-

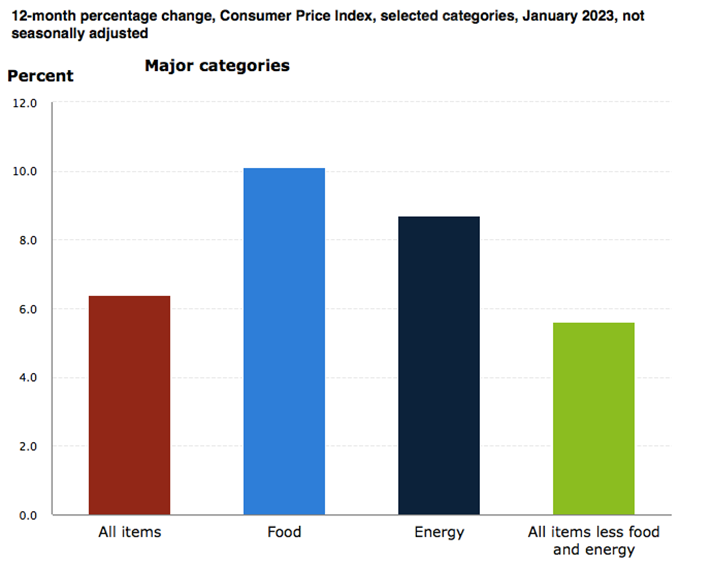

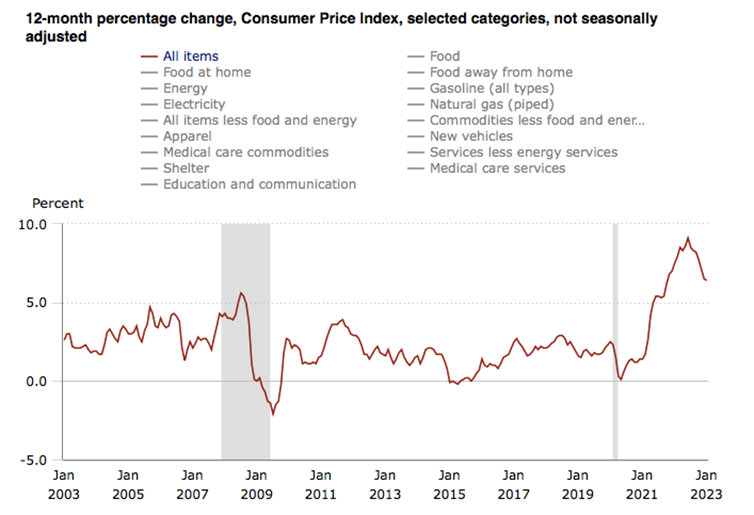

Inflation Was Up 0.5% in January and 6.4% Over the Past 12-Months

On Tuesday, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U) rose 0.5% in January on a seasonally adjusted basis, after increasing 0.1% in December. Over the last 12 months, the all items index increased 6.4% before seasonal adjustment.

Specifically:

- The index for shelter was by far the largest contributor to the monthly all items increase, accounting for nearly half of the monthly all items increase, with the indexes for food, gasoline, and natural gas also contributing.

- The food index increased 0.5% over the month with the food at home index rising 0.4%.

- The energy index increased 2.0% over the month as all major energy component indexes rose over the month.

The index for all items less food and energy rose 0.4% in January. Categories which increased in January include the shelter, motor vehicle insurance, recreation, apparel, and household furnishings and operations indexes. The indexes for used cars and trucks, medical care, and airline fares were among those that decreased over the month.

The all items index increased 6.4% for the 12 months ending January; this was the smallest 12-month increase since the period ending October 2021. The all items less food and energy index rose 5.6% over the last 12 months, its smallest 12-month increase since December 2021. The energy index increased 8.7% for the 12 months ending January, and the food index increased 10.1%.

Items of Note January 2023 12-Months Ended January 2023 All Items 0.5% 6.4% Food 0.5% 10.1% Energy 2.0% 8.7% Fuel Oil -1.2% 27.7% Utility (piped) gas service 6.7% 26.7% Used cars and trucks -1.9% -11.6% Shelter 0.7% 7.9% Inflation Over the Past 20-Years

Sources: bls.gov

-

2022 Goods and Services Deficit Increased By $103 Billion From 2021

On Tuesday, the U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced that the goods and services deficit was $67.4 billion in December, up $6.4 billion from $61.0 billion in November.

