-

5 Things You Need To Know To Ride Out A Volatile Stock Market

This article, written by Franklin Distributors, LLC, provides great insight on how to approach today’s investment environment.

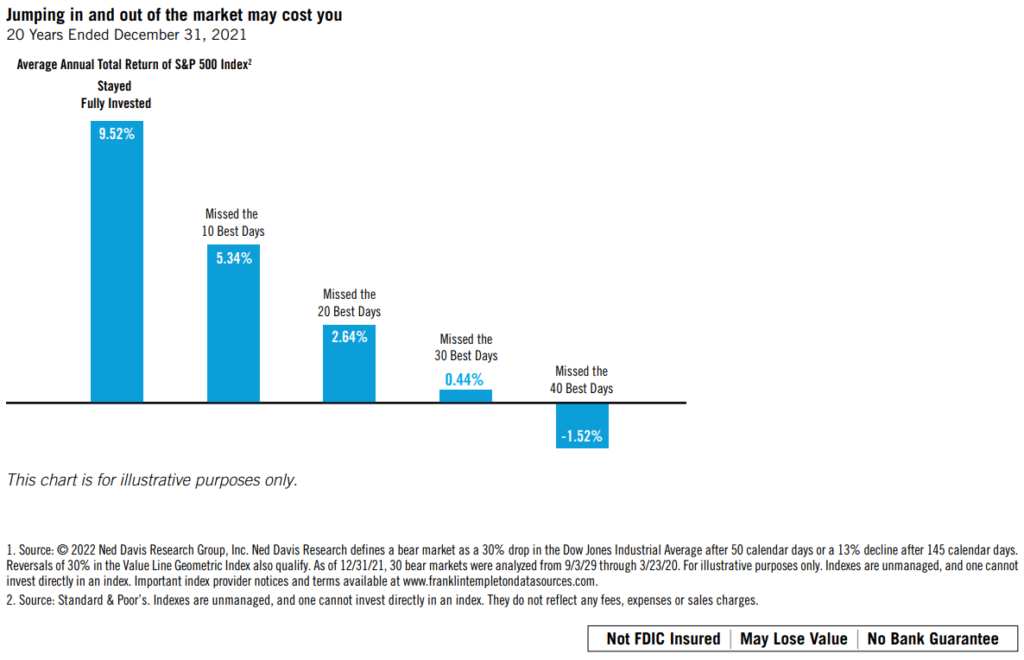

1. Watching from the sidelines may cost you

When markets become volatile, a lot of people try to guess when stocks will bottom out. In the meantime, they often park their investments in cash. But just as many investors are slow to recognize a retreating stock market, many also fail to see an upward trend in the market until after they have missed opportunities for gains. Missing out on these opportunities can take a big bite out of your returns. Consider that on average, for the 12 months following the end of a bear market, a fully invested stock portfolio had an average total return of 38.3%. However, if an investor missed the first six months of the recovery by holding cash, their return would have been only 8.0%¹. The chart below is a hypothetical illustration showing the risk of trying to time the market. By missing just a few of the stock market’s best single-day advances, you could put a real crimp in your potential returns.

2. Dollar-cost averaging makes it easier to cope with volatility

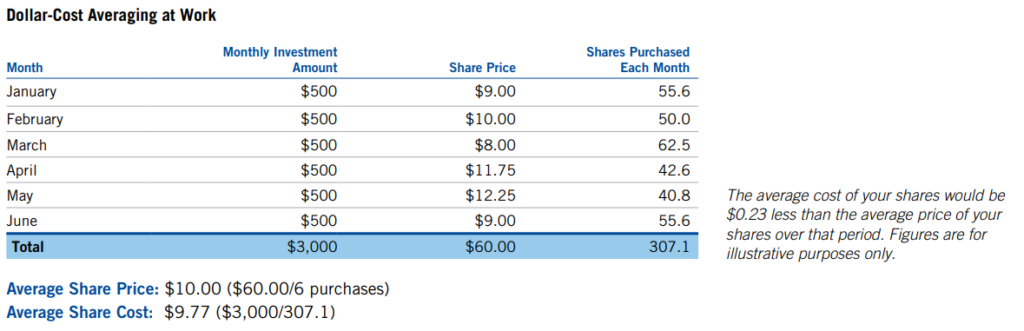

Most people are quick to agree that volatile markets may present buying opportunities for investors with a long-term horizon. But mustering the discipline to make purchases during a volatile market can be difficult. You can’t help wondering, “Is this really the right time to buy?”

