-

Understanding Stock Options: ISOs, NQSOs & Restricted Stock

Employee stock options can be a valuable way to take advantage of your company’s growth and enhance your financial security. However, it’s important to understand the fine print. Each opportunity comes with its own set of rules for how you receive, manage, and maximize it. Not fully understanding your stock options can negatively impact your financial success.

In order to guard yourself against leaving money on the table, unsavory tax surprises, and poor stock management, you need a plan. Keep reading to get the information and strategies you need to make the most of NQSOs, ISOs, and restricted stock options.

Non-Qualified Stock Options (NQSOs)

Non-Qualified Stock Options (NQSOs) are by far the most common stock incentive offering. They give you the right to buy a certain number of company shares, at a specified price (the exercise price) during a window of time (typically 10 years). The “non-qualified” in its name doesn’t mean that it’s exclusive—on the contrary, NQSOs can be given to all levels of individuals including employees, directors, contracts, and consultants. They are considered “non-qualified” because this type of stock option isn’t eligible for special tax consideration under the IRS code.

Here’s how NQSOs work. Once NQSOs vest, you can choose to exercise and purchase the shares, but you are not required to do so. If you choose to exercise the options, taxes are based on the spread, meaning the difference between the grant price and the fair market value of the stock at the time of exercise. The difference will be considered compensation income, which means your employer will also withhold income tax, Medicare tax, and Social Security, and this compensation will be declared on that year’s W-2.

When you subsequently sell the shares, any further increase will be taxed as either a short or long-term capital gain, depending on how long you’ve held onto the shares. You’ll report any earnings on your IRS 1040 tax return, on Form 8949, Schedule D.

Incentive Stock Options (ISOs)

Like NQSOs, Incentive Stock Options (ISOs) are a form of equity compensation that may be offered to you by an employer. Unlike NQSOs, however, ISOs qualify for a special kind of tax treatment, meaning they aren’t subject to Medicare, Social Security, or withholding taxes, though they must meet very rigid tax code criteria.

ISOs differ from NQSOs in a number of other notable ways including:

- There’s a $100,000 limit on an ISO’s vested aggregate value in a calendar year.

- While NQSOs can be given to a number of different kinds of people affiliated with a company, ISOs can only be given to employees, not consultants or contractors.

- In order to get the full tax benefits, you’re required to exercise your ISOs within 90 days of leaving the company.

Keep in mind that you must hold your shares for at least two years from when they were granted and at least one year from when they were exercised in order to take advantage of the long-term capital gains tax after exercising your ISOs. If you hold onto them for any shorter length of time, anything you appreciate will be taxed at the standard income tax rate, which is generally much higher than the long-term capital gains tax rate.

Conversely, if you hold onto your ISOs beyond the calendar year in which they were exercised and have gains, you will be subject to the alternative minimum tax. In and of itself, that’s a financial nuisance, but not a problem. However, in the hypothetical but very real scenario that your company’s stock price takes a dive, you’ll be left to pay a high amount of tax on income that has completely disappeared.

One other important consideration for both NQSOs and ISOs: whether it’s advantageous to make a Section 83(b) election, which allows you to be taxed on the value of shares when they’re granted to you, rather than when they are vested. Consulting a financial advisor is a good idea when making this choice—between costs, taxes, requirements, and deadlines, it can be a very complicated endeavor.

Restricted Stock

Some companies aren’t able to give stock options and choose to give restricted stock units (RSUs) instead. RSUs are a common form of employee compensation that grants non-transferable shares, which usually come with conditions and restrictions regarding the timing of sales.

RSUs maintain their value of vesting regardless of the performance of the stock itself. It could have increased, decreased, or remained the same since the grant date and the restricted stock would have the same value. That’s in stark contrast to NQSOs and ISOs, both of which depend on how much your company’s stock price differs from the price set on the date you received it.

From the IRS’s perspective, restricted stock is considered to be a supplemental wage, which means it follows the same tax and reporting requirements as NQSOs do. Restricted stock may be particularly attractive to people who have a lower risk tolerance, but to receive that surefire value, you must remain employed until your shares vest. Oftentimes, unvested restricted stock is forfeited immediately once employment is terminated.

