-

Quarterly Tax Ideas

GETTING OUT OF THE MARKET BECAUSE OF TAXES?

Are you thinking about bailing out of stocks because you are worried that the capital gains tax structure might change? Before you hit the sell button, think it over carefully and make sure you truly understand the tax implications – especially the differences between short- and long-term capital gains.

Capital gains taxes are essentially separated into one of two categories: short-term and long-term. And as you might surmise, the category that applies to you depends on how long you’ve held the assets.

- Short-term capital gains taxes are applied to profits from selling an asset you’ve held for less than a year. Short-term capital gains taxes are aligned with where your income places you in federal tax brackets – in other words, you pay the same rate as you would on ordinary income taxes.

- Long-term capital gains taxes are applied to assets held for more than a year. The long-term capital gains tax rates are 0%, 15% and 20%, depending on your income. Generally speaking, these rates are lower than the ordinary income tax rates.

Long-Term Capital Gains Tax Rates

The tax rate on most net capital gain is no higher than 15% for most individuals, but if you are a high-earner, you might fall into the 20% long-term cap gain bracket.

FILING STATUS 0% RATE 15% RATE 20% RATE Single Up to $41,675 $41,676 $459,750 Over $459,750 Married filing jointly Up to $83,350 $83,351 $517,200 Over $517,200 Married filing separately Up to $41,675 $41,676 $459,750 Over $459,750 Head of household Up to $55,800 $55,801 $488,500 Over $488,500 SOURCE: IRS

There are a few other exceptions where capital gains may be taxed at rates greater than 20%:

- The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate.

- Net capital gains from selling collectibles (such as coins or art) are taxed at a maximum 28% rate.

- The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25% rate.

2023 Mileage Rates Announced

The Internal Revenue Service issued the 2023 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

- 65.5 cents per mile driven for business use, up 3 cents from the midyear increase setting the rate for the second half of 2022.

- 22 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces, consistent with the increased midyear rate set for the second half of 2022.

- 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2022.

In addition, the IRS announced that:

- These rates apply to electric and hybrid-electric automobiles, as well as gasoline and diesel-powered vehicles.

- The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs.

- It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Taxpayers also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station.

- Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

- Taxpayers can use the standard mileage rate but generally must opt to use it in the first year the car is available for business use. Then, in later years, they can choose either the standard mileage rate or actual expenses. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen.

Remember, the IRS Will Never…

Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. Generally, the IRS will first mail you a bill if you owe any taxes.

- Threaten to immediately bring in local police or other law-enforcement groups to have you arrested for not paying.

- Demand that you pay taxes without giving you the opportunity to question or appeal the amount they say you owe.

- Ask for credit or debit card numbers over the phone.

Your Financial Advisor

Although Congress continues to pass large economic bills (the CARES Act and the Inflation Reduction Act were each about 800 pages long), no single bill can account for every unique situation. Worse, the federal tax code is crazily long. At over 2,500 pages, it is 5x the length of the Grapes of Wrath, written by John Steinbeck.

So, before you go down a path that might not be in your best interest long-term, make sure you consult with your financial advisor to determine how any new tax changes and any proposed tax changes might impact you and your family.

Nothing contained herein shall constitute an offer to sell or solicitation of an offer to buy any security. Material in this publication is original or from published sources and is believed to be accurate. However, we do not guarantee the accuracy or timeliness of such information and assume no liability for any resulting damages. Readers are cautioned to consult their own tax and investment professionals with regard to their specific situations.

- Short-term capital gains taxes are applied to profits from selling an asset you’ve held for less than a year. Short-term capital gains taxes are aligned with where your income places you in federal tax brackets – in other words, you pay the same rate as you would on ordinary income taxes.

-

Small Business Optimism Drops Amidst Continued Inflation Challenges

The National Federation of Independent Business was founded in 1943 and is the largest small business association in the U.S. The NFIB collects data from small and independent businesses and publishes their Small Business Economic Trends data on the second Tuesday of each month. The Index is a composite of 10 components based on expectations for: employment, capital outlays, inventories, the economy, sales, inventory, job openings, credit, growth and earnings.

Here is what the Small Business Economic Trends data released on January 10th reported:

The NFIB Small Business Optimism Index declined 2.1 points in December to 89.8, marking the 12th consecutive month below the 49-year average of 98. Owners expecting better business conditions over the next six months worsened by eight points from November to a net negative 51%. Inflation remains the single most important business problem with 32% of owners reporting it as their top problem in operating their business.

