-

Social Security Benefits Set to Increase in 2024

Proper financial planning includes forecasting future Social Security benefits

In a welcome development for millions of Americans relying on Social Security, the Social Security Administration has recently announced an increase in retirement and disability benefits. Starting in January 2024, recipients will see a meaningful boost, with benefits set to rise by 3.2%, translating to an average increase of more than $50 a month.

This cost-of-living adjustment (COLA) marks a helpful step in ensuring financial stability for retirees and individuals with disabilities, impacting over 71 million Social Security beneficiaries across the nation.

Historic Increases

This COLA increase of 3.2% follows a historic 8.7% surge for 2023 and a 5.9% rise in 2022. These significant adjustments are a testament to the government’s commitment to addressing the rising cost of living, especially for those who depend on Social Security benefits as a primary source of income.

Impact on Recipients

For the average recipient, the 3.2% increase means more than just additional dollars in their monthly budget. It signifies improved financial security, providing a cushion against inflation and ensuring that essential needs are met with less strain. This extra income can contribute to covering healthcare expenses, purchasing necessities, and even indulging in a few luxuries, hopefully enhancing the overall quality of life for retirees and disabled individuals.

Importance of Social Security Forecasting

Understanding and forecasting Social Security benefits are vital components of financial planning. As demonstrated by the recent COLA adjustments, these benefits are subject to change, and staying informed about these fluctuations is essential for effective financial planning.

Retirement Planning: For those approaching retirement, accurately estimating Social Security benefits can help plan for additional income streams and bridge the gap between retirement savings and living expenses.

Budgeting: Knowing the exact amount of the monthly benefit allows individuals to budget effectively, ensuring that essential expenses are covered without relying solely on these funds.

Long-term Financial Security: Forecasting Social Security benefits aids in long-term financial planning, enabling individuals to make informed decisions about investments, healthcare costs, and potential legacy planning.

Disability and Survivor Benefits: For those receiving disability benefits, understanding the potential adjustments in benefits can help plan for healthcare and support services, ensuring a higher quality of life despite the challenges faced.

The Elephant in the Room

Relying solely on Social Security as a primary source of income during retirement, however, is a very risky proposition, and any good financial advisor will caution against this for several reasons.

Firstly, the future of Social Security benefits is uncertain. While the government has taken steps to address immediate concerns, the program is projected to face financial challenges due to the aging population and a declining worker-to-beneficiary ratio. With a growing number of retirees drawing from the system and a shrinking workforce contributing, there are concerns about the long-term sustainability of Social Security in its current form.

Secondly, Social Security benefits alone might not be sufficient to maintain the standard of living many individuals desire during retirement. The benefits are designed to replace only a portion of pre-retirement income, and for many people, especially those with higher incomes before retirement, this replacement rate might not be enough to cover essential living expenses, healthcare costs, and other financial obligations. Depending solely on these benefits could lead to financial hardship, forcing retirees to compromise on their lifestyle or struggle with unexpected expenses.

Additionally, the cost of living adjustments made to Social Security benefits might not keep up with the actual rise in living expenses, particularly healthcare and housing costs, which tend to increase at a faster rate than the general inflation rate. This discrepancy can erode the purchasing power of Social Security benefits over time, making it challenging for retirees to keep up with rising costs.

Planning Matters

The increase in Social Security benefits by 3.2%, coupled with previous historic adjustments, is a significant stride towards supporting the financial well-being of retirees and disabled individuals. Proper financial planning, including forecasting Social Security benefits, empowers individuals to navigate their financial futures with confidence, ensuring a comfortable and secure retirement.

However, while Social Security benefits can provide crucial support, they should be viewed as a supplemental income rather than the sole foundation of a retirement plan. Diversifying income sources, such as personal savings, investments, and employer-sponsored retirement accounts, is essential for building a robust financial cushion that can withstand the uncertainties of the future and ensure a comfortable retirement.

Accordingly, as these benefits evolve, staying informed and seeking guidance from financial experts becomes paramount, allowing Americans to make the most out of their hard-earned benefits and enjoy their golden years with peace of mind.