December exports were $250.2 billion, $2.2 billion less than November exports. December imports were $317.6 billion, $4.2 billion more than November imports.

The December increase in the goods and services deficit reflected an increase in the goods deficit of $7.4 billion to $90.6 billion and an increase in the services surplus of $1.0 billion to $23.2 billion.

For 2022, the goods and services deficit increased $103.0 billion, or 12.2%, from 2021. Exports increased $453.1 billion or 17.7%. Imports increased $556.1 billion or 16.3%.

Three-Month Moving Averages

The average goods and services deficit decreased $2.1 billion to $68.6 billion for the three months ending in December.

- Average exports decreased $2.6 billion to $253.0 billion in December.

- Average imports decreased $4.7 billion to $321.6 billion in December.

Year-over-year, the average goods and services deficit decreased $6.4 billion from the three months ending in December 2021.

- Average exports increased $24.2 billion from December 2021.

- Average imports increased $17.8 billion from December 2021.

Exports of Goods

- Nonmonetary gold decreased $1.6 billion.

- Crude oil decreased $0.8 billion.

- Other petroleum products decreased $0.6 billion.

- Jewelry decreased $0.4 billion.

- Pharmaceutical preparations decreased $0.2 billion.

- Foods, feeds, and beverages increased $0.7 billion.

Imports of Goods

- Cell phones and other household goods increased $3.5 billion.

- Automotive vehicles, parts, and engines increased $2.9 billion.

- Passenger cars increased $1.6 billion.

- Other automotive parts and accessories increased $0.7 billion.

- Fuel oil decreased $0.8 billion.

- Organic chemicals decreased $0.8 billion.

Sources: bea.gov

-

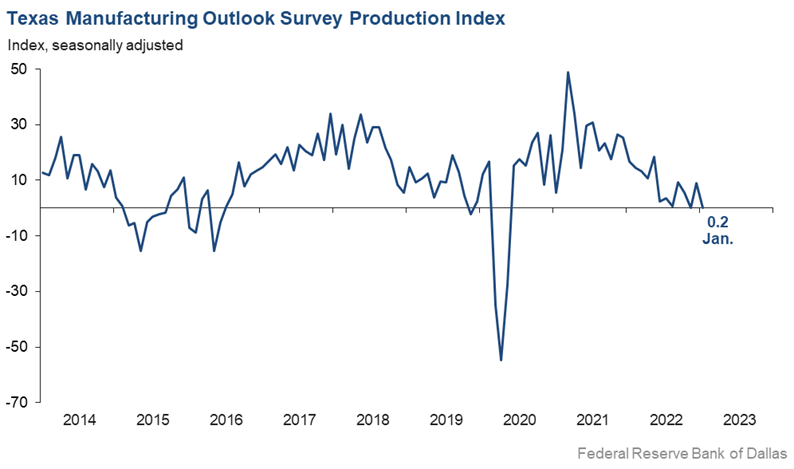

Manufacturers in Texas Saw Growth in Factory Activity Slow in January

Every month, the Federal Reserve Bank of Dallas asks Texas business executives questions on labor market conditions and the results are compiled into the Texas Manufacturing Outlook Survey, the Texas Service Sector Outlook Survey and the Texas Retail Outlook Survey.

On January 30th, the Federal Reserve Bank of Dallas reported that: “Growth in Texas factory activity slowed in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 9.1 to 0.2, with the near-zero reading suggestive of flat output.

Other measures generally indicated weakened manufacturing activity this month. The new orders index was negative for an eighth month in a row – suggesting a continued decrease in demand – though it moved up from -11.0 to -4.0. The growth rate of orders index inched down to -12.3. The capacity utilization index was positive but dipped from 7.9 to 6.0, while the shipments index returned to negative territory at a reading of -6.3.

Perceptions of broader business conditions continued to worsen in January, though pessimism waned. The general business activity index remained negative but shot up 12 points to -8.4. Similarly, the company outlook index posted its 11th straight negative reading but moved up 11 points to -2.5. The outlook uncertainty index was largely unchanged at 16.8.

Labor Market & Price Pressures

Labor market measures pointed to stronger employment growth and longer workweeks.

- The employment index climbed four points to 17.6, a reading significantly above its series average of 7.9.

- Thirty-one percent of firms noted net hiring, while 13 percent noted net layoffs.

- The hours worked index held fairly steady at 3.8.

