-

Social Security Benefits Set to Increase in 2024

Proper financial planning includes forecasting future Social Security benefits

In a welcome development for millions of Americans relying on Social Security, the Social Security Administration has recently announced an increase in retirement and disability benefits. Starting in January 2024, recipients will see a meaningful boost, with benefits set to rise by 3.2%, translating to an average increase of more than $50 a month.

This cost-of-living adjustment (COLA) marks a helpful step in ensuring financial stability for retirees and individuals with disabilities, impacting over 71 million Social Security beneficiaries across the nation.

Historic Increases

This COLA increase of 3.2% follows a historic 8.7% surge for 2023 and a 5.9% rise in 2022. These significant adjustments are a testament to the government’s commitment to addressing the rising cost of living, especially for those who depend on Social Security benefits as a primary source of income.

Impact on Recipients

For the average recipient, the 3.2% increase means more than just additional dollars in their monthly budget. It signifies improved financial security, providing a cushion against inflation and ensuring that essential needs are met with less strain. This extra income can contribute to covering healthcare expenses, purchasing necessities, and even indulging in a few luxuries, hopefully enhancing the overall quality of life for retirees and disabled individuals.

Importance of Social Security Forecasting

Understanding and forecasting Social Security benefits are vital components of financial planning. As demonstrated by the recent COLA adjustments, these benefits are subject to change, and staying informed about these fluctuations is essential for effective financial planning.

Retirement Planning: For those approaching retirement, accurately estimating Social Security benefits can help plan for additional income streams and bridge the gap between retirement savings and living expenses.

Budgeting: Knowing the exact amount of the monthly benefit allows individuals to budget effectively, ensuring that essential expenses are covered without relying solely on these funds.

Long-term Financial Security: Forecasting Social Security benefits aids in long-term financial planning, enabling individuals to make informed decisions about investments, healthcare costs, and potential legacy planning.

Disability and Survivor Benefits: For those receiving disability benefits, understanding the potential adjustments in benefits can help plan for healthcare and support services, ensuring a higher quality of life despite the challenges faced.

The Elephant in the Room

Relying solely on Social Security as a primary source of income during retirement, however, is a very risky proposition, and any good financial advisor will caution against this for several reasons.

Firstly, the future of Social Security benefits is uncertain. While the government has taken steps to address immediate concerns, the program is projected to face financial challenges due to the aging population and a declining worker-to-beneficiary ratio. With a growing number of retirees drawing from the system and a shrinking workforce contributing, there are concerns about the long-term sustainability of Social Security in its current form.

Secondly, Social Security benefits alone might not be sufficient to maintain the standard of living many individuals desire during retirement. The benefits are designed to replace only a portion of pre-retirement income, and for many people, especially those with higher incomes before retirement, this replacement rate might not be enough to cover essential living expenses, healthcare costs, and other financial obligations. Depending solely on these benefits could lead to financial hardship, forcing retirees to compromise on their lifestyle or struggle with unexpected expenses.

Additionally, the cost of living adjustments made to Social Security benefits might not keep up with the actual rise in living expenses, particularly healthcare and housing costs, which tend to increase at a faster rate than the general inflation rate. This discrepancy can erode the purchasing power of Social Security benefits over time, making it challenging for retirees to keep up with rising costs.

Planning Matters

The increase in Social Security benefits by 3.2%, coupled with previous historic adjustments, is a significant stride towards supporting the financial well-being of retirees and disabled individuals. Proper financial planning, including forecasting Social Security benefits, empowers individuals to navigate their financial futures with confidence, ensuring a comfortable and secure retirement.

However, while Social Security benefits can provide crucial support, they should be viewed as a supplemental income rather than the sole foundation of a retirement plan. Diversifying income sources, such as personal savings, investments, and employer-sponsored retirement accounts, is essential for building a robust financial cushion that can withstand the uncertainties of the future and ensure a comfortable retirement.

