-

Inflation Reduction Act: Biden Signs Sweeping Measures into Law

What it Means for Climate Change, Health Care, and Taxes

President Biden signed the Inflation Reduction Act into law on Tuesday, August 16, marking a major legislative victory for Democrats.

No Republican lawmakers voted for the bill, and it required a tie-breaking vote in the Senate by Vice President Harris in order to go to Biden’s desk. The legislation was a year in the making, and it contains measures aimed at combatting climate change, increasing tax revenue, and lowering health care costs for Americans. That sounds good, but what does it actually do for the record-high inflation numbers we have seen this year? Critics of the bill argue that it is counterintuitive in the long-run because of the billions in government spending it requires and the stifling of gross national profit through higher corporate tax.

Below, we have a high-level summary of some of the measures taken via the Inflation Reduction Act and how Americans may feel it impacts them now and in the future.

For a more detailed analysis of the bill, the Tax Foundation published this article sharing projections on how the bill will affect the U.S. budget window from 2022-2031.

A Year-Long Legislative Battle

Democrats struggled to make the legislation a reality after conservative Democratic Senator Joe Manchin of West Virginia pulled his support. At the time, Manchin cited concerns over approving more spending measures during a time of record inflation. However, Manchin and Senate Majority Leader Chuck Schumer, D-NY, resumed talks in July and struck a deal.

“The American people won, and the special interests lost,” Biden noted during the bill signing, with Manchin joining him on the dais.

What the Inflation Reduction Act Means for Health Care

When Biden mentioned special interests losing, he was referring to pharmaceutical companies. Many had lobbied against measures in the bill related to Medicare prescription drug costs. That’s because the new law enables the federal health secretary to negotiate the prices of some prescription drugs for Americans on Medicare, leading to lower prices for consumers.

The law also caps out-of-pocket prescription costs for Medicare Part D recipients at $2,000 annually. This cap goes into effect in 2025 and, combined with lower prescription drug costs, it is expected to lower health care spending for more than five million Americans.

Additionally, more than three million diabetic Americans on Medicare are now guaranteed that their monthly insulin costs will be capped at $35.

Finally, the Inflation Reduction Act also provides a three-year extension on the Affordable Care Act (ACA) health care subsidies that were created in 2021 as a pandemic relief measure.

Bold Steps on Climate Change

The Inflation Reduction Act set aside more than $300 billion to be invested in energy and climate reform measures. This gives it the distinction of being the largest federal clean energy investment in American history. In short, it’s the most significant step the U.S. has taken toward addressing climate change.

The law includes a $60 billion allocation to boost renewable energy infrastructure in the manufacturing sector, related to things like wind turbines and solar panels. It also created tax credits for electric vehicles, solar panel systems, and other measures to make homes more energy efficient. These tax credits take effect immediately, and the White House has plans to unveil an interactive website that allows individuals, families, and small businesses to easily access information about the tax credits.

The Biden administration and Democratic congressional leaders say the collective measures will reduce greenhouse gas emissions by 40%, based on 2005 levels, by 2030. However, this still falls short of Biden’s original goal.

Tax Measures

Energy efficiency tax credits aren’t the only tax measure in the new law. The Inflation Reduction Act also established a 15% minimum tax for all corporations earning $1 billion or more in income. This is expected to bring in more than $300 million in revenue.

Critics have noted that the legislation paves the way for 87,000 new IRS agents to be hired. This could disproportionately impact middle-class Americans and small businesses through increased audits.

Read Article: Strategies for Building Wealth In Your 50s

What’s NOT in the Legislation

Democrats initially hoped the new law would include funding for childcare, universal pre-K, and paid family leave. All of these items were dropped as negotiations with Manchin played out.

Additionally, and despite the law’s moniker, it does little to address inflation – at least in the present. The Congressional Budget Office reports that the Inflation Reduction Act will have a negligible impact on inflation in 2022 and into 2023. The Biden Administration says the combination of deficit reduction measures, higher taxes, and new green energy revenue streams will eventually lower inflation.

Additional summary information about the new law is available on the White House website.