Need Help Making Sense of Your Stock Options? We Can Help

If you’d like to be sure you understand the ins and outs of your stock options, consider partnering with a professional to develop the right strategy for you. If you think you may benefit from a conversation about your equity compensation, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. We have been granted a license in perpetuity to publish this article on our website’s blog and share its contents on social media platforms. We have no right to distribute the articles, or any other content provided to our Firm, by Illuminated Advisors in a printed or otherwise non-digital format. We are not permitted to use the content provided to us or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

Midterm Elections – What Do They Mean For Markets?

Studying the history of stock market returns relative to midterm elections will give you a sense of how impactful they are to your own portfolio’s potential gain or loss.

This article was written by Dimensional Fund Advisors and can be found HERE.

It’s almost Election Day in the US once again. For those who need a brief civics refresher, every two years the full US House of Representatives and one-third of the Senate are up for reelection. While the outcomes of the elections are uncertain, one thing we can count on is that plenty of opinions and prognostications will be floated in the days to come. In financial circles, this will almost assuredly include any potential for perceived impact on markets. But should long-term investors focus on midterm elections?

Markets Work

We would caution investors against making short-term changes to a long-term plan to try to profit or avoid losses from changes in the political winds. For context, it is helpful to think of markets as a powerful information-processing machine. The combined impact of millions of investors placing billions of dollars’ worth of trades each day results in market prices that incorporate the aggregate expectations of those investors. This makes outguessing market prices consistently very difficult.¹ While surprises can and do happen in elections, the surprises don’t always lead to clear-cut outcomes for investors.

The 2016 presidential election serves as a recent example of this. There were a variety of opinions about how the election would impact markets, but many articles at the time posited that stocks would fall if Trump were elected.² The day following President Trump’s win, however, the S&P 500 Index closed 1.1% higher. So even if an investor would have correctly predicted the election outcome (which was not apparent in pre-election polling), there is no guarantee that they would have predicted the correct directional move, especially given the narrative at the time.

But what about congressional elections? For the upcoming midterms, market strategists and news outlets are still likely to offer opinions on who will win and what impact it will have on markets. However, data for the stock market going back to 1926 shows that returns in months when midterm elections took place did not tend to be that different from returns in any other month.

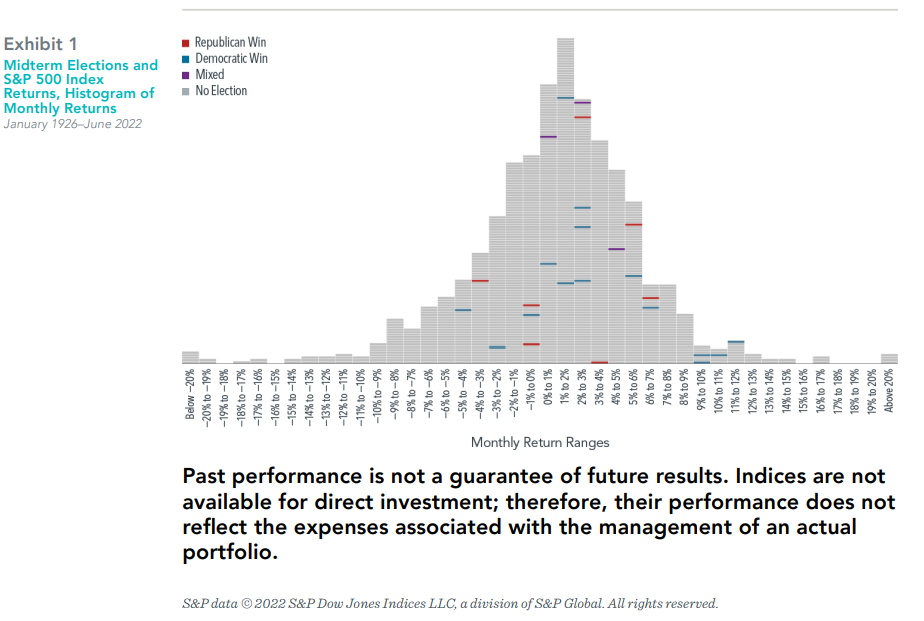

Exhibit 1 shows the frequency of monthly returns (expressed in 1% increments) for the S&P 500 Index from January 1926–June 2022. Each horizontal dash represents one month, and each vertical bar shows the cumulative number of months for which returns were within a given 1% range (e.g., the tallest bar shows all months where returns were

