-

Cinnaminson Education Foundation Annual Golf Classic

Cinnaminson Education Foundation Raises Over $45,000

From left: Carmen Saginario, Greg Reymann, and Thomas Lane, III On Monday, June 19, 2023, Lane Hipple Partner Thomas Lane, III, along with his fellow board members, hosted the annual Cinnaminson Education Foundation golf outing. On a beautiful day at the Riverton Country Club, over $45,000 was raised, which will go directly towards programs and initiatives that are intended to enrich and enhance the educational experience of local students.

Joined by many volunteers, the CEF board (Thomas Lane, III, Charlie Hanna, Carmen Saginario, and Greg Reymann) oversaw yet another successful effort to bring corporate sponsors together with caring participants to benefit a foundation that has funded over $475,000 worth of project grants for Cinnaminson students.

As they do every year, Lane Hipple sponsored the event and also spent time organizing the activities, silent auctions, and contests.

If you would like to learn more about the CEF, click here.

To read more about Lane Hipple’s community involvement, click here.

-

Building Permits, Housing Starts, and Housing Completions Up From April

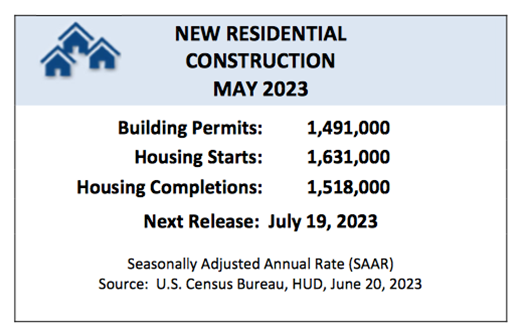

On Tuesday, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announced the following new residential construction statistics for May 2023:

Building Permits

- Privately‐owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,491,000.

- This is 5.2% above the revised April rate of 1,417,000.

- This is 12.7% below the May 2022 rate of 1,708,000.

- Single‐family authorizations in May were at a rate of 897,000.

- This is 4.8% above the revised April figure of 856,000.

- Authorizations of units in buildings with five units or more were at a rate of 542,000 in May.

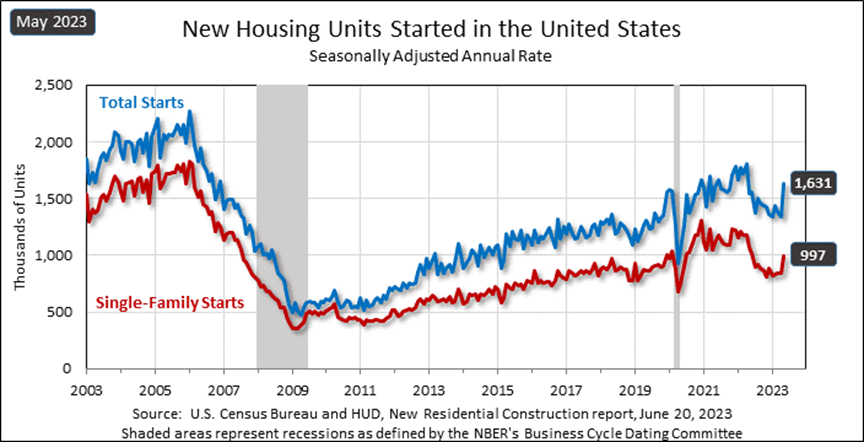

Housing Starts

- Privately‐owned housing starts in May were at a seasonally adjusted annual rate of 1,631,000.

- This is 21.7% above the revised April estimate of 1,340,000.

- This is 5.7% above the May 2022 rate of 1,543,000.

- Single‐family housing starts in May were at a rate of 997,000

- This is 18.5% above the revised April figure of 841,000.

- The May rate for units in buildings with five units or more was 624,000.

Housing Completions

- Privately‐owned housing completions in May were at a seasonally adjusted annual rate of 1,518,000.

- This is 9.5% above the revised April estimate of 1,386,000.

- This is 5.0% above the May 2022 rate of 1,446,000.

