-

College Costs Are Rising 5X Faster Than Inflation

The vital role of inflation in financial planning for children’s college expenses

In today’s rapidly changing economic landscape, proper financial planning has become more critical than ever. When it comes to saving for children’s college costs, accounting for inflation is a fundamental aspect that cannot be overlooked.

Inflation, the gradual increase in the cost of goods and services over time, has the potential to erode the purchasing power of your money if not factored into your financial strategy.

Rising College Costs vs. Inflation

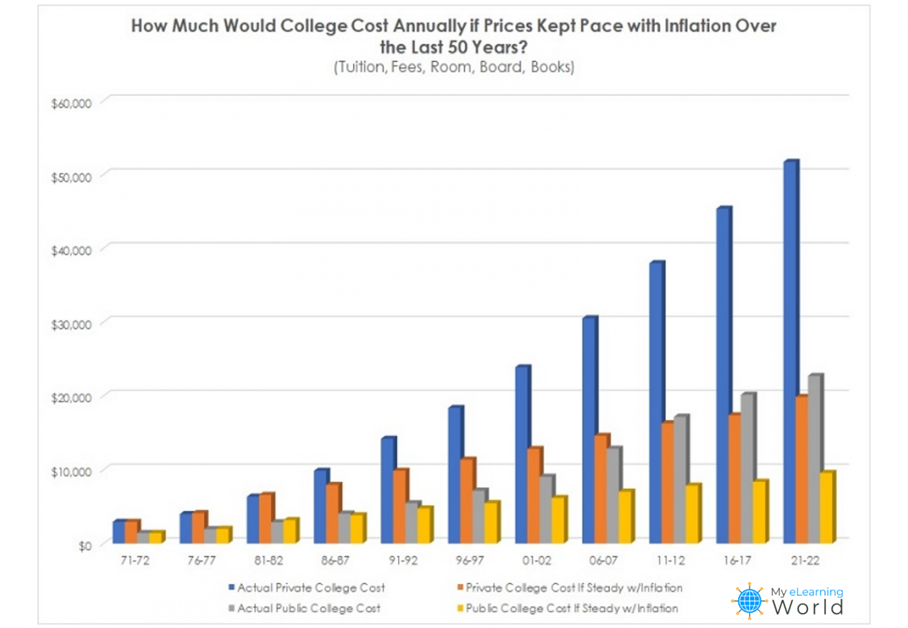

Did you know that in 1980, the price to attend a four-year college full-time was $10,231 annually – including tuition, fees, room and board, and adjusted for inflation – according to the National Center for Education Statistics? By 2019-20, the total price increased to $28,775. That’s a staggering 180% increase.

But let’s look at it another (and more sobering way):

If the cost of going to college increased consistently with the U.S. inflation rate over the last 50 years, students today would be paying between $10,000 to $20,000 per year to attend public or private universities.

The Inflation Challenge

Inflation is a natural economic phenomenon that affects virtually every aspect of our lives. From groceries to healthcare to college costs, the cost of living tends to rise over time.

If not addressed in your financial planning, inflation can have a profound impact on your savings’ ability to cover future expenses. This is particularly relevant when it comes to saving for children’s college education, given the long-term nature of the goal.

Preserving Purchasing Power

Imagine you start saving for your child’s college education when they are born. Over the next 18 years, you diligently save a significant amount. However, if inflation averages around 3% per year, the cost of college education could easily double during that time. Without accounting for inflation, you might find that the money you’ve saved falls way short of covering the actual expenses when your child is ready to enroll.

By accounting for inflation, you ensure that the purchasing power of your savings remains intact.

You are essentially future-proofing your investments, allowing them to maintain their value over time. This safeguards your ability to meet rising expenses without compromising the quality of your child’s education.

Related Article: Financial Planning for Recent College Graduates

Realistic Goal Setting

Incorporating inflation into your financial planning helps set realistic goals. When planning for a future expense like college, it’s essential to understand the true cost. Ignoring inflation can lead to underestimating the required savings amount, potentially causing stress and financial strain in the long run.

