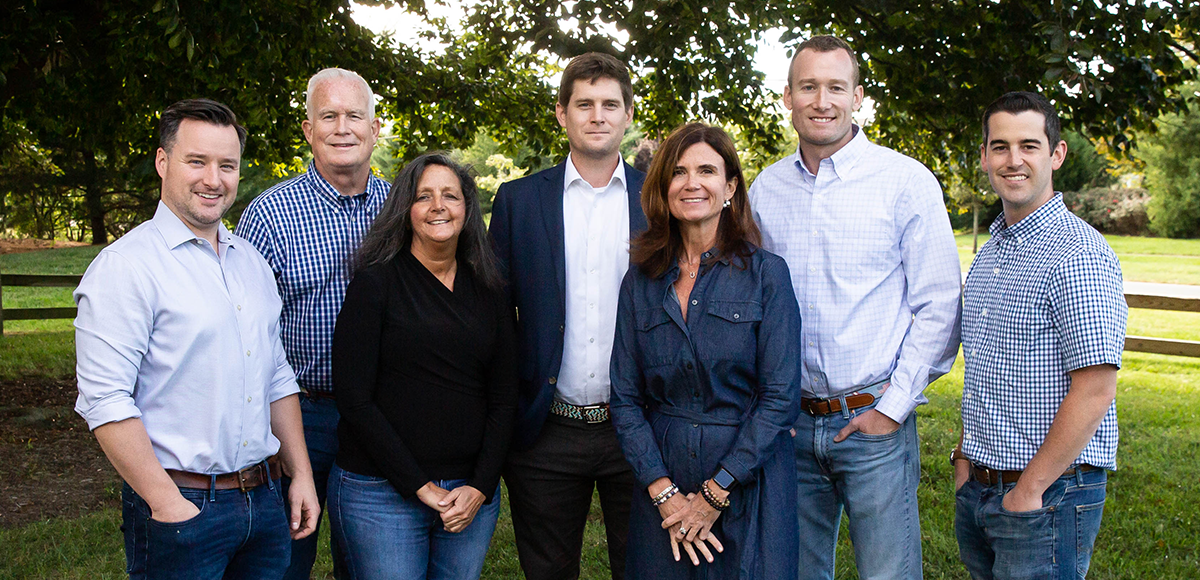

An independently-owned Registered Investment Advisor

Lane Hipple Wealth Management Group is a registered investment advisor held to the fiduciary standard of care, meaning that we are always serving clients’ best interest. Additionally, our independence allows us to offer a full menu of investment products and services, including fee-only platforms, that align our clients’ objectives with that of our own. Our investment advisory clients include individuals, trusts, charitable organizations, retirement plans, and corporate accounts. Charles Schwab acts as the custodian for our advisory accounts.

Our independence also allows us to affiliate ourselves with several insurance companies and insurance brokerage firms. This enables us to procure insurance products that best meet the needs of our clients, whether it is term life insurance, long-term care insurance, “second-to-die coverage,” etc. Unlike many of the larger brokerage firms, we have no proprietary products.

Lane Hipple provides the answer to the critical question “Who can I trust to create, manage, preserve and distribute my wealth?” We are committed to providing honest, high quality financial planning and wealth management, and are dedicated to faithfully serving our clients.

We Want You To Understand How We Are Compensated

How you pay for financial planning services and investment advice can have an effect on your peace of mind and the outcome of your financial life. At Lane Hipple, we believe in complete transparency with regard to how we invoice our clients for the services they receive. We work with our clients in the role of advisor, counselor, and friend. It is paramount that you clearly understand what, why, and how you are paying for the financial services and advice you are receiving.

Financial Planning

Lane Hipple may charge a service fee for the development, time, and implementation of a client’s financial plan. The financial planning fee may be a one-time planning fee or an annual retainer for services rendered. We will cap our fee based on the estimated hours involved once we have a more precise picture of the client’s situation, scope of services, and nature of engagement. Lane Hipple reserves the right to waive the financial planning fee in lieu of other compensation and fees adequate to meet the client’s service expectations.

Assets Under Management

Lane Hipple is an independently-owned Registered Investment Advisor (RIA) and offers investment advisory services, which are performed on a fee-only basis. We do not sell any investment products. We do not sell mutual funds, stocks, variable annuities, or other investment “products”. When investment management services are desired, clients give us limited discretionary trading authority. We place trades for the client and are compensated by a percentage of assets under management; not by the number or size of trades. Unless otherwise noted, advisory fees will be debited from a designated account(s) on a quarterly basis and are equal to 25% of the agreed-upon annual fee.

Insurance Commissions

We are a fee-based financial planning firm, meaning that we do not accept commissions from investment products; however, sometimes we do receive commissions from life insurance and fixed annuity products. When we do, we fully disclose the commission we receive. Insurance products, such as level term insurance or fixed annuities, may have associated commissions; however, the commission will not be deducted from your premium. It is paid by the insurance company, out of their own budget. With regard to insurance products, we act as independent agents. In other words, we are not limited to what we can recommend and have access to several insurance products across many different companies.

This blend of fees and commissions results in Lane Hipple being able to maintain objectivity and serve more of the client’s financial needs than if we took a strictly fee-only or commission-only approach. Fee-based financial planners are less likely to be biased by sales commissions. They do not rely on selling products or generating trades to earn their living. Instead, they are paid by you for the effort they expend.

If you feel you can benefit from our services, please click here to schedule an introductory call with one of our Partners and Certified Financial Planners. During this call, you can discuss your financial goals and concerns. It will allow us the opportunity to explain our process, services, and engagements in further detail. From there, we can decide if we are a good fit for each other. We look forward to hearing from you!