Copyright © 2023 FMeX. All rights reserved.

Distributed by Financial Media Exchange. -

Are We On the Brink of the Elusive Soft Landing?

Signs are encouraging and the possibility seems more tangible than ever

In the intricate world of economics, maneuvering the vast U.S. economy without causing disruptions is likened to steering a colossal ship through a tempestuous storm. Since early 2022, U.S. policymakers, including Federal Reserve Chair Jerome Powell, have embarked on the challenging mission of curbing inflationary pressures through heightened interest rates, all the while avoiding economic contraction. This elusive equilibrium, historically challenging to achieve, is what economists fondly term a “soft landing.”

The question that beckons is: are we on the brink of witnessing this rare economic feat?

Historical Context

Historically, efforts to tame inflation with increased interest rates have sometimes led to unintended consequences. Often, rapid rate hikes inadvertently plunge economies into recessions, exacerbating unemployment rates and dampening investment climates. This is because as borrowing becomes expensive, consumers reduce spending and businesses curtail investments, leading to an economic slowdown or even contraction.

Given this background, it’s understandable why the ideal scenario of a soft landing, where price pressures are contained without causing economic downturns, is seen as almost mythical in economic circles.

Indicative Signs

Recent economic data, however, provides a glimmer of hope. A somewhat declining inflation trend coupled with a sustained growth in economic output has sparked optimistic whispers among economists. Here’s why many believe a soft landing might be on the horizon:

Measured Rate Hikes: Under Powell’s stewardship, the Federal Reserve has been cautious, opting for gradual and measured rate increases rather than aggressive jumps. This approach allows the economy to adjust without being jolted abruptly.

Recent News: The Federal Reserve holds interest rates at September meeting

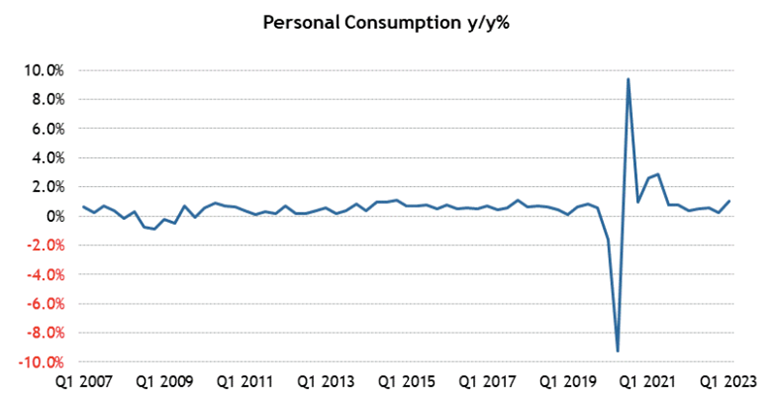

Resilient Consumer Spending: Despite the rate hikes, consumer spending – a significant driver of the U.S. economy – has remained robust. This resilience indicates that the economy still has underlying strength.

Flexible Policy Stance: The Federal Reserve has consistently signaled its readiness to adjust its policies based on evolving economic conditions. This adaptability is crucial in navigating the unpredictable waters of global economics.

Stabilizing External Factors: Global economic conditions, including stabilizing trade relationships and steady growth in emerging markets, have provided a conducive backdrop for the U.S. to manage its internal economic challenges.

Skepticism and Vigilance

While the indicators are promising, it’s worth noting that economic predictions are inherently fraught with uncertainties. There are always external shocks, geopolitical tensions, and unforeseen events that can derail even the most optimistic forecasts. As a result, while there’s growing consensus about the possibility of a soft landing, there’s also a shared understanding of the need for continued vigilance.

Time Will Tell

Achieving a soft landing for the U.S. economy would indeed be a remarkable accomplishment, especially given the historical challenges associated with it. The signs are undeniably encouraging, and under the Fed’s pragmatic leadership, the possibility seems more tangible than ever.

However, in the ever-fluid landscape of global economics, only time will tell whether this optimism translates into a realized economic equilibrium.

