-

2022 Goods and Services Deficit Increased By $103 Billion From 2021

On Tuesday, the U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced that the goods and services deficit was $67.4 billion in December, up $6.4 billion from $61.0 billion in November.

December exports were $250.2 billion, $2.2 billion less than November exports. December imports were $317.6 billion, $4.2 billion more than November imports.

The December increase in the goods and services deficit reflected an increase in the goods deficit of $7.4 billion to $90.6 billion and an increase in the services surplus of $1.0 billion to $23.2 billion.

For 2022, the goods and services deficit increased $103.0 billion, or 12.2%, from 2021. Exports increased $453.1 billion or 17.7%. Imports increased $556.1 billion or 16.3%.

Three-Month Moving Averages

The average goods and services deficit decreased $2.1 billion to $68.6 billion for the three months ending in December.

- Average exports decreased $2.6 billion to $253.0 billion in December.

- Average imports decreased $4.7 billion to $321.6 billion in December.

Year-over-year, the average goods and services deficit decreased $6.4 billion from the three months ending in December 2021.

- Average exports increased $24.2 billion from December 2021.

- Average imports increased $17.8 billion from December 2021.

Exports of Goods

- Nonmonetary gold decreased $1.6 billion.

- Crude oil decreased $0.8 billion.

- Other petroleum products decreased $0.6 billion.

- Jewelry decreased $0.4 billion.

- Pharmaceutical preparations decreased $0.2 billion.

- Foods, feeds, and beverages increased $0.7 billion.

Imports of Goods

- Cell phones and other household goods increased $3.5 billion.

- Automotive vehicles, parts, and engines increased $2.9 billion.

- Passenger cars increased $1.6 billion.

- Other automotive parts and accessories increased $0.7 billion.

- Fuel oil decreased $0.8 billion.

- Organic chemicals decreased $0.8 billion.

Sources: bea.gov

-

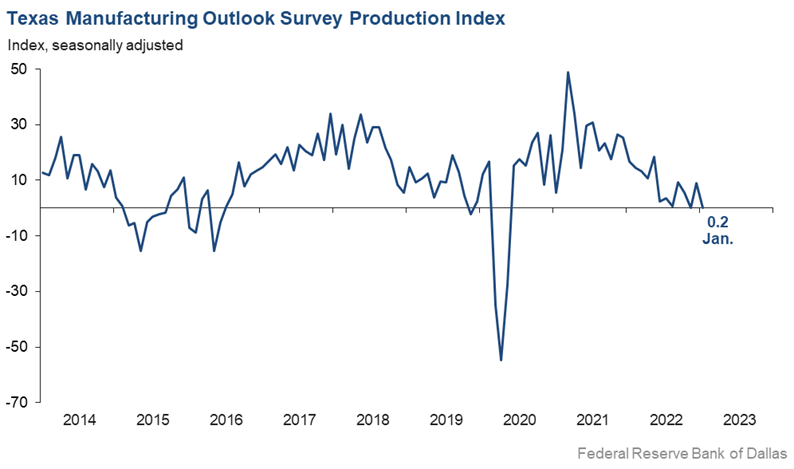

Manufacturers in Texas Saw Growth in Factory Activity Slow in January

Every month, the Federal Reserve Bank of Dallas asks Texas business executives questions on labor market conditions and the results are compiled into the Texas Manufacturing Outlook Survey, the Texas Service Sector Outlook Survey and the Texas Retail Outlook Survey.

On January 30th, the Federal Reserve Bank of Dallas reported that: “Growth in Texas factory activity slowed in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 9.1 to 0.2, with the near-zero reading suggestive of flat output.

Other measures generally indicated weakened manufacturing activity this month. The new orders index was negative for an eighth month in a row – suggesting a continued decrease in demand – though it moved up from -11.0 to -4.0. The growth rate of orders index inched down to -12.3. The capacity utilization index was positive but dipped from 7.9 to 6.0, while the shipments index returned to negative territory at a reading of -6.3.

Perceptions of broader business conditions continued to worsen in January, though pessimism waned. The general business activity index remained negative but shot up 12 points to -8.4. Similarly, the company outlook index posted its 11th straight negative reading but moved up 11 points to -2.5. The outlook uncertainty index was largely unchanged at 16.8.

Labor Market & Price Pressures

Labor market measures pointed to stronger employment growth and longer workweeks.

- The employment index climbed four points to 17.6, a reading significantly above its series average of 7.9.

- Thirty-one percent of firms noted net hiring, while 13 percent noted net layoffs.

- The hours worked index held fairly steady at 3.8.

Further, price pressures were generally steady and wage growth eased slightly in January.

- The raw materials prices index was largely stable at 20.5, remaining below its series average of 28.0 for the third month in a row.

- The finished goods prices index was little changed at 9.9, roughly in line with its series average of 9.0.

