-

Capitalize on Inflation with I Bonds

New data from the Consumer Price Index for Urban Consumers (CPI-U) shows a higher-than-expected inflation rate in April. Over the last 12 months, the average change in the prices paid by urban consumers for goods and services was 8.3% higher. As of this writing, the Dow Jones Industrial Average and the NASDAQ have each shed over 6% of their value over the past 5 days. Investors are looking for investment alternatives that can return something in this market environment. Here is why we see Series I bonds as a potential suitable investment that is attractive right now.

The interest is derived from a combination of a fixed rate and a variable inflation rate tied to CPI-U. Therefore, as inflation rises or falls, the interest rate will increase or decrease. It is set twice a year for a six-month period, and right now, any I bonds issued between May and October 2022 earns interest at 9.62% annually.

Read more about Series I bonds here

Although these are 30-year bonds, owners can redeem them after twelve months. There is a $10,000 purchase limit per person per year and they must be purchased direct from the Treasury Department. Additionally, if you earned a federal income tax refund, you can elect to use it to purchase up to $5,000 of paper I bonds. Lane Hipple cannot purchase I bonds for you, therefore, if you feel this is ideal, then you must purchase the bonds yourself from the Treasury.

To purchase or learn more, please go here https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds.htm

-

Stock market pullback puts spotlight on Roth conversions

You may have heard the strategy, “buy the dip”, but do you know how to “convert the dip”? That is a maneuver some financial planners are educating their clients on to maximize tax benefits. A Roth IRA conversion involves the transfer of assets from a traditional, SEP, or SIMPLE IRA, or from a defined contribution plan like a 401(k), into a Roth IRA. To convert, the account owner pays a one-time income tax on the amount transferred and the account becomes eligible to make tax-free withdrawals in the future. As a result, the Roth IRA is now growing tax-free. The following article from InvestmentNews.com, written by Jeff Benjamin, explains why now may be the right time to convert.

Click to Read Article

-

7 Investment Trends for 2022

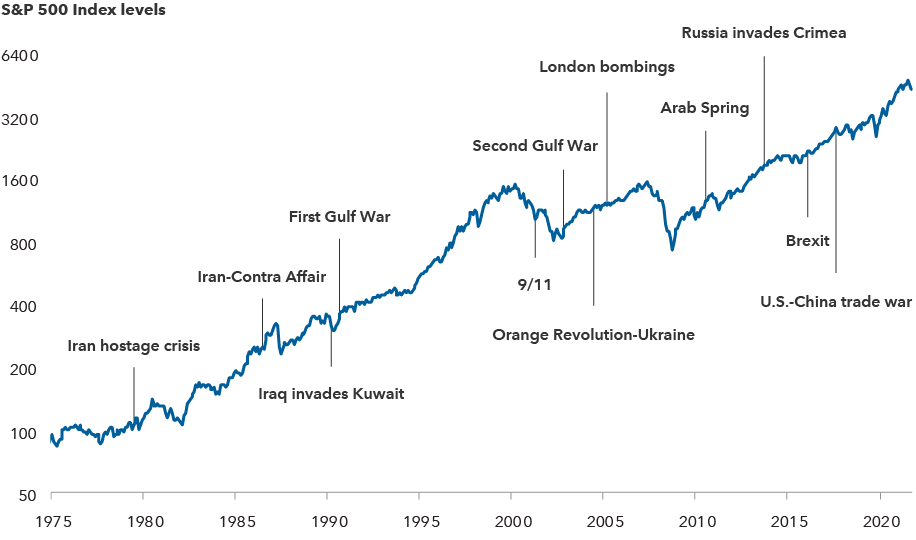

Equity markets have historically powered through geopolitical events

Sources: Capital Group, Refinitiv Datastream, Standard & Poor’s. Index levels reflect price returns, and do not include the impact of dividends. Chart shown on logarithmic scale. As of 2/28/22. Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

It may be easy to feel overwhelmed by news headlines and stock tickers on a daily basis, however, it is important to pause, take a breath, and gain some perspective to the long-term trends that are driving companies and markets. Historically, economic and geopolitical turmoil have not be able to outlast patient, strategic financial planning. In other words, in any market condition, there are always investment opportunities. You just need to know where to look. That is why we have summarized for you a recent article from Capital Group to provide some insights into 7 investment trends for 2022.- Pricing Power – With inflation hitting record levels, investors should be looking at companies that can sustain their profit margins by passing the increased cost of goods sold along to customers. Certain industries have an easier ability to accomplish this. Pharmaceutical and biotech companies like Pfizer and UnitedHealth will always be in high demand. Business with strong brand recognition, like Keurig Dr Pepper and Coca-Cola, carry less risk of losing customers over increased prices.

- Technology – While many consumers are complaining about supply chain issues, chipmakers like Advanced Micro Devices, Samsung, and ST Microelectronics are benefiting from sky-high demand. Many businesses are turning to cloud technology to power their operations, making semiconductors, legacy software, and software-as-a-service (SaaS) one of the fastest growing industries of the last decade. That does not look to be slowing down any time soon.