-

Optimism Among Small Business Owners Declined in August

According to the NFIB’s Small Business Economic Trends data

The National Federation of Independent Business was founded in 1943 and is the largest small business association in the U.S. The NFIB collects data from small and independent businesses and publishes their Small Business Economic Trends data on the second Tuesday of each month. The Index is a composite of 10 components based on expectations for: employment, capital outlays, inventories, the economy, sales, inventory, job openings, credit, growth and earnings.

Here is what the NFIB released on September 12th:

“NFIB’s Small Business Optimism Index decreased 0.6 of a point in August to 91.3, the 20th consecutive month below the 49-year average of 98. Twenty-three percent of small business owners reported that inflation was their single most important business problem, up two points from last month. The net percent of owners raising average selling prices increased two points to a net 27% (seasonally adjusted), still at an inflationary level.

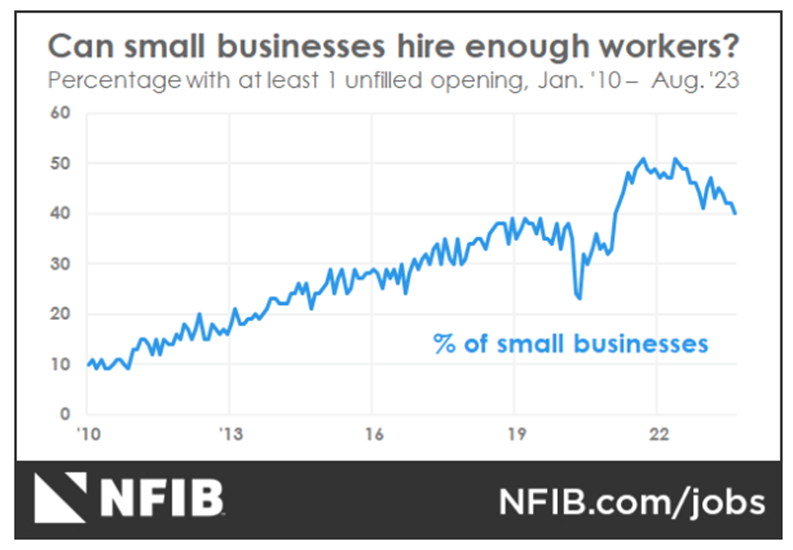

As reported in the NFIB monthly jobs report, 40% (seasonally adjusted) of all owners reported job openings they could not fill in the current period. Owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 17% planning to create new jobs in the next three months.

Related Article: Job Openings Decline in July

Sales Trends

A net negative 14% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, the lowest reading since August 2020. The net percent of owners expecting higher real sales volumes declined two points to a net negative 14%.

The net percent of owners reporting inventory gains declined four points to a net negative 7%. Not seasonally adjusted, 11% reported increases in stocks and 16% reported reductions. A net negative 5% of owners viewed current inventory stocks as “too low” in August, down one point from July. By industry, shortages are the most frequent in retail (9%), finance (7%), manufacturing (7%), and services (7%).

The net percent of owners raising average selling prices increased two points from July to a net 27% (seasonally adjusted). Twenty-three percent of owners reported that inflation was their single most important problem in operating their business, up two points.

Unadjusted, 12% reported lower average selling prices and 38% reported higher average prices. Price hikes were the most frequent in finance (52% higher, 7% lower), construction (51% higher, 6% lower), retail (45% higher, 11% lower), and wholesale (36% higher, 20% lower). Seasonally adjusted, a net 30% plan price hikes.

Raising Compensation

A net 36% reported raising compensation, down two points from July. A net 26% of owners plan to raise compensation in the next three months, up five points.

80% of owners cited labor costs as their top business problem, down two points from July. 24% percent said that labor quality was their top business problem.

-

College Costs Are Rising 5X Faster Than Inflation

The vital role of inflation in financial planning for children’s college expenses

In today’s rapidly changing economic landscape, proper financial planning has become more critical than ever. When it comes to saving for children’s college costs, accounting for inflation is a fundamental aspect that cannot be overlooked.