If you have questions about the Inflation Reduction Act or wish to speak with a financial professional, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. We have been granted a license in perpetuity to publish this article on our website’s blog and share its contents on social media platforms. We have no right to distribute the articles, or any other content provided to our Firm, by Illuminated Advisors in a printed or otherwise non-digital format. We are not permitted to use the content provided to us or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

Every Woman Needs Her Own Financial Strategy

Ahead of National Women’s Equality Day on August 26th, this article shares key data points highlighting why women must take a different approach to their financial strategy than men.

Women continue to earn less

Despite an increased presence in the workforce, the average woman working full-time earns $0.82 for every $1 earned by her male counterpart.¹

Women live longer

A man reaching age 65 today can expect to live, on average, until age 84, while a woman the same age can expect to live almost 87 years.² As a result, women generally need to rely on retirement income for a longer span. They also face higher health care costs than men during their retirement years.³

Women are more likely to be single later in life

In 2020, 70% of men age 65 and older were married, compared to just 48% of women.⁴ Single women don’t have the opportunity to capitalize on the resource pooling and economies of scale accompanying a marriage or partnership.

Women are time-starved

In their many roles as workers, wives, mothers, and daughters, women are responsible for more than three-quarters of unpaid domestic work.⁵ This includes housekeeping duties and care-taking responsibilities for children, aging parents or disabled family members.

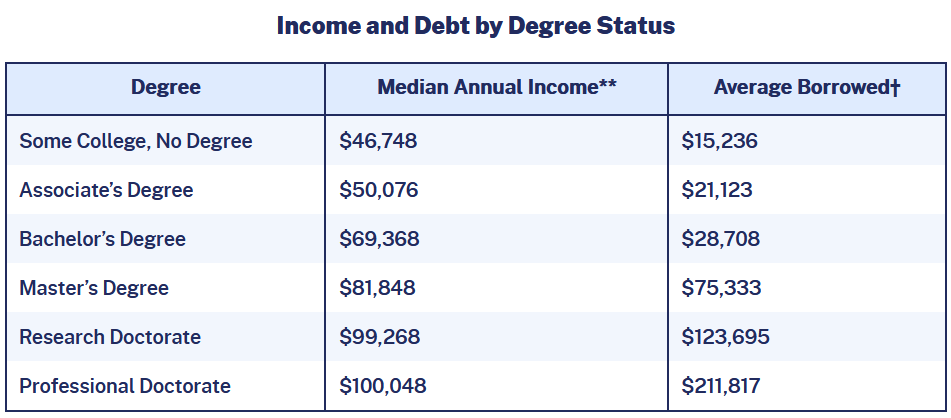

Women are paying the price for going back to school

American now hold over $1.75 trillion in outstanding student loan debt with women holding almost two-thirds of that debt.⁶

For many women, financial independence is the number one concern. But what steps can a woman take to help her achieve this throughout her life? Here are a few key action steps you can take to help create financial confidence in your retirement years:

1. Keep Money In Your Name

Every woman needs a pot of money to call her own. This means that in addition to joint financial accounts you may have, you should consider keeping some financial accounts in your name only. Also, make sure you maintain an individual credit history. You can do this by holding a credit card or personal loan issued just to you.

2. Confront Your Fears

Are you controlling you money, or is it controlling you? Are your ideas about money and money management keeping you from becoming financially confident? As women increase education levels and continue to take on expanded roles in the workforce, they control more wealth. As a result, traditional views about finances need to be redefined, and women need to face financial decisions head-on.

3. Share the Decisions

If you share finances with someone else, you need to start talking. This way, you’ll know if you share the same goals and dreams for the future, as well as whether you are on track to meet those goals. Also, remember that disagreements are bound to happen; good communication is key to working through those disagreements and getting you back on track financially as a couple.

4. Maintain Access To All Financial Documents

Keep your financial records accessible and easy to gather when you need them. This could include brokerage accounts, insurance policies, retirement plan statements, tax returns and other important documents. Keep a record of who owns each account. Be sure to notify the person responsible for handling your estate where all your documents are and whom to contact in the event of your passing.

