-

Employee Stock Ownership Plans for Executives

Tips to navigate ESOP suitability within the context of financial planning strategies

Employee Stock Ownership Plans (ESOPs) have emerged as a popular mechanism for companies to foster employee ownership and align the interests of employees with those of shareholders. For seasoned executives, considering participation in an ESOP entails a careful evaluation of the potential benefits and risks involved.

Benefits of ESOPs for Seasoned Executives

Ownership and Alignment of Interests: ESOPs grant employees, including seasoned executives, a direct stake in the company’s performance and financial success. By owning shares of the company, executives are motivated to work towards enhancing shareholder value, fostering a sense of ownership, commitment, and alignment of interests across all levels of the organization.

Wealth Accumulation and Retirement Planning: Participation in an ESOP provides seasoned executives with an opportunity to accumulate wealth over time, leveraging the potential appreciation in the value of company stock. ESOPs can serve as a valuable component of executives’ retirement planning strategies, allowing them to build a diversified portfolio of assets while benefiting from potential tax advantages associated with qualified retirement plans.

Tax Deferral and Liquidity Options: ESOP contributions are typically made with pre-tax dollars, allowing participants to defer taxes on the value of the contributed shares until distribution.

Additionally, ESOP participants may have access to various liquidity options, including the ability to sell shares back to the company or on the open market, providing flexibility in managing their investment portfolio and liquidity needs.

Retention and Incentive Alignment: ESOPs can serve as effective retention tools for seasoned executives, incentivizing long-term commitment and loyalty to the company. By offering a stake in the company’s ownership, ESOPs reinforce the executive’s connection to the organization’s mission, values, and long-term success, fostering a culture of employee engagement and dedication.

RELATED: Understanding Stock Options: ISOs, NQSOs, & Restricted Stock

Risks and Considerations for Executives

Concentration of Risk: Participation in an ESOP exposes seasoned executives to concentration risk, as their investment portfolio becomes heavily weighted towards company stock. In the event of adverse developments or underperformance of the company, executives may experience significant declines in the value of their ESOP holdings, potentially jeopardizing their financial security and retirement goals.

Lack of Diversification: ESOP participants may face limited diversification options, particularly if the company’s stock represents a substantial portion of their investment portfolio. Without adequate diversification, seasoned executives may be vulnerable to market volatility and sector-specific risks, underscoring the importance of implementing sound diversification strategies to mitigate downside risk.

Liquidity Constraints: Unlike publicly traded stocks, shares held in an ESOP may have limited liquidity, making it challenging for seasoned executives to convert their holdings into cash when needed. Illiquid ESOP shares may pose liquidity constraints and inhibit executives’ ability to access funds for personal financial goals, necessitating careful planning and consideration of alternative liquidity options.

Regulatory and Fiduciary Compliance: ESOPs are subject to a complex regulatory framework governed by ERISA (Employee Retirement Income Security Act) and other federal and state laws. Seasoned executives serving on the board of directors or as trustees of the ESOP bear fiduciary responsibilities and must adhere to strict compliance requirements, including the duty to act prudently and in the best interests of ESOP participants.

Navigating the Decision Process with Care

For seasoned executives contemplating participation in an ESOP, the decision entails a nuanced assessment of the potential benefits and risks in light of their financial objectives, risk tolerance, and long-term outlook.

Consultation with financial advisors, legal experts, and other professionals can provide valuable insights and guidance in navigating the complexities of ESOPs and evaluating their suitability within the broader context of executives’ financial planning strategies.

Copyright © 2024 FMeX. All rights reserved.

Distributed by Financial Media Exchange. -

Bridging The Retirement Income Gap With FIAs

Authored By: Heather L. Schreiber, RICP® NSSA®

What do retirees fear most?

According to a GoBankingRates survey, 66% of Americans worry that they will run out of money during retirement. That’s ahead of the 50% who were concerned about a steep healthcare outlay¹.

How can seniors and their financial advocates address this worry? Many are choosing to do so with a fixed index annuity (FIA). LIMRA reports that FIA sales were $79.4 billion in 2022, up 25% from 2021, and 8% higher than the record set in 2019²’³. What’s so appealing about FIAs? Before the big reveal, let’s set the stage.

