-

Clients of Lane Hipple Make Christmas Possible for Local Families

From left: Heather Hackl (SVE Principal), Melissa Rush (Lane Hipple Director of Client Services), and Maureen Ioannucci (SVE School Counselor)

As we do each year, Lane Hipple sought out a giving opportunity that would help improve Christmas for local families in need. After reaching out to schools throughout Burlington County, our team – led by Director of Client Services Melissa Rush – was compelled to partner with South Valley Elementary School and Upper Elementary School, both located in Moorestown, NJ. We learned of families that are going through tough times, some that are homeless, and others being helped regularly by the school with lunches, snacks, and coats.

When informed of this opportunity to come together and help these neighborhood families, our clients quickly took action and began showing up at our office on 155 E. 3rd Street to drop off gift cards, toys, clothes, books, and more. We provided general guidelines to make sure the gifts would be put to good use. There was a family of four boys in need of winters coats, gloves, and food; another family seeking pretend play toys for their special needs daughter and trucks for her older brother; and a mother of a 6- and 10-year old in desperate need of clothes who, when she discovered the school could help, replied with a text saying, “I wasn’t going to pull off Christmas this year. I’m crying now!!”

After only ten days, Lane Hipple collected $2,400 in gift cards and a substantial number of gifts to drop-off to both schools. Now, as a result of the amazing generosity of our clients, team members, and owners – and with the help of the South Valley Elementary School and Upper Elementary School – these local Moorestown families will be able to have the Christmas they had hoped for.

It is extremely important to our team to give back to the local community and help those who are less fortunate. In 2021, Lane Hipple partnered with social services organization, Family Promise of Burlington County, and collected an abundance of daily life supplies, over $3,000 in cash and gift cards, and even provided two families with Christmas trees and gifts for their children.

To our clients:

Thank you for being a huge part of this mission. Your thoughtfulness and kindness means as much to us as it does to the families you have helped. We wish you all a very happy holiday season, Merry Christmas, and Happy New Year!

-

Savvy Year-End Wealth Management Moves

Make the Most of These December Money Moves

Everyone goes into the year with the best of plans, but December money moves can help you take your wealth management strategy to a new level in the new year. If you want to make sure you’re not leaving money on the table, use this time to examine your financial position so you can make the most of end-of-year opportunities.

Taxes are a part of that strategy but don’t consider them their own separate category. They should always be viewed as a part of your bigger-picture investment and financial plan. If you’re ready to end the year strong, take a look at these savvy December money moves.

Take a Look at Your Losses

Unfortunately, 2022 gave us some record-low numbers in the financial markets. The S&P 500, the Dow, and the NASDAQ all remain down, resulting in a high degree of market loss for some investors. Of course, every investor’s portfolio is unique, and your relative gains or losses could be varied depending on where you’ve invested.

So, for one of your December money moves, take a look at your brokerage statement. Do you notice some unrealized gains or losses? At first glance, it can be disheartening to see negative numbers, but you could parlay that into a positive come tax time. By harvesting those losses, you can rebalance your portfolio and reduce the financial impact.

A few important things to note:

- The IRS individual deduction for capital losses is capped at $3,000 in 2022.

- In order to take advantage of this, you must offset your losers with your winners, or you could end up with a carryforward tax loss, which may not be ideal.

- You can also offset your losses against your gains. For example, if you sell enough to have $5,000 in losses, and then sell enough to have up to $5,000 in gains, then you’ve offset your gains with losses. That means you won’t owe any capital gains tax.

- If you choose to buy back your sold positions within 30 days, then the benefit does not apply.

Be sure to work with your professional investment advisor to ensure you’re making the best moves for you.

Assess Your Investment Portfolio

As 2022 has shown us, market volatility is a very real phenomenon. One of the best ways to make the most of the end of the year is to set aside time to assess and evaluate your investment strategy. Did it withstand the tests of 2022? How strong have your gains been recently? Have your financial goals changed in the months or years since you first set up an investment strategy?

You don’t know what’s going to happen in the markets, but the best thing you can do is make sure your portfolio accurately reflects your risk comfort level and complements your overall financial plan.