5. Pay Yourself First

Fund your IRA, 401(k) or other retirement account to the maximum. This will reduce your taxable income and allow you to benefit from tax-deferred compounding. When you leave a job, working with a Certified Financial Planner™ can help you determine if rolling your 401(k) funds into an IRA is right for you. An IRA account balance can continue to grow tax-deferred, and you will gain the ability to choose from a broader array of investments than what is likely available in your employer’s plan.

6. Choose The Right Financial Professional For You

It’s important to work with a Certified Financial Planner™ you trust. Ask for referrals and interview several to find rapport. Don’t be shy about asking for references, and check their credentials. An experienced Certified Financial Planner™ can help you look for the right solutions at every stage of your life and help you build confidence in your ability to take control of your finances.

7. Put Your Strategy In Writing

Ask your Certified Financial Planner™ to help you create a formal, written, long-term retirement income strategy. A written strategy will provide the framework for defining your financial goals and shaping your decisions. It also will help you set your sights on those goals in the long-term and help you keep on track regardless of economic conditions or unexpected life events.

8. Have A Backup Plan

Speaking of life events, don’t let a critical life change – such as marriage, divorce, widowhood or illness – derail your goals. Your Certified Financial Planner™ can work with you to create a strategy to address the unexpected and keep you moving toward your goals.

9. Understand What You Own

Although working with a Certified Financial Planner™ is vital, you must also know and make sense of the financial products you hold. Educate yourself on basic financial principles by taking classes, reading books or financial trade journals, and doing research.

10. Plan For Your Family’s Future

When planning your estate, you can create a strategy designed to take care of your heirs while optimizing your retirement income. Work with a qualified estate planner and Certified Financial Planner™ to design a strategy for passing on wealth to your loved ones while enjoying the fruits of what you’ve worked hard to earn throughout your lifetime.

Financial independence starts with determining your financial goals and putting in place a strategy designed to help you reach them. By implementing the steps outlined here, you can be well on your way to creating financial confidence for yourself, both now and in your retirement years.

¹ Payscale. March 15, 2022. “The State of the Gender Pay Gap 2022.” https://www.payscale.com/research-and-insights/gender-pay-gap/. Accessed May 17, 2022.

² Social Security Administration. “Important Thins to Consider When Planning for Retirement: What is Your Life Expectancy?” https://www.ssa.gov/benefits/retirement/planner/otherthings.html. Accessed May 17, 2022.

³ RegisteredNusing.org. Dec. 28, 2021. “Here’s How Much Your Healthcare Costs Will Rise as You Age.” https://www.registerednursing.org/articles/healthcare-costs-by-age/. Accessed May 17, 2022.

⁴ Administration for Community Living. May 2021. “2020 Profile of Older Americans.” Page 6. https://acl.gov/sites/default/files/Aging%20and%20Disability%20in%20America/2020ProfileOlderAmerican.Final_.pdf. Accessed May 17, 2022.

⁵ Free Network. Dec. 20, 2021. “Global Gender Gap in Unpaid Care: Why Domestic Work Still Remains a Woman’s Burden.” https://freepolicybriefs.org/2021/12//20/gender-gap-unpaid-care/. Accessed May 17, 2022.

⁶ AAUW. “Deeper in Debt: Women & Student Loans 2021 Update.” https://www.aauw.org/app/uploads/2021/05/Deeper_In_Debt_2021.pdf. Accessed May 17, 2022.

Content provided by Advisors Excel. © 2022 Advisors Excel, LLC

-

College Student Financial Tips for the Young People in Your Life

How to Help a New College Student Prepare for Success

The first semester of college is an exciting time, and the perfect moment to pass along financial tips for your new college student. Oftentimes, it’s the first chance young people have to leave the nest, spread their wings, and experience the ups and downs that come with financial freedom.

Your kids have come a long way from the days of the tooth fairy and piggy banks as fiscal cornerstones. It’s critical that young people enter into this next stage of life with everything they need to not only succeed academically, but financially, too. The college student financial tips below are helpful topics to discuss with the new college students in your life to help them start off on the right foot.

Tip #1: Learn Budgeting Basics

There are many different ways to budget and prioritize. You can give your child a big advantage by sitting down and coming up with a reasonable and realistic financial plan for fixed items, extracurriculars, academic needs, and even an emergency fund to prepare for the unexpected.