between 1% and 2%). The blue and red horizontal lines represent months during which a midterm election was held, with red meaning Republicans won or maintained majorities in both chambers of Congress, and blue representing the same for Democrats. Striped boxes indicate mixed control, where one party controls the House of Representatives, and the other controls the Senate, while gray boxes represent non-election months. This graphic illustrates that election month returns were well within the typical range of returns, regardless of which party won the election. Results similarly appeared random when looking at all Congressional elections (midterm and presidential) and for annual returns (both the year of the election and the year after).

In It For The Long Haul

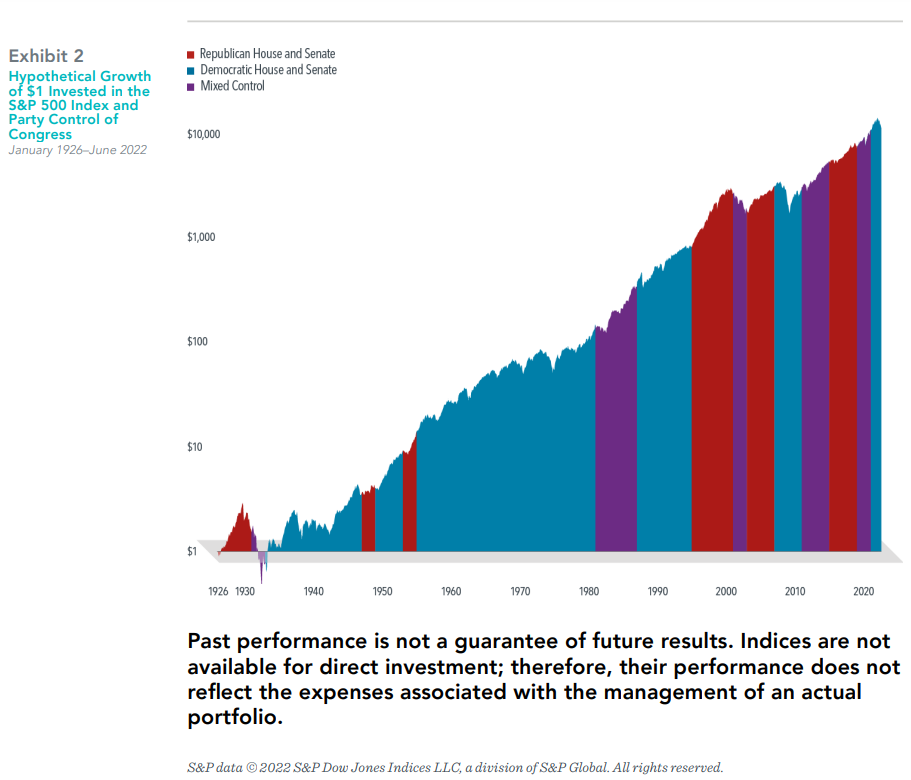

While it can be easy to get distracted by month-to-month or even one-year returns, what really matters for long-term investors is how their wealth grows over longer periods of time. Exhibit 2 shows the hypothetical growth of wealth for an investor who put $1 in the S&P 500 Index in January 1926. Again, the chart lays out party control of Congress over

time. And again, both parties have periods of significant growth and significant declines during their time of majority rule. However, there does not appear to be a pattern of stronger returns when any specific party is in control of Congress, or when there is mixed control for that matter. Markets have historically continued to provide returns over the long run irrespective of (and perhaps for those who are tired of hearing political ads, even in spite of) which party is in power at any given time.

Equity markets can help investors grow their assets, and we believe investing is a long-term endeavor. Trying to make investment decisions based on the outcome of elections is unlikely to result in reliable excess returns for investors. At best, any positive outcome based on such a strategy will likely be the result of random luck. At worst, it can lead to

costly mistakes. Accordingly, there is a strong case for investors to rely on patience and portfolio structure, rather than trying to outguess the market, to pursue investment returns.