Inflation, the gradual increase in the cost of goods and services over time, has the potential to erode the purchasing power of your money if not factored into your financial strategy.

Rising College Costs vs. Inflation

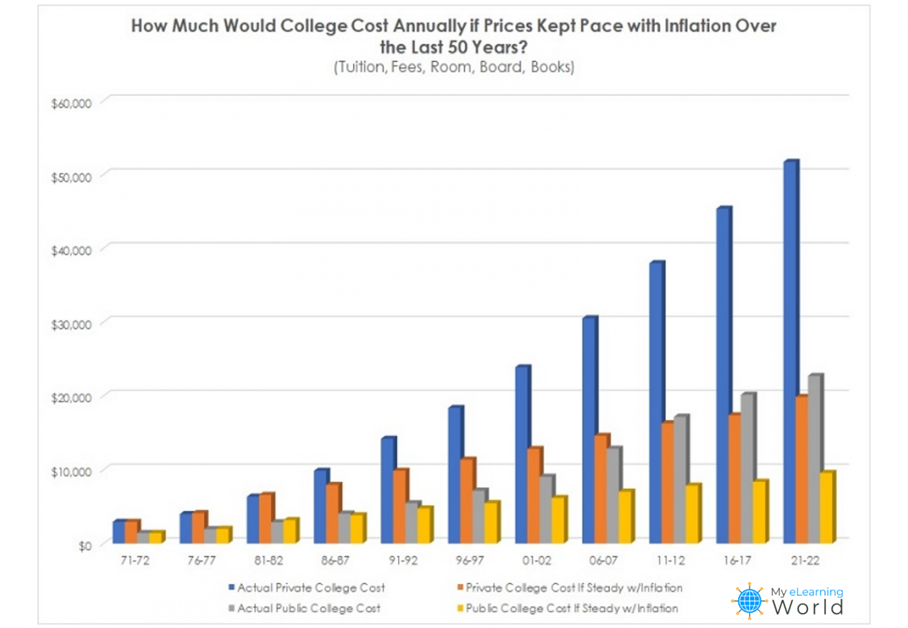

Did you know that in 1980, the price to attend a four-year college full-time was $10,231 annually – including tuition, fees, room and board, and adjusted for inflation – according to the National Center for Education Statistics? By 2019-20, the total price increased to $28,775. That’s a staggering 180% increase.

But let’s look at it another (and more sobering way):

If the cost of going to college increased consistently with the U.S. inflation rate over the last 50 years, students today would be paying between $10,000 to $20,000 per year to attend public or private universities.

The Inflation Challenge

Inflation is a natural economic phenomenon that affects virtually every aspect of our lives. From groceries to healthcare to college costs, the cost of living tends to rise over time.

If not addressed in your financial planning, inflation can have a profound impact on your savings’ ability to cover future expenses. This is particularly relevant when it comes to saving for children’s college education, given the long-term nature of the goal.

Preserving Purchasing Power

Imagine you start saving for your child’s college education when they are born. Over the next 18 years, you diligently save a significant amount. However, if inflation averages around 3% per year, the cost of college education could easily double during that time. Without accounting for inflation, you might find that the money you’ve saved falls way short of covering the actual expenses when your child is ready to enroll.

By accounting for inflation, you ensure that the purchasing power of your savings remains intact.

You are essentially future-proofing your investments, allowing them to maintain their value over time. This safeguards your ability to meet rising expenses without compromising the quality of your child’s education.

Related Article: Financial Planning for Recent College Graduates

Realistic Goal Setting

Incorporating inflation into your financial planning helps set realistic goals. When planning for a future expense like college, it’s essential to understand the true cost. Ignoring inflation can lead to underestimating the required savings amount, potentially causing stress and financial strain in the long run.

When you accurately account for inflation, you gain a more accurate understanding of the amount you need to save to cover college expenses. This empowers you to allocate your resources effectively, thereby minimizing the risk of falling short and maximizing the chances of achieving your goals.