“Overall, small business owners are not optimistic about 2023 as sales and business conditions are expected to deteriorate. Owners are managing several economic uncertainties and persistent inflation and they continue to make business and operational changes to compensate.”

Key findings include:

- Forty-one percent of owners reported job openings that were hard to fill, down three points from November but historically very high.

- The net percent of owners raising average selling prices decreased eight points to a net 43% (seasonally adjusted), historically high.

- The net percent of owners who expect real sales to be higher worsened two points from November to a net negative 10%.

More Small Business Woes

As reported in the NFIB’s monthly jobs report:

- Owners’ plans to add positions remain elevated, with a seasonally adjusted net 17% planning to create new jobs in the next three months.

- Overall, 55% of owners reported hiring or trying to hire in December.

- Ninety-three percent of those hiring or trying to hire reported few or no qualified applicants for the positions they were trying to fill.

Further:

- A net 44% of owners reported raising compensation.

- A net 27% plan to raise compensation in the next three months, down one point from November.

- 8% of owners cited labor costs as their top business problem.

- 23% said that labor quality was their top business problem.

More Data Later This Week

More economic data will be released later this week, including MBA Mortgage Applications on Wednesday; Jobless Claims and CPI data on Thursday; and Consumer Sentiment on Friday.

Sources: nfib.com

- Forty-one percent of owners reported job openings that were hard to fill, down three points from November but historically very high.

-

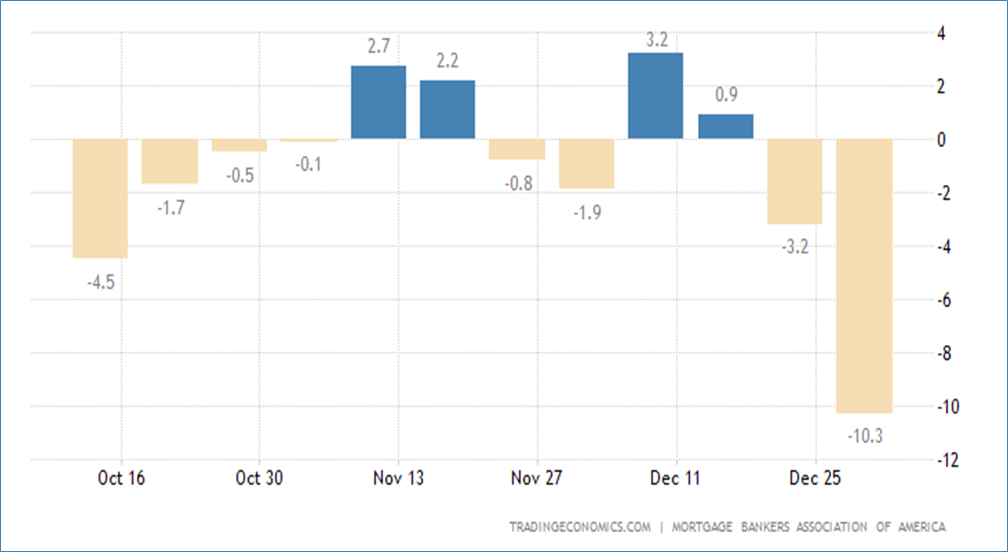

Mortgage Applications Drop as Mortgage Rates Increase

Mortgage Applications Drop as Mortgage Rates Increase

On Wednesday, the Mortgage Bankers Association announced that mortgage applications decreased 13.2% from two weeks earlier (and include adjustments to account for the holidays).

- The Market Composite Index, a measure of mortgage loan application volume, decreased 13.2% on a seasonally adjusted basis from two weeks earlier.

- On an unadjusted basis, the Index decreased 39.4% compared with the two weeks ago.

- The holiday adjusted Refinance Index decreased 16.3% from the two weeks ago and was 87% lower than the same week one year ago.

- The seasonally adjusted Purchase Index decreased 12.2% from two weeks earlier.

- The unadjusted Purchase Index decreased 38.5% compared with the two weeks ago and was 42% lower than the same week one year ago.

“The end of the year is typically a slower time for the housing market, and with mortgage rates still well above 6% and the threat of a recession looming, mortgage applications continued to decline over the past two weeks to the lowest level since 1996. Purchase applications have been impacted by slowing home sales in both the new and existing segments of the market. Even as home-price growth slows in many parts of the country, elevated mortgage rates continue to put a strain on affordability and are keeping prospective home buyers out of the market.”