Then determine the best way to keep track of the budget. There are several apps loaded with features that can make it easy to stay on track. Or, if your college student is a fan of spreadsheets, they can put their math skills to good use with some easy formulas and templates. Better yet, see if they can sign up for a budgeting, financial skills, or economics course that can help integrate their personal and academic goals.

Tip #2: Be Wary of Borrowing

Student loans are a staple of college education financing for many students these days. But even though they’re available, it pays to be wary of how much you borrow and how you use the funds. Though there are plenty of temptations in campus life—spring break, shopping, or late-night pizzas—student loan dollars should only be used for tuition, books, and necessary living expenses.

Depending on how savvy your child is with financial situations, you may want to suggest that you help take them through the loan paperwork before they sign it. Student loan debt in the United States totals a whopping $1.75 trillion dollars, and the average U.S. household with student debt owes $62,913. So, it’s important to be clear that there’s a lot on the line.

SOURCE: www.educationdata.org *Among workers aged 25 years and over; based on average weekly earnings of full-time wage and salary workers.

†Cumulative student loans only (no Parent PLUS); data collected between 2015 and 2018, currency inflated to 2021Q2 values to match income data collection period; amount borrowed is not equivalent to current debt.Tip #3: Prioritize Education

We want our kids to make the most of college on the academic front, but we also hope that it’s a fun and enjoyable time in their lives. It’s a new and exciting environment, and often the first chapter of their lives in which they are able to branch out on their own and discover who they are and what they want out of life. Of course, life is about balance, and new students need to walk the line between the call of adventure and important academic obligations. Falling behind can quickly lead to failing a class. Not only will that hurt their academic standing, but if they have to make up the class, they’ll likely have to pay for it again.

Tip #4: Credit Is Complicated

Credit cards can seem a bit like an “easy button” for young people tempted by the latest fashions, technology, and experiences. Fortunately, by law, credit card companies aren’t permitted to market on college campuses or issue cards to anyone under 21 without proof of income or an adult cosigner.

You can, of course, add your child to your card as an authorized user, but be sure to limit use to emergencies only and discuss the dangers of high-interest debt.

Tip #5: Live by the Textbook

Textbooks are notoriously expensive—over the course of a college career a student can easily exceed thousands of dollars on textbooks alone. Buying used books can save some funds, as can sharing costs with a study partner who is in the same class. Renting is also an option—there are plenty of companies online that will let you rent or borrow books one semester at a time for a much lower price point. Make certain your student knows that buying new isn’t the only option.

Tip #6: Master the Basics

Your child may be book smart, but often the biggest life lessons aren’t covered in school. Make sure your new college student has a good grasp of basic living skills. Teach them how to cook on a budget instead of ordering food out. That one habit alone can save them thousands of dollars. Encourage them to carpool or take public transportation instead of relying on cabs or Uber. Making sure they do their own laundry can also ensure their clothes last for years instead of months. These may sound like basic life skills instead of college student financial tips but, when combined, they can help your child prepare for a successful college career and a financially responsible life ahead.

College Sets the Course

Your child’s college years are consequential on several fronts. How your new college student does in their academic career can have a big impact on their career prospects, of course, but there’s more to it. Looking beyond grades, it’s also a time during which they discover who they are and what they’re made of. Giving sound advice can help them feel confident and accomplished and set them up for a future they (and you) can be proud of. So, use these financial tips for your new college student to help them chart a successful course through college and beyond.

If you think you would benefit from a conversation about personal finance or broader financial planning topics, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. We have been granted a license in perpetuity to publish this article on our website’s blog and share its contents on social media platforms. We have no right to distribute the articles, or any other content provided to our Firm, by Illuminated Advisors in a printed or otherwise non-digital format. We are not permitted to use the content provided to us or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

5 Things You Need To Know To Ride Out A Volatile Stock Market

This article, written by Franklin Distributors, LLC, provides great insight on how to approach today’s investment environment.