When you accurately account for inflation, you gain a more accurate understanding of the amount you need to save to cover college expenses. This empowers you to allocate your resources effectively, thereby minimizing the risk of falling short and maximizing the chances of achieving your goals.

The Power of Compounding

Compound interest is a powerful force in wealth accumulation. When you invest your savings, they have the potential to grow over time. However, if you fail to account for inflation, your investment returns might not keep pace with rising costs.

Inflation-adjusted returns are crucial to ensure that your investments genuinely generate wealth and provide the returns you need to meet your financial goals.

Mitigating Financial Stress

One of the primary purposes of financial planning is to alleviate financial stress and provide peace of mind. Inflation, when unaccounted for, can disrupt this objective. Unexpectedly high costs can lead to last-minute financial scrambling, potentially forcing you to compromise on the quality of your child’s education or take on substantial debt.

By accounting for inflation, you are adopting a proactive approach to financial planning. You are preparing for the future’s uncertainties and ensuring that your child’s educational aspirations are not compromised due to financial constraints.

Planning Matters

Financial planning is a holistic process that requires careful consideration of various variables, with inflation being a critical one. When saving for children’s college expenses, it’s vital to factor in inflation to preserve the purchasing power of your money, set realistic goals, harness the power of compounding, and mitigate potential financial stress.

By incorporating inflation into your financial strategy, you are taking a proactive step toward securing your child’s education and your family’s financial future. Remember, time is on your side, and early, informed financial decisions can make all the difference in achieving your goals.

-

What They Don’t Teach in School: Financial Literacy Lessons for Kids of All Ages

Guiding Your Children Towards a Prosperous Financial Tomorrow

With the start of a new school year, the fall season can be an exciting time for parents and children alike. And while you can be sure your kids will learn about math, science, and history, there is a significant subject that is often skipped, regardless of grade level: financial literacy. Even when schools do offer this practical subject, it’s not usually a requirement. This means the majority of children and young adults are lacking in knowledge, experience, and skills related to personal finance. If you’re a parent wanting to help teach your children about financial literacy but you’re unsure where to start, read on to learn more about the significance of nurturing financial awareness in youngsters and discover actionable suggestions for their financial education.

Start Early with the Basic Concepts

Begin teaching financial literacy as early as possible – and start simply. Even preschoolers can learn basic concepts like counting money, recognizing different coins and bills, and understanding the concept of saving. Use real coins or play money to make learning engaging and practical.

Normalize Conversations Around Money

This is a big one, because many people still feel money topics are taboo and to be avoided. Normalize this topic in your home by incorporating discussions about money into everyday conversations. Whether it’s shopping, budgeting for a family activity, or explaining the value of items, these conversations help demystify money matters and make kids comfortable discussing finances.

Use Allowances to Teach About Budgeting

As your kids get older, give them a small allowance, and guide them on how to manage it. Encourage them to allocate a portion to savings, a portion for spending, and perhaps even a portion for charitable giving. This hands-on approach helps them understand the concept of budgeting and gives them confidence in their ability to make smart money choices.

Set Savings Goals

Teach children about setting goals and saving towards them. Whether it’s buying a toy, a gadget, or saving for a future trip, having a goal encourages discipline while also teaching them delayed gratification. Sitting down with your kids and drawing up visual aids like progress charts can make the process more tangible and exciting for them.

It’s back to school time: Does Your Retirement Savings Plan Earn a Passing Grade?

Involve Kids in Family Decisions

Here’s a question to ask yourself: if your children don’t hear you discuss money matters, how are they going to learn what managing money in real life should look like? As your kids grow older, involve them in appropriate family financial discussions. This could include decisions about family vacations, major purchases, or even basic bill-paying routines. These experiences will provide practical insights into financial decision-making, while also helping them gain more confidence in their abilities to contribute.

