-

Financial Planning for Recent College Graduates

Six Steps to Prepare for Long-Term Success

Graduating from college is a major milestone, but it can also be a daunting time for many young adults as they transition into the “real world”. If you have a recent college graduate in your life, they may be facing a number of financial challenges, from student loan debt to finding their first job. Financial planning may be the last thing on their mind, but you can use your influence and experience to help them see the benefit of taking financial planning steps as a recent college graduate in order to set themselves up for long-term success.

Share the six steps below to help them get started.

Financial Planning for Recent College Graduates Tip #1: Create a Budget

The first step in any financial plan is to create a budget. Don’t think of it as something that constrains you. Rather, consider your budget a tool to balance spending on needs and wants, and to help you achieve your goals. Creating a budget helps you understand where your money is going and where you can make adjustments to save more. Start by listing all of your monthly income and expenses, including rent, utilities, groceries, transportation, and any debt payments, such as student loans. Then, look for areas where you can cut back, such as eating out less or finding a more cost-effective apartment. Be sure to set aside some money each month for savings, as well. (More on that below.)

Financial Planning for Recent College Graduates Tip #2: Make a Plan to Pay Off Student Loans

Student loan debt is a major concern for many recent college graduates. If you have student loans, make a plan to pay them off as quickly as possible. Consider consolidating your loans or refinancing them to get a lower interest rate. You may also want to explore income-driven repayment plans, which can reduce your monthly payments based on your income.

Financial Planning for Recent College Graduates Tip #3: Start Saving for Retirement Now

It’s never too early to start saving for retirement – even if you’re in your early twenties. When you begin your first professional job, be sure to take advantage of your employer’s 401(k). If they don’t offer one or you dislike the plan details, you can also open your own individual retirement account (IRA). The earlier you start saving, the more time your money has to grow. Your future self will thank you!

Related Article: How Inflation Impacts Wealth Management and Investment Strategies

Financial Planning for Recent College Graduates Tip #4: Plan to Navigate Rainy Days

Life is unpredictable, and you never know when you might face an unexpected expense or job loss. That’s why it’s important to build an emergency fund so you won’t be forced into debt on rainy days – or seasons of life. Aim to save three to six months’ worth of living expenses in a separate savings account. This will give you a financial cushion in case of an emergency, and it will give you peace of mind, too.

Financial Planning for Recent College Graduates Tip #5: Understand and Protect Your Credit Score

Your credit score is an important factor in many financial decisions, such as getting a loan or renting an apartment. Make sure you understand what affects your credit score, such as paying bills on time and keeping your credit card balances low. It’s important to protect your credit score, too, so check your report regularly to make sure there are no errors or fraudulent activity. Check out this resource from the Consumer Financial Protection Bureau to learn more.

Financial Planning for Recent College Graduates Tip #6: Set Financial Goals

Another important step in financial planning for anyone – recent college graduates included – is to set financial goals. These could be anything from saving for a down payment on a house to paying off your student loans by a certain date. Having clear goals will help you stay motivated and focused on your financial plan.

Recent College Graduates Should Begin Financial Planning Now

Graduating from college is a big win and something to be proud of. It’s also a time of significant transition for many people, and it’s important to start off on the right foot financially in order to protect your future. Use the six steps above to take control of your finances now and set yourself up for long-term financial success.

If you’d like to discuss financial planning for recent college graduates, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-452-8026, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

5 Ways a Financial Advisor Can Help You Prepare for Tax Season

A Strong Tax Strategy is Part of a Thoughtful, Comprehensive Financial Plan

Tax season is upon us and, while not every financial advisor is a Certified Public Accountant (CPA), that doesn’t mean they can’t be helpful. Your financial advisor can assist you with making strategic tax moves throughout the year to help reduce your overall tax burden. As you read below, keep in mind that the sooner you begin having these conversations with your advisor about your tax strategy, the better off you’ll be at tax time.