Dollar-cost averaging can help reduce anxiety about the investment process. Simply put, dollar-cost averaging is committing a fixed amount of money at regular intervals to an investment. You buy more shares when prices are low and fewer shares when prices are high. And over time, your average cost per share may be less than the average price per share. Dollar-cost averaging involves a continuous, disciplined investment in fund shares, regardless of fluctuating price levels. Investors should consider their financial ability to continue purchases through periods of low price levels or changing economic conditions. Such a plan does not guarantee a profit or eliminate risk, nor does it protect against loss in a declining market.

3. Now may be a great time for a portfolio checkup

Is your portfolio as diversified as you think it is? Meet with your financial professional to find out. Your portfolio’s weightings in different asset classes may shift over time as one investment performs better or worse than another. Together with your financial professional, you can re-examine your portfolio to see if you are properly diversified. You can also determine whether your current portfolio mix is still a suitable match with your goals and risk tolerance.

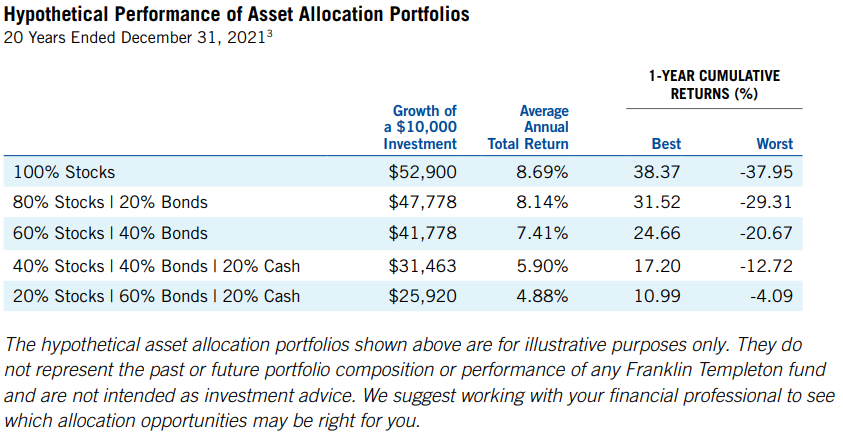

4. Tune out the noise and gain a longer-term perspective

Numerous television stations, websites and social media channels are dedicated to reporting investment news 24 hours a day, seven days a week. What’s more, there are almost too many financial publications to count. While the media provides a valuable service, they typically offer a very short-term outlook. To put your own investment plan in a longer-term perspective and bolster your confidence, you may want to look at how different types of portfolios have performed over time.

- Source: © 2022 Morningstar, Inc., 12/31/21. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results. Stock investments are represented by equal investments in the S&P 500 Index, Russell 2000® Index, and MSCI EAFE Index, representing large U.S. stocks, small U.S. stocks, and foreign stocks, respectively. Bonds are represented by the Bloomberg Barclays U.S. Aggregate Index. Cash equivalents are represented by the FTSE 3-Month U.S. Treasury Bill Index. Portfolios are rebalanced annually. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges.

5. Believe your beliefs and doubt your doubts

There are no real secrets to managing volatility. Most investors already know that the best way to navigate a choppy market is to have a good long-term plan and a well-diversified portfolio. But sticking to these fundamental beliefs is sometimes easier said than done. When put to the test, you sometimes begin doubting your beliefs and believing your

doubts, which can lead to short-term moves that divert you from your long-term goals.To keep a balance perspective, we recommend that you contact your financial professional before making any changes to your portfolio.