The Power of Compounding

Compound interest is a powerful force in wealth accumulation. When you invest your savings, they have the potential to grow over time. However, if you fail to account for inflation, your investment returns might not keep pace with rising costs.

Inflation-adjusted returns are crucial to ensure that your investments genuinely generate wealth and provide the returns you need to meet your financial goals.

Mitigating Financial Stress

One of the primary purposes of financial planning is to alleviate financial stress and provide peace of mind. Inflation, when unaccounted for, can disrupt this objective. Unexpectedly high costs can lead to last-minute financial scrambling, potentially forcing you to compromise on the quality of your child’s education or take on substantial debt.

By accounting for inflation, you are adopting a proactive approach to financial planning. You are preparing for the future’s uncertainties and ensuring that your child’s educational aspirations are not compromised due to financial constraints.

Planning Matters

Financial planning is a holistic process that requires careful consideration of various variables, with inflation being a critical one. When saving for children’s college expenses, it’s vital to factor in inflation to preserve the purchasing power of your money, set realistic goals, harness the power of compounding, and mitigate potential financial stress.

By incorporating inflation into your financial strategy, you are taking a proactive step toward securing your child’s education and your family’s financial future. Remember, time is on your side, and early, informed financial decisions can make all the difference in achieving your goals.

-

EQUITIES ADVANCE LAST WEEK AS THE FED RAISES RATES BY 25 BASIS POINTS

CORPORATE EARNINGS COME IN BETTER THAN EXPECTED

Summary

- The small-cap Russell 2000 (+1.1%) recorded another positive week, followed closely by the S&P 500 (+1.0%) and the DJIA (+0.7%)

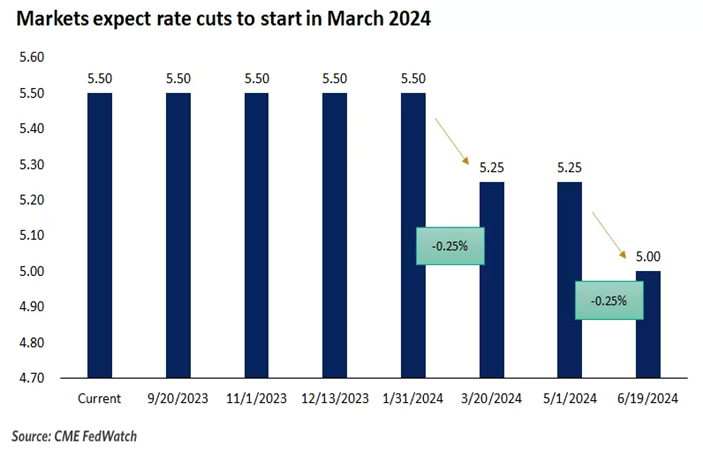

- There was a lot of economic news last week, but by far the biggest news was probably also the most expected, when the Fed voted on Wednesday to raise the target range for the fed funds rate by 25 basis points to 5.25-5.50%

- Surprisingly, Wall Street reacted well to the expected rate hike, on hopes that the Fed is done raising rates for the year, as the CME FedWatch Tool put the probability of a second rate hike any time later this year at less than 30%

- It was a busy earnings week, too, with Microsoft, Google (Alphabet) and Facebook (Meta) all moving decently

- Of the 11 S&P 500 sectors, 9 were positive as the Communication Services led the pack with a whopping 6.9% gain, whereas Utilities and Real Estate dropped by about 2% each

- The 10-year Treasury yield moved up 11 basis points and came to rest at 3.96%, a whisper away from that 4% threshold so important to Wall Street

Weekly Market Update – as of JULY 28, 2023

Close Week YTD DJIA 35,459 +0.7% +7.0% S&P 500 4,582 +1.0% +18.3% NASDAQ 14,317 +2.0% +36.8% Russell 2000 1,982 +1.1% +12.5% MSCI EAFE 2,196 +1.0% +13.0% Bond Index* 2,087.52 -0.35% +1.80% 10-Year Treasury 3.96% +0.11% +0.1% *Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD.