Review Your Retirement Plan

It’s never too late to contribute to your retirement account, so your December money moves should also include maxing out your retirement contributions – or at least contributing enough to get your full employer match. If you’ve had a milestone birthday recently, remember that if you happen to be 50 years or older, you can contribute even more than when you were younger.

Boosting your retirement contributions at year-end isn’t just smart for preparing for your golden years. It’s also a sound December money move because it allows you to reduce your taxable income if you contribute pretax money to a traditional retirement plan.

Consider Roth Conversions

Roth conversions can be a savvy year-end tool for some investors. A Roth conversion is when you withdraw money from a traditional tax-deferred retirement account and transfer it into a Roth IRA. You do have to pay income taxes on the distribution, but the assets you transfer can grow from there and you’ll enjoy tax-free distributions in the future. This can be particularly beneficial as part of your December money moves if you think your tax bracket will be higher in the future than it is today.

Related Article: 7 Year-End Tax Planning Tips

Evaluate Your Health Plan

Every health plan is different, and with insurance getting even more expensive, choosing a different health plan can make a significant difference in the new year. Make one of your December money moves an evaluation of the options available to you. Do you choose a high-deductible option or stick with the more traditional, low-deductible choice?

A high-deductible health plan (HDHP) will be more cost-effective in the short term, but it could end up costing you more if you have any major health issues develop. On the other hand, they offer HSAs, an account into which you can contribute pretax money to pay for qualified health expenses. There’s an additional benefit that can be a plus for your financial plan, too: those funds can be carried forward and invested, which can allow you another avenue to build your wealth long-term.

Don’t Forget Your Distributions

If you’re 72 or older, it’s important to take your required minimum distributions (RMDs) from your employer-sponsored retirement plan, or else you could be facing a steep 50% penalty. Withdrawal amounts have to be calculated each year, and if you have multiple accounts, the amount must be calculated for each. Be sure to work with your financial advisor to ensure you’re meeting your RMD requirement.

Decide on Your Charitable Donations

If you’re charitably inclined, another of your December money moves may be to identify any last-minute giving that could benefit organizations you support – while improving your bottom line, too. Charitable donations are a valuable way to give back and do good in the world, but they are also a smart way to reduce taxable income. Tax benefits from charitable donations vary based on regulations and legislation, which dictate how, and how much, you can deduct. Sometimes, it can be hard to reach the threshold you need to in order to get tax benefits. In that case, bundling your donations in a given year instead of spreading them over many years, can help you sidestep the situation.

Use December Money Moves to Reach Your Current and Future Financial Goals

If you think you would benefit from more savvy December money moves, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. We have been granted a license in perpetuity to publish this article on our website’s blog and share its contents on social media platforms. We have no right to distribute the articles, or any other content provided to our Firm, by Illuminated Advisors in a printed or otherwise non-digital format. We are not permitted to use the content provided to us or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

5 Reasons Women Should Plan for Long-Term Care

Women Face Many Challenges in Retirement and Planning Ahead is Key to Achieve Financial Security

As healthcare costs continue to skyrocket, it’s becoming more and more important for American workers to develop a plan for addressing the costs of long-term care within their overall retirement plans. Failing to do so can pose a significant risk to your financial security, and it’s particularly critical for women, who already face extra challenges when it comes to living comfortably in retirement.

Below we’ll discuss five specific reasons that women should consider the costs of long-term care when planning for retirement.

#1. Women Find Themselves at a Statistical Disadvantage

Despite the substantial progress we’ve made as a nation towards gender equality, women still find themselves at a consistent financial disadvantage compared to their male counterparts. Currently, white women earn 17% less than men on average, with the gap being even larger for women of color. What’s more is that women are more likely to leave the workplace or put their careers on the back burner to care for children or elders, causing them to lose career momentum or to miss out on gaining the crucial experience needed to stay competitive. Additionally, due to a lifetime of socialization and ingrained biases, women are more likely to shy away from salary negotiations with superiors and be overlooked for leadership promotions.

Taken together, these challenges create a unique financial situation for women that puts them at a serious disadvantage when it comes to saving enough for a financially secure retirement. Not only that, but it also means that women have less working capital to put towards necessary things like long-term care expenses.