-

Focus on Your Financial Freedom this Independence Day

Five Steps to Declare Your Financial Independence

Are you ready to revolutionize your fiscal plan and attain financial freedom?

In 2019, an AARP study found that 53% of adult households in the United States did not have an emergency savings account. The pandemic applied even more pressure to struggling Americans, exacerbating that anxiety. The fear of not having financial security can feel overwhelming, but you can take this moment to embrace the nation’s ethos of “land of the free and home of the brave” and apply it to your money management plan. Read on for five steps to follow to reach your personal money goals and achieve financial independence.

1. Expect the Unexpected with an Emergency Fund

It’s always been a smart idea to set aside some money in a savings account for the unexpected. The COVID-19 pandemic, and the economic and employment downturn it spurred, turned that theoretical possibility into a reality for many Americans. Having emergency cash in the bank can give you back the financial freedom that comes from having peace of mind. In the event of a global issue, the loss of your employment, or even an unexpected car repair or medical bill, an emergency fund is there to help. Though we’re all hopeful to soon put the pandemic and its effects fully behind us, one of the lasting lessons we can take away is that an emergency fund is a critical financial strategy.

Exactly how much you should set aside is a personal equation based on what you can afford today and your cost of living, but a good rule of thumb is to put away three to six months of expenses. You can sock it away in any savings account, but an FDIC- (or NCUA-) insured account at your bank or credit union is ideal. Set a monthly goal for how much you can contribute to savings and look for ways to automate the process.

Looking for a way to level up your emergency fund? Once you build it up to a certain amount, you may want to consider having your money work for you. If you exceed your emergency fund goals, keep saving and set aside some to invest in a low-risk fund to maximize yield.

Deciding to save into an emergency fund is a great way to regain control over your financial wellness and boost your overall well-being. Financial freedom can give you peace of mind that’s truly priceless.

2. Curb Spending and Increase Calm

Feeling financially free isn’t about being able to spend whatever you want today. It’s about knowing that you’ve saved enough that you don’t have to worry in the future. Setting a budget does force you to curb spending in the short term but setting up those fiscal guardrails is one of the surest paths to financial independence.

Having a realistic budget gives you a deep sense of calm and reassurance. Once you know how much money is coming in and how much you can spend, you have a holistic picture of where your money is going. Think of a budget as a road map. You wouldn’t set out on a cross-country trip without any idea of which road to follow. Living without a budget is like driving blind. Setting targets, defining priorities, and giving every dollar a job can help you get to where you need to go by putting you in the driver’s seat. What better way is there to achieve financial freedom?

Related Article: Financial Goal-Setting Tips to Help Achieve Your Money Goals

3. Make a Debt-Free Declaration

Being debt-free is one of the best markers of financial freedom. Getting out of debt and staying out permanently can help you save the money you need to have a stable future.

However, not all debt is created equal. There’s a difference between good debt and bad debt—the former can help you complete your education or buy a dream home, while the latter can bog you down with high-interest rates and unnecessary monthly payments. A 2020 Experian report showed that the average American owes approximately $92,727 in total debt—the highest amount ever recorded. If you’re in debt, you’re not alone. There are several strategies and steps that can help, but whichever path you take, make sure it’s both attainable and sustainable.

Before you buy something that will come with a high-payment plan, ask yourself if you a) need it and b) can actually afford it. Using an auto loan calculator or mortgage calculator can help you determine what fits into your budget.

4. Retirement Plan to Brighten Your Future

What is the ultimate financial freedom goal? For many people, it’s being able to have a secure, comfortable retirement in your later years. Here are a few simple things you can do today to help prepare for a great tomorrow:

- Maximize contributions to any tax-advantaged retirement savings accounts, like an IRA or a 401(k) plan

- Take advantage of any employer matching contributions so you can receive the full amount offered

- Diversify your investment portfolio with a mix of asset classes

It can be difficult to make short-term sacrifices in the name of a more comfortable future but keep your eye on the ball and remember you’re giving yourself the gift of financial independence.

