The National Federation of Independent Business was founded in 1943 and is the largest small business association in the U.S. The NFIB collects data from small and independent businesses and publishes their Small Business Economic Trends data on the second Tuesday of each month. The Index is a composite of 10 components based on expectations for: employment, capital outlays, inventories, the economy, sales, inventory, job openings, credit, growth and earnings.

Here is what the Small Business Economic Trends data released on January 10th reported:

The NFIB Small Business Optimism Index declined 2.1 points in December to 89.8, marking the 12th consecutive month below the 49-year average of 98. Owners expecting better business conditions over the next six months worsened by eight points from November to a net negative 51%. Inflation remains the single most important business problem with 32% of owners reporting it as their top problem in operating their business.

“Overall, small business owners are not optimistic about 2023 as sales and business conditions are expected to deteriorate. Owners are managing several economic uncertainties and persistent inflation and they continue to make business and operational changes to compensate.”

Key findings include:

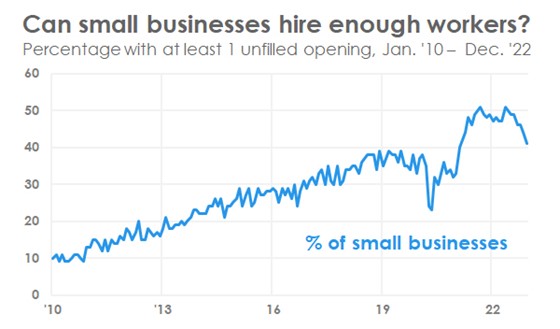

- Forty-one percent of owners reported job openings that were hard to fill, down three points from November but historically very high.

- The net percent of owners raising average selling prices decreased eight points to a net 43% (seasonally adjusted), historically high.

- The net percent of owners who expect real sales to be higher worsened two points from November to a net negative 10%.

More Small Business Woes

As reported in the NFIB’s monthly jobs report:

- Owners’ plans to add positions remain elevated, with a seasonally adjusted net 17% planning to create new jobs in the next three months.

- Overall, 55% of owners reported hiring or trying to hire in December.

- Ninety-three percent of those hiring or trying to hire reported few or no qualified applicants for the positions they were trying to fill.

Further:

- A net 44% of owners reported raising compensation.

- A net 27% plan to raise compensation in the next three months, down one point from November.

- 8% of owners cited labor costs as their top business problem.

- 23% said that labor quality was their top business problem.

More Data Later This Week

More economic data will be released later this week, including MBA Mortgage Applications on Wednesday; Jobless Claims and CPI data on Thursday; and Consumer Sentiment on Friday.

Sources: nfib.com