Shaky Stool

During the 20th century, a so-called 3-legged stool provided an underpinning for retirees’ finances. That is, cash flow could come from 3 sources: Social Security, pensions from former employers, and personal savings. However, employer pensions have become the exception rather than the rule for many retirees. Pensions are still common for long-term government workers but are relatively rare in the private sector.

Instead of pensions, private sector employers offer employees the opportunity to put wages into defined contribution plans such as 401(k)s. Generally, those dollars go into funds holding stocks and bonds. Recently, though, market

volatility has been in the headlines.Down Year

The Morningstar U.S. Market Index lost 19.4% in 2022, the biggest annual loss since 2008…when it lost a 38.4%. Bonds are supposed to offer stability when stocks sag, but the Morningstar U.S. Core Bond Index lost 12.9% in 2022, its biggest annual loss since inception of the index in 1993³.

To demonstrate the potential effect of such results on an approaching retirement, suppose a hypothetical Holly Smith retired in early 2022. At the start of that year, Holly had managed to accumulate $600,000 in retirement savings, evenly divided between stock funds and bond funds.Assume Holly’s investments matched the broad equity and fixed-income markets. At the start of 2023, her holdings would have been down to $241,800 in stocks and $261,300 in bonds—from $600,000 for retirement to just over $500,000. After such a loss, Holly would need almost a 20% gain just to get back to where she had been. Moreover, our Holly had retired in 2022, taking 4% of her savings ($24,000) to supplement Social Security last year. Now, Holly bears sequence-of-return risk, which impacts people whose retirement coincides with a bear market.

Holly’s choices might be taking that same $24,000 this year, from the $479,100 left in her portfolio. That’s a 5% withdrawal rate, which could lead to depletion while Holly is still alive. Or, Holly might stick to her 4% strategy, withdrawing only $19,164 (4% of $479,100) in 2023, which could mean cutting back on her lifestyle in retirement.

Financial markets have bounced back in the past, and that could be the case again, helping Holly’s portfolio last longer. Even with a rebound, retirees such as Holly face risks such as longevity that could eventually drain her portfolio, inflation that could strain her budget, and a need for costly long-term care. Threats to cut back on Social Security benefits add to Holly’s dilemma.

Mitigating Retirement Risks

Savvy planning can help take these key retirement risks off the table, or at least reduce them to the point where retirees are comfortable. Fixed Index Annuities (FIAs) can help mitigate these concerns to the extent that exceeds what other sources of retirement income can provide for retirees.

An FIA is funded either through a single lumpsum payment or a series of periodic contributions from a consumer to an insurance company. In exchange, the consumer receives a contract that may deliver tax-deferred buildup, principal protection in a down market, and growth potential. Increases to the annuity value, termed interest, are credited to the contract annually, tied to a market index such as the S&P 500. FIA dollars are not directly invested in the index components but are pegged to the results.

Generally, FIAs offer protection against market losses. In return, they usually provide lower upside potential than being invested directly in the market. With a crediting rate of 70% of the S&P 500, for example, a hypothetical 12-month index gain of 10% would generate a 7% crediting rate to the annuity value of an FIA with that provision. The tax-deferred nature of an FIA allows money to compound over time without having to pay ordinary income taxes on the growth until funds are withdrawn. Consumer have the choice of turning on a reliable income stream from an FIA for a period of time or for a lifetime to supplement other sources of income in retirement.

Related Article: Passing an Inheritance to Your Children: 8 Important Considerations

Bountiful Benefits

On the plus side, considering a fixed index annuity when building a retirement income strategy has several advantages which include:

Tax deferral. Any gains inside an FIA avoids immediate income tax, allowing the annuity owner to take advantage of pre-tax compound growth during the accumulation phase. FIA owners also benefit from flexibility in creating retirement income drawdown strategies by controlling when and how to take income from the annuity.

Asset allocation alternative. Conventional wisdom holds that a 60-40 split, stocks to bonds, combines the growth potential of equities with the stability of fixed income. However, both stocks and bonds suffered double-digit losses in 2022, as previously mentioned. Concerns of ongoing inflation may lead to hesitation regarding investing in bonds.

An income stream that retirees can’t outlive. Americans are living longer than ever. That generally equates to more time spent in retirement and pressure on retirement assets to last longer. Even with Social Security and perhaps other sources of dependable cash flow, there still may be a gap between actual income and desired annual outflow. An FIA can fill that gap, generating income that will last as long as the retiree (and perhaps a spouse) may live.

