-

Are You Protecting Your Online Financial Information?

How to Keep Your Sensitive Information Safe from Cyber-Criminals

Do you manage some or all of your finances online? It’s a common – and convenient – practice today, but protecting your online financial information is of the utmost importance.

With the benefits of online banking and investing also comes the risk of cyber-attacks and identity theft. Hackers are becoming increasingly sophisticated in their methods, and it’s more important than ever to take steps to protect your online financial information.

In this article, we’ll explore some common threats to your online financial security and provide practical tips to help keep your sensitive information safe.

Common Cyber Attacks and Identity Theft Strategies

Knowledge is power when it comes to protecting your online financial information. There are numerous types of cyber-attacks and identity theft strategies to be aware of, so let’s review some of the most common scams:

Phishing

This is when cybercriminals use deceptive emails, phone calls, or text messages to trick people into providing their personal information or online financial information such as login credentials, Social Security numbers, or bank account details.

Malware Attacks

Malware refers to malicious software designed to damage or gain unauthorized access to a computer system. Cybercriminals use malware to steal personal information such as usernames and passwords, some of which may be used to access your bank accounts or other online financial information.

Ransomware Attacks

Ransomware is a specific type of malware that encrypts a victim’s files and demands payment in exchange for the decryption key. If the victim doesn’t pay, their files can be permanently lost or publicly released.

Social Engineering Attacks

This is when cybercriminals use human manipulation tactics to gain access to personal information. For example, they may impersonate a customer service representative and ask for login credentials.

Password Attacks

This includes brute force attacks where cyber criminals try numerous password combinations to gain access to a user’s account. It also includes password “spraying” where they use a list of commonly used passwords to gain access.

Account Takeover Attacks

This is when cybercriminals gain access to a user’s account by stealing their login credentials or using phishing attacks to trick them into revealing their information. If you become a victim and your information is available, cybercriminals may use it to access your online financial information, steal your identity, or perpetrate other criminal acts.

SIM Swapping

This is when a cybercriminal convinces a phone carrier to transfer a victim’s phone number to a new SIM card in their possession. They can then use this to gain access to accounts that use two-factor authentication via text message.

What You Can Do to Better Protect Your Online Financial Information

Threats like those described above are concerning, but it’s important to be aware. Of course, having awareness about threats to your online financial information is only half the battle. The other half is taking steps to keep your information safe. Here’s what you can do:

Use Strong Passwords

Your passwords should be complex, unique, and not used across multiple accounts. Avoid using obvious personal information such as your name, birth date, or address as part of your password. Consider using a password manager to generate and store strong passwords, making it easier to keep track of your various logins. Here’s a tutorial from Consumer Reports that may be helpful in getting started with a password manager.

Enable Two-Factor Authentication

Two-factor authentication adds an extra layer of security to your accounts by requiring you to enter a code sent to your phone or email in addition to your password. This ensures that even if someone gains access to your password, they still can’t log in without the second factor of authentication. Many financial institutions and other online services offer this added security feature, so be sure to enable it whenever possible.

New Article: Social Security for Divorced Individuals

Be Wary of Phishing Scams

Phishing scams, as described above, are fraudulent attempts to obtain your personal information, such as your login credentials, credit card numbers, and other sensitive online financial information. These scams often come in the form of unsolicited emails, texts, or phone calls that appear to be from a legitimate source, such as your bank or an online retailer. Be cautious when entering personal information on unfamiliar websites and avoid clicking on links or downloading attachments from unsolicited emails.

Keep Your Software Up to Date

Software updates often include security patches that address vulnerabilities and protect against the latest threats. Make sure to install updates for your operating system, web browser, and other software as soon as they become available. This will help keep your devices and accounts secure from potential cyberattacks.

Monitor Your Accounts Regularly

Most of us don’t have time to monitor all our online financial information daily, or even weekly. However, it’s important to check your bank and credit card statements regularly – at least monthly – for any suspicious activity and report any unauthorized transactions immediately. It’s also a good idea to review your credit reports periodically to ensure that no one has opened new accounts in your name. The sooner you catch any fraudulent activity, the easier it will be to resolve the issue and prevent further damage.

Are You Protecting Your Online Financial Information?