#2. Women Have Longer Lifespans

According to the latest CDC figures, the average American man will live to age 75, while the average woman in America will live to age 80. There are plenty of theories about why women are more likely to outlive men, some having to do with biology and others with behavior. Whatever the reasons, a longer lifespan for women means a longer retirement and a greater chance of needing long-term care. In fact, women comprise 75% of nursing home residents. So, for women who are planning for life after retirement, incorporating a plan to cover the expenses of long-term care is imperative.

Related Article: Every Woman Needs Her Own Financial Strategy

#3. Women are Disproportionately Impacted by Disabilities and Chronic Health Problems

Another consequence of living longer is that women have a longer window to experience poor health and disability. A study done for the Journal of Women’s Health showed that women report more health concerns in terms of functional limitations and disability than men. It also showed that women report more cases of chronic health problems such as arthritis, hypertension, and poor vision.

Collectively, these statistics indicate that, even though women are living longer lives than men, they’re not necessarily enjoying more active, healthy years. This highlights why it’s so crucial that women have a plan in place for long-term care in their later years.

#4. Women Often Live Alone in Their Later Years

Because women tend to live longer than men, they’re more likely to find themselves living alone in their older age. In fact, recent research from Harvard University showed that we can expect the number of people in their 80s and 90s living alone to increase dramatically. In the same report, it was stated that women comprise 74% of solo households aged 80 and over, with that percentage continuing to grow in the next two decades. This means that women are often in need of long-term care that they must pay for rather than being able to depend on their partner or other live-in family members for care.

#5. Women Are More Likely to Be Caregivers

In America today, there are roughly 48 million unpaid or informal caregivers of adults, and women account for approximately 75% of that demographic. While this may not seem to be related to a woman’s need for long-term care, studies show that women who become caregivers are 2.5 times more likely to end up in poverty and five times more likely to depend on Social Security in retirement.

One major reason for this is that women are often forced to take a job with greater flexibility or are forced to leave the workforce completely to take care of their children or elderly family members. Many times, these limitations lead to a troubling impact on earning ability. Such workforce interruptions, compounded by a lifelong pay gap, leave women likely to have earned a cumulative $1,055,000 less than their male counterparts by retirement. Ironically, becoming a caregiver means a woman is less likely to be able to care for herself in her later years.

What Can Women Do to Properly Plan for Long-Term Care?

In the face of these very real challenges, long-term care planning is an integral piece of a woman’s retirement plan. There are various ways you can go about planning for long-term care. Perhaps you want to set up a designated long-term care investment account that will solely be used for future long-term care expenses. Or you may simply want to cut back on current expenses to further increase your retirement savings so that you’ll have more resources to depend on later. Another option could be to purchase long-term care insurance that will cover expenses as needed.

If you think you would benefit from a conversation with one of our Certified Financial Planners® about creating a long-term care plan that works with your retirement plans, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. We have been granted a license in perpetuity to publish this article on our website’s blog and share its contents on social media platforms. We have no right to distribute the articles, or any other content provided to our Firm, by Illuminated Advisors in a printed or otherwise non-digital format. We are not permitted to use the content provided to us or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

Understanding Stock Options: ISOs, NQSOs & Restricted Stock

Employee stock options can be a valuable way to take advantage of your company’s growth and enhance your financial security. However, it’s important to understand the fine print. Each opportunity comes with its own set of rules for how you receive, manage, and maximize it. Not fully understanding your stock options can negatively impact your financial success.

In order to guard yourself against leaving money on the table, unsavory tax surprises, and poor stock management, you need a plan. Keep reading to get the information and strategies you need to make the most of NQSOs, ISOs, and restricted stock options.

Non-Qualified Stock Options (NQSOs)

Non-Qualified Stock Options (NQSOs) are by far the most common stock incentive offering. They give you the right to buy a certain number of company shares, at a specified price (the exercise price) during a window of time (typically 10 years). The “non-qualified” in its name doesn’t mean that it’s exclusive—on the contrary, NQSOs can be given to all levels of individuals including employees, directors, contracts, and consultants. They are considered “non-qualified” because this type of stock option isn’t eligible for special tax consideration under the IRS code.