Finding Ways to Maximize Your Tax Savings

There are many financial moves you can make throughout the year that will result in paying lower taxes, and a financial advisor will be educated about them. For example, some investment accounts let you make tax-deferred contributions, which can offer you the opportunity to save money on taxes while working to build your retirement savings. Take a company-sponsored 401(k), for instance. If you max out your contributions to this account, all of the money going in is pre-taxed, so you’ll be putting money away for retirement while reducing your tax bill in the present.

Keeping Record of Your Capital Gains and Losses

When filing your taxes, you’ll have to know how much you earned and lost from your investments for that year. A financial advisor will have an accurate and consistent record of your investments, which they can give to your accountant on your behalf. This will save you time and energy, and help you ensure you’re paying appropriate capital gains tax, without over-paying.

Developing a Tax-Savvy Gifting Strategy

There’s a lot to be gained when we gift our money to others. Not only do you get the intrinsic rewards associated with the joy and meaning that comes from helping others, but you can enjoy valuable tax benefits, too. Sit down with your financial advisor and discuss how you can gift your money in ways that ultimately help lower your tax bill, too. And this isn’t just for charities; if you want to give money to your family members for any reason, there are plenty of gifting strategies that let you transfer your wealth without a tax penalty. Check-in with your financial advisor before making any gifts so you can be sure to maximize the opportunity.

8 Considerations For Passing an Inheritance To Your Children

Minimizing the Tax Burden that RMDs Bring

Once you reach the age of 73, you’ll have to begin taking out Required Minimum Distributions (RMDs) from any IRA or 401(k) accounts that you have. While this comes as no surprise, often the uptick in your tax bill from having to pay income tax on those distributions does come as a surprise to retirees. A financial advisor will be able to provide you with management strategies so that you can lower your tax liabilities and be more prepared when the time comes to begin taking distributions.

Determining Tax-Efficient Investment Strategies

Although a financial advisor can’t necessarily protect you from capital gains tax, they will be able to help you by implementing strategies such as tax-loss harvesting, offsetting gains with losses, and avoiding issues such as “phantom tax,” which limit your overall tax liability. So, they’ll not only be able to help you manage and balance a portfolio, but they’ll be able to ensure you’re following the best investment strategies to benefit you the most when it comes time to file your taxes.

Do You Need a Financial Advisor to Assist with a Tax Strategy?

The world of taxes can be incredibly confusing, especially considering they’re constantly changing depending on the economy and new legislation. Having a financial advisor you trust is an important addition to your tax planning arsenal. A financial advisor can guide you throughout the year to ensure you’re making the best financial choices to help boost your tax strategy, with the ultimate goal of allowing you to save more of your hard-earned dollars.

If you think you would benefit from a conversation about your tax strategy, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

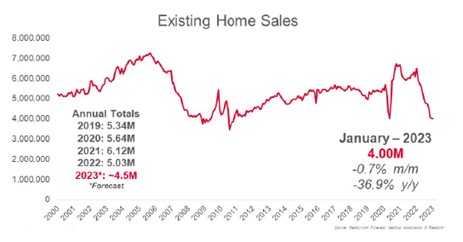

Existing Home Sales Drop for 12th Straight Month, Lowest Since 2010

On Tuesday, the National Association of Realtors reported that existing-home sales fell for the 12th straight month in January. In addition, month-over-month sales were mixed among the four major U.S. regions, as the South and West registered increases, while the East and Midwest experienced declines. All regions recorded year-over-year declines.

Housing Highlights

- Existing-home sales waned for the twelfth consecutive month to a seasonally adjusted annual rate of 4.00 million. Sales slipped 0.7% from December 2022 and 36.9% from the previous year.

- The median existing-home sales price increased 1.3% from one year ago to $359,000.

- The inventory of unsold existing homes grew from the prior month to 980,000 at the end of January, or the equivalent of 2.9 months’ supply at the current monthly sales pace.

Bottoming Out?

“Home sales are bottoming out. Prices vary depending on a market’s affordability, with lower-priced regions witnessing modest growth and more expensive regions experiencing declines. Inventory remains low, but buyers are beginning to have better negotiating power.