It’s easy to assume that all of your online financial accounts have built-in protections from common scams – and most do. However, it’s critical to be sure you’re activating optional steps, like two-factor authentication so that your accounts are as protected as possible. By following the above tips, you can help protect your online financial information and reduce the risk of falling victim to fraud or identity theft. Remember to stay vigilant and be proactive in keeping your personal and financial data secure.

If you’d like to discuss more about safe ways to use online financial accounts, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-249-4342, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

Social Security for Divorced Individuals

Written by Elaine Floyd, CFP®

If there is one key differentiator between baby boomers and their parents, it is the higher incidence of divorce.

Americans over 50 are twice as likely to be divorced compared to the same age group 20 years ago.

If you have been divorced in the past and are currently unmarried, you may be able to qualify for Social Security benefits based on your ex-spouse’s work record. In order to qualify for a divorced-spouse benefit you must:

- Be age 62 or older

- Be finally divorced from the worker on whose record benefits are being claimed

- Have been married for over 10 years

- Be currently unmarried

Your ex-spouse must be at least age 62. If the divorce occurred more than two years prior, your ex-spouse does not need to have filed for his or her own retirement benefit.

Example: Michael and Maria were married over 10 years. They have been divorced over two years. Both are age 62. Maria has not remarried. Maria is eligible for a divorced-spouse benefit based on Michael’s work record, regardless of whether or not Michael has filed for his benefit.

If you claim your divorced-spouse benefit at full retirement age or later (66 for those born before 1954, increasing gradually to 67), your benefit will be 50% of your ex-spouse’s primary insurance amount (PIA). The primary insurance amount is the amount your ex-spouse will receive if he claims his benefit at full retirement age.

Example: Jim and Judy are divorced. Jim’s PIA is $2,400. Judy files for her divorced-spouse benefit at age 66. She will receive 50% of Jim’s PIA, or $1,200, as her divorced-spouse benefit.

What if you also qualify for Social Security on your own work record?

If you also worked and qualify for a Social Security benefit based on your own work record, you may be able to coordinate your divorced-spouse benefit with your own retirement benefit in order to maximize each type of benefit. But you must get the timing right.

Don’t file at 62. If you file for Social Security at age 62, you may not be able to receive a divorced-spouse benefit. That’s because you will be required to take your own reduced benefit first. If your PIA is more than one-half of your ex-spouse’s PIA, you will not ever be able to receive a divorced-spouse benefit.

Example: Sam and Sue are divorced after being married more than 10 years. Sam’s PIA is $2,400. Sue’s PIA is $2,200. If Sue files for Social Security at 62, she will be forced to receive her own reduced benefit of $1,650 (75% of $2,200). Since her PIA is more than one-half of Sam’s PIA, she will not ever be able to receive a divorced spouse benefit. The $1,650 will be her permanent benefit except for annual cost-of-living adjustments.

File a restricted application at FRA. To receive a divorced-spouse benefit while your own benefit builds delayed credits – an ideal strategy for divorced people – you can file a restricted application for your divorced spouse benefit at full retirement age and switch to your own maximum retirement benefit at age 70.

Example: If Sue, from the above example, waits until age 66 to file a restricted application for her divorced-spouse benefit, she can receive 50% of Sam’s PIA, or $1,200 from age 66 to 70. At age 70, she can switch to her own maximum retirement benefit of $2,904 ($2,200 x 1.32). This is Sue’s optimal Social Security claiming strategy, allowing her to maximize both benefits and giving her the highest lifetime benefits.

Note: The Budget Act of 2015 is phasing out the ability to file a restricted application. You must have attained age 62 by January 1, 2016 to file a restricted application for spousal benefits. If you are not able to file a restricted application, you may still be eligible to receive a divorced-spouse benefit, but only if it is higher than your own benefit.

Mechanics of filing

To file for a divorced-spouse benefit, you need not be in contact with your ex-spouse. Your ex-spouse’s current marital status is not relevant. In fact, if your ex-spouse has remarried, the current spouse and any other ex-spouses can also receive benefits without affecting your divorced-spouse benefit. Or, if your ex-spouse has not remarried, he (or she) can claim a divorced-spouse benefit off your record. Unlike with spousal benefits, two divorced spouses can each claim a spousal benefit off the other’s record at the same time.

If you are not in contact with your ex-spouse, it may be difficult to estimate the amount of your divorced-spouse benefit. Due to privacy issues, the Social Security Administration will not give out this information until you are ready to apply for the benefit.