Introduce Banking Concepts

As your children become teenagers, take some time to teach them the basics of banking. Open a checking and savings account in their name, and explain concepts like interest, deposits, and withdrawals. You’re also going to want to be sure that you teach them about the pitfalls of debt. Explain how credit cards work, the concept of interest rates, and the consequences of excessive borrowing. These lessons will help provide a real-world understanding of how banks work, the benefits of saving money over time, and help prepare kids to make wise decisions about credit and debt.

Explore Investments

Investing can be complicated even for adults to understand, but to the best of your ability, be sure that you teach the concept of investing to your older teens. Explain the difference between saving and investing, and touch on basic investment options like stocks and bonds. This early exposure can spark an interest in long-term financial planning and help pave the way to a solid financial future.

Promote and Encourage Critical Thinking

Promoting critical thinking in kids is an essential aspect of teaching financial literacy. Encourage kids to think critically about advertisements, deals, and spending choices. Teach them to evaluate whether a purchase is a want or a need, and to consider the long-term value of their choices. By encouraging them to question, analyze, and evaluate financial choices, you’re equipping your kids with valuable skills that extend far beyond the realm of money.

Lead by Example

A lot of the financial literacy knowledge your children will pick up will come from observing your own behavior. So, be sure that you’re modeling responsible financial habits, such as budgeting, saving, and making thoughtful spending decisions. Your actions will have a lasting impact on their financial attitudes and behaviors.

Giving Your Children the Gift of Financial Literacy

Gaining a strong grasp of financial literacy is an essential skill for young minds, enabling them to make well-informed choices and construct a stable economic foundation for their future. By starting this learning process early and seamlessly integrating practical teachings into their daily experiences, you can cultivate a positive and enduring comprehension of effective money management.

If you’d like to discuss financial literacy and financial educational resources further, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

-

Existing Home Sales Decline as Inventory and Mortgage Rates Rise

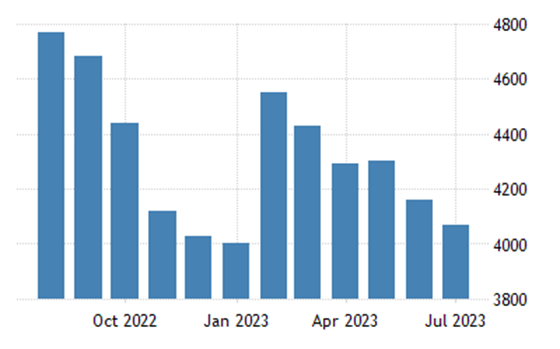

United States Existing Home Sales

On Tuesday, the National Association of Realtors announced that existing-home sales receded in July, Among the four major U.S. regions, sales grew in the West but faded in the Northeast, Midwest and South. All four regions registered year-over-year sales declines.

Total existing home sales completed transactions – that include single-family homes, townhomes, condominiums and co-ops – waned 2.2% from June. Year-over-year, sales slumped 16.6%.

- Total housing inventory registered at the end of July was 1.11 million units, up 3.7% from June but down 14.6% from one year ago (1.3 million).

- Unsold inventory sits at a 3.3-month supply at the current sales pace, up from 3.1 months in June and 3.2 months in July 2022.

- The median existing-home pricefor all housing types in July was $406,700, an increase of 1.9% from July 2022 ($399,000).

- Properties typically remained on the market for 20 days in July, up from 18 days in June and 14 days in July 2022.

- Seventy-four percent of homes sold in July were on the market for less than a month.

30-Year Mortgage Rates Up Over 7%According to Freddie Mac, the 30-year fixed rate mortgage averaged 7.09% as of August 17. That’s up from 6.96% the prior week and 5.13% one year ago.

Single-family and Condo/Co-Op Sales

- Single-family home sales slid in July, down 1.9% from June and 16.3% from the previous year. The median existing single-family home price was $412,300 in July, up 1.6% from July 2022.

- Existing condominium and co-op sales also slid in July, down 4.5% from June and 19.2% from one year ago. The median existing condo price was $357,600 in July, up 4.5% from the previous year ($342,200).