Principal protection against possible market losses. As explained above, sequence-of-returns risk occurs when financial markets drop early in retirement while a retiree is tapping his or her investment portfolio. That can cause lifelong savings to deplete more rapidly than would have been the case if those market corrections occur later in retirement. An FIA can protect retirement assets by offering a source of cash flow that is not exposed to this risk during a market downturn.

Income to allow deferral of Social Security benefits. Waiting to claim Social Security benefits, perhaps to as late as age 70, can increase lifelong payouts substantially and often increase payments to a surviving spouse. In order to finance such a delay while avoiding additional stress on other assets, an FIA can play a key role. A retiree might start tapping into an FIA at, say, age 62 to bridge income so that Social Security claiming occurs later. Seniors can make their accumulated retirement assets work smarter, not harder.

Support for a surviving spouse. When one spouse dies, the Social Security income benefit of the lower-earning spouse goes away, and the higher benefit is payable to the survivor. Loss of a spouse generally means a decline in income—going from two Social Security benefits to one survivor benefit—so depending on an FIA to replace lost income may be a strategy that can help the survivor maintain the same standard of living.

A hedge against unanticipated long-term care expenses in retirement. Standalone LTC insurance policies can be costly. Data from the American Association for Long-Term Care Insurance put the average premium for a 55-year-old couple on a $165,000 initial policy with a 3% annual growth in maximum coverage at approximately $5,025 per year³. That can be an unnecessary expense if the policy benefits are never used.

Nevertheless, LTC coverage may be necessary, because Medicare does not cover custodial LTC and the average cost nationwide for a private room in a nursing home is about $9,000 a month, according to Seniorliving.org⁴. Adding a long-term care rider to an FIA can provide an additional layer of protection, offsetting the potential expense of a need for LTC.

Spousal benefits. FIAs, when jointly owned, can create income streams over the course of two lives for a married couple. This can be extremely important because widow(er)s typically become single taxpayers, owing increased income tax. What’s more, a surviving spouse may not have much experience handling the couple’s finances. An FIA offering continued contract ownership to the survivor may provide tax deferral and market risk-free cash flow to an aging widow(er) in need of stable income.

Legacy planning: Non-qualified annuities, with properly named beneficiaries, may be utilized as an estate planning opportunity to permit non-spousal beneficiaries, such as the owner’s children, to stretch post-death withdrawals over decades, based upon their life expectancy. That’s because non-qualified annuities are not covered by SECURE Act’s 10-year rule.

Due Diligence

No financial product is perfect for every consumer in every situation, and that’s true for FIAs, too. These annuities may deliver exceptional results, but there are risks as well. For starters, any guarantees are backed by the issuer, so it’s necessary to evaluate the insurer’s financial strength; therefore, due diligence is vital. A knowledgeable financial professional can provide real value here.

In addition, FIAs may have costs, just as is the case with any financial product, such as an additional fee for an income rider. Again, a financial professional can help by determining the actual cost of buying a specific FIA to ensure that the product and associated costs meets the specific needs of the investor. The more that is known before buying an FIA, the greater the chance of enjoying the multiple benefits listed above.

Retirement Action Plan:

- Prepare early. Determine a realistic retirement timeline that considers income needs in retirement, source of retirement income, family history, and current investor health.

- Develop a plan that includes guaranteed income sources for predicable and necessary expenses. This plan should aim to fill any projected gaps.

- Recognize the various risks that come with any financial plan, including market risk, healthcare risk, inflation, loss of employment, or death of a loved one. Adjust the approach to minimize such concerns.

- Schedule a plan review at least annually with a knowledgeable financial professional and make needed changes.

- Consider including a fixed index annuity as part of a retirement income plan, to provide needed lifelong income without exposure to possible market weakness.