You can generally ballpark your ex-spouse’s PIA at somewhere between $2,000 and $2,600. Your divorced spouse benefit will be 50% of that amount if you file for it at your full retirement age.

To file for your divorced-spouse benefit, you will need to make an appointment with your local Social Security office and show a certified copy of the divorce decree. It is helpful to have your ex-spouse’s Social Security number (you can get it off an old tax return), but not essential.

If you do not have your divorce papers you can order a certified copy through VitalChek, www.vitalchek. com. If your marriage lasted right around ten years and you’re not sure if you meet the ten-year requirement, check the date on the divorce decree; some people are surprised to learn that the actual date of dissolution is later than they had thought.

Ex-spouse deceased?

If your ex-spouse has died, and if you were married at least ten years, you may qualify for a divorced-spouse survivor benefit. If you apply for it at your full retirement age or later, the benefit amount will be 100% of his PIA, or, if he had already started benefits, the amount your ex-spouse was receiving at the time of death.

As with divorced-spouse benefits, you can sequence the timing of the survivor benefit and your own retirement benefit to maximize each benefit. For example, you could apply for a reduced divorced-spouse survivor benefit as early as age 60 (50 if disabled) and then switch to your own maximum retirement benefit at age 70. Or you might do it the other way: start your own reduced retirement benefit at age 62 and switch to your maximum survivor benefit at full retirement age. Your financial advisor can help you determine the optimal strategy.

More than one ex-spouse?

If you were married two (or three) times and each marriage lasted more than ten years, you can choose which ex-spouse’s record to draw from. In fact, you can sequence these benefits for maximum advantage, essentially taking advantage of several benefits, just not at the same time. It can get complicated. Your advisor and SSA can help you sort it all out.

Think twice before remarrying

Keep in mind that divorced-spouse benefits must stop upon remarriage. You cannot receive a divorced spouse benefit if you are married (one exception: the divorced-spouse benefit may continue if the person you marry is receiving survivor benefits at the time of the remarriage). But also consider the potential spousal benefit from your new spouse. If you are receiving a divorced-spouse benefit at the time of your remarriage, that benefit would stop but you may immediately start receiving a spousal benefit based on your new spouse’s earnings record without waiting the usual one year for spousal benefits.

So here you might want to compare the two benefits and either remarry or remain single depending on which benefit is higher.

If your ex-spouse is deceased, divorced-spouse survivor benefits would not be available to you if you remarry before age 60. Or, to put it another way, if you remarry after age 60, you may still receive a divorced-spouse survivor benefit based on the earnings record of your ex-spouse who has died.

The bottom line: if you are eligible for divorced-spouse benefits or divorced-spouse survivor benefits and are thinking of remarrying, consider delaying the marriage. If your ex is still alive (and has a higher PIA than your new potential spouse), remarriage at age 70 will allow you to receive full divorced-spouse benefits from age 66 to 70, when you would switch to your own maximum retirement benefit. If your ex is deceased, you can remarry anytime after age 60 without jeopardizing your divorced-spouse survivor benefit.

Talk to the Social Security Administration and to your financial advisor about the best claiming strategy for you based on your personal circumstances.

Elaine Floyd, CFP®, is Director of Retirement and Life Planning for Horsesmouth, LLC, where she focuses on helping people understand the practical and technical aspects of retirement income planning.

Copyright © 2023 by Horsesmouth, LLC. All rights reserved. IMPORTANT NOTICE This reprint is provided exclusively for use by the licensee, including for client education, and is subject to applicable copyright laws. Unauthorized use, reproduction or distribution of this material is a violation of federal law and punishable by civil and criminal penalty. This material is furnished “as is” without warranty of any kind. Its accuracy and completeness is not guaranteed and all warranties expressed or implied are hereby excluded.

-

How Inflation Impacts Wealth Management and Investment Strategies

Navigating High Inflationary Periods and Protecting Your Wealth Over Time

Inflation is an economic concept that describes the increase in the cost of goods and services over time. As inflation rises, the purchasing power of your money decreases – which you may feel in your daily life. However, it can also have a significant impact on your long-term wealth management and investment strategies. In this article, we’ll explore how inflation impacts wealth management and investment strategies and provide tips on how to navigate inflationary periods.