This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results

Stocks Advance as Fed Raises Rates

Stocks had a good week, as all four of the major U.S. equity indexes advanced on hopes that a soft landing engineered by the Federal Reserve was becoming real. Most encouraging for investors was the fact that the DJIA saw its 13th consecutive daily gain through Wednesday, marking its longest winning streak since 1987. Growth stocks far outpaced Value stocks, driven by NASDAQ’s 2% gain, which padded its 36%+ YTD gain.

The week’s biggest news was widely anticipated, as the Federal Reserve voted unanimously on Wednesday to raise the fed funds rate by 25 basis points, after pausing last month. Fed Chair Jerome Powell was non-committal about whether rates would be raised further, but he did acknowledge that inflation is far from its most-recent peak. The fed futures market is predicting that there will be about a 30% chance of another rate hike later this year.

There was a lot of economic data received last week and here are a few highlights:

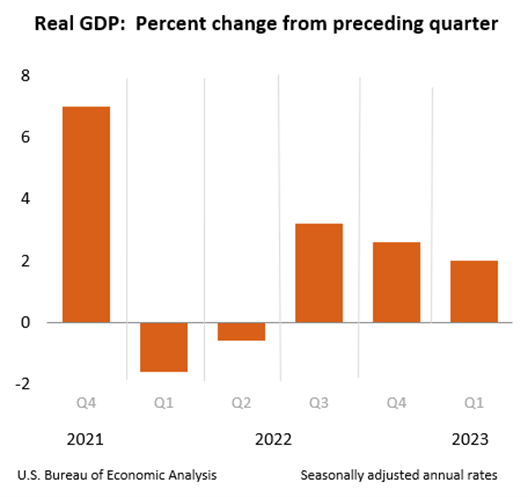

- Q1 GDP revised up significantly;

- New home sales jumped in May;

- New home sales prices declined in May;

- Durable goods orders advanced in May;

- Consumer confidence leapt in July;

- Personal income increased in May;

- Personal spending rose in May;

- Wages and salaries increased in May;

- Initial jobless claims dropped last week

GDP Revised Up Significantly

The third estimate for Q1 GDP saw a very large, upward revision to 2.0% from 1.3%, as consumer spending proved to be much more robust than anticipated.

Highlights

- Personal consumption expenditures growth was revised to 4.2% from 3.8%. That contributed 2.79 percentage points to Q1 GDP growth versus the second estimate of 2.52 percentage points.

- Gross private domestic investment declined 11.9%, versus the second estimate of -11.5%, after increasing 4.5% in Q4. This subtracted 2.22 percentage points from GDP growth versus 2.14 percentage points in the second estimate.

- Exports were up 7.8%, versus the second estimate of 5.2%, after declining 3.7% in Q4. Imports were up 2.0%, versus 4.0% in the second estimate, after declining 5.5% in Q4. Net exports contributed 0.58 percentage points to Q1 GDP growth versus the second estimate of 0.00 percentage points.

- Government spending increased 5.0%, versus the second estimate of 5.2%, after increasing 3.8% in Q4. This added 0.85 percentage points to Q1 GDP growth versus 0.89 percentage points in the second estimate.

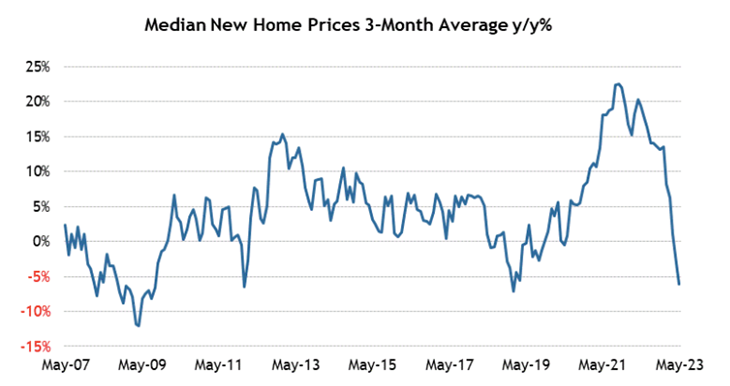

New Home Sales Jump in May But Sales Prices Decline

New home sales surged 12.2% month-over-month in May to a seasonally adjusted annual rate of 763,000 units. On a year-over-year basis, new home sales were up 20.0%, but the median sales price declined 7.6% year-over-year to $416,300 while the average sales price declined 6.6% to $487,300.