- This is known as the efficient market theory, which postulates that market prices reflect the knowledge and expectations of all investors and that any new development is instantaneously priced into a security.

- Examples include: “A Trump win would sink stocks. What about Clinton?” CNN Money, 10/4/16, “What do financial markets think of the 2016 election?” Brookings Institution, 10/21/16, “What Happens to the Markets if Donald Trump Wins?” New York Times, 10/31/16.

In USD. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of

an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss.

There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Investors should

talk to their financial advisor prior to making any investment decision. There is always the risk that an investor may lose money. A long-term

investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an

offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. - This is known as the efficient market theory, which postulates that market prices reflect the knowledge and expectations of all investors and that any new development is instantaneously priced into a security.

-

Social Security Gets Biggest Boost Since 1981

The Cost of Living Adjustment, or COLA, from the Social Security Administration (SSA) is announced every fall and has major implications for the 66 million people who receive benefit checks. With inflation surging, retirees need help maintaining purchasing power. The agency announced its 2023 COLA will be 8.7%, the highest since 1981.

For those concerned about medical costs eating into this increase, Medicare – the health insurance plan for older Americans – said last month it would drop its premiums next year by about 3% for its Medicare Park B Plan.

For more information and context, please read this article from CBS News.

For instructions on how to sign up for a “my Social Security” account with the SSA, which is the fastest way to find out when and how much you will receive, watch the video below:

-

7 Year-End Tax Planning Tips

Consider preparing for the upcoming tax season by taking advantage of a few important end-of-year tax strategies.

Original article from www.usbank.com HERE

We’re now in the final quarter of the year, so why not start thinking about how to minimize our tax burden with actionable tips required prior to December 31st.

1. Check your paycheck withholdings

An incorrect W-4 can result in an unexpected refund at tax time – or an unexpected tax bill. Beginning in 2020, the IRS eliminated the old system of withholding “allowances” and now allows employees to provide the specific amount by which they would like to increase or decrease their federal tax withholdings directly.

Use the IRS Tax Withholding Estimator to find out if you’ve been withholding the right amount or even to calculate your desired refund amount.

Take action: If you need to make adjustments, file a new Form W-4 at your workplace that includes the added (or subtracted) withholding amount provided by the Withholding Estimator.

Tip: This is a good time to confirm your state income tax withholding information (if applicable) as well.

2. Max out your retirement account contributions

Tax-advantaged retirement accounts (such as a traditional IRA or 401(k) plan) compound over time and are funded with pre-tax dollars. That makes them a great investment in your future. They’re also helpful at tax time, since any contributions you make to these plans lower your taxable income.For the current tax year, the maximum allowable 401(k) contributions are as follows:

- $20,500 up to age 49

- $27,000 for age 50+ (with $6,500 catch-up contribution)

For the current tax year, the maximum allowable IRA contributions are as follows:

- $6,000 up to age 49

- $7,000 for age 50+ (with $1,000 catch-up contribution)

If you have an HSA (health savings account), consider maxing out contributions to that account as well (currently $3,650 for individuals, $7,300 for families and an additional $1,000 for individuals age 55+).

Take action: Can’t make the maximum contribution to your 401(k)? Try at least to contribute the amount your employer is willing to match. All 401(k) contributions must be made by December 31 for that calendar year. However, you have a few extra months to make contributions to IRAs and HSAs, up until the tax filing deadline in April.

3. Take any RMDs from traditional retirement accounts (if you’re age 72 or older)

All employer-sponsored retirement plans, traditional IRAs and SEP and SIMPLE IRAs mandate required minimum distributions (RMDs) by the April 1 that follows the year you turn 72. Thereafter, annual withdrawals must happen by December 31 to avoid the penalty.*RMDs are considered taxable income. If you don’t take the RMD, you face a 50 percent excise tax on the amount you should have withdrawn based on your age, life expectancy, and beginning-of-year account balance.

Take action: Take your RMD by December 31. Once you turn 72, you must take your first withdrawal on or before April 1 the following year to avoid penalty.

If you don’t need the cash flow and would prefer not to increase your taxable income, you may want to consider a Qualified Charitable Distribution (QCD), directly from your qualified account to a public charity. However, you won’t get the charitable contribution itemized deduction. QCDs are limited to $100,000 per year. Different from rules governing RMDs, you can make a QCD gift as early as age 70 ½ if you’re charitably inclined..