5. Pay it Forward and Let Freedom Ring

If you’ve already accomplished all the items on this list and feel secure in your financial freedom, consider celebrating this July 4th holiday by helping others. Determine how much you can set aside for charitable giving and help support the missions and people who are important to you.

If you have younger loved ones, you can help set up or fund their 529 college savings account. It’s a great way to promote financial independence for the next generation, and maybe even help yourself along the way—some states let you claim a tax deduction for that kind of donation.

If you don’t have relatives that need help, consider donating to a child-focused charity, particularly one with a focus on education. Investing in the next era of earners can help us all enjoy more financial freedom in the years ahead.

Financial Independence on July 4th and Beyond

Freedom means many things for many different people, but on the fourth day of the seventh month of the year, we all come together to celebrate how lucky we are to be able to have the opportunities associated with independence. Financial security can help you feel more confident, in control, at peace, and, of course, free to live the life of your dreams.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

Seasonal Spending: Why we Overspend in the Summer

Curb Your Spending This Season with These Helpful Tips

Did you know that the summer season can affect your spending habits? Feeling the sun on your skin, the sand between your toes, and looking up at blue skies are all sure signs of the season, but you may notice a change in your bank account, too. It turns out more than half of all Americans—52%—tend to overspend in the summertime, according to a study from MassMutual. And another survey showed only 28% of respondents bothered to set a summer budget.

Why Does Summer Spending Affect Us?

What’s behind these free-for-all seasonal spending habits? Two-thirds of Americans say it’s a desire to “Make the most of the summer” that causes their spending to skyrocket. Of course, summer activities can cost more, too, and fear of missing out (also known as FOMO) may also contribute to slightly looser purse strings. Though this is likely the case in any year, it’s perhaps particularly so during the last years of the pandemic, when one of the only safe ways to gather has been when enjoying the great outdoors.

If you’d like to be more intentional about your summer spending habits, we can help. Use these tips to guide your spending habits so you can have a fantastic summer without breaking the bank.

Balance Fun and Responsibility

Staying inside all summer to avoid overspending isn’t a sustainable strategy. Of course, neither is spending money left and right on beach getaways and gourmet picnics. If you have children who are out of school in the summer, you’ll likely need a little cash on hand to keep them engaged and cared for.

Luckily, you can have your fun and save up, too—you just need to have a plan. Here’s a reasonable goal: pledge to spend a little bit more in the summer without going overboard. Here are some ways you can enjoy yourself without getting into financial trouble:

- Budget. Planning can help you stay on track during the summer. There are many different ways to budget, each with its own benefits and drawbacks. The important thing is finding something you can stick to, especially when summer temptations are plentiful. The best thing about budgeting is that when you know where your money is going, you give yourself permission to spend what you can. Need a new bathing suit? Want to schedule a long weekend away? If it fits within your financial goals, you can start packing your bag.

- Shop smarter. Many fun summer activities come with price tags. If you can get ahead of your seasonal spending, you can find innovative ways to save. Take outdoor furniture, beach necessities, and pool staples, for example—those are usually marked down as summer slides into fall. If you plan to stock up in advance, you can know you have what you need for a more affordable price.

- Start a summer fund. Throughout the year, you may find yourself saving in small ways. If you skip ordering takeout, stash those funds away. If you happen to make a little extra income one month, put it aside so you can enjoy it when the weather turns. Adding unexpected money to your fund is a great way to make sure you can maximize your summer fun, and it can be a motivating way to develop smarter spending habits, too.

- Focus on the long term. When the smell of barbecue is in the air and the waves beckon you from shore, it can be difficult to say no to overspending. But keeping your eyes on your long-term savings plan can help you keep your head when summer temperatures and temptations rise.

- Practice the pause. Picture this: you’re walking down the street in your favorite vacation spot and something in a store window catches your eye. What you want to do: go inside and buy it straight away. What you should do: keep walking and, if the urge to purchase it is still there a day or two later, check to see if it would fit in your budget. Pressing pause in that scenario can help save you from impulse buying, which rises in the summer months.