1. Watching from the sidelines may cost you

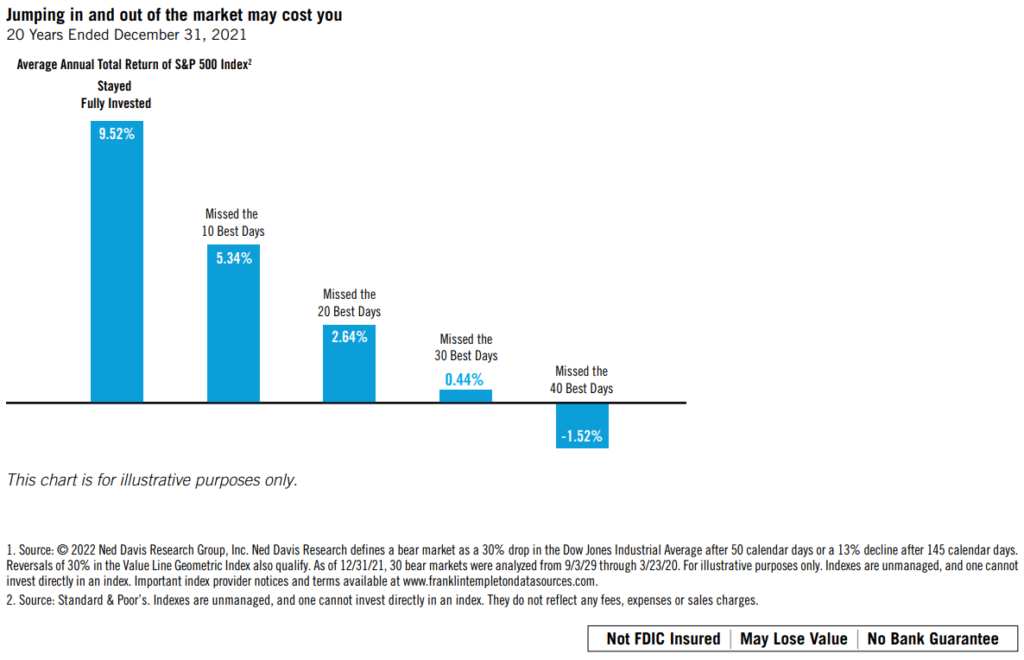

When markets become volatile, a lot of people try to guess when stocks will bottom out. In the meantime, they often park their investments in cash. But just as many investors are slow to recognize a retreating stock market, many also fail to see an upward trend in the market until after they have missed opportunities for gains. Missing out on these opportunities can take a big bite out of your returns. Consider that on average, for the 12 months following the end of a bear market, a fully invested stock portfolio had an average total return of 38.3%. However, if an investor missed the first six months of the recovery by holding cash, their return would have been only 8.0%¹. The chart below is a hypothetical illustration showing the risk of trying to time the market. By missing just a few of the stock market’s best single-day advances, you could put a real crimp in your potential returns.

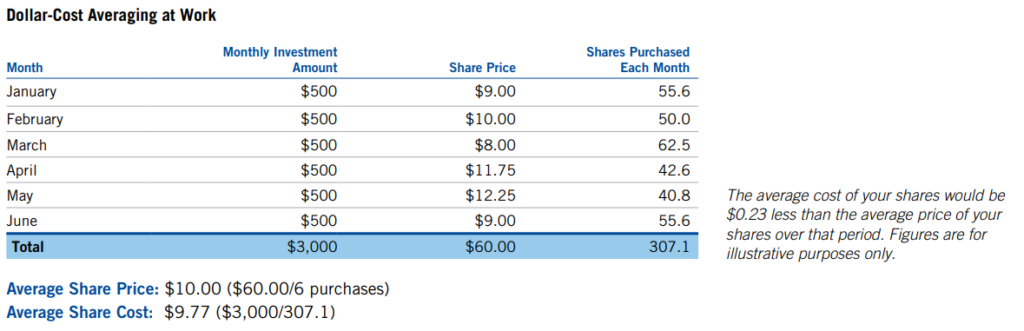

2. Dollar-cost averaging makes it easier to cope with volatility

Most people are quick to agree that volatile markets may present buying opportunities for investors with a long-term horizon. But mustering the discipline to make purchases during a volatile market can be difficult. You can’t help wondering, “Is this really the right time to buy?”