Homes sitting on the market for more than 60 days can be purchased for around 10% less than the original list price.”

- The median existing-home pricefor all housing types in January was $359,000, an increase of 1.3% from January 2022 ($354,300), as prices climbed in three out of four U.S. regions while falling in the West.

- This marks 131 consecutive months of year-over-year increases, the longest-running streak on record.

- Properties typically remained on the market for 33 days in January, up from 26 in December and 19 in January 2022. 54% of homes sold in January were on the market for less than a month.

Location, Location, Location- Existing-home sales in the Northeast retracted 3.8% from December, down 35.9% from January 2022. The median price in the Northeast was $383,000, up 0.3% from the previous year.

- In the Midwest, existing-home sales slid 5.0% from the previous month, declining 33.3% from one year ago. The median price in the Midwest was $252,300, up 2.7% from January 2022.

- Existing-home sales in the South rose 1.1% in January from December, a 36.6% decrease from the prior year. The median price in the South was $332,500, an increase of 3.4% from one year ago.

- In the West, existing-home sales elevated 2.9% in January, down 42.4% from the previous year. The median price in the West was $525,200, down 4.6% from January 2022.

Sources: nar.realtor

Copyright © 2023 MainStreet Journal. All rights reserved

Distributed by Financial Media Exchange. -

Social Security Gets Biggest Boost Since 1981

The Cost of Living Adjustment, or COLA, from the Social Security Administration (SSA) is announced every fall and has major implications for the 66 million people who receive benefit checks. With inflation surging, retirees need help maintaining purchasing power. The agency announced its 2023 COLA will be 8.7%, the highest since 1981.

For those concerned about medical costs eating into this increase, Medicare – the health insurance plan for older Americans – said last month it would drop its premiums next year by about 3% for its Medicare Park B Plan.

For more information and context, please read this article from CBS News.

For instructions on how to sign up for a “my Social Security” account with the SSA, which is the fastest way to find out when and how much you will receive, watch the video below:

-

Every Woman Needs Her Own Financial Strategy

Ahead of National Women’s Equality Day on August 26th, this article shares key data points highlighting why women must take a different approach to their financial strategy than men.

Women continue to earn less

Despite an increased presence in the workforce, the average woman working full-time earns $0.82 for every $1 earned by her male counterpart.¹

Women live longer

A man reaching age 65 today can expect to live, on average, until age 84, while a woman the same age can expect to live almost 87 years.² As a result, women generally need to rely on retirement income for a longer span. They also face higher health care costs than men during their retirement years.³

Women are more likely to be single later in life

In 2020, 70% of men age 65 and older were married, compared to just 48% of women.⁴ Single women don’t have the opportunity to capitalize on the resource pooling and economies of scale accompanying a marriage or partnership.

Women are time-starved

In their many roles as workers, wives, mothers, and daughters, women are responsible for more than three-quarters of unpaid domestic work.⁵ This includes housekeeping duties and care-taking responsibilities for children, aging parents or disabled family members.

Women are paying the price for going back to school

American now hold over $1.75 trillion in outstanding student loan debt with women holding almost two-thirds of that debt.⁶

For many women, financial independence is the number one concern. But what steps can a woman take to help her achieve this throughout her life? Here are a few key action steps you can take to help create financial confidence in your retirement years:

1. Keep Money In Your Name

Every woman needs a pot of money to call her own. This means that in addition to joint financial accounts you may have, you should consider keeping some financial accounts in your name only. Also, make sure you maintain an individual credit history. You can do this by holding a credit card or personal loan issued just to you.

2. Confront Your Fears

Are you controlling you money, or is it controlling you? Are your ideas about money and money management keeping you from becoming financially confident? As women increase education levels and continue to take on expanded roles in the workforce, they control more wealth. As a result, traditional views about finances need to be redefined, and women need to face financial decisions head-on.