Here’s how NQSOs work. Once NQSOs vest, you can choose to exercise and purchase the shares, but you are not required to do so. If you choose to exercise the options, taxes are based on the spread, meaning the difference between the grant price and the fair market value of the stock at the time of exercise. The difference will be considered compensation income, which means your employer will also withhold income tax, Medicare tax, and Social Security, and this compensation will be declared on that year’s W-2.

When you subsequently sell the shares, any further increase will be taxed as either a short or long-term capital gain, depending on how long you’ve held onto the shares. You’ll report any earnings on your IRS 1040 tax return, on Form 8949, Schedule D.

Incentive Stock Options (ISOs)

Like NQSOs, Incentive Stock Options (ISOs) are a form of equity compensation that may be offered to you by an employer. Unlike NQSOs, however, ISOs qualify for a special kind of tax treatment, meaning they aren’t subject to Medicare, Social Security, or withholding taxes, though they must meet very rigid tax code criteria.

ISOs differ from NQSOs in a number of other notable ways including:

- There’s a $100,000 limit on an ISO’s vested aggregate value in a calendar year.

- While NQSOs can be given to a number of different kinds of people affiliated with a company, ISOs can only be given to employees, not consultants or contractors.

- In order to get the full tax benefits, you’re required to exercise your ISOs within 90 days of leaving the company.

Keep in mind that you must hold your shares for at least two years from when they were granted and at least one year from when they were exercised in order to take advantage of the long-term capital gains tax after exercising your ISOs. If you hold onto them for any shorter length of time, anything you appreciate will be taxed at the standard income tax rate, which is generally much higher than the long-term capital gains tax rate.

Conversely, if you hold onto your ISOs beyond the calendar year in which they were exercised and have gains, you will be subject to the alternative minimum tax. In and of itself, that’s a financial nuisance, but not a problem. However, in the hypothetical but very real scenario that your company’s stock price takes a dive, you’ll be left to pay a high amount of tax on income that has completely disappeared.

One other important consideration for both NQSOs and ISOs: whether it’s advantageous to make a Section 83(b) election, which allows you to be taxed on the value of shares when they’re granted to you, rather than when they are vested. Consulting a financial advisor is a good idea when making this choice—between costs, taxes, requirements, and deadlines, it can be a very complicated endeavor.

Restricted Stock

Some companies aren’t able to give stock options and choose to give restricted stock units (RSUs) instead. RSUs are a common form of employee compensation that grants non-transferable shares, which usually come with conditions and restrictions regarding the timing of sales.

RSUs maintain their value of vesting regardless of the performance of the stock itself. It could have increased, decreased, or remained the same since the grant date and the restricted stock would have the same value. That’s in stark contrast to NQSOs and ISOs, both of which depend on how much your company’s stock price differs from the price set on the date you received it.

From the IRS’s perspective, restricted stock is considered to be a supplemental wage, which means it follows the same tax and reporting requirements as NQSOs do. Restricted stock may be particularly attractive to people who have a lower risk tolerance, but to receive that surefire value, you must remain employed until your shares vest. Oftentimes, unvested restricted stock is forfeited immediately once employment is terminated.

Need Help Making Sense of Your Stock Options? We Can Help

If you’d like to be sure you understand the ins and outs of your stock options, consider partnering with a professional to develop the right strategy for you. If you think you may benefit from a conversation about your equity compensation, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. We have been granted a license in perpetuity to publish this article on our website’s blog and share its contents on social media platforms. We have no right to distribute the articles, or any other content provided to our Firm, by Illuminated Advisors in a printed or otherwise non-digital format. We are not permitted to use the content provided to us or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

Midterm Elections – What Do They Mean For Markets?

Studying the history of stock market returns relative to midterm elections will give you a sense of how impactful they are to your own portfolio’s potential gain or loss.

This article was written by Dimensional Fund Advisors and can be found HERE.