Further, price pressures were generally steady and wage growth eased slightly in January.

- The raw materials prices index was largely stable at 20.5, remaining below its series average of 28.0 for the third month in a row.

- The finished goods prices index was little changed at 9.9, roughly in line with its series average of 9.0.

- The wages and benefits index ticked down from 34.2 to 30.5.

Expectations regarding future manufacturing activity were mixed in January. The future production index pushed further positive to 16.1, signaling that respondents expect output growth over the next six months. The future general business activity index remained negative, coming in at -9.1. Most other measures of future manufacturing activity were positive this month.”

Sources: dallasfed.org

-

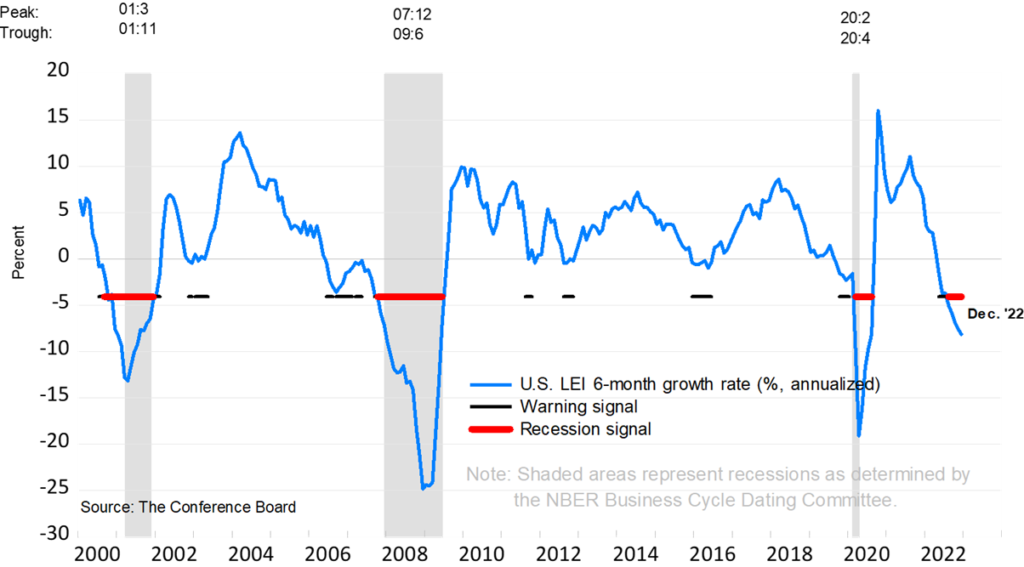

Conference Board Leading & Coincident Economic Indicators Pointing to a Recession

The Conference Board was founded in 1916 by a group of CEOs “concerned about the impact of workplace issues on business, and with a desire for greater cooperation and knowledge sharing among businesses.”

Every month, the Conference Board compiles a composite of economic indexes designed to signal peaks and troughs in the business cycle. The leading, coincident, and lagging economic indexes are essentially composite averages of 10 individual indicators and help smooth out some of the volatility of individual components.

The ten components include:

- Average weekly hours, manufacturing

- Average weekly initial claims for unemployment insurance

- Manufacturers’ new orders, consumer goods and materials

- ISM Index of New Orders

- Manufacturers’ new orders, nondefense capital goods excluding aircraft orders

- Building permits, new private housing units

- Stock prices, 500 common stocks

- Leading Credit Index

- Interest rate spread, 10-year Treasury bonds less federal funds

- Average consumer expectations for business conditions

Leading Indicators Signaling a Recession

On January 23rd, the Conference Board announced that its Leading Economic Index for the U.S. decreased by 1.0% in December 2022 to 110.5 (2016=100), following a decline of 1.1% in November.

The LEI is now down 4.2% over the six-month period between June and December 2022 – a much steeper rate of decline than its 1.9% contraction over the previous six-month period (December 2021–June 2022).

“The US LEI fell sharply again in December – continuing to signal recession for the US economy in the near term. There was widespread weakness among leading indicators in December, indicating deteriorating conditions for labor markets, manufacturing, housing construction, and financial markets in the months ahead.

Meanwhile, the coincident economic index (CEI) has not weakened in the same fashion as the LEI because labor market related indicators (employment and personal income) remain robust. Nonetheless, industrial production – also a component of the CEI – fell for the third straight month.

