CORPORATE EARNINGS COME IN BETTER THAN EXPECTED

Summary

- The small-cap Russell 2000 (+1.1%) recorded another positive week, followed closely by the S&P 500 (+1.0%) and the DJIA (+0.7%)

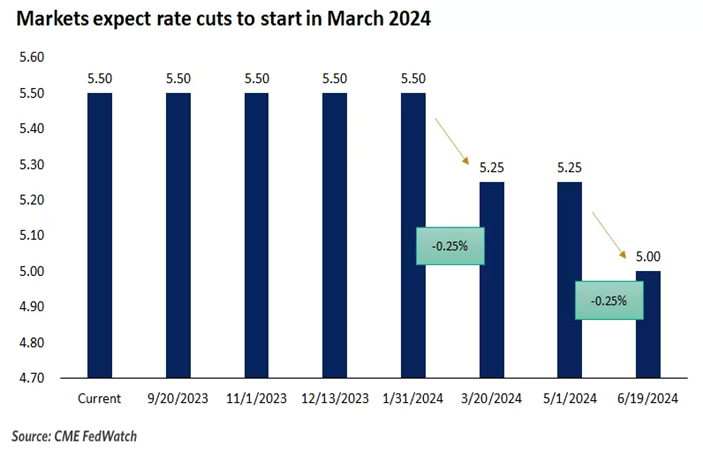

- There was a lot of economic news last week, but by far the biggest news was probably also the most expected, when the Fed voted on Wednesday to raise the target range for the fed funds rate by 25 basis points to 5.25-5.50%

- Surprisingly, Wall Street reacted well to the expected rate hike, on hopes that the Fed is done raising rates for the year, as the CME FedWatch Tool put the probability of a second rate hike any time later this year at less than 30%

- It was a busy earnings week, too, with Microsoft, Google (Alphabet) and Facebook (Meta) all moving decently

- Of the 11 S&P 500 sectors, 9 were positive as the Communication Services led the pack with a whopping 6.9% gain, whereas Utilities and Real Estate dropped by about 2% each

- The 10-year Treasury yield moved up 11 basis points and came to rest at 3.96%, a whisper away from that 4% threshold so important to Wall Street

Weekly Market Update – as of JULY 28, 2023

| Close | Week | YTD | |

| DJIA | 35,459 | +0.7% | +7.0% |

| S&P 500 | 4,582 | +1.0% | +18.3% |

| NASDAQ | 14,317 | +2.0% | +36.8% |

| Russell 2000 | 1,982 | +1.1% | +12.5% |

| MSCI EAFE | 2,196 | +1.0% | +13.0% |

| Bond Index* | 2,087.52 | -0.35% | +1.80% |

| 10-Year Treasury | 3.96% | +0.11% | +0.1% |

*Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD.

This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results

Stocks Advance as Fed Raises Rates

Stocks had a good week, as all four of the major U.S. equity indexes advanced on hopes that a soft landing engineered by the Federal Reserve was becoming real. Most encouraging for investors was the fact that the DJIA saw its 13th consecutive daily gain through Wednesday, marking its longest winning streak since 1987. Growth stocks far outpaced Value stocks, driven by NASDAQ’s 2% gain, which padded its 36%+ YTD gain.

The week’s biggest news was widely anticipated, as the Federal Reserve voted unanimously on Wednesday to raise the fed funds rate by 25 basis points, after pausing last month. Fed Chair Jerome Powell was non-committal about whether rates would be raised further, but he did acknowledge that inflation is far from its most-recent peak. The fed futures market is predicting that there will be about a 30% chance of another rate hike later this year.