Accordingly, as these benefits evolve, staying informed and seeking guidance from financial experts becomes paramount, allowing Americans to make the most out of their hard-earned benefits and enjoy their golden years with peace of mind.

Copyright © 2023 FMeX. All rights reserved.

Distributed by Financial Media Exchange. -

Crucial Estate Planning Steps Before It’s Too Late

Countdown to the sunset of the 2017 Tax Cuts and Jobs Act has started

As 2026 approaches, the financial and legal communities are abuzz with discussions about the imminent sunset of the 2017 Tax Cuts and Jobs Act. For many, this translates to pressing changes affecting estate planning.

With only two years left to address these modifications, it’s imperative to understand the urgency and take action now.

Understanding the Impending Estate Planning Changes

The 2017 Tax Cuts and Jobs Act introduced favorable estate tax provisions, offering a hefty federal estate tax exemption of $12.92 million per person. However, by January 1, 2026, this exemption is set to drop significantly to roughly half its current value, adjusted for inflation.

Related Article: What to Do Before the Tax Cuts and Jobs Act Provisions Sunset

Why Immediate Action is Essential

Estate planning is not a process to be hurried. Comprehensive strategies, especially ones revolving around gifting to trusts or establishing gifting vehicles, demand time. Here’s why immediate action is crucial:

Short Planning Window: Two years might seem adequate. However, in the realm of estate planning, it’s but a blink of an eye. Advisors and clients alike must act swiftly.

Overwhelmed Attorneys: As the 2026 deadline approaches, estate planning attorneys will inevitably face a surge in demand. This influx means many attorneys might stop accepting new clients long before the deadline, leaving procrastinators in a lurch.

Maximizing the Exemption: By acting now, you’ll make the most of the current exemption before it reduces, potentially saving millions in estate taxes.

Estate Planning Steps Clients Should Take Immediately

Consult Your Advisor: If you haven’t already, now is the time to meet with your financial advisor. They can provide insights tailored to your unique financial situation.

Review Your Current Estate Plan: Understand the implications of the looming changes on your existing estate plan. A periodic review is always advisable, but now it’s non-negotiable.

Consider Gifting: With the high exemption limit, consider gifting assets to trusts or using other gifting vehicles. It’s a prime opportunity to move wealth out of your estate and leverage the generous exemptions.

Engage an Estate Planning Attorney: Given the anticipated demand surge, seek out and engage a reputable estate planning attorney sooner rather than later.

Stay Updated: As we inch closer to 2026, there might be new legislative changes, court rulings, or other factors impacting estate planning. Regularly check in with your advisor to stay abreast of these changes.

Act Now

The countdown to the sunset of the 2017 Tax Cuts and Jobs Act provisions is more than a looming date on the calendar; it’s a clarion call for immediate action. As a client, seizing the moment now can mean securing a more stable financial legacy for your heirs.

Don’t wait until it’s too late; the time to act is now.

-

Are We On the Brink of the Elusive Soft Landing?

Signs are encouraging and the possibility seems more tangible than ever

In the intricate world of economics, maneuvering the vast U.S. economy without causing disruptions is likened to steering a colossal ship through a tempestuous storm. Since early 2022, U.S. policymakers, including Federal Reserve Chair Jerome Powell, have embarked on the challenging mission of curbing inflationary pressures through heightened interest rates, all the while avoiding economic contraction. This elusive equilibrium, historically challenging to achieve, is what economists fondly term a “soft landing.”

The question that beckons is: are we on the brink of witnessing this rare economic feat?

Historical Context

Historically, efforts to tame inflation with increased interest rates have sometimes led to unintended consequences. Often, rapid rate hikes inadvertently plunge economies into recessions, exacerbating unemployment rates and dampening investment climates. This is because as borrowing becomes expensive, consumers reduce spending and businesses curtail investments, leading to an economic slowdown or even contraction.