- The wages and benefits index ticked down from 34.2 to 30.5.

Expectations regarding future manufacturing activity were mixed in January. The future production index pushed further positive to 16.1, signaling that respondents expect output growth over the next six months. The future general business activity index remained negative, coming in at -9.1. Most other measures of future manufacturing activity were positive this month.”

Sources: dallasfed.org

-

5 investment ideas for small-business owners struggling to keep their finances liquid

Three local financial experts share their advice.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/YJPKYC62CJFITAB5DO2ZNXQAWU.jpg)

Andrew Hipple has advice on how small business owners (and individuals) can take advantage of the rish in interest rates. (photo credit: Steven M. Falk / Inquirer Staff Photographer) Written by Gene Marks

Even as commercial lending rates have more than doubled in the last year, interest rates earned on checking, money market and savings accounts remain stubbornly low as banks seek to maintain their profitability.

That’s not helpful for business owners, who need to earn money on their cash reserves while keeping enough liquidity to meet faily working capital needs. Options remain limited, but the environment is slowly changing, and a number of investment choices with minimal risks are emerging.

Click here to read full article from the Philadelphia Inquirer, featuring Andrew Hipple CFP®, Partner at Lane Hipple Wealth Management Group.

-

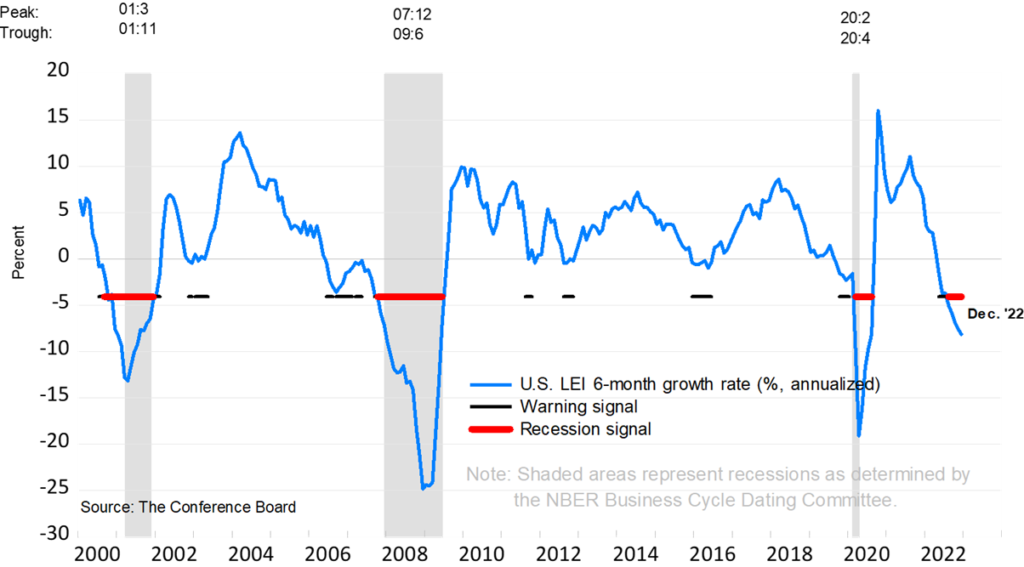

Conference Board Leading & Coincident Economic Indicators Pointing to a Recession

The Conference Board was founded in 1916 by a group of CEOs “concerned about the impact of workplace issues on business, and with a desire for greater cooperation and knowledge sharing among businesses.”

Every month, the Conference Board compiles a composite of economic indexes designed to signal peaks and troughs in the business cycle. The leading, coincident, and lagging economic indexes are essentially composite averages of 10 individual indicators and help smooth out some of the volatility of individual components.

The ten components include:

- Average weekly hours, manufacturing

- Average weekly initial claims for unemployment insurance

- Manufacturers’ new orders, consumer goods and materials

- ISM Index of New Orders

- Manufacturers’ new orders, nondefense capital goods excluding aircraft orders

- Building permits, new private housing units

- Stock prices, 500 common stocks

- Leading Credit Index

- Interest rate spread, 10-year Treasury bonds less federal funds

- Average consumer expectations for business conditions

Leading Indicators Signaling a Recession

On January 23rd, the Conference Board announced that its Leading Economic Index for the U.S. decreased by 1.0% in December 2022 to 110.5 (2016=100), following a decline of 1.1% in November.

The LEI is now down 4.2% over the six-month period between June and December 2022 – a much steeper rate of decline than its 1.9% contraction over the previous six-month period (December 2021–June 2022).

“The US LEI fell sharply again in December – continuing to signal recession for the US economy in the near term. There was widespread weakness among leading indicators in December, indicating deteriorating conditions for labor markets, manufacturing, housing construction, and financial markets in the months ahead.