Regional BreakdownExisting-home sales in the Northeast descended 5.9% from June to an annual rate of 480,000 in July, down 23.8% from July 2022. The median price in the Northeast was $467,500, up 5.5% from one year ago.

In the Midwest, existing-home sales decreased by 3.0% from the prior month to an annual rate of 960,000 in July, dropping 20.0% from the previous year. The median price in the Midwest was $304,600, up 3.9% from July 2022.

Existing-home sales in the South retracted 2.6% from June to an annual rate of 1.86 million in July, a decrease of 14.3% from one year ago. The median price in the South was $366,200, up 1.7% from July 2022.

In the West, existing-home sales increased 2.7% from the previous month to an annual rate of 770,000 in July, down 12.5% from the prior year. The median price in the West was $610,500, unchanged from July 2022.

-

Staying Physically (and Fiscally) Fit as You Age

Keep connected, develop good sleep hygiene and get in fiscal shape

Aging is a natural process that everyone goes through, but how we age can be significantly influenced by our daily habits. Staying fit and healthy as we grow older is not just about physical exercise, though that plays a crucial role. Experts emphasize that it’s also about focusing on mental well-being, maintaining social connections, and prioritizing good sleep hygiene.

Exercise for the Body and Brain

Physical Exercise: Engaging in regular physical activity helps to maintain muscle mass, flexibility, and cardiovascular health. It can also reduce the risk of chronic conditions like obesity, diabetes, and heart disease. Whether it’s walking, swimming, or practicing yoga, find an exercise routine that suits your abilities and preferences.

Cognitive Exercise: Just as the body needs exercise, so does the brain. Mental exercises like puzzles, reading, or learning a new skill can sharpen cognitive function and ward off memory-related ailments like dementia. Never stop challenging and engaging your mind.

Related article: How to Preserve and Grow Your Family’s Legacy

Strive for Mental Fitness

Mental fitness goes beyond cognitive exercises. It encompasses emotional well-being, resilience, and overall psychological health. Engaging in activities that bring joy and purpose, practicing mindfulness, and seeking professional help if needed, can keep your mind in top shape. Staying fit and positive mental health supports overall well-being and can even enhance immune function.

Staying Fit Socially

Humans are social creatures, and staying connected to friends and family is essential for emotional health. Social interactions stimulate the brain and enhance feelings of happiness and fulfillment. Joining clubs, volunteering, or simply maintaining regular contact with loved ones can foster a strong social network. Remember, quality is often more valuable than quantity when it comes to social connections.

Develop Good Sleep Hygiene

Sleep is a vital but often overlooked aspect of overall health. Good sleep hygiene means creating a conducive environment for sleep, establishing a regular sleep schedule, and avoiding things that might disrupt sleep patterns (such as screens or caffeine close to bedtime).

Aging might come with changes in sleep patterns, but maintaining a healthy sleep routine can have profound impacts on physical and mental health. Adequate rest supports cognitive function, mood regulation, and overall wellness.

Not Just About Staying Fit at the Gym

A holistic approach to staying fit as you age encompasses more than just hitting the gym. These habits aren’t just for those in their golden years either; starting early can lay the foundation for a robust and resilient aging process.

Regular check-ins with healthcare professionals who understand your individual needs can further support these habits. Ultimately, the journey of aging is unique to each person, and cultivating these habits can make that journey a fulfilling and healthy one.

Your Financial Advisor

A good advisor will spell everything out for you in ways that you understand. After all, it is your future that you are working on. If your doctor or advisor shoos you out without explaining problems and solutions, you can find a better one.

Decision-making in both areas changes with circumstances and works best with consistent, objective planning. Just as your health changes over time, markets and economies change even faster.

- Your financial advisor is there to discuss your future and be a sounding board for your career.

- Your financial advisor can help you maintain a healthy lifestyle.

- Your financial advisor will be there for to help you get in – and stay in – fiscal shape.

Your financial advisor is always there to care for your financial well-being, but also your emotional well-being. Always.