3. Share the Decisions

If you share finances with someone else, you need to start talking. This way, you’ll know if you share the same goals and dreams for the future, as well as whether you are on track to meet those goals. Also, remember that disagreements are bound to happen; good communication is key to working through those disagreements and getting you back on track financially as a couple.

4. Maintain Access To All Financial Documents

Keep your financial records accessible and easy to gather when you need them. This could include brokerage accounts, insurance policies, retirement plan statements, tax returns and other important documents. Keep a record of who owns each account. Be sure to notify the person responsible for handling your estate where all your documents are and whom to contact in the event of your passing.

5. Pay Yourself First

Fund your IRA, 401(k) or other retirement account to the maximum. This will reduce your taxable income and allow you to benefit from tax-deferred compounding. When you leave a job, working with a Certified Financial Planner™ can help you determine if rolling your 401(k) funds into an IRA is right for you. An IRA account balance can continue to grow tax-deferred, and you will gain the ability to choose from a broader array of investments than what is likely available in your employer’s plan.

6. Choose The Right Financial Professional For You

It’s important to work with a Certified Financial Planner™ you trust. Ask for referrals and interview several to find rapport. Don’t be shy about asking for references, and check their credentials. An experienced Certified Financial Planner™ can help you look for the right solutions at every stage of your life and help you build confidence in your ability to take control of your finances.

7. Put Your Strategy In Writing

Ask your Certified Financial Planner™ to help you create a formal, written, long-term retirement income strategy. A written strategy will provide the framework for defining your financial goals and shaping your decisions. It also will help you set your sights on those goals in the long-term and help you keep on track regardless of economic conditions or unexpected life events.

8. Have A Backup Plan

Speaking of life events, don’t let a critical life change – such as marriage, divorce, widowhood or illness – derail your goals. Your Certified Financial Planner™ can work with you to create a strategy to address the unexpected and keep you moving toward your goals.

9. Understand What You Own

Although working with a Certified Financial Planner™ is vital, you must also know and make sense of the financial products you hold. Educate yourself on basic financial principles by taking classes, reading books or financial trade journals, and doing research.

10. Plan For Your Family’s Future

When planning your estate, you can create a strategy designed to take care of your heirs while optimizing your retirement income. Work with a qualified estate planner and Certified Financial Planner™ to design a strategy for passing on wealth to your loved ones while enjoying the fruits of what you’ve worked hard to earn throughout your lifetime.

Financial independence starts with determining your financial goals and putting in place a strategy designed to help you reach them. By implementing the steps outlined here, you can be well on your way to creating financial confidence for yourself, both now and in your retirement years.

¹ Payscale. March 15, 2022. “The State of the Gender Pay Gap 2022.” https://www.payscale.com/research-and-insights/gender-pay-gap/. Accessed May 17, 2022.

² Social Security Administration. “Important Thins to Consider When Planning for Retirement: What is Your Life Expectancy?” https://www.ssa.gov/benefits/retirement/planner/otherthings.html. Accessed May 17, 2022.

³ RegisteredNusing.org. Dec. 28, 2021. “Here’s How Much Your Healthcare Costs Will Rise as You Age.” https://www.registerednursing.org/articles/healthcare-costs-by-age/. Accessed May 17, 2022.

⁴ Administration for Community Living. May 2021. “2020 Profile of Older Americans.” Page 6. https://acl.gov/sites/default/files/Aging%20and%20Disability%20in%20America/2020ProfileOlderAmerican.Final_.pdf. Accessed May 17, 2022.

⁵ Free Network. Dec. 20, 2021. “Global Gender Gap in Unpaid Care: Why Domestic Work Still Remains a Woman’s Burden.” https://freepolicybriefs.org/2021/12//20/gender-gap-unpaid-care/. Accessed May 17, 2022.

⁶ AAUW. “Deeper in Debt: Women & Student Loans 2021 Update.” https://www.aauw.org/app/uploads/2021/05/Deeper_In_Debt_2021.pdf. Accessed May 17, 2022.

Content provided by Advisors Excel. © 2022 Advisors Excel, LLC