Sources

² www.morningstar.com/articles/1131213/just-how-bad-was-2022s-stock-and-bond-market-performance

³ www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2022.php#2022costs

⁴ www.seniorliving.org/nursing-homes/costs/

Not affiliated with the Social Security Administration or any other government agency. This information is being provided only as a general source of information and is not intended to be the primary basis for financial decisions. It should not be construed as advice designed to meet the needs of an individual situation. Please seek the guidance of a professional regarding your specific financial needs. Consult with your tax advisor or attorney regarding specific tax or legal advice. ©2023 BILLC. All rights reserved. #23-0432-053024

-

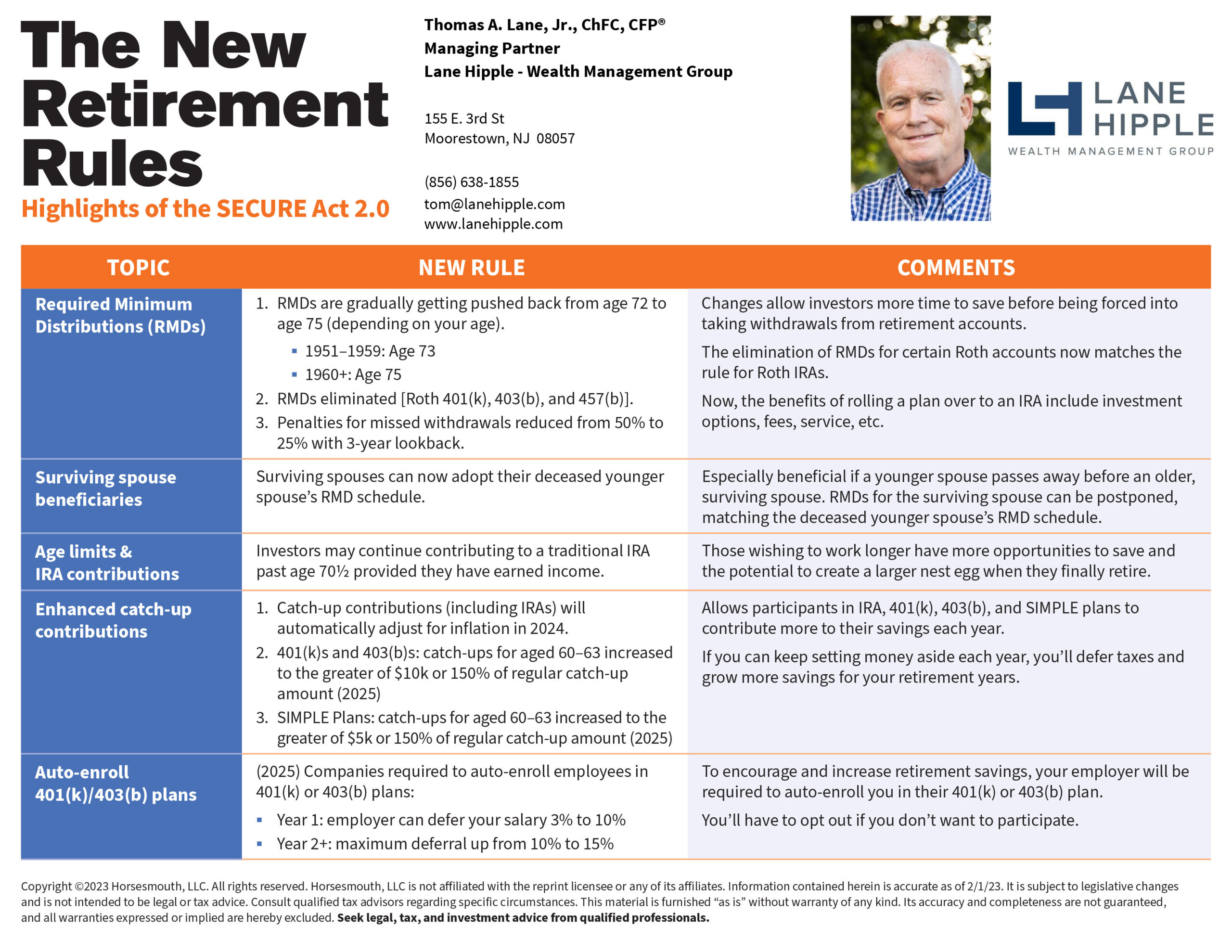

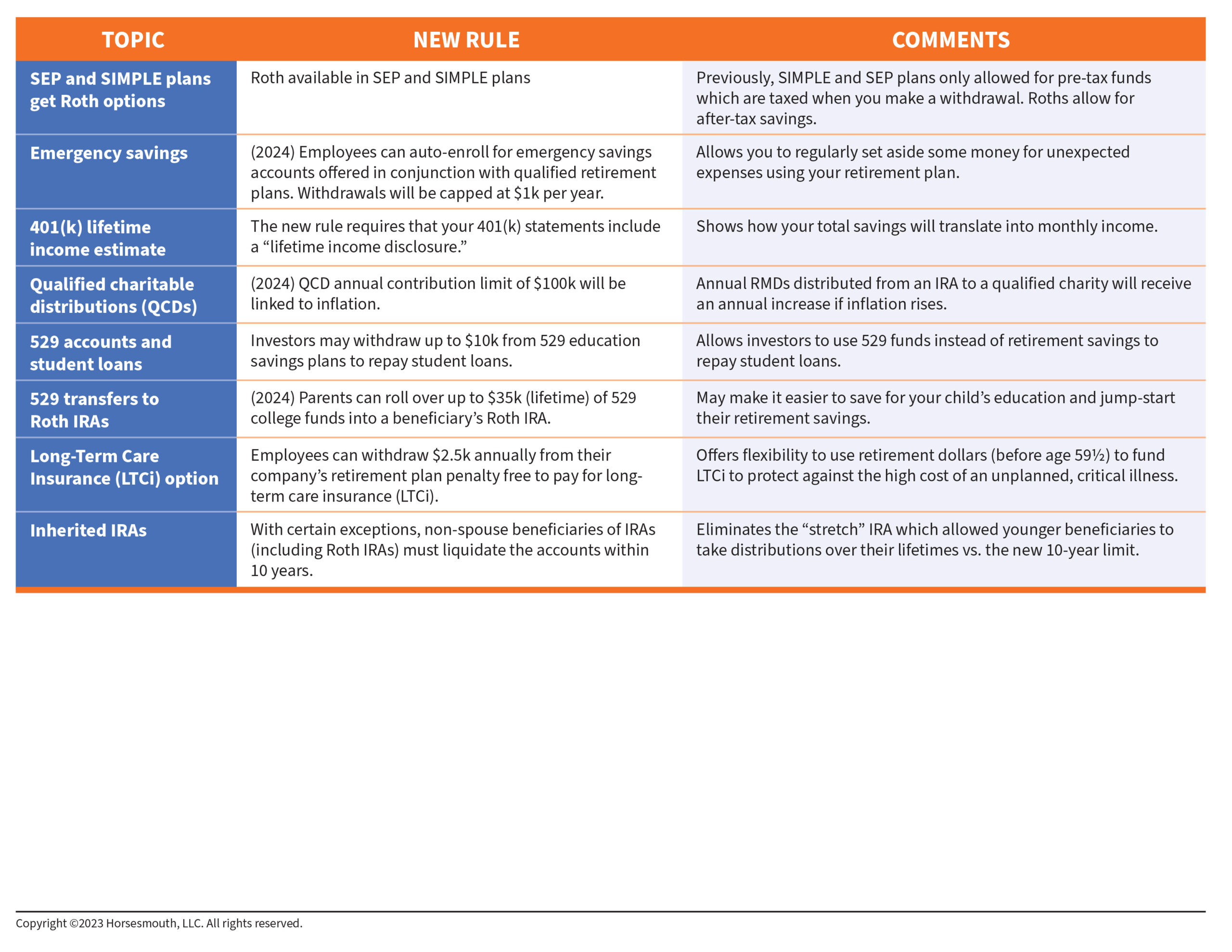

The New Retirement Rules

Highlights of the SECURE Act 2.0

-

Social Security Gets Biggest Boost Since 1981

The Cost of Living Adjustment, or COLA, from the Social Security Administration (SSA) is announced every fall and has major implications for the 66 million people who receive benefit checks. With inflation surging, retirees need help maintaining purchasing power. The agency announced its 2023 COLA will be 8.7%, the highest since 1981.

For those concerned about medical costs eating into this increase, Medicare – the health insurance plan for older Americans – said last month it would drop its premiums next year by about 3% for its Medicare Park B Plan.

For more information and context, please read this article from CBS News.

For instructions on how to sign up for a “my Social Security” account with the SSA, which is the fastest way to find out when and how much you will receive, watch the video below:

-

It’s Back to School Time: Does Your Retirement Savings Plan Earn a Passing Grade?