Given this background, it’s understandable why the ideal scenario of a soft landing, where price pressures are contained without causing economic downturns, is seen as almost mythical in economic circles.

Indicative Signs

Recent economic data, however, provides a glimmer of hope. A somewhat declining inflation trend coupled with a sustained growth in economic output has sparked optimistic whispers among economists. Here’s why many believe a soft landing might be on the horizon:

Measured Rate Hikes: Under Powell’s stewardship, the Federal Reserve has been cautious, opting for gradual and measured rate increases rather than aggressive jumps. This approach allows the economy to adjust without being jolted abruptly.

Recent News: The Federal Reserve holds interest rates at September meeting

Resilient Consumer Spending: Despite the rate hikes, consumer spending – a significant driver of the U.S. economy – has remained robust. This resilience indicates that the economy still has underlying strength.

Flexible Policy Stance: The Federal Reserve has consistently signaled its readiness to adjust its policies based on evolving economic conditions. This adaptability is crucial in navigating the unpredictable waters of global economics.

Stabilizing External Factors: Global economic conditions, including stabilizing trade relationships and steady growth in emerging markets, have provided a conducive backdrop for the U.S. to manage its internal economic challenges.

Skepticism and Vigilance

While the indicators are promising, it’s worth noting that economic predictions are inherently fraught with uncertainties. There are always external shocks, geopolitical tensions, and unforeseen events that can derail even the most optimistic forecasts. As a result, while there’s growing consensus about the possibility of a soft landing, there’s also a shared understanding of the need for continued vigilance.

Time Will Tell

Achieving a soft landing for the U.S. economy would indeed be a remarkable accomplishment, especially given the historical challenges associated with it. The signs are undeniably encouraging, and under the Fed’s pragmatic leadership, the possibility seems more tangible than ever.

However, in the ever-fluid landscape of global economics, only time will tell whether this optimism translates into a realized economic equilibrium.

-

Optimism Among Small Business Owners Declined in August

According to the NFIB’s Small Business Economic Trends data

The National Federation of Independent Business was founded in 1943 and is the largest small business association in the U.S. The NFIB collects data from small and independent businesses and publishes their Small Business Economic Trends data on the second Tuesday of each month. The Index is a composite of 10 components based on expectations for: employment, capital outlays, inventories, the economy, sales, inventory, job openings, credit, growth and earnings.

Here is what the NFIB released on September 12th:

“NFIB’s Small Business Optimism Index decreased 0.6 of a point in August to 91.3, the 20th consecutive month below the 49-year average of 98. Twenty-three percent of small business owners reported that inflation was their single most important business problem, up two points from last month. The net percent of owners raising average selling prices increased two points to a net 27% (seasonally adjusted), still at an inflationary level.

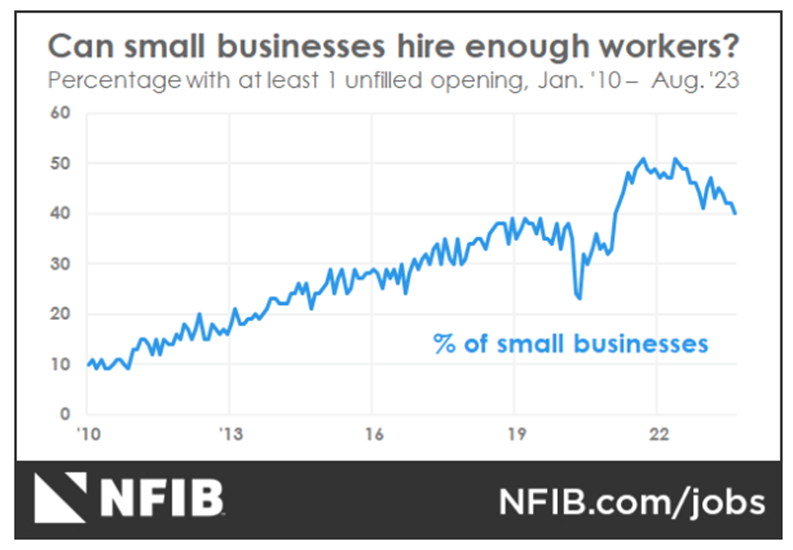

As reported in the NFIB monthly jobs report, 40% (seasonally adjusted) of all owners reported job openings they could not fill in the current period. Owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 17% planning to create new jobs in the next three months.