FOMO vs. Financial Goals

There’s so much to love about the summertime—the laid-back vibe, the beautiful weather, taking time off, and exploring new places. It’s natural to want to make the most of this time, but don’t let fear of missing out on summer fun dictate your financial wellbeing.

If you feel tempted to spend when you see the summer fun your friends and acquaintances are posting on social media, take a break from your social accounts for a while. If you need reminders to keep your eye on your long-term financial goals, write them out and post them on your fridge or keep them in a note on your phone.

Curbing seasonal spending habits can be tough but spending too much and suffering later can be an even bigger challenge. Keeping your wits about you during the warmer months can be a big benefit to you all year round.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

- Budget. Planning can help you stay on track during the summer. There are many different ways to budget, each with its own benefits and drawbacks. The important thing is finding something you can stick to, especially when summer temptations are plentiful. The best thing about budgeting is that when you know where your money is going, you give yourself permission to spend what you can. Need a new bathing suit? Want to schedule a long weekend away? If it fits within your financial goals, you can start packing your bag.

-

Strategies for Building Wealth in Your 50s

Now is The Time to Strengthen Your Finances and Finalize Your Retirement Plans

While it’s true that it’s better to begin saving earlier rather than later, it’s not too late to start building wealth in your 50s. In this decade of life, there are still smart moves you can make to help strengthen and grow your finances. Of course, as you get closer to retirement, the financial choices you make begin to carry more weight, so how you save and invest during this decade of your life will directly affect what your life looks like in retirement.

Below are six moves you can make in your 50s to build your wealth and better prepare yourself for retirement.

1. Build a Budget for Retirement

One of the most crucial aspects of proper money management in any decade of life is having a budget that appropriately reflects your financial reality and future goals. You’ll want to start by looking at how much you have saved for retirement, along with how your income and expenses are going to look as you get closer to that next phase of life. Don’t forget to factor in healthcare expenses as they’re one of the biggest roadblocks to financial security that retirees face. If your savings is still lacking, look at where you might be able to cut out some unnecessary spending in your life – now is really the time to singularly focus on saving as much as you can for the next stage of your life.

2. Eliminate Any Lingering Debt

While you’re still working and have a steady income that you can depend on, now is a good time to tackle your debts so that you can leave that financial stress behind once you retire. It’s financially savvy to start with your higher balances and any debts that have high interest rates. And while that’s a good idea, it may help you stay motivated to start with your smaller balances instead. Being able to watch yourself cross off debts one at a time can give you the motivation and confidence you need to finally face those larger balances. Whatever avenue you choose to take to stamp out your debts, what matters is that you stay committed to eliminating as much of them as possible before you leave the workforce.

3. Beef Up Your Retirement Accounts

With decades of work behind you, chances are you’ve been putting some money away into your retirement accounts consistently. Now that you’re in your 50s though, it’s time to maximize your contributions and get as much as you can out of compounding interest. So, start maxing out your 401(k), 403(b) and other retirement savings accounts. Once you hit age 50, you’re able to contribute an additional $1,000 into your IRAs, which can be a great super boost to your savings, too.

4. Rebalance Your Portfolio

As a young investor, taking more risks with your investments is smart, and it can be exciting, too. However, the closer you get to retirement the more you’re going to want to begin scaling back the risk in your portfolio. After all, you’re going to need to depend on that money to provide you with an income stream once you no longer have traditional paychecks. Take some time to review your portfolio and pull your money out of your riskier stocks to invest them into ones that are more stable. You’ll also want to be sure that your investments are properly diversified so that you don’t have all of your eggs in one proverbial basket.

Concluding Thoughts on Building Wealth in Your 50s

You can make smart retirement planning moves at any stage of life, but your 50s are the time to be sure that you have a firm grasp on your plans, and you know what steps to take before you finally say goodbye to your working life. If you’re not where you think you should be on your savings journey, that’s okay – you still have time make progress toward building wealth in your 50s. You just have to be diligent and intentional about it. The above tips are meant to help you boost your finances and bring you closer to accomplishing your money goals for retirement.