Here’s How to Give Your Financial Education a Boost

They don’t often teach how to create a retirement savings plan in school, but it’s time to put your thinking cap on and ask yourself a question: what grade would your retirement savings plan earn if it was put to the test today?

It’s tough to know exactly how much you should save, what strategies might work for you, and exactly how to get to where you want to be. Just like in the classroom, though, the best way to get a passing grade for your retirement savings plan is to educate yourself and put in the effort.

If you aren’t sure where you stand – or you know that your plan could be strengthened – the following advice can help you cram for your retirement savings plan.

First, if you don’t feel like you’ve earned an A+ on the retirement progress you’ve made to-date, know that you’re not alone. The Road to Retirement Survey from TD Ameritrade found that most Americans feel like they’re doing poorly saving for retirement. Of surveyed adults ages 40 to 79, the majority gave themselves a grade of C or lower. This result seems fair when you look at the data, too. Nearly two thirds of 40-year-olds have less than $100K saved for retirement, and one in five of those in their 70s have less than $50K saved.

If you’re in this boat, these steps will help:

1. Keep building your nest egg

There are many reasons people can’t seem to attain the savings they need. Yet there are as many reasons you should save for retirement as there are excuses not to. Even if you’re only able to save a small amount at present, stay the course. It all makes a difference down the road.

If you’re under 40 and have saved even a small amount, you’ve got several decades ahead of you to make up for any lost time. If you start putting away $500 a month in an IRA or 401(k), you could retire in 25 years with an additional $380,000, assuming a conservative annual average of 7% market returns during that time.

If you’re closer to 60 than to 40, though, you have less time to get your retirement savings plan right. Putting money into savings now will mean you struggle less in the future. Consider some big-time ways to sock away more money—maybe a second job, moving to a smaller home with a smaller mortgage, or other ways to build up your savings.

Say you’re around 57 years old and want to retire in a decade. If you save $500 a month for the next 10 years, you’ll only be able to save $83,000, assuming the same conservative 7% rate of return mentioned above. If you double that and put away $1,000 a month instead, you’ll double your savings amount. While $166,000 may seem like a lot of cash, it’s hard to stretch that through your retirement years. Instead, consider readjusting your lifestyle and maxing out your 401(k).

2. Increase your Social Security benefits

Social Security benefits can help anyone approaching retirement have peace of mind. Avoid making the mistake of depending too much on them, though. As the system works now, benefits are projected to replace around 40% of the average American’s preretirement income, but most people need around 80% of their former earnings to live at the comfort level they’re accustomed to.

Still, there are significant benefits to Social Security. It’s a government-backed, 8% guaranteed investment. Navigating the system can be complicated, but there are ways you can plan to get the most out of your retirement options, especially these days a people live much longer than they used to.

These tips can help you increase your Social Security income:

- Earn as much as you can right up until full retirement age (usually 66 years old), or even beyond

- Work at least 35 years or more

- Wait as long as possible to claim (If you wait until age 70, you can boost your benefit by 8% a year)

- Pay attention to taxes—50% to 85% of your benefits could be subject to federal taxes if you reach a certain income threshold

These strategies are helpful, but remember that even if you maximize your Social Security benefit in these ways, you’ll likely still have to make up the difference with personal savings. So, preparation is critical.

Related Article: Retirement Planning: How to Live Like It’s Summer Vacation Forever

3. Boost your retirement readiness grade

If you have concerns about your retirement savings plan, the good news is that there are different strategies for different stages in life. No matter where you are, there are ways to plan and prepare for where you want to be.

When it comes to retirement, having your finances in order is about more than just money. It’s a direct indication of how much you’ll be able to savor that chapter of your life.

It’s important to consider how ready you are. Do you make the grade, or are you like one of the many Americans who barely pass the retirement readiness test? Readiness requires discipline, clearly defined goals, and actionable plans. This requires quite a bit of hard work and preparation, but the result is enjoying and maintaining the same standard of living you’ve experienced while in the working world.

Get A+ Strategies for Your Retirement Savings Plan

If you think you would benefit from expert help with your retirement readiness plan, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. We have been granted a license in perpetuity to publish this article on our website’s blog and share its contents on social media platforms. We have no right to distribute the articles, or any other content provided to our Firm, by Illuminated Advisors in a printed or otherwise non-digital format. We are not permitted to use the content provided to us or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.