-

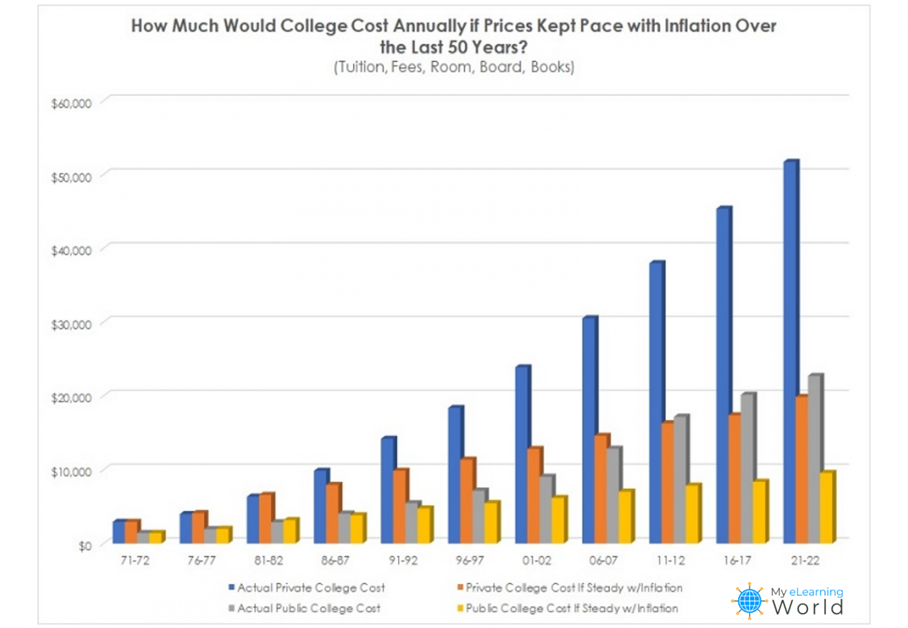

College Costs Are Rising 5X Faster Than Inflation

The vital role of inflation in financial planning for children’s college expenses

In today’s rapidly changing economic landscape, proper financial planning has become more critical than ever. When it comes to saving for children’s college costs, accounting for inflation is a fundamental aspect that cannot be overlooked.

Inflation, the gradual increase in the cost of goods and services over time, has the potential to erode the purchasing power of your money if not factored into your financial strategy.

Rising College Costs vs. Inflation

Did you know that in 1980, the price to attend a four-year college full-time was $10,231 annually – including tuition, fees, room and board, and adjusted for inflation – according to the National Center for Education Statistics? By 2019-20, the total price increased to $28,775. That’s a staggering 180% increase.

But let’s look at it another (and more sobering way):

If the cost of going to college increased consistently with the U.S. inflation rate over the last 50 years, students today would be paying between $10,000 to $20,000 per year to attend public or private universities.

The Inflation Challenge

Inflation is a natural economic phenomenon that affects virtually every aspect of our lives. From groceries to healthcare to college costs, the cost of living tends to rise over time.

If not addressed in your financial planning, inflation can have a profound impact on your savings’ ability to cover future expenses. This is particularly relevant when it comes to saving for children’s college education, given the long-term nature of the goal.

Preserving Purchasing Power

Imagine you start saving for your child’s college education when they are born. Over the next 18 years, you diligently save a significant amount. However, if inflation averages around 3% per year, the cost of college education could easily double during that time. Without accounting for inflation, you might find that the money you’ve saved falls way short of covering the actual expenses when your child is ready to enroll.

By accounting for inflation, you ensure that the purchasing power of your savings remains intact.

You are essentially future-proofing your investments, allowing them to maintain their value over time. This safeguards your ability to meet rising expenses without compromising the quality of your child’s education.

Related Article: Financial Planning for Recent College Graduates

Realistic Goal Setting

Incorporating inflation into your financial planning helps set realistic goals. When planning for a future expense like college, it’s essential to understand the true cost. Ignoring inflation can lead to underestimating the required savings amount, potentially causing stress and financial strain in the long run.