- Single‐family housing completions in May were at a rate of 1,009,000; this is 3.9% above the revised April rate of 971,000.

- The May rate for units in buildings with five units or more was 493,000.

Sources: nfib.com

-

New Data from the NFIB Small Business Optimism Index

Small Businesses Feeling More Optimistic But This is the 17th Month in a Row Below the 49-Year Average

There are over 30 million small businesses in the United States, according to the Small Business Administration and small businesses comprise about 99% of all U.S. businesses. Further, about half of all Americans – 48% – are employed by small businesses, meaning almost 60 million employees in the U.S. work for a smaller company.

Small Businesses Feeling More Optimistic

On June 13th, “the NFIB Small Business Optimism Index increased 0.4 points in May to 89.4, which is the 17th consecutive month below the 49-year average of 98. The last time the Index was at or above the average was in December 2021. Small business owners expecting better business conditions over the next six months declined one point from April to a net negative 50%. Twenty-five percent of owners reported that inflation was their single most important problem in operating their business, up two points from last month and followed by labor quality at 24%.

Key findings include:

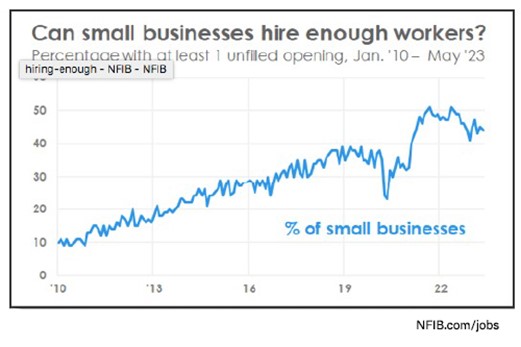

- Forty-four percent of owners reported job openings that were hard to fill, down one point from April and remaining historically very high.

- The net percent of owners raising average selling prices decreased one point to a net 32% (seasonally adjusted), still an inflationary level but trending down.

- The net percent of owners who expect real sales to be higher deteriorated two points from April to a net negative 21%.”

Job Openings Still Hard to Fill

Further, as reported in the NFIB’s monthly jobs report:

- Owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 19% planning to create new jobs in the next three months.

- Overall, 63% of owners reported hiring or trying to hire in May, up three points from April.

- Of those hiring or trying to hire, 89% of owners reported few or no qualified applicants for their open positions.

In addition:

- A net 41% of owners reported raising compensation, up one point from April.

- A net 22% plan to raise compensation in the next three months, up one point.

- Ten percent of owners cited labor costs as their top business problem.

- 24% said that labor quality was their top business problem.

-

Retail Trade Corporations’ After-Tax Profits Up in Q1

Manufacturing Corporations’ Profits are Down in Q1

The U.S. Census Bureau today announced the following seasonally adjusted quarterly after-tax profits for retail trade industries statistics for First Quarter 2023:

After-Tax Profits and Sales, 1Q 2023 – Seasonally Adjusted, Retail Trade Corporations

- Seasonally adjusted after-tax profits of U.S. retail corporations with assets of $50 million and over totaled $36.6 billion, up $5.6 billion from the $31.0 billion recorded in the fourth quarter of 2022.

- This is up $1.7 billion from the $35.0 billion recorded in the first quarter of 2022.

- Seasonally adjusted sales for the quarter totaled $1,001.6 billion, not statistically different from the $1,002.3 billion in the fourth quarter of 2022 and not statistically different from the $994.2 billion in the first quarter of 2022.

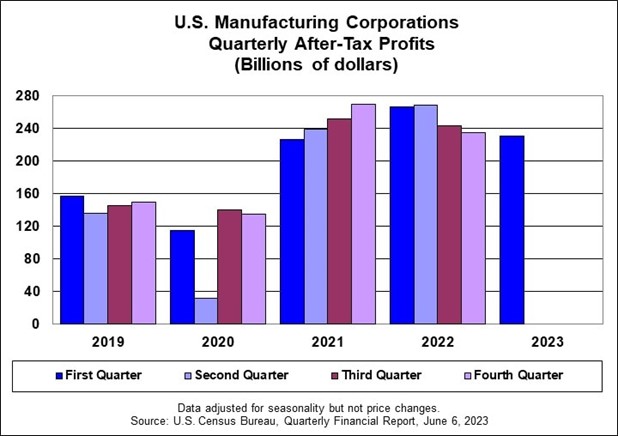

Manufacturing Industries

The U.S. Census Bureau also announced today the following seasonally adjusted quarterly after-tax profits for manufacturing industries statistics for First Quarter 2023:

After-Tax Profits and Sales, 1Q 2023 – Seasonally Adjusted, Manufacturing Corporations

- U.S. manufacturing corporations’ seasonally adjusted after-tax profits in the first quarter of 2023 totaled $230.5 billion, down $4.1 billion from the after-tax profits of $234.6 billion recorded in the fourth quarter of 2022.

- This is down $35.8 billion from the after-tax profits of $266.3 billion recorded in the first quarter of 2022.

- Seasonally adjusted sales for the quarter totaled $2,050.4 billion, down $19.7 billion from the $2,070.1 billion recorded in the fourth quarter of 2022, but not statistically different from the $2,019.9 billion in the first quarter of 2022.

Sources: census.gov

-

Summer Vacation Budgeting

Tips for Saving Money While Traveling

How You Can Enjoy the Season without Breaking the Bank

Summer is the perfect time to take a break from the daily grind and go on a vacation. However, if you’re not careful, the cost of travel can quickly add up and leave you with a hefty bill. The good news is that with some careful planning and budgeting, you can enjoy a memorable vacation without breaking the bank. Here are some summer vacation budgeting tips for saving money while traveling this summer.

Summer Vacation Budgeting Tip #1: Choose Your Destination Wisely

The first step in saving money on your summer vacation is to choose your destination wisely. Consider destinations that are less popular or off the beaten path, as these are often more affordable. Look for deals on airfare and accommodations and consider traveling during the week instead of on weekends, as this can also save you money.

Summer Vacation Budgeting Tip #2: Set a Budget

Before you start planning your vacation, it’s important to set a budget. Determine how much you can afford to spend on airfare, accommodations, food, and activities, and stick to this budget as closely as possible. Keep in mind that unexpected expenses can arise, so it’s a good idea to set aside some extra money for emergencies.

Summer Vacation Budgeting Tip #3: Look for Deals and Discounts

There are many ways to save money on travel, such as using travel reward points, booking early, and looking for deals and discounts. Consider using a travel rewards credit card to earn points that can be redeemed for airfare or hotel stays. Check with your employer, school, or membership organizations for any travel discounts that may be available. If you’re a veteran, you may qualify for special travel discounts, too.

Related Article: Financial Planning For Recent College Graduates

Summer Vacation Budgeting Tip #4: Plan Your Meals

Eating out at restaurants can be a major expense while traveling. To save money, plan your meals in advance and look for affordable dining options, such as street food or local markets. Consider staying in accommodations that have a kitchen so you can cook some meals yourself.

Summer Vacation Budgeting Tip #5: Choose Free or Low-Cost Activities

One of the best ways to save money while traveling is to choose free or low-cost activities. Look for outdoor activities, such as hiking or biking, that don’t cost anything. Visit local museums or parks that offer free admission or take a self-guided walking tour of the city.

Summer Vacation Budgeting Tip #6: Be Flexible

Finally, be flexible with your travel plans. If you’re willing to travel during off-peak times or stay in less expensive accommodations, you can save a significant amount of money. Consider taking a road trip instead of flying or staying in a vacation rental instead of a hotel.

Are You Financially Prepared for the Summer Season?

For many people, summer is the time to enjoy travel and time off with family and friends. With some careful planning and budgeting, you can enjoy a memorable summer vacation without breaking the bank or veering off the path to achieving your financial goals. By choosing your destination wisely, setting a budget, looking for deals and discounts, planning your meals, choosing free or low-cost activities, and being flexible with your plans, you can save money and have a great time on your summer vacation.

If you’d like to discuss more personal finance tips or create a financial plan, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-249-4342, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.