-

Optimism Among Small Business Owners Declined in August

According to the NFIB’s Small Business Economic Trends data

The National Federation of Independent Business was founded in 1943 and is the largest small business association in the U.S. The NFIB collects data from small and independent businesses and publishes their Small Business Economic Trends data on the second Tuesday of each month. The Index is a composite of 10 components based on expectations for: employment, capital outlays, inventories, the economy, sales, inventory, job openings, credit, growth and earnings.

Here is what the NFIB released on September 12th:

“NFIB’s Small Business Optimism Index decreased 0.6 of a point in August to 91.3, the 20th consecutive month below the 49-year average of 98. Twenty-three percent of small business owners reported that inflation was their single most important business problem, up two points from last month. The net percent of owners raising average selling prices increased two points to a net 27% (seasonally adjusted), still at an inflationary level.

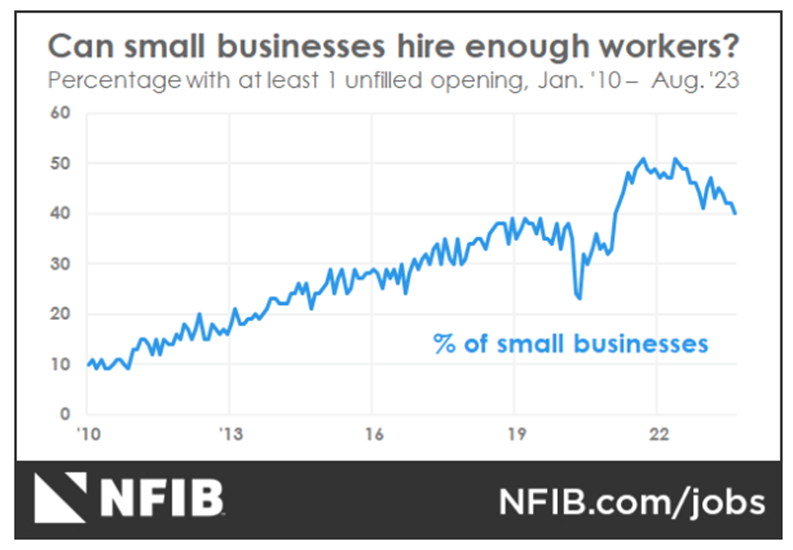

As reported in the NFIB monthly jobs report, 40% (seasonally adjusted) of all owners reported job openings they could not fill in the current period. Owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 17% planning to create new jobs in the next three months.

Related Article: Job Openings Decline in July

Sales Trends

A net negative 14% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, the lowest reading since August 2020. The net percent of owners expecting higher real sales volumes declined two points to a net negative 14%.

The net percent of owners reporting inventory gains declined four points to a net negative 7%. Not seasonally adjusted, 11% reported increases in stocks and 16% reported reductions. A net negative 5% of owners viewed current inventory stocks as “too low” in August, down one point from July. By industry, shortages are the most frequent in retail (9%), finance (7%), manufacturing (7%), and services (7%).

The net percent of owners raising average selling prices increased two points from July to a net 27% (seasonally adjusted). Twenty-three percent of owners reported that inflation was their single most important problem in operating their business, up two points.

Unadjusted, 12% reported lower average selling prices and 38% reported higher average prices. Price hikes were the most frequent in finance (52% higher, 7% lower), construction (51% higher, 6% lower), retail (45% higher, 11% lower), and wholesale (36% higher, 20% lower). Seasonally adjusted, a net 30% plan price hikes.

Raising Compensation

A net 36% reported raising compensation, down two points from July. A net 26% of owners plan to raise compensation in the next three months, up five points.

80% of owners cited labor costs as their top business problem, down two points from July. 24% percent said that labor quality was their top business problem.

-

New Data from the NFIB Small Business Optimism Index

Small Businesses Feeling More Optimistic But This is the 17th Month in a Row Below the 49-Year Average

There are over 30 million small businesses in the United States, according to the Small Business Administration and small businesses comprise about 99% of all U.S. businesses. Further, about half of all Americans – 48% – are employed by small businesses, meaning almost 60 million employees in the U.S. work for a smaller company.

Small Businesses Feeling More Optimistic

On June 13th, “the NFIB Small Business Optimism Index increased 0.4 points in May to 89.4, which is the 17th consecutive month below the 49-year average of 98. The last time the Index was at or above the average was in December 2021. Small business owners expecting better business conditions over the next six months declined one point from April to a net negative 50%. Twenty-five percent of owners reported that inflation was their single most important problem in operating their business, up two points from last month and followed by labor quality at 24%.