When you accurately account for inflation, you gain a more accurate understanding of the amount you need to save to cover college expenses. This empowers you to allocate your resources effectively, thereby minimizing the risk of falling short and maximizing the chances of achieving your goals.

The Power of Compounding

Compound interest is a powerful force in wealth accumulation. When you invest your savings, they have the potential to grow over time. However, if you fail to account for inflation, your investment returns might not keep pace with rising costs.

Inflation-adjusted returns are crucial to ensure that your investments genuinely generate wealth and provide the returns you need to meet your financial goals.

Mitigating Financial Stress

One of the primary purposes of financial planning is to alleviate financial stress and provide peace of mind. Inflation, when unaccounted for, can disrupt this objective. Unexpectedly high costs can lead to last-minute financial scrambling, potentially forcing you to compromise on the quality of your child’s education or take on substantial debt.

By accounting for inflation, you are adopting a proactive approach to financial planning. You are preparing for the future’s uncertainties and ensuring that your child’s educational aspirations are not compromised due to financial constraints.

Planning Matters

Financial planning is a holistic process that requires careful consideration of various variables, with inflation being a critical one. When saving for children’s college expenses, it’s vital to factor in inflation to preserve the purchasing power of your money, set realistic goals, harness the power of compounding, and mitigate potential financial stress.

By incorporating inflation into your financial strategy, you are taking a proactive step toward securing your child’s education and your family’s financial future. Remember, time is on your side, and early, informed financial decisions can make all the difference in achieving your goals.

-

What They Don’t Teach in School: Financial Literacy Lessons for Kids of All Ages

Guiding Your Children Towards a Prosperous Financial Tomorrow

With the start of a new school year, the fall season can be an exciting time for parents and children alike. And while you can be sure your kids will learn about math, science, and history, there is a significant subject that is often skipped, regardless of grade level: financial literacy. Even when schools do offer this practical subject, it’s not usually a requirement. This means the majority of children and young adults are lacking in knowledge, experience, and skills related to personal finance. If you’re a parent wanting to help teach your children about financial literacy but you’re unsure where to start, read on to learn more about the significance of nurturing financial awareness in youngsters and discover actionable suggestions for their financial education.

Start Early with the Basic Concepts

Begin teaching financial literacy as early as possible – and start simply. Even preschoolers can learn basic concepts like counting money, recognizing different coins and bills, and understanding the concept of saving. Use real coins or play money to make learning engaging and practical.

Normalize Conversations Around Money

This is a big one, because many people still feel money topics are taboo and to be avoided. Normalize this topic in your home by incorporating discussions about money into everyday conversations. Whether it’s shopping, budgeting for a family activity, or explaining the value of items, these conversations help demystify money matters and make kids comfortable discussing finances.

Use Allowances to Teach About Budgeting

As your kids get older, give them a small allowance, and guide them on how to manage it. Encourage them to allocate a portion to savings, a portion for spending, and perhaps even a portion for charitable giving. This hands-on approach helps them understand the concept of budgeting and gives them confidence in their ability to make smart money choices.

Set Savings Goals

Teach children about setting goals and saving towards them. Whether it’s buying a toy, a gadget, or saving for a future trip, having a goal encourages discipline while also teaching them delayed gratification. Sitting down with your kids and drawing up visual aids like progress charts can make the process more tangible and exciting for them.

It’s back to school time: Does Your Retirement Savings Plan Earn a Passing Grade?

Involve Kids in Family Decisions

Here’s a question to ask yourself: if your children don’t hear you discuss money matters, how are they going to learn what managing money in real life should look like? As your kids grow older, involve them in appropriate family financial discussions. This could include decisions about family vacations, major purchases, or even basic bill-paying routines. These experiences will provide practical insights into financial decision-making, while also helping them gain more confidence in their abilities to contribute.

Introduce Banking Concepts

As your children become teenagers, take some time to teach them the basics of banking. Open a checking and savings account in their name, and explain concepts like interest, deposits, and withdrawals. You’re also going to want to be sure that you teach them about the pitfalls of debt. Explain how credit cards work, the concept of interest rates, and the consequences of excessive borrowing. These lessons will help provide a real-world understanding of how banks work, the benefits of saving money over time, and help prepare kids to make wise decisions about credit and debt.