There was a lot of economic data received last week and here are a few highlights:

- Q1 GDP revised up significantly;

- New home sales jumped in May;

- New home sales prices declined in May;

- Durable goods orders advanced in May;

- Consumer confidence leapt in July;

- Personal income increased in May;

- Personal spending rose in May;

- Wages and salaries increased in May;

- Initial jobless claims dropped last week

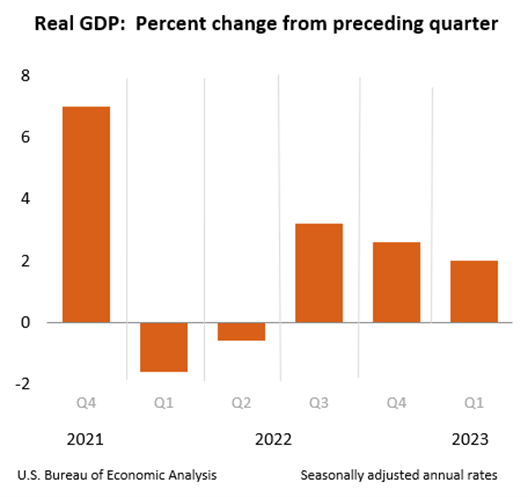

GDP Revised Up Significantly

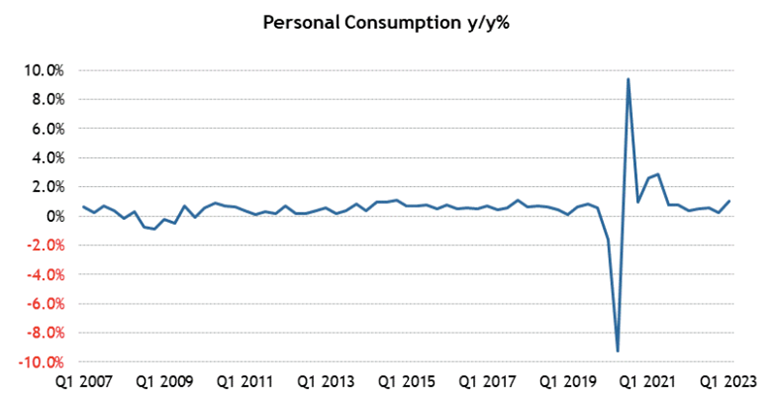

The third estimate for Q1 GDP saw a very large, upward revision to 2.0% from 1.3%, as consumer spending proved to be much more robust than anticipated.

Highlights

- Personal consumption expenditures growth was revised to 4.2% from 3.8%. That contributed 2.79 percentage points to Q1 GDP growth versus the second estimate of 2.52 percentage points.

- Gross private domestic investment declined 11.9%, versus the second estimate of -11.5%, after increasing 4.5% in Q4. This subtracted 2.22 percentage points from GDP growth versus 2.14 percentage points in the second estimate.

- Exports were up 7.8%, versus the second estimate of 5.2%, after declining 3.7% in Q4. Imports were up 2.0%, versus 4.0% in the second estimate, after declining 5.5% in Q4. Net exports contributed 0.58 percentage points to Q1 GDP growth versus the second estimate of 0.00 percentage points.

- Government spending increased 5.0%, versus the second estimate of 5.2%, after increasing 3.8% in Q4. This added 0.85 percentage points to Q1 GDP growth versus 0.89 percentage points in the second estimate.

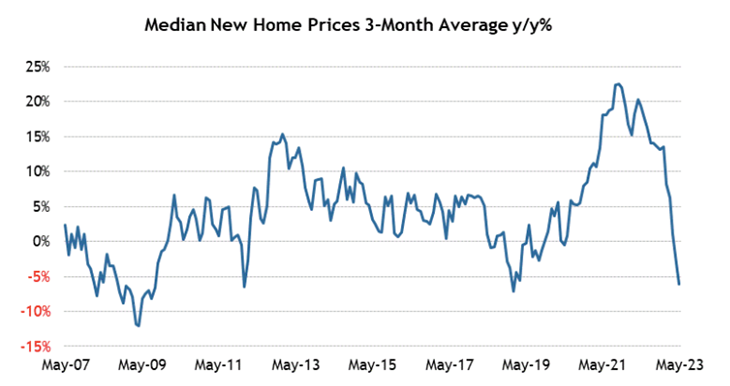

New Home Sales Jump in May But Sales Prices Decline

New home sales surged 12.2% month-over-month in May to a seasonally adjusted annual rate of 763,000 units. On a year-over-year basis, new home sales were up 20.0%, but the median sales price declined 7.6% year-over-year to $416,300 while the average sales price declined 6.6% to $487,300.