Erosion of the Value of Money

Inflation can have a significant impact on the value of your money. As prices rise, the purchasing power of your money decreases, which means you can buy fewer goods and services with the same amount of money. This erosion of value can have a significant impact on your wealth management and investment strategies, regardless of your stage in life. If you’re still working and building a nest egg, it may mean you’re able to save or invest less than you can in periods of lower inflation. If you’re already retired, it may mean you need to adjust your withdrawal strategy to pay the bills, which means your nest egg may not last as long as you had planned.

Investment Returns May Not Keep Pace

Inflation can also have an impact on investment returns and require you to take a closer look at your portfolio. While investments can generate returns over time, those returns may not keep pace with inflation. For example, if inflation is 3% per year, and your investment returns are only 2%, your purchasing power will still decrease over time. If you find yourself in this situation, you’ll want to consider seeking out investments that provide returns that are higher than the rate of inflation in order to better protect your wealth.

Diversification Becomes Even More Critical

Diversification is always a smart option, but it becomes a key strategy for wealth management and investment in inflationary periods. By diversifying your investments across different asset classes, you can spread your risk and reduce the impact of inflation on your overall portfolio. For example, investing in stocks, bonds, and real estate can provide a more balanced portfolio that is less vulnerable than a portfolio that is more heavily weighted toward inflationary shocks.

You Might Consider Inflation-Protected Securities

Inflation-protected securities (IPS) are investments that are specifically designed to protect against inflation. These securities are typically linked to the Consumer Price Index (CPI), which measures inflation, and they provide returns that are adjusted for inflation. IPS can provide a hedge against inflationary periods and can be a valuable tool for wealth management in times of high inflation.

Mitigate Impact with Tax-Efficient Investment Strategies

If you’re not already practicing tax-efficient investment strategies, you’ll want to begin for a number of reasons – not the least of which is that doing so can help mitigate the impact of inflation on your wealth. By investing in tax-efficient vehicles, such as 401(k) plans, IRAs, and municipal bonds, you can reduce the amount of taxes you pay on your investment returns, which can help boost your overall returns and protect your wealth against inflation over the long term.

Would You Like to Learn More About How Inflation Impacts Wealth Management and Investing?

Inflation can have a significant impact on wealth management and investment strategies, and on your day-to-day life, too. By understanding how inflation erodes the value of money, considering diversification and investing in inflation-protected securities, and taking advantage of tax-efficient investment strategies, you can take steps that may help protect your wealth and stay ahead of inflationary periods. With careful planning and a diversified portfolio, you can better navigate inflationary periods and continue building wealth over time.

If you’d like to discuss more about how inflation impacts wealth management, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

Inheriting Wealth: How to Preserve and Grow Your Family’s Legacy

Inheriting wealth can be a life-changing event, but it also comes with a great responsibility to preserve and grow your family’s legacy. Whether you receive an inheritance from a parent, grandparent, or another family member, it’s important to have a plan in place to use the wealth wisely and continue to benefit future generations. In this article, we will provide guidance on how you might preserve and grow your family’s legacy after inheriting wealth.

Educate Yourself on Financial Management

To effectively manage an inheritance, it’s important to have a basic understanding of financial management. This includes knowledge of financial concepts such as budgeting, saving, investing, and debt management. If you don’t have this knowledge, consider taking a personal finance course or working with a financial advisor to develop a financial plan that aligns with your goals and values.

Assess Your Current Financial Situation

When inheriting wealth, it can be tempting to make big moves right away, such as paying off your mortgage. However, before making any decisions with your inherited wealth, take the time to assess your current financial situation. This includes reviewing your income, expenses, debts, and any existing investments or savings. By having a clear understanding of your financial position, you can make informed decisions about how to best use your inheritance to benefit your family now and into the future.

Consider Tax Implications

Inheriting wealth can also come with tax implications. Depending on the type and size of the inheritance, you may be subject to estate or inheritance taxes. It’s important to understand these tax implications and work with a financial advisor or tax professional to develop a tax strategy that minimizes your tax liability and preserves your family’s wealth.

Related Article: Passing an Inheritance To Your Children: 8 Important Considerations

Develop a Long-Term Plan

When inheriting wealth, you may want to develop a long-term plan that considers the needs of future generations. This includes setting financial goals, developing an investment strategy, and creating an estate plan. Research shows that up to 70% of families lose their wealth by the second generation, so having a long-term plan can help your family avoid that common fate.