- The refinance share of mortgage activity increased to 30.3% of total applications from 28.8% the previous week.

- The adjustable-rate mortgage (ARM) share of activity decreased to 7.3% of total applications.

- The FHA share of total applications increased to 14.0% from 13.1% the week prior.

- The VA share of total applications increased to 13.4% from 12.0% the week prior.

- The USDA share of total applications remained unchanged at 0.6%.

MBA Mortgage Applications Over the Past Year

Increases to Mortgage Rates

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 6.58% from 6.42%, with points increasing to 0.73 from 0.65 (including the origination fee) for 80% loan-to-value ratio (LTV) loans. The effective rate increased from last week.

- The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $647,200 ) remained at 6.12%, with points increasing to 0.45 from 0.37 (including the origination fee) for 80% LTV loans. The effective rate increased from last week.

- The average contract interest rate for 15-year fixed-rate mortgages increased to 6.06% from 5.97%, with points increasing to 0.70 from 0.57 (including the origination fee) for 80% LTV loans. The effective rate increased from last week.

Sources: mba.org

- The Market Composite Index, a measure of mortgage loan application volume, decreased 13.2% on a seasonally adjusted basis from two weeks earlier.

-

Passing an Inheritance to Your Children: 8 Important Considerations

Choosing to Leave an Inheritance Can Impact Many Other Financial Planning Decisions

If you have worked hard and planned properly, you may be well situated to leave an inheritance to your children. It can feel very meaningful to be able to provide a financial legacy for your loved ones, but it’s important to be practical, too, and to go about your estate planning in the right way. This single decision can impact all of your financial decisions, such as how much you put into savings, the types of retirement accounts you utilize, and your strategy for taking distributions.

Make sure you’ve covered all your estate planning bases by reading through these eight considerations for passing an inheritance to your children.

1. Your Personal Income Needs

Generosity feels good, but it must be wise, too. Don’t make the mistake of giving away more of your retirement savings than you’re truly able to. While the decision to provide for your children can be a very emotional one, it’s important to be financially savvy about it. Determine your own monthly or annual income needs, then use a retirement calculator like this one to help you develop a savings and withdrawal plan.

2. Rising Healthcare Costs

It’s important to remain vigilant about planning to pay for an unexpected illness or injury – and the medical bills that come with them. These costs pose a risk to your retirement and to your heirs’ inheritance, and there’s no good way to predict how much you could need. It’s also risky to rely on government programs like Medicare and Medicaid because they don’t cover everything. One potential option to explore is long-term care insurance. It offers protection for your assets in the event of catastrophic illness. However, policies can be quite expensive and aren’t wise investments for everyone.

3. Outliving Your Nest Egg

One of the most common retiree fears is running out of money in retirement. Make sure you have a plan to manage your savings and withdrawals appropriately so you can avoid depleting your assets while you’re still alive. If your goal in estate planning is to leave an inheritance for your children, the last thing you want is to saddle them with paying your bills as you age.

4. Tax Liability

When you leave an inheritance to your children, consider how best to protect them from significant tax liability. The choices you can make now can help them to enjoy more favorable tax treatment when you’re gone. For example, inherited stocks and mutual funds are eligible for a step-up in basis that could lead to significant savings.

Be mindful, too, about the rules for inheriting IRAs, such as the requirement that non-spousal beneficiaries take full distribution of the amount inherited within ten years. Formerly, heirs could take advantage of a “stretch IRA” that allowed them to stretch distributions over their entire lives. However, the stretch IRA was eliminated by the Setting Every Community Up for Retirement Enhancement (SECURE) Act in 2019. Some exceptions to this remain for a child who is not yet 18, for those who are disabled or chronically ill, and for heirs who are less than ten years younger than the owner of the IRA

SECURE Act 2.0: What It Means For Your Retirement

5. The Advantages of a Trust

Some estate planning tools can allow you more control when you want to leave an inheritance. A trust, for instance, will control distributions on behalf of your estate. This can help you ensure that specific assets pass to the children you designate them to. For this reason, a trust can be particularly useful for blended families where one or both spouses have children from previous relationships.

6. Wise Investment Decisions

You should always choose your investments wisely, whether you hope to leave an inheritance or not. However, if it is your goal to pass inherited assets to your children, then you need to design a portfolio that will last for several generations. You want your investment portfolio to continue to grow, preserve capital, and generate income. You should also do everything you can to avoid dipping into the principal for withdrawals. When you’re estimating the amount that you’ll be able to use to leave an inheritance to your children, don’t neglect to consider both compound interest and inflation.