4. Consider a Roth IRA conversion

While eligibility to open and contribute to a Roth IRA is based on income level, you can convert some or all of the assets in a traditional IRA or workplace savings plan (e.g., 401(k)) to a Roth IRA. Roth IRAs can play a valuable role in your retirement portfolio; unlike traditional IRAs, Roth IRAs are not subject to income taxes at the time of withdrawal in retirement. This can give you more flexibility to manage your cash flow and future tax liability.

Converting qualified assets, such as 401(k) or traditional IRA assets, to Roth IRA assets is considered a taxable event during the conversion year. Any pre-tax contributions and all earnings converted to the Roth IRA are added to the taxpayer’s gross income and taxed as ordinary income.

Take action: Talk with your tax advisor or Lane Hipple to determine if a Roth conversion is right for you. If you move forward with a conversion, try to manage the tax impact. One strategy is to convert amounts only to the level where you remain in your current tax bracket. You can utilize partial Roth IRA conversions over a period of years to manage the tax liability.

5. “Harvest” your investment losses to offset your gains

Tax-loss harvesting is a strategy by which you sell taxable* investment assets such as stocks, bonds, and mutual funds at a loss to lower your tax liability. You can apply this loss against capital gains elsewhere in your portfolio, which reduces the capital gains tax you owe.

In a year when your capital losses outweigh gains, the IRS will let you to apply up to $3,000 in losses against your other income, and to carry over the remaining losses to offset income in future years.

The goal of tax-loss harvesting is to potentially defer income taxes many years into the future — ideally until after you retire, when you’d likely be in a lower tax bracket. This process lets your portfolio grow and compound more quickly than it would if you had to take money from it to pay the taxes on its gains.

Take action: Tax-loss harvesting requires you to diligently track tax loss across a portfolio, as well as monitor market movements, since the chance for tax-loss harvesting can occur at any time. Lane Hipple can help you identify any losses you can use to offset any gains.

*Note: Tax-loss harvesting does not apply to tax-advantaged accounts such as traditional, Roth, and SEP IRAs, 401(k)s and 529 plans.

6. Think about “bunching” your itemized deductions

Certain expenses, such as the following, can be classified as “itemized” deductions:- Medical and dental expenses

- Deductible taxes

- Qualified mortgage interest, including points for buyers

- Investment interest on net investment income

- Charitable contributions

- Casualty, disaster and theft losses

In order to itemize, your expenses in each category must be higher than a certain percentage of your adjusted gross income (AGI). For example, let’s say you’d like to itemize your medical expenses. For the current tax year, the threshold for itemizing medical expenses is 7.5% of your AGI. If your medical expenses total 5% of your AGI, it wouldn’t be beneficial to itemize.

“Bunching” is a way to reach that minimum threshold. In this example, you could delay 2.5% of your expenses to the following year. And then you’d be more likely to reach the minimum 7.5% AGI that next tax season, allowing you to itemize.

Take action: If you’ve been waiting on certain medical and dental expenses or charitable contributions, you might want to group these expenses to take the most advantage of itemizing the deductions.

7. Spend any leftover funds in your flexible spending account (FSA)

FSAs are basically bank accounts for out-of-pocket healthcare costs. An FSA earmarks your pre-tax dollars for medical expenses, lowering your taxable income.When you tell your employer how much of each paycheck to set aside for your FSA, remember you’ll pay taxes on any funds still in the account on December 31*. Plus, you’ll lose access to the money unless your employer allows a certain amount in rollovers for the next calendar year.

Take action: Schedule any last-minute check-ups and eye exams by December 31. Fill prescriptions for you and your family. Still carrying a balance? Stock up on items approved for FSA spending (e.g., contact lenses, eyeglasses, bandages).

*Note: Some employers give you until March of the following year to use your FSA dollars.

With a little planning before the year ends, you can be better prepared for the upcoming tax season.

