Every month, the Federal Reserve Bank of Dallas asks Texas business executives questions on labor market conditions and the results are compiled into the Texas Manufacturing Outlook Survey, the Texas Service Sector Outlook Survey and the Texas Retail Outlook Survey.

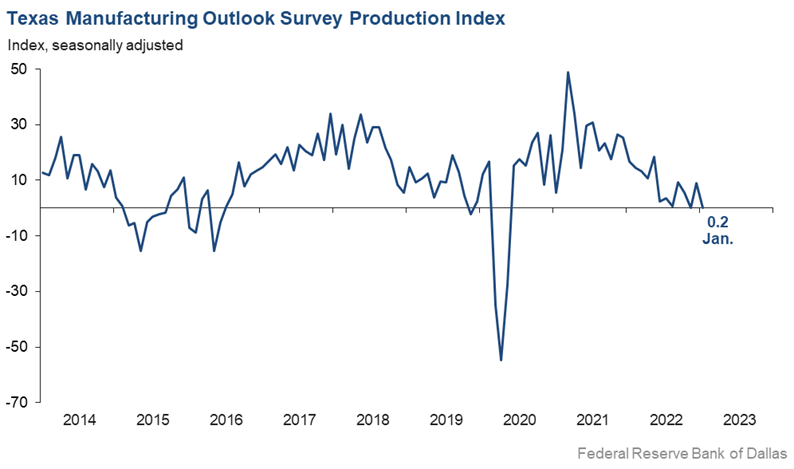

On January 30th, the Federal Reserve Bank of Dallas reported that: “Growth in Texas factory activity slowed in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 9.1 to 0.2, with the near-zero reading suggestive of flat output.

Other measures generally indicated weakened manufacturing activity this month. The new orders index was negative for an eighth month in a row – suggesting a continued decrease in demand – though it moved up from -11.0 to -4.0. The growth rate of orders index inched down to -12.3. The capacity utilization index was positive but dipped from 7.9 to 6.0, while the shipments index returned to negative territory at a reading of -6.3.

Perceptions of broader business conditions continued to worsen in January, though pessimism waned. The general business activity index remained negative but shot up 12 points to -8.4. Similarly, the company outlook index posted its 11th straight negative reading but moved up 11 points to -2.5. The outlook uncertainty index was largely unchanged at 16.8.

Labor Market & Price Pressures

Labor market measures pointed to stronger employment growth and longer workweeks.

- The employment index climbed four points to 17.6, a reading significantly above its series average of 7.9.

- Thirty-one percent of firms noted net hiring, while 13 percent noted net layoffs.

- The hours worked index held fairly steady at 3.8.

Further, price pressures were generally steady and wage growth eased slightly in January.

- The raw materials prices index was largely stable at 20.5, remaining below its series average of 28.0 for the third month in a row.

- The finished goods prices index was little changed at 9.9, roughly in line with its series average of 9.0.

- The wages and benefits index ticked down from 34.2 to 30.5.

Expectations regarding future manufacturing activity were mixed in January. The future production index pushed further positive to 16.1, signaling that respondents expect output growth over the next six months. The future general business activity index remained negative, coming in at -9.1. Most other measures of future manufacturing activity were positive this month.”

Sources: dallasfed.org