Dollar-cost averaging can help reduce anxiety about the investment process. Simply put, dollar-cost averaging is committing a fixed amount of money at regular intervals to an investment. You buy more shares when prices are low and fewer shares when prices are high. And over time, your average cost per share may be less than the average price per share. Dollar-cost averaging involves a continuous, disciplined investment in fund shares, regardless of fluctuating price levels. Investors should consider their financial ability to continue purchases through periods of low price levels or changing economic conditions. Such a plan does not guarantee a profit or eliminate risk, nor does it protect against loss in a declining market.

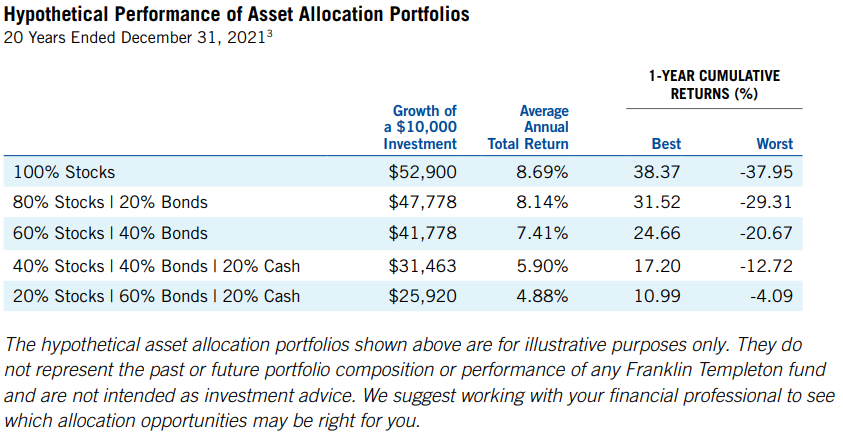

3. Now may be a great time for a portfolio checkup

Is your portfolio as diversified as you think it is? Meet with your financial professional to find out. Your portfolio’s weightings in different asset classes may shift over time as one investment performs better or worse than another. Together with your financial professional, you can re-examine your portfolio to see if you are properly diversified. You can also determine whether your current portfolio mix is still a suitable match with your goals and risk tolerance.

4. Tune out the noise and gain a longer-term perspective

Numerous television stations, websites and social media channels are dedicated to reporting investment news 24 hours a day, seven days a week. What’s more, there are almost too many financial publications to count. While the media provides a valuable service, they typically offer a very short-term outlook. To put your own investment plan in a longer-term perspective and bolster your confidence, you may want to look at how different types of portfolios have performed over time.

- Source: © 2022 Morningstar, Inc., 12/31/21. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results. Stock investments are represented by equal investments in the S&P 500 Index, Russell 2000® Index, and MSCI EAFE Index, representing large U.S. stocks, small U.S. stocks, and foreign stocks, respectively. Bonds are represented by the Bloomberg Barclays U.S. Aggregate Index. Cash equivalents are represented by the FTSE 3-Month U.S. Treasury Bill Index. Portfolios are rebalanced annually. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges.

5. Believe your beliefs and doubt your doubts

There are no real secrets to managing volatility. Most investors already know that the best way to navigate a choppy market is to have a good long-term plan and a well-diversified portfolio. But sticking to these fundamental beliefs is sometimes easier said than done. When put to the test, you sometimes begin doubting your beliefs and believing your

doubts, which can lead to short-term moves that divert you from your long-term goals.To keep a balance perspective, we recommend that you contact your financial professional before making any changes to your portfolio.

-

Focus on Your Financial Freedom this Independence Day

Five Steps to Declare Your Financial Independence

Are you ready to revolutionize your fiscal plan and attain financial freedom?

In 2019, an AARP study found that 53% of adult households in the United States did not have an emergency savings account. The pandemic applied even more pressure to struggling Americans, exacerbating that anxiety. The fear of not having financial security can feel overwhelming, but you can take this moment to embrace the nation’s ethos of “land of the free and home of the brave” and apply it to your money management plan. Read on for five steps to follow to reach your personal money goals and achieve financial independence.