Key findings include:

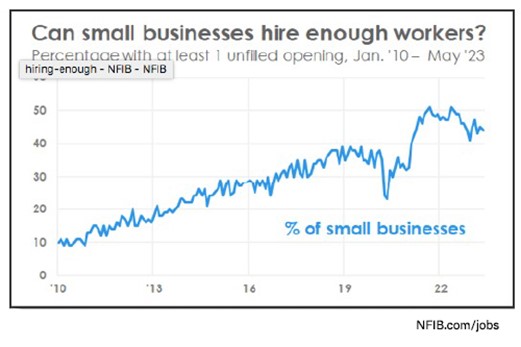

- Forty-four percent of owners reported job openings that were hard to fill, down one point from April and remaining historically very high.

- The net percent of owners raising average selling prices decreased one point to a net 32% (seasonally adjusted), still an inflationary level but trending down.

- The net percent of owners who expect real sales to be higher deteriorated two points from April to a net negative 21%.”

Job Openings Still Hard to Fill

Further, as reported in the NFIB’s monthly jobs report:

- Owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 19% planning to create new jobs in the next three months.

- Overall, 63% of owners reported hiring or trying to hire in May, up three points from April.

- Of those hiring or trying to hire, 89% of owners reported few or no qualified applicants for their open positions.

In addition:

- A net 41% of owners reported raising compensation, up one point from April.

- A net 22% plan to raise compensation in the next three months, up one point.

- Ten percent of owners cited labor costs as their top business problem.

- 24% said that labor quality was their top business problem.

-

5 investment ideas for small-business owners struggling to keep their finances liquid

Three local financial experts share their advice.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/YJPKYC62CJFITAB5DO2ZNXQAWU.jpg)

Andrew Hipple has advice on how small business owners (and individuals) can take advantage of the rish in interest rates. (photo credit: Steven M. Falk / Inquirer Staff Photographer) Written by Gene Marks

Even as commercial lending rates have more than doubled in the last year, interest rates earned on checking, money market and savings accounts remain stubbornly low as banks seek to maintain their profitability.

That’s not helpful for business owners, who need to earn money on their cash reserves while keeping enough liquidity to meet faily working capital needs. Options remain limited, but the environment is slowly changing, and a number of investment choices with minimal risks are emerging.

Click here to read full article from the Philadelphia Inquirer, featuring Andrew Hipple CFP®, Partner at Lane Hipple Wealth Management Group.

-

Small Business Optimism Drops Amidst Continued Inflation Challenges

The National Federation of Independent Business was founded in 1943 and is the largest small business association in the U.S. The NFIB collects data from small and independent businesses and publishes their Small Business Economic Trends data on the second Tuesday of each month. The Index is a composite of 10 components based on expectations for: employment, capital outlays, inventories, the economy, sales, inventory, job openings, credit, growth and earnings.

Here is what the Small Business Economic Trends data released on January 10th reported:

The NFIB Small Business Optimism Index declined 2.1 points in December to 89.8, marking the 12th consecutive month below the 49-year average of 98. Owners expecting better business conditions over the next six months worsened by eight points from November to a net negative 51%. Inflation remains the single most important business problem with 32% of owners reporting it as their top problem in operating their business.

“Overall, small business owners are not optimistic about 2023 as sales and business conditions are expected to deteriorate. Owners are managing several economic uncertainties and persistent inflation and they continue to make business and operational changes to compensate.”

Key findings include:

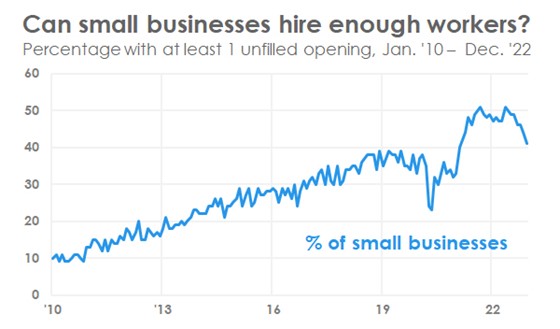

- Forty-one percent of owners reported job openings that were hard to fill, down three points from November but historically very high.

- The net percent of owners raising average selling prices decreased eight points to a net 43% (seasonally adjusted), historically high.

- The net percent of owners who expect real sales to be higher worsened two points from November to a net negative 10%.

More Small Business Woes

As reported in the NFIB’s monthly jobs report:

- Owners’ plans to add positions remain elevated, with a seasonally adjusted net 17% planning to create new jobs in the next three months.

- Overall, 55% of owners reported hiring or trying to hire in December.

- Ninety-three percent of those hiring or trying to hire reported few or no qualified applicants for the positions they were trying to fill.

Further:

- A net 44% of owners reported raising compensation.

- A net 27% plan to raise compensation in the next three months, down one point from November.

- 8% of owners cited labor costs as their top business problem.

- 23% said that labor quality was their top business problem.

More Data Later This Week

More economic data will be released later this week, including MBA Mortgage Applications on Wednesday; Jobless Claims and CPI data on Thursday; and Consumer Sentiment on Friday.

Sources: nfib.com

- Forty-one percent of owners reported job openings that were hard to fill, down three points from November but historically very high.