It’s almost Election Day in the US once again. For those who need a brief civics refresher, every two years the full US House of Representatives and one-third of the Senate are up for reelection. While the outcomes of the elections are uncertain, one thing we can count on is that plenty of opinions and prognostications will be floated in the days to come. In financial circles, this will almost assuredly include any potential for perceived impact on markets. But should long-term investors focus on midterm elections?

Markets Work

We would caution investors against making short-term changes to a long-term plan to try to profit or avoid losses from changes in the political winds. For context, it is helpful to think of markets as a powerful information-processing machine. The combined impact of millions of investors placing billions of dollars’ worth of trades each day results in market prices that incorporate the aggregate expectations of those investors. This makes outguessing market prices consistently very difficult.¹ While surprises can and do happen in elections, the surprises don’t always lead to clear-cut outcomes for investors.

The 2016 presidential election serves as a recent example of this. There were a variety of opinions about how the election would impact markets, but many articles at the time posited that stocks would fall if Trump were elected.² The day following President Trump’s win, however, the S&P 500 Index closed 1.1% higher. So even if an investor would have correctly predicted the election outcome (which was not apparent in pre-election polling), there is no guarantee that they would have predicted the correct directional move, especially given the narrative at the time.

But what about congressional elections? For the upcoming midterms, market strategists and news outlets are still likely to offer opinions on who will win and what impact it will have on markets. However, data for the stock market going back to 1926 shows that returns in months when midterm elections took place did not tend to be that different from returns in any other month.

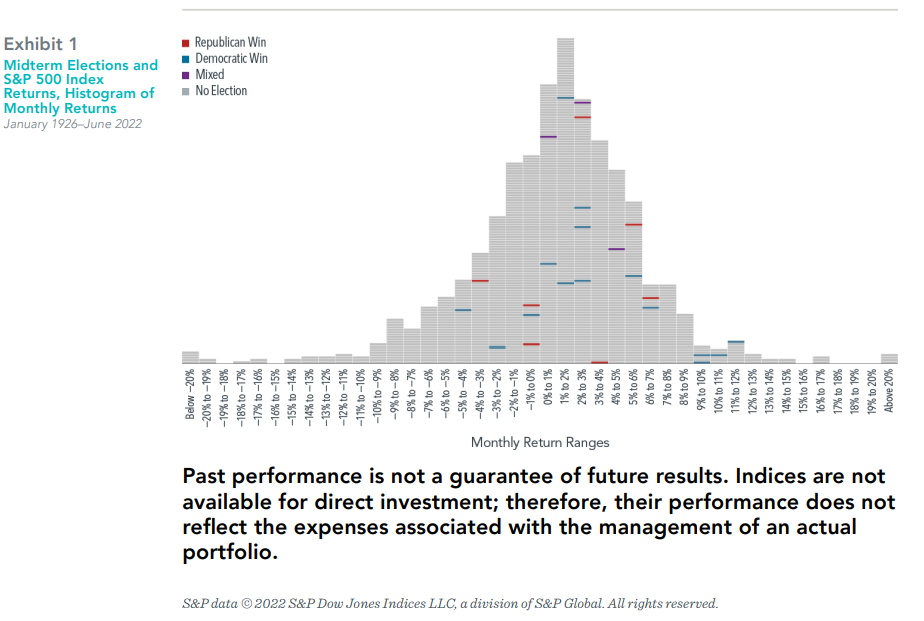

Exhibit 1 shows the frequency of monthly returns (expressed in 1% increments) for the S&P 500 Index from January 1926–June 2022. Each horizontal dash represents one month, and each vertical bar shows the cumulative number of months for which returns were within a given 1% range (e.g., the tallest bar shows all months where returns were

between 1% and 2%). The blue and red horizontal lines represent months during which a midterm election was held, with red meaning Republicans won or maintained majorities in both chambers of Congress, and blue representing the same for Democrats. Striped boxes indicate mixed control, where one party controls the House of Representatives, and the other controls the Senate, while gray boxes represent non-election months. This graphic illustrates that election month returns were well within the typical range of returns, regardless of which party won the election. Results similarly appeared random when looking at all Congressional elections (midterm and presidential) and for annual returns (both the year of the election and the year after).