Related Article: Job Openings Decline in July

Sales Trends

A net negative 14% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, the lowest reading since August 2020. The net percent of owners expecting higher real sales volumes declined two points to a net negative 14%.

The net percent of owners reporting inventory gains declined four points to a net negative 7%. Not seasonally adjusted, 11% reported increases in stocks and 16% reported reductions. A net negative 5% of owners viewed current inventory stocks as “too low” in August, down one point from July. By industry, shortages are the most frequent in retail (9%), finance (7%), manufacturing (7%), and services (7%).

The net percent of owners raising average selling prices increased two points from July to a net 27% (seasonally adjusted). Twenty-three percent of owners reported that inflation was their single most important problem in operating their business, up two points.

Unadjusted, 12% reported lower average selling prices and 38% reported higher average prices. Price hikes were the most frequent in finance (52% higher, 7% lower), construction (51% higher, 6% lower), retail (45% higher, 11% lower), and wholesale (36% higher, 20% lower). Seasonally adjusted, a net 30% plan price hikes.

Raising Compensation

A net 36% reported raising compensation, down two points from July. A net 26% of owners plan to raise compensation in the next three months, up five points.

80% of owners cited labor costs as their top business problem, down two points from July. 24% percent said that labor quality was their top business problem.

-

Job Openings Decline in July

The U.S. Bureau of Labor Statistics reported that job openings lowered to 8.8 million

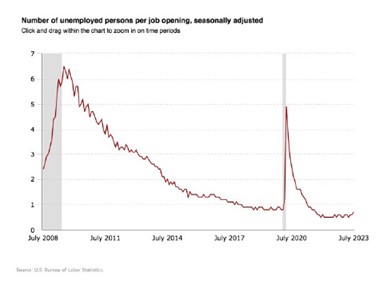

On Tuesday, the number of job openings edged down to 8.8 million on the last business day of July, the U.S. Bureau of Labor Statistics reported. Over the month, the number of hires and total separations changed little at 5.8 million and 5.5 million, respectively. Within separations, quits (3.5 million) decreased, while layoffs and discharges (1.6 million) changed little.

Job Openings

- On the last business day of July, the number of job openings edged down to 8.8 million (-338,000), while the rate changed little at 5.3%.

- Over the month, job openings decreased in professional and business services (-198,000); health care and social assistance (-130,000); state and local government, excluding education (-67,000); state and local government education (-62,000); and federal government (-27,000).

- By contrast, job openings increased in information (+101,000) and in transportation, warehousing, and utilities (+75,000).

Separations

Total separations include quits, layoffs and discharges, and other separations. Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. Other separations include separations due to retirement, death, disability, and transfers to other locations of the same firm.

The number and rate of total separations in July were little changed at 5.5 million and 3.5%, respectively. Over the month, the number of total separations decreased in accommodation and food services (-132,000).

In July, the number of quits decreased to 3.5 million (-253,000), while the rate changed little at 2.3%. The number of quits declined in accommodation and food services (-166,000); wholesale trade (-27,000); and arts, entertainment, and recreation (-17,000). The number of quits increased in state and local government education (+18,000).

In July, the number of layoffs and discharges changed little at 1.6 million, and the rate held at 1.0%. The number of layoffs and discharges changed little in all industries.

The number of other separations was little changed in July at 378,000.

Establishment Size Class

In July, establishments with 1 to 9 employees saw little change in all data elements. Establishments with more than 5,000 employees had decreases in their quits rates and total separations rates.