In addition:

- New home sales month-over-month/year-over-year by region:

- Northeast (+17.6%/+110.5%);

- Midwest (+4.1%/+40.0%);

- South (+11.3%/+22.0%);

- West (+17.4%/-0.6%).

- At the current sales pace, the supply of new homes for sale stood at 6.7 months, versus 7.6 months in April and 8.3 months in May 2022.

- The percentage of new homes sold for $399,999 or less accounted for 44% of new homes sold versus 49% in April and 39% one year ago.

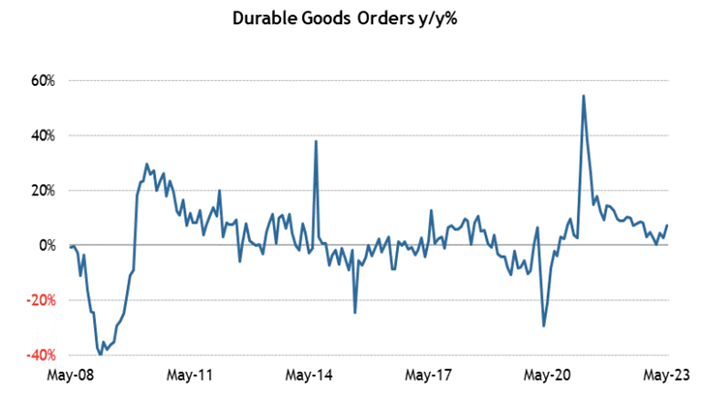

Durable Goods Orders Are UP

Total durable goods orders were up 1.7% month-over-month following an upwardly revised 1.2% increase (from 1.1%) in April. Excluding transportation, durable goods orders increased 0.6% month-over-month following a downwardly revised 0.6% decline (from -0.2%) in April.

Highlights

- New orders for machinery jumped 1.0% after increasing 0.3% in April.

- New orders for computers and electronic products increased 0.3% after declining 1.8% in April.

- New orders for fabricated metal products were flat after declining 0.2% in April.

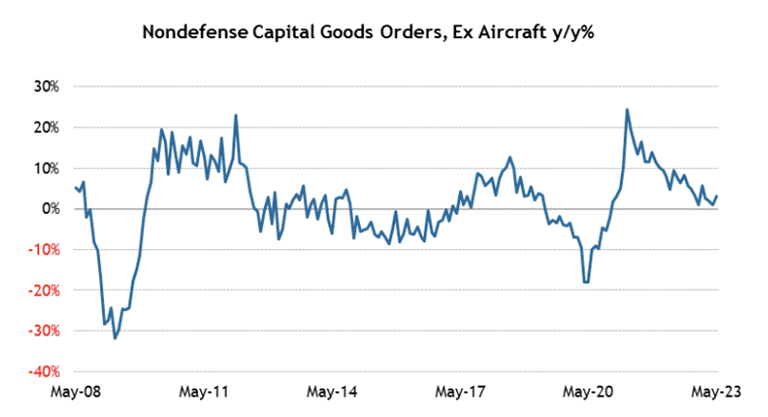

- Transportation equipment orders jumped 3.9% after increasing 4.8% in April. New orders for motor vehicles and parts were up 2.2% after being flat in April. New orders for nondefense aircraft and parts rose 32.5% after slipping 2.0% in April.

- Shipments of nondefense capital goods excluding aircraft, which factors into GDP computations, increased 0.2% following a 0.4% increase in April.

Sources: conference-board.org; bea.gov; census.gov; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com

- The small-cap Russell 2000 (+1.1%) recorded another positive week, followed closely by the S&P 500 (+1.0%) and the DJIA (+0.7%)