-

Small Business Optimism Drops Amidst Continued Inflation Challenges

The National Federation of Independent Business was founded in 1943 and is the largest small business association in the U.S. The NFIB collects data from small and independent businesses and publishes their Small Business Economic Trends data on the second Tuesday of each month. The Index is a composite of 10 components based on expectations for: employment, capital outlays, inventories, the economy, sales, inventory, job openings, credit, growth and earnings.

Here is what the Small Business Economic Trends data released on January 10th reported:

The NFIB Small Business Optimism Index declined 2.1 points in December to 89.8, marking the 12th consecutive month below the 49-year average of 98. Owners expecting better business conditions over the next six months worsened by eight points from November to a net negative 51%. Inflation remains the single most important business problem with 32% of owners reporting it as their top problem in operating their business.

“Overall, small business owners are not optimistic about 2023 as sales and business conditions are expected to deteriorate. Owners are managing several economic uncertainties and persistent inflation and they continue to make business and operational changes to compensate.”

Key findings include:

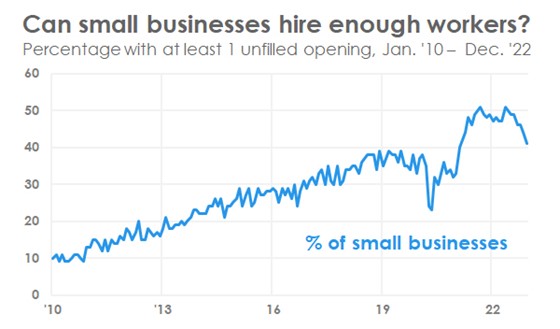

- Forty-one percent of owners reported job openings that were hard to fill, down three points from November but historically very high.

- The net percent of owners raising average selling prices decreased eight points to a net 43% (seasonally adjusted), historically high.

- The net percent of owners who expect real sales to be higher worsened two points from November to a net negative 10%.

More Small Business Woes

As reported in the NFIB’s monthly jobs report:

- Owners’ plans to add positions remain elevated, with a seasonally adjusted net 17% planning to create new jobs in the next three months.

- Overall, 55% of owners reported hiring or trying to hire in December.

- Ninety-three percent of those hiring or trying to hire reported few or no qualified applicants for the positions they were trying to fill.

Further:

- A net 44% of owners reported raising compensation.

- A net 27% plan to raise compensation in the next three months, down one point from November.

- 8% of owners cited labor costs as their top business problem.

- 23% said that labor quality was their top business problem.

More Data Later This Week

More economic data will be released later this week, including MBA Mortgage Applications on Wednesday; Jobless Claims and CPI data on Thursday; and Consumer Sentiment on Friday.

Sources: nfib.com

- Forty-one percent of owners reported job openings that were hard to fill, down three points from November but historically very high.

-

Social Security Gets Biggest Boost Since 1981

The Cost of Living Adjustment, or COLA, from the Social Security Administration (SSA) is announced every fall and has major implications for the 66 million people who receive benefit checks. With inflation surging, retirees need help maintaining purchasing power. The agency announced its 2023 COLA will be 8.7%, the highest since 1981.

For those concerned about medical costs eating into this increase, Medicare – the health insurance plan for older Americans – said last month it would drop its premiums next year by about 3% for its Medicare Park B Plan.

For more information and context, please read this article from CBS News.

For instructions on how to sign up for a “my Social Security” account with the SSA, which is the fastest way to find out when and how much you will receive, watch the video below:

-

Capitalize on Inflation with I Bonds

New data from the Consumer Price Index for Urban Consumers (CPI-U) shows a higher-than-expected inflation rate in April. Over the last 12 months, the average change in the prices paid by urban consumers for goods and services was 8.3% higher. As of this writing, the Dow Jones Industrial Average and the NASDAQ have each shed over 6% of their value over the past 5 days. Investors are looking for investment alternatives that can return something in this market environment. Here is why we see Series I bonds as a potential suitable investment that is attractive right now.

The interest is derived from a combination of a fixed rate and a variable inflation rate tied to CPI-U. Therefore, as inflation rises or falls, the interest rate will increase or decrease. It is set twice a year for a six-month period, and right now, any I bonds issued between May and October 2022 earns interest at 9.62% annually.

Read more about Series I bonds here

Although these are 30-year bonds, owners can redeem them after twelve months. There is a $10,000 purchase limit per person per year and they must be purchased direct from the Treasury Department. Additionally, if you earned a federal income tax refund, you can elect to use it to purchase up to $5,000 of paper I bonds. Lane Hipple cannot purchase I bonds for you, therefore, if you feel this is ideal, then you must purchase the bonds yourself from the Treasury.

To purchase or learn more, please go here https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds.htm