1. Expect the Unexpected with an Emergency Fund

It’s always been a smart idea to set aside some money in a savings account for the unexpected. The COVID-19 pandemic, and the economic and employment downturn it spurred, turned that theoretical possibility into a reality for many Americans. Having emergency cash in the bank can give you back the financial freedom that comes from having peace of mind. In the event of a global issue, the loss of your employment, or even an unexpected car repair or medical bill, an emergency fund is there to help. Though we’re all hopeful to soon put the pandemic and its effects fully behind us, one of the lasting lessons we can take away is that an emergency fund is a critical financial strategy.

Exactly how much you should set aside is a personal equation based on what you can afford today and your cost of living, but a good rule of thumb is to put away three to six months of expenses. You can sock it away in any savings account, but an FDIC- (or NCUA-) insured account at your bank or credit union is ideal. Set a monthly goal for how much you can contribute to savings and look for ways to automate the process.

Looking for a way to level up your emergency fund? Once you build it up to a certain amount, you may want to consider having your money work for you. If you exceed your emergency fund goals, keep saving and set aside some to invest in a low-risk fund to maximize yield.

Deciding to save into an emergency fund is a great way to regain control over your financial wellness and boost your overall well-being. Financial freedom can give you peace of mind that’s truly priceless.

2. Curb Spending and Increase Calm

Feeling financially free isn’t about being able to spend whatever you want today. It’s about knowing that you’ve saved enough that you don’t have to worry in the future. Setting a budget does force you to curb spending in the short term but setting up those fiscal guardrails is one of the surest paths to financial independence.

Having a realistic budget gives you a deep sense of calm and reassurance. Once you know how much money is coming in and how much you can spend, you have a holistic picture of where your money is going. Think of a budget as a road map. You wouldn’t set out on a cross-country trip without any idea of which road to follow. Living without a budget is like driving blind. Setting targets, defining priorities, and giving every dollar a job can help you get to where you need to go by putting you in the driver’s seat. What better way is there to achieve financial freedom?

Related Article: Financial Goal-Setting Tips to Help Achieve Your Money Goals

3. Make a Debt-Free Declaration

Being debt-free is one of the best markers of financial freedom. Getting out of debt and staying out permanently can help you save the money you need to have a stable future.

However, not all debt is created equal. There’s a difference between good debt and bad debt—the former can help you complete your education or buy a dream home, while the latter can bog you down with high-interest rates and unnecessary monthly payments. A 2020 Experian report showed that the average American owes approximately $92,727 in total debt—the highest amount ever recorded. If you’re in debt, you’re not alone. There are several strategies and steps that can help, but whichever path you take, make sure it’s both attainable and sustainable.

Before you buy something that will come with a high-payment plan, ask yourself if you a) need it and b) can actually afford it. Using an auto loan calculator or mortgage calculator can help you determine what fits into your budget.

4. Retirement Plan to Brighten Your Future

What is the ultimate financial freedom goal? For many people, it’s being able to have a secure, comfortable retirement in your later years. Here are a few simple things you can do today to help prepare for a great tomorrow:

- Maximize contributions to any tax-advantaged retirement savings accounts, like an IRA or a 401(k) plan

- Take advantage of any employer matching contributions so you can receive the full amount offered

- Diversify your investment portfolio with a mix of asset classes

It can be difficult to make short-term sacrifices in the name of a more comfortable future but keep your eye on the ball and remember you’re giving yourself the gift of financial independence.

5. Pay it Forward and Let Freedom Ring

If you’ve already accomplished all the items on this list and feel secure in your financial freedom, consider celebrating this July 4th holiday by helping others. Determine how much you can set aside for charitable giving and help support the missions and people who are important to you.

If you have younger loved ones, you can help set up or fund their 529 college savings account. It’s a great way to promote financial independence for the next generation, and maybe even help yourself along the way—some states let you claim a tax deduction for that kind of donation.

If you don’t have relatives that need help, consider donating to a child-focused charity, particularly one with a focus on education. Investing in the next era of earners can help us all enjoy more financial freedom in the years ahead.

Financial Independence on July 4th and Beyond

Freedom means many things for many different people, but on the fourth day of the seventh month of the year, we all come together to celebrate how lucky we are to be able to have the opportunities associated with independence. Financial security can help you feel more confident, in control, at peace, and, of course, free to live the life of your dreams.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.