7. Options for Carrying Out Your Legacy

Estate planning isn’t one-size-fits-all, and there are several options to choose from to leave an inheritance:

Gifts

If you choose to, you can gift assets to your children and allow to make use of your money before you die. If they qualify as annual exclusion gifts, they won’t be subject to the gift tax. This makes them completely tax-free and not subject to IRS filing. This strategy is also advantageous in that you can use a separate annual exclusion for each person to whom you make a gift. While your recipients won’t receive the step-up in cost basis, any capital gains will be taxed at their rate (rather than yours) which may be higher.

Trusts

Trusts are advantageous when you choose to leave an inheritance because they avoid probate, maintain privacy, and protect your heirs’ interests. You can select an individual or a company to act as your trustee to manage distributions according to your wishes. A revocable trust allows you to maintain control of the assets during your lifetime, while an irrevocable trust is treated as a gift that you cannot control or take back into your possession. Examine which type might benefit your estate planning goals.

Deferred Income

Certain retirement accounts, including IRAs and 401(k) plans, defer taxes on capital gains, interest, and dividends until the funds are withdrawn. When they are, they’re taxed as ordinary income. If you believe you will be in a higher tax bracket in retirement than you are in currently, you might look into using a non-deductible IRA. It’s a tool that allows earnings to grow tax-free, and there won’t be any taxes upon withdrawal either.

Life Insurance

Life insurance offers several estate planning benefits if your goal is to leave an inheritance to your children. If you have a policy, your beneficiaries receive the money tax-free. They won’t be required to go through probate, and there are no concerns about market fluctuations impacting the dollar amount. If life insurance is an attractive option for you, you might also consider fixed or variable annuities. They allow you to invest in the stock market through mutual funds, but they also have a life insurance component. Many times, they also carry hidden fees, so be cautious before taking this route. It’s usually best to discuss your options with a trusted financial advisor before you purchase an annuity product.

8. Estate Planning Legal Details

After you determine the mechanics of your estate plan, work with an estate attorney or a financial planner who specialized in estate planning to ensure you have everything in writing. This also gives you a chance to ask questions about beneficiary changes, probate laws in your state, and whether you’ve included all necessary items in your will. You should feel comfortable and confident in the estate plan you’ve created to leave an inheritance to your children, so be diligent and intentional in getting all the information you need from the professional you’re working with.

If you think you would benefit from a conversation about estate planning and how best to leave an inheritance to your children, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-406-5120, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

Clients of Lane Hipple Make Christmas Possible for Local Families

From left: Heather Hackl (SVE Principal), Melissa Rush (Lane Hipple Director of Client Services), and Maureen Ioannucci (SVE School Counselor)

As we do each year, Lane Hipple sought out a giving opportunity that would help improve Christmas for local families in need. After reaching out to schools throughout Burlington County, our team – led by Director of Client Services Melissa Rush – was compelled to partner with South Valley Elementary School and Upper Elementary School, both located in Moorestown, NJ. We learned of families that are going through tough times, some that are homeless, and others being helped regularly by the school with lunches, snacks, and coats.

When informed of this opportunity to come together and help these neighborhood families, our clients quickly took action and began showing up at our office on 155 E. 3rd Street to drop off gift cards, toys, clothes, books, and more. We provided general guidelines to make sure the gifts would be put to good use. There was a family of four boys in need of winters coats, gloves, and food; another family seeking pretend play toys for their special needs daughter and trucks for her older brother; and a mother of a 6- and 10-year old in desperate need of clothes who, when she discovered the school could help, replied with a text saying, “I wasn’t going to pull off Christmas this year. I’m crying now!!”

After only ten days, Lane Hipple collected $2,400 in gift cards and a substantial number of gifts to drop-off to both schools. Now, as a result of the amazing generosity of our clients, team members, and owners – and with the help of the South Valley Elementary School and Upper Elementary School – these local Moorestown families will be able to have the Christmas they had hoped for.

It is extremely important to our team to give back to the local community and help those who are less fortunate. In 2021, Lane Hipple partnered with social services organization, Family Promise of Burlington County, and collected an abundance of daily life supplies, over $3,000 in cash and gift cards, and even provided two families with Christmas trees and gifts for their children.

To our clients:

Thank you for being a huge part of this mission. Your thoughtfulness and kindness means as much to us as it does to the families you have helped. We wish you all a very happy holiday season, Merry Christmas, and Happy New Year!