Communicate with Your Family

Inheriting wealth can be a sensitive topic, and it’s important to communicate with your family about your plans and intentions. This includes discussing your long-term plan, setting expectations, and ensuring that everyone is on the same page. Open and honest communication can help prevent misunderstandings and ensure that your family’s legacy is preserved.

Consider Philanthropic Opportunities

Inheriting wealth can also provide opportunities to make a positive impact on your community and the world. Consider philanthropic opportunities that align with your family’s values and interests. This can include donating to charitable organizations, establishing a family foundation, or funding scholarships for deserving students.

Final Thoughts on Inheriting Wealth

Inheriting wealth can be a life-changing event, but it also tends to come with feelings of responsibility to preserve and grow your family’s legacy. To effectively manage an inheritance, it’s important to educate yourself on financial management, assess your current financial situation, consider tax implications, develop a long-term plan, communicate with your family, and consider philanthropic opportunities. By taking a thoughtful and strategic approach, you can preserve and grow your family’s wealth and leave a lasting legacy for future generations.

If you think you would benefit from a conversation about inheriting wealth, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

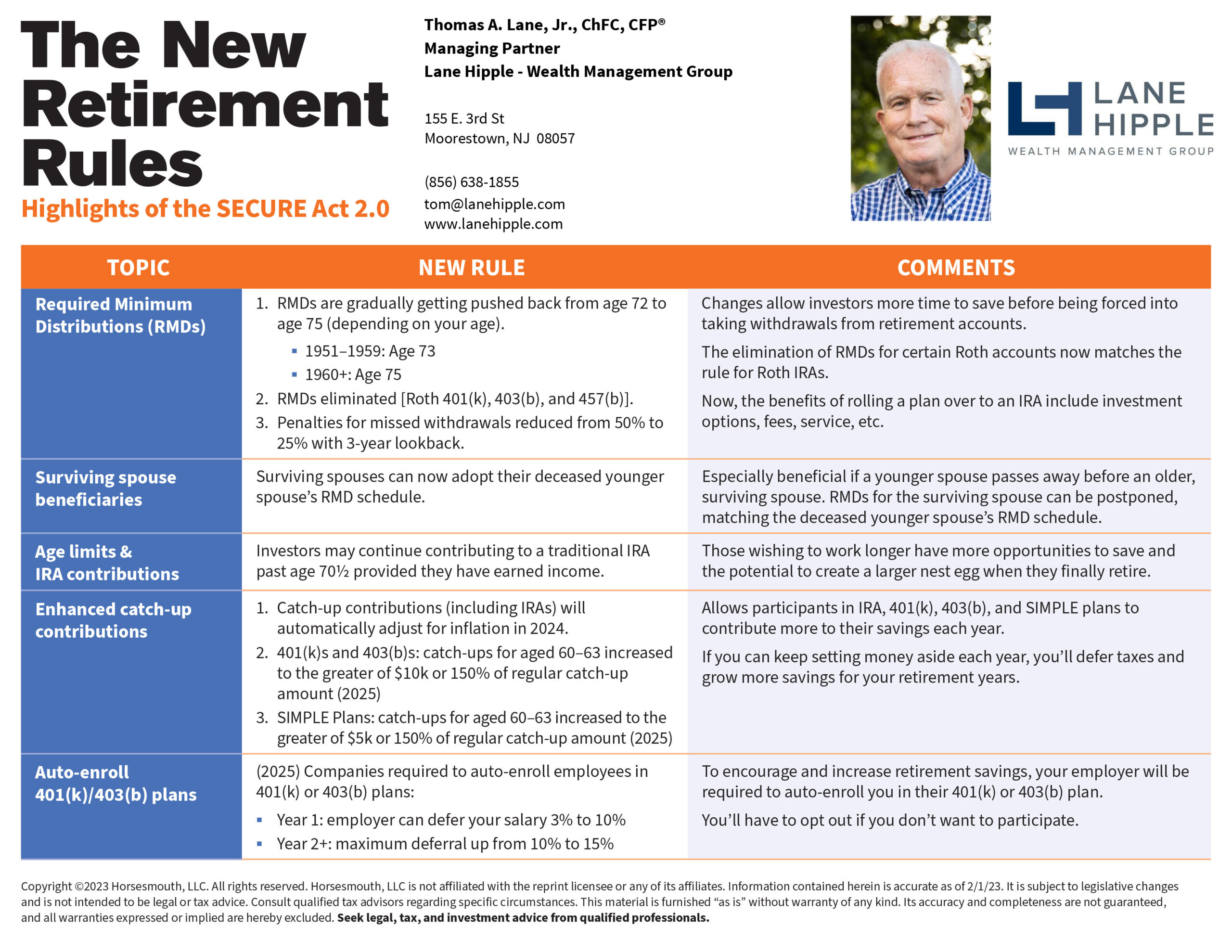

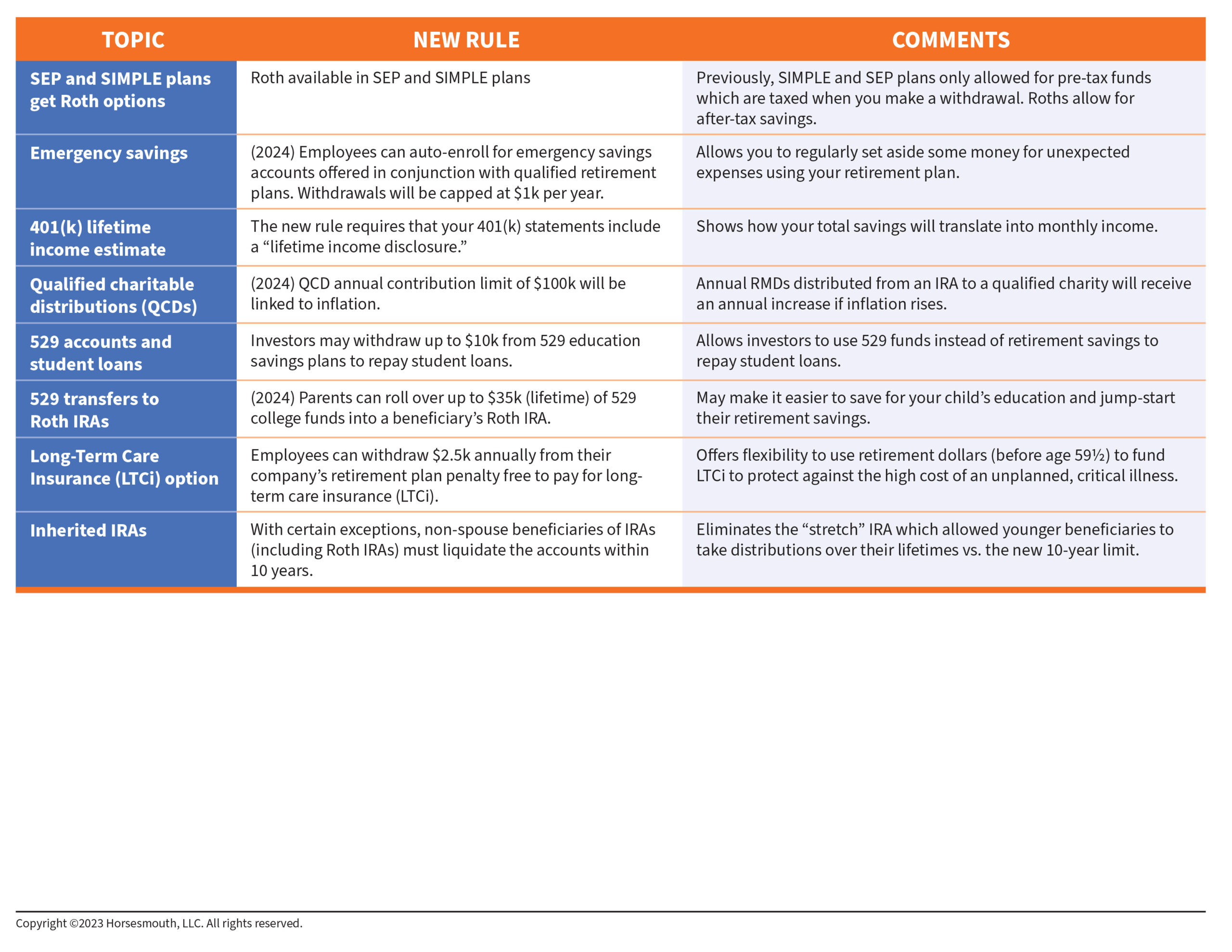

The New Retirement Rules

Highlights of the SECURE Act 2.0