- The Return of Dividends – During the pandemic, some companies – particularly in Europe – suspended dividends primarily due to political or regulatory pressure. As a result, many of them have surplus capital to redeploy as regular and catch-up dividends. Don’t be so fast to snatch up the highest yields because research conducted by Capital Group shows that since 2007, the highest yielding quintile of stocks had the lowest overall returns. It is still wise to find companies focused on sustained, earnings-based dividend growth over the long-term because it offers a measure of resilience against inflation and interest rate hikes – two events the United States is currently experiencing.

- Healthcare – Although it’s satisfying to refer to the pandemic in past tense, we are not out of the woods yet, which means innovation in health care remains a top priority. The speed at which Pfizer and Moderna developed and deployed their vaccines is an indication of the strength and commitment to discovering new drugs, therapies, and improved diagnostics. According to the Food and Drug Administration, in the last 5 years the FDA has approved, on average, 75% more novel drugs than in the previous nine years. In addition, as technology improves, remote patient monitoring and home diagnostics are becoming part of the continuum of care.

- Transportation – This sector is moving faster in favor of electric vehicles (EVs), due mostly to government incentives and more strict emissions standards for gas-burning cars. Companies are competing for market share with lower prices, better performance, and longer range. The inclusion of software has given vehicles the ability to learn and improve over time through wireless updates. Most exciting (or unnerving, depending on who you ask) is the advancements in the autonomous vehicle industry. Alphabet’s Waymo operates a fully functional robotaxi service in Arizona open to the public. General Motors’ Cruise intends to launch their fully driverless robotaxi service in San Francisco before the end of this year. Self-driving truck startup TuSimple completed an industry first 80-mile autonomous truck ride on public roads with no human in the cab and zero interventions required.

- Media Disruption – The fast-growing segment of the media sector is gaming. Interactive video game companies like Microsoft and Sony are big reasons why this $200 billion industry has surpassed the movie industry in terms of annual gross revenue. In another segment, Netflix continues to get punished by investors for its massive subscriber loss. In Q1, Netflix loss over 200,000 subscribers – the first quarter they have lost subscribers since 2011. For those hoping for a bounce back, the streaming entertainment company anticipates losing 2 million more subscribers in the 2nd quarter!

- Flexible Fixed Income – As mentioned earlier, inflation can lead to increased profits for companies able to pass the additional cost of goods sold to customers. The economy is doing well because more people have jobs and cash they’ve been sitting on throughout the pandemic. Consumer demand is very high and that bodes well for companies with strong balance sheets and a comprehensive growth plan. That is why corporate bonds may be a worthwhile venture and, more specifically, high yield and securitized debt bonds because of their shorter interest duration and the economy’s overall strength.

Don’t allow short-term events around the world derail your financial plan. Focus on your long-term objectives and speak with your Certified Financial Planner to strengthen your portfolio. Perhaps it will result in following one of these trends of 2022.

- Pricing Power – With inflation hitting record levels, investors should be looking at companies that can sustain their profit margins by passing the increased cost of goods sold along to customers. Certain industries have an easier ability to accomplish this. Pharmaceutical and biotech companies like Pfizer and UnitedHealth will always be in high demand. Business with strong brand recognition, like Keurig Dr Pepper and Coca-Cola, carry less risk of losing customers over increased prices.

-

Elon Musk’s Twitter Takeover

It has been a busy month for the richest man in the world, Elon Musk. The CEO of SpaceX and Tesla, Inc. has an estimated net worth of around $252 billion and a penchant for free speech, specifically on social media. A Twitter user since June 2010, Musk has faced some controversy through his choice of Tweets over the years. In August 2018, he claimed in a tweet that he was taking Tesla private at $420 per share. The SEC fined Musk and Tesla $20 million each, concluding that the tweets had no basis in fact and hurt investors.

This time around, Musk moved more deliberately and was almost compliant in his quest to acquire Twitter for $44 billion and take it private.

For Twitter shareholders, they will receive $54.20 per share in cash once the deal meets regulatory approval and other closing considerations. Even if you don’t hold Twitter stock, the changes Musk could bring to Twitter may impact how other social media and tech companies operate, like Facebook or Apple. As a private company, Twitter won’t have to report their financials in the same way as other competing companies, which means less transparency overall in the space. The following article outlines how exactly we got here in such a short time frame:

Click to Read Article

-

Welcome Mike Stringer!

We are excited to announce the addition of Mike Stringer as Chief Operating Officer.

Mike embodies our fundamentals and will help enhance every aspect of our business and client experience. Mike will focus his efforts on building and managing our organization to drive the evolution of Lane Hipple.

“Mike brings dynamic capabilities to our organization and his leadership will positively affect all Lane Hipple stakeholders,” said Lane Hipple partner Andy Hipple, CFP. “I am confident he will strategically advance our organization as the premier financial planning firm for our community.”

Mike has 12 years of industry experience and extraordinary talents to fuel Lane Hipple’s growth and effectiveness. He has implemented systems and solutions in the areas of process, people, marketing, and operations. Mike will be working to progress the strategic planning, business continuity, and operational efficiency of the organization. A graduate of La Salle University, Mike resides in Medford with his wife and two children.

Please join us in welcoming Mike Stringer to our team at Lane Hipple. This addition is part of a continued commitment to our existing clients to enhance their value and service while expanding our capacity to help more families far into the future.

Thank you for being a crucial part of our journey and for your continued support of our firm!

Tom Lane, Jr., Andy Hipple, Tom Lane, III