In addition:

- New home sales month-over-month/year-over-year by region:

- Northeast (+17.6%/+110.5%);

- Midwest (+4.1%/+40.0%);

- South (+11.3%/+22.0%);

- West (+17.4%/-0.6%).

- At the current sales pace, the supply of new homes for sale stood at 6.7 months, versus 7.6 months in April and 8.3 months in May 2022.

- The percentage of new homes sold for $399,999 or less accounted for 44% of new homes sold versus 49% in April and 39% one year ago.

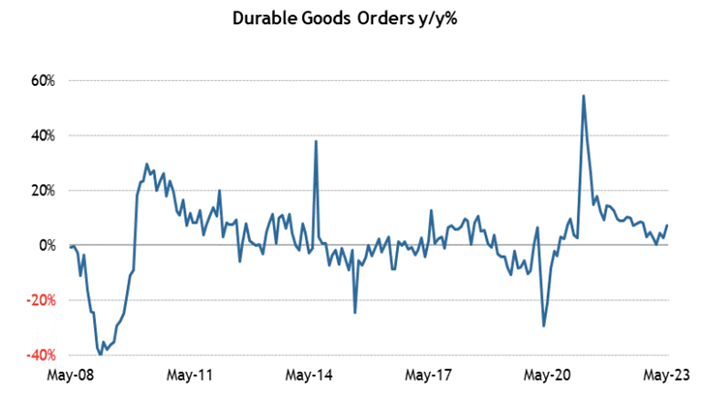

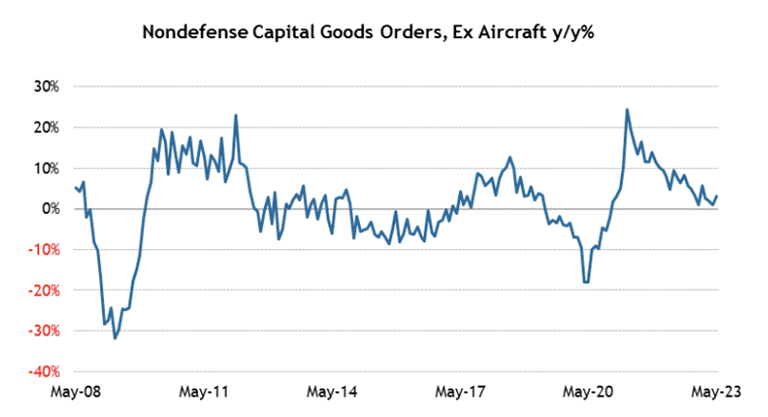

Durable Goods Orders Are UP

Total durable goods orders were up 1.7% month-over-month following an upwardly revised 1.2% increase (from 1.1%) in April. Excluding transportation, durable goods orders increased 0.6% month-over-month following a downwardly revised 0.6% decline (from -0.2%) in April.

Highlights

- New orders for machinery jumped 1.0% after increasing 0.3% in April.

- New orders for computers and electronic products increased 0.3% after declining 1.8% in April.

- New orders for fabricated metal products were flat after declining 0.2% in April.

- Transportation equipment orders jumped 3.9% after increasing 4.8% in April. New orders for motor vehicles and parts were up 2.2% after being flat in April. New orders for nondefense aircraft and parts rose 32.5% after slipping 2.0% in April.

- Shipments of nondefense capital goods excluding aircraft, which factors into GDP computations, increased 0.2% following a 0.4% increase in April.

Sources: conference-board.org; bea.gov; census.gov; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com