Overall economic activity is likely to turn negative in the coming quarters before picking up again in the final quarter of 2023.”

The trajectory of the US LEI continues to signal a recession

Sources: conference-board.org

-

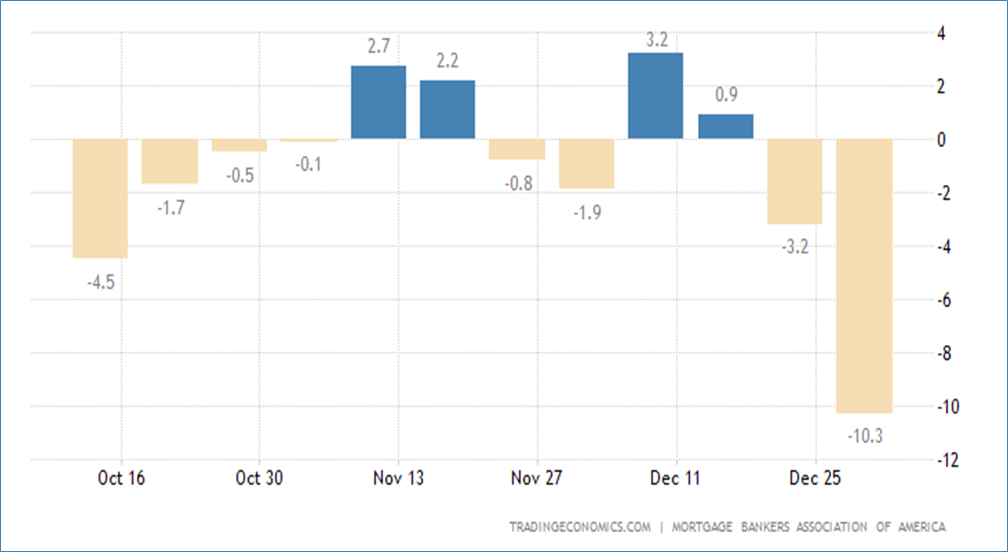

Mortgage Applications Drop as Mortgage Rates Increase

Mortgage Applications Drop as Mortgage Rates Increase

On Wednesday, the Mortgage Bankers Association announced that mortgage applications decreased 13.2% from two weeks earlier (and include adjustments to account for the holidays).

- The Market Composite Index, a measure of mortgage loan application volume, decreased 13.2% on a seasonally adjusted basis from two weeks earlier.

- On an unadjusted basis, the Index decreased 39.4% compared with the two weeks ago.

- The holiday adjusted Refinance Index decreased 16.3% from the two weeks ago and was 87% lower than the same week one year ago.

- The seasonally adjusted Purchase Index decreased 12.2% from two weeks earlier.

- The unadjusted Purchase Index decreased 38.5% compared with the two weeks ago and was 42% lower than the same week one year ago.

“The end of the year is typically a slower time for the housing market, and with mortgage rates still well above 6% and the threat of a recession looming, mortgage applications continued to decline over the past two weeks to the lowest level since 1996. Purchase applications have been impacted by slowing home sales in both the new and existing segments of the market. Even as home-price growth slows in many parts of the country, elevated mortgage rates continue to put a strain on affordability and are keeping prospective home buyers out of the market.”

- The refinance share of mortgage activity increased to 30.3% of total applications from 28.8% the previous week.

- The adjustable-rate mortgage (ARM) share of activity decreased to 7.3% of total applications.

- The FHA share of total applications increased to 14.0% from 13.1% the week prior.

- The VA share of total applications increased to 13.4% from 12.0% the week prior.

- The USDA share of total applications remained unchanged at 0.6%.

MBA Mortgage Applications Over the Past Year

Increases to Mortgage Rates

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 6.58% from 6.42%, with points increasing to 0.73 from 0.65 (including the origination fee) for 80% loan-to-value ratio (LTV) loans. The effective rate increased from last week.

- The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $647,200 ) remained at 6.12%, with points increasing to 0.45 from 0.37 (including the origination fee) for 80% LTV loans. The effective rate increased from last week.

- The average contract interest rate for 15-year fixed-rate mortgages increased to 6.06% from 5.97%, with points increasing to 0.70 from 0.57 (including the origination fee) for 80% LTV loans. The effective rate increased from last week.

Sources: mba.org

- The Market Composite Index, a measure of mortgage loan application volume, decreased 13.2% on a seasonally adjusted basis from two weeks earlier.