Meanwhile, the coincident economic index (CEI) has not weakened in the same fashion as the LEI because labor market related indicators (employment and personal income) remain robust. Nonetheless, industrial production – also a component of the CEI – fell for the third straight month.

Overall economic activity is likely to turn negative in the coming quarters before picking up again in the final quarter of 2023.”

The trajectory of the US LEI continues to signal a recession

Sources: conference-board.org

-

Financial Tips for Doctors with Student Loan Debt

How to Get Strategic About Tackling Your Medical School Costs

Medical school can certainly be viewed as an investment – but it’s a costly one. Statistics show that the average student loan debt for college students is $28,950, while the average medical school debt is around $200,000. Even for doctors who are earning high salaries, it can be challenging to pay down such a hefty amount of educational debt.

Feeling burdened by debt can seriously impact your finances, but it can wreak havoc on your emotional and physical well-being, too. If you’re a medical student or doctor looking to protect your net worth and quality of life, it’s imperative that you establish a savvy plan for paying off your student loans. Below are five tips to help you get started.

First: A Word on Federal Student Loan Forgiveness for Doctors

At this article’s writing, President Biden’s student loan forgiveness program is tied up in the courts and it remains unclear when borrowers may get final answers on whether they qualify for any form of federal loan forgiveness. However, it should be noted that some doctors could eventually qualify for medical school loan forgiveness. Get updates here as they come.

Now, onto helpful tips that doctors can use to pay off student loan debt.

Tip #1: Don’t Throw All Your Money at Your Loans

It’s tempting to want to discharge your debt as quickly as possible, but it’s important to budget out your paycheck to fund other priorities, too. This means putting some money into a savings account to establish an emergency fund so that you’re protected from the unexpected, and thinking about other financial goals you’re working towards, too.

Should you amass huge savings? No, not while you have significant debt. However, you should save at least three to six months’ worth of expenses so that you have a solid amount to fall back on should life throw you a curveball – which it’s bound to do at some point. The last thing you want to do is increase your overall debt because you didn’t have the funds to cover an unforeseen expense.

Tip #2: Investigate Income-Driven Repayment Options

You may be able to ease your student loan debt through the federal income-driven repayment program. They set your monthly student loan payment to an amount that is deemed to be affordable based on your income and family size. Often, your payments can be adjusted to around 10% of your discretionary income amount. Discretionary income is determined by taking the difference between your Adjusted Gross Income and 150% of the federal poverty guideline.

Income-based repayment plans can be quite advantageous from a cash-flow point of view. However, when taking on any new payment plan, be sure to also consider any anticipated medical school loan debt forgiveness, any risk of capitalizing interest, and potential tax consequences.

Tip #3: Refinance Cautiously

Oftentimes, you’ll come across options to refinance your loans at a lower rate through private lenders. This can be a smart move if the loans are equal, though that isn’t always the case. You may end up taking on more risk through a refinance than originally intended, so proceed with care.

Though it might not be obvious at first glance, federal student loans come with several benefits that refinanced loans don’t have. For example, with federal student loans, you can qualify for income-driven repayment programs, public service loan forgiveness opportunities, and more forgiving ways of dealing with financial setbacks such as long-term disability. So, before refinancing medical school debt, doctors should consider all factors and carefully weigh the pros and cons of a refi.

Tip #4: Avoid ‘Lifestyle Creep’

This is a concept that can be detrimental in any profession, but high earners such as doctors can be particularly susceptible. As you get more established in your medical career and begin to see your hard work reflected in your paycheck, it can be tempting to begin introducing more luxury into your lifestyle or to increase your spending. While you don’t have to deny yourself material rewards like a big house or fancy car, be sure that you’re budgeting appropriately and not getting carried away. For example, a pay increase should never always go to new lifestyle expenses. Be sure to increase your savings and investments, too.

Prioritize building an emergency fund, think about your mid-term savings goals, always work to max out your retirement accounts, and pay extra on your student loan debt, too. After your financial responsibilities are satisfied, then you can indulge in more lifestyle spending with the knowledge that you’re on firm financial footing.

Tip #5: Tackle High-Interest Loans with Gusto

Some people tackle large amounts of debt by paying off smaller loans first, which is called the snowball method. However, note that the benefit of paying off your debts this way is purely psychological. The idea is that each small debt you pay off will motivate you to continue on to larger ones. Financially speaking, there’s no real benefit to paying off smaller loans before others. For doctors with significant student loan debt, paying off your loans with the highest interest rates first allows you to pay less in interest over time and more towards the loan principal – a savvier strategy for your financial outlook.

Are You a Doctor Chipping Away at Student Loan Debt?

To achieve your dream of entering the medical profession, you’ve likely invested time and money and made countless personal sacrifices, too. And while your career may be rewarding, it’s also normal to feel the heavy burden of medical school loan debt. If you think you would benefit from a conversation about your debt repayment strategy or your overall financial plan, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.