If you think you would benefit from a conversation about how to build your wealth in your fifties, or at any age for that matter, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

If you like what you’ve read, please share this article, and connect with us on your favorite social media channel.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents of it on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

Retirement Planning: How to Live Like It’s Summer Vacation Forever

Focus on Your Retirement Strategy Scorecard So You Can Relax

Wouldn’t you love to live like it’s summer vacation forever? With a strong financial retirement strategy, you can. How? When it comes to finances, looking at the long-term game is often the smartest course of action. That’s why we suggest setting up your own personalized “retirement strategy scorecard,” a method that can help you get started and guide you along the way.

Whatever you want out of retirement, your retirement strategy scorecard can be a great tool to help you get there. Get out the SPF and get ready to relax–summer vacation in retirement can last, well, all year with proper planning.

Financial Retirement Planning: Start where you are

Seasons change, but where you start makes a big difference. Take account of where your finances currently stand by reviewing your resources. Make sure you have these documents on hand to get started on your retirement strategy scorecard:

- A net worth statement, which analyzes how much cash flow you’ll need to support your retirement lifestyle

- A high-level look at your 401(K) plan or other retirement accounts, and your current investment allocation

- An analysis of the rest of your portfolio, which can outline what’s included in any funds beyond your 401(k)

Then look beyond the basics

When planning for retirement, a lot of people fail to realize they should take resources into account beyond their 401(k) and other funds. When you’re putting together your retirement big picture, take these into an account:

- Mortgages: How much do you owe and how long do you have to pay it off?

- Social Security benefits: Make sure you log into the official Social Security Administration website to determine your benefit level

- Benefits from previous partners, which can include retirement benefits, interests in accounts, or life insurance

- Your own permanent life insurance policies, to determine if there’s cash value

Analyze your retirement options

Now that you know where your finances stand, you can start planning the fun part: everything that’s possible once the next phase of your life begins.

Don’t be afraid to dream big. See this as an opportunity to reassess your wants and needs. Retirement is relatively responsibility-free, which can be disorienting after a successful career. It’s a chance to recapture your spark, to build your next step intentionally.

Wherever you want to go, whatever you want to do, develop a plan that points the way.

Give your plan a practice run

You wouldn’t buy a car without a test drive. The same goes for your retirement plan. Once you’ve analyzed your options and have a good idea of how you’d like to spend your time and structure your life, consider taking some time off to take your retirement ideas for a spin.

Immersing yourself in these activities can give you a good idea of how well reality meets expectations. If the two don’t quite match up, fear not. There’s plenty of time to alter your plan and create a retirement life that truly works for you.

One thing to consider: think about picking up a part-time job in an industry that you’re interested in. Studies show that a successful retirement isn’t necessarily all about leisure—working in retirement can actually bring you greater happiness.

Get your goals down on paper

Taking time to outline goals makes a big difference when it comes to achieving them. If you have an idea in mind, writing it down can actually help you turn it into a reality—according to a recent study, 76% of participants with written goals achieved those goals, compared to 43% of people who didn’t write them down.

Draft your plan, create a map for your next phase, and dig into the details. Outline the steps you need to take to get where you want to be and keep them at the front of your mind. Continuously review them as your circumstances change and your priorities shift. They’re your goals—you get to choose what’s important and where your future goes.

It’s about more than just finances

If you think the most common retirement planning pitfall is a lack of finances, think again. It’s actually a lack of vision. Summer vacation is about enjoying the moment, leaving stress behind, and leaning into life’s smaller, simpler moments. Embrace that mindset when you embark on the retirement planning process, but don’t forget to enjoy the present, too.

The retirement strategy scorecard’s added power is its ability to deliver peace of mind not just for tomorrow, but also for today. To get started on a retirement plan that can help you live your next chapter like it’s summer vacation forever, contact Lane Hipple at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents of it on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.