In It For The Long Haul

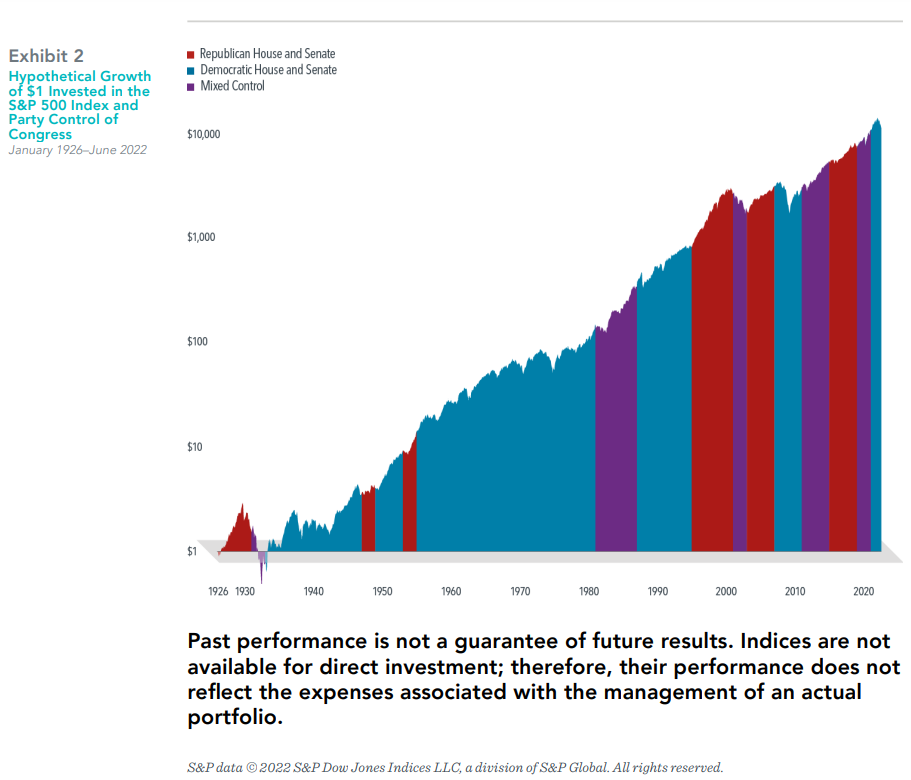

While it can be easy to get distracted by month-to-month or even one-year returns, what really matters for long-term investors is how their wealth grows over longer periods of time. Exhibit 2 shows the hypothetical growth of wealth for an investor who put $1 in the S&P 500 Index in January 1926. Again, the chart lays out party control of Congress over

time. And again, both parties have periods of significant growth and significant declines during their time of majority rule. However, there does not appear to be a pattern of stronger returns when any specific party is in control of Congress, or when there is mixed control for that matter. Markets have historically continued to provide returns over the long run irrespective of (and perhaps for those who are tired of hearing political ads, even in spite of) which party is in power at any given time.

Equity markets can help investors grow their assets, and we believe investing is a long-term endeavor. Trying to make investment decisions based on the outcome of elections is unlikely to result in reliable excess returns for investors. At best, any positive outcome based on such a strategy will likely be the result of random luck. At worst, it can lead to

costly mistakes. Accordingly, there is a strong case for investors to rely on patience and portfolio structure, rather than trying to outguess the market, to pursue investment returns.

- This is known as the efficient market theory, which postulates that market prices reflect the knowledge and expectations of all investors and that any new development is instantaneously priced into a security.

- Examples include: “A Trump win would sink stocks. What about Clinton?” CNN Money, 10/4/16, “What do financial markets think of the 2016 election?” Brookings Institution, 10/21/16, “What Happens to the Markets if Donald Trump Wins?” New York Times, 10/31/16.

In USD. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of

an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss.

There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Investors should

talk to their financial advisor prior to making any investment decision. There is always the risk that an investor may lose money. A long-term

investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an

offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. - This is known as the efficient market theory, which postulates that market prices reflect the knowledge and expectations of all investors and that any new development is instantaneously priced into a security.