-

Tax-Efficient Wealth Building: Strategies to Maximize Your Returns

Tips to Keep More of Your Hard-Earned Money Working for You

When it comes to preparing for a financially secure future, utilizing tax-efficient wealth building strategies can help you make the most of your assets. In fact, one often overlooked aspect of wealth building is the impact of taxes on investment returns. Implementing tax-efficient strategies can help you minimize tax liabilities and keep more of your hard-earned money working for you. In this article, we will explore various strategies that can optimize your investment returns and help you on your journey to tax-efficient wealth building.

Understand Tax-Advantaged Accounts

One of the foundational strategies for tax-efficient wealth building is leveraging tax-advantaged accounts. Familiarize yourself with options such as Individual Retirement Accounts (IRAs), 401(k) plans, Health Savings Accounts (HSAs), and 529 education savings plans. These accounts offer tax advantages, such as tax-deferred growth or tax-free withdrawals, allowing your investments to grow more efficiently.

Capitalize on Tax-Deferred Investments

Investing in tax-deferred vehicles can have a significant impact on your long-term wealth accumulation. Explore options like traditional IRAs, 401(k) plans, and deferred annuities. By deferring taxes on investment gains until withdrawal, you can potentially benefit from compounding growth and keep more of your returns working for you.

Utilize Tax-Efficient Asset Location

Strategic asset location involves placing different types of investments in the most appropriate accounts to optimize tax efficiency. For example, high-growth assets that generate significant capital gains may be best held in tax-advantaged accounts to defer taxes, while tax-efficient investments like index funds or tax-managed funds can be placed in taxable brokerage accounts. If you’re unsure about the tax treatments of different types of accounts, work with a financial advisor or tax professional to determine the most tax-efficient wealth-building strategies for your personal circumstances.

Harvest Tax Losses

Tax-loss harvesting involves strategically selling investments that have experienced losses to offset taxable gains. By realizing losses, you can reduce your tax liability while maintaining a similar investment position by reinvesting in similar assets. Careful consideration of tax rules and restrictions is crucial to ensure compliance and maximize the benefits of tax-efficient wealth building strategies like this one.

Long-Term Investing for Capital Gains

Holding investments for the long term can have substantial tax advantages. Capital gains from investments held for more than one year are subject to lower long-term capital gains tax rates. By adopting a long-term investment strategy, you can take advantage of these preferential tax rates and enhance after-tax returns.

Consider Tax-Efficient Investment Vehicles

Certain investment vehicles, such as exchange-traded funds (ETFs) or index funds, are designed to be tax-efficient. These funds aim to minimize taxable distributions by minimizing portfolio turnover or using in-kind transfers. Exploring these options can help you reduce taxable events and improve overall tax efficiency.

Charitable Giving

Charitable giving may strike you as an odd addition to a list of tax-efficient wealth building strategies, but these types of contributions offer potential tax benefits while supporting causes you care about. Consider donating appreciated securities directly to charitable organizations instead of cash. By doing so, you can potentially avoid capital gains taxes and still claim a deduction for the fair market value of the donated assets.

Related Article: Five Charitable Gifting Strategies That Come With Tax Advantages

Seek Professional Guidance

Navigating the complexities of tax-efficient wealth building can be challenging, and some of the above strategies may leave you feeling confused or overwhelmed if you try to go it alone. Consider working with a knowledgeable financial advisor or tax professional who can provide personalized guidance based on your unique financial situation. They can help you identify and implement the most effective tax strategies and ensure compliance with tax laws.

Are You Utilizing Tax-Efficient Wealth Building Strategies?

Building wealth requires a comprehensive approach that includes optimizing your investment returns while minimizing tax liabilities. By implementing tax-efficient wealth building strategies such as leveraging tax-advantaged accounts, capitalizing on tax-deferred investments, and utilizing strategic asset location, you can enhance your after-tax returns and accelerate your wealth-building journey. By making tax efficiency a priority, you can keep more of your wealth working for you and achieve greater long-term financial success.

If you’d like to discuss strategies for tax-efficient wealth building, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.