Take Action

If you think you would benefit from a conversation about year-end tax planning, contact Lane Hipple in Moorestown, NJ by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

-

Don’t Get Spooked by Estate Planning

Tackle Your Estate Planning Fears and Plan for the Future

Nothing strikes fear into the hearts of adults quite like estate planning, and it’s about more than the technicalities of creating a will or a trust. Estate planning brings up anxiety about the end-of-life, fear about what will happen to future generations, and concerns about how much weight the plan itself could hold over the course of your own life.

Certainly, it can be difficult to confront the what-ifs of the future, but it’s critical to plan ahead. Putting off an estate plan isn’t a viable strategy. If you’ve been hesitant, review the estate planning fears below and learn how to overcome them.

1. Catastrophes and Tragic Accidents

We’ve all had irrational fear creep in from time to time, whether you’re scared of venomous snakes or terrified a train will hop off the rails. It won’t surprise you then that many people make an appointment with a professional before they take a flight, no matter how short or long.

Though crash landings could hypothetically occur, it’s incredibly unlikely. In fact, it’s far more common for someone to need long-term care or develop an end-of-life illness than to die in a plane crash. While revisiting or creating your estate plan is a good idea under almost any circumstance, fear of a freak accident shouldn’t be the only impetus. An estate plan includes health directives and assigns power of attorney – the right for someone to make financial or medical decisions on your behalf – which is important to have in place in a multitude of circumstances.

2. Over-Considering Contingencies

Just like it’s unlikely a plane crash will cause your demise, it’s (thankfully) equally unlikely that some catastrophic event will take out your entire immediate family. That’s a great comfort in many ways, but even the extremely unlikely possibility that it could occur is enough to twist people’s minds into an estate planning pretzel.

Analysis paralysis, the inability to move forward with a decision because of overthinking the issue, can set in. When faced with that difficult scenario, it can feel equally impossible to pick a charity or next-tier contingent beneficiary.

So, how do you proceed? Consider your options thoughtfully, but also as quickly as possible. Agonizing over what would happen if everyone you love passes away simultaneously isn’t helpful to your state of mind or your estate. Choose a contingency plan you’re comfortable with and move forward.

3. ‘Do and Then Die’ Thinking

It’s a common, but faulty, fear that the grim reaper will come for you the moment you sign the dotted line on your estate planning documents. Facing mortality head-on can make you forget all logic in favor of the what-ifs.

One trick that can help you get past this kind of thinking is to remind yourself that you can change your plan whenever you like. Though the document should accurately reflect your current wishes, thinking of your estate plan as a first draft can help you overcome the illogical reasoning that a completed will means you’ll be meeting your demise soon.

Financial Goal-Setting Tips to Help Achieve Your Money Goals

1. Decisions = Family Discontent

Money can be a divisive topic in some families, which is why a common estate planning fear is stirring up conflict in your family. Though making estate planning choices can seem difficult, having any plan in place – even a flawed or clandestine one – is better than not having any plan at all.

It’s easy to become overwhelmed by the thought of causing family trouble, but try to think past it. If tragedy strikes, it would be even more challenging for your family if there’s no estate plan to guide the ones you leave behind.

2. Too Complicated, Too Costly

Doing anything that requires an attorney is enough to spook people, especially when it comes to estate planning. Many people fear the complications or the cost. On average, professionally done estate plans cost around $2,500, which can be a hefty sum to swallow. But consider this: if your home is valued at $500,000 and you have no estate plan to protect it, it will cost roughly $40,000 when it goes through probate.

If your financial situation is holding you back, it can be difficult to prioritize something that feels far off. However, it’s worth saving up now for a professionally prepared will or living trust to protect your assets and your loved ones in the future.

3. Limited Time Only?

There’s a common misconception that an estate plan is somehow structured like a warranty—that it will run out after a period of time. However, there’s good news if this is what’s been holding you back—these documents are valid until revoked or amended. There’s no need to fear that your plans will expire or that your hard work will go to waste.

Estate Planning: There’s No Time Like the Present

If you think you would benefit from expert help to dispel your estate planning fears and get your assets in order for your heirs, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. We have been granted a license in perpetuity to publish this article on our website’s blog and share its contents on social media platforms. We have no right to distribute the articles, or any other content provided to our Firm, by Illuminated Advisors in a printed or otherwise non-digital format. We are not permitted to use the content provided to us or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.