Explore Investments

Investing can be complicated even for adults to understand, but to the best of your ability, be sure that you teach the concept of investing to your older teens. Explain the difference between saving and investing, and touch on basic investment options like stocks and bonds. This early exposure can spark an interest in long-term financial planning and help pave the way to a solid financial future.

Promote and Encourage Critical Thinking

Promoting critical thinking in kids is an essential aspect of teaching financial literacy. Encourage kids to think critically about advertisements, deals, and spending choices. Teach them to evaluate whether a purchase is a want or a need, and to consider the long-term value of their choices. By encouraging them to question, analyze, and evaluate financial choices, you’re equipping your kids with valuable skills that extend far beyond the realm of money.

Lead by Example

A lot of the financial literacy knowledge your children will pick up will come from observing your own behavior. So, be sure that you’re modeling responsible financial habits, such as budgeting, saving, and making thoughtful spending decisions. Your actions will have a lasting impact on their financial attitudes and behaviors.

Giving Your Children the Gift of Financial Literacy

Gaining a strong grasp of financial literacy is an essential skill for young minds, enabling them to make well-informed choices and construct a stable economic foundation for their future. By starting this learning process early and seamlessly integrating practical teachings into their daily experiences, you can cultivate a positive and enduring comprehension of effective money management.

If you’d like to discuss financial literacy and financial educational resources further, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

-

Bridging The Retirement Income Gap With FIAs

Authored By: Heather L. Schreiber, RICP® NSSA®

What do retirees fear most?

According to a GoBankingRates survey, 66% of Americans worry that they will run out of money during retirement. That’s ahead of the 50% who were concerned about a steep healthcare outlay¹.

How can seniors and their financial advocates address this worry? Many are choosing to do so with a fixed index annuity (FIA). LIMRA reports that FIA sales were $79.4 billion in 2022, up 25% from 2021, and 8% higher than the record set in 2019²’³. What’s so appealing about FIAs? Before the big reveal, let’s set the stage.

Shaky Stool

During the 20th century, a so-called 3-legged stool provided an underpinning for retirees’ finances. That is, cash flow could come from 3 sources: Social Security, pensions from former employers, and personal savings. However, employer pensions have become the exception rather than the rule for many retirees. Pensions are still common for long-term government workers but are relatively rare in the private sector.

Instead of pensions, private sector employers offer employees the opportunity to put wages into defined contribution plans such as 401(k)s. Generally, those dollars go into funds holding stocks and bonds. Recently, though, market

volatility has been in the headlines.Down Year

The Morningstar U.S. Market Index lost 19.4% in 2022, the biggest annual loss since 2008…when it lost a 38.4%. Bonds are supposed to offer stability when stocks sag, but the Morningstar U.S. Core Bond Index lost 12.9% in 2022, its biggest annual loss since inception of the index in 1993³.

To demonstrate the potential effect of such results on an approaching retirement, suppose a hypothetical Holly Smith retired in early 2022. At the start of that year, Holly had managed to accumulate $600,000 in retirement savings, evenly divided between stock funds and bond funds.Assume Holly’s investments matched the broad equity and fixed-income markets. At the start of 2023, her holdings would have been down to $241,800 in stocks and $261,300 in bonds—from $600,000 for retirement to just over $500,000. After such a loss, Holly would need almost a 20% gain just to get back to where she had been. Moreover, our Holly had retired in 2022, taking 4% of her savings ($24,000) to supplement Social Security last year. Now, Holly bears sequence-of-return risk, which impacts people whose retirement coincides with a bear market.

Holly’s choices might be taking that same $24,000 this year, from the $479,100 left in her portfolio. That’s a 5% withdrawal rate, which could lead to depletion while Holly is still alive. Or, Holly might stick to her 4% strategy, withdrawing only $19,164 (4% of $479,100) in 2023, which could mean cutting back on her lifestyle in retirement.

Financial markets have bounced back in the past, and that could be the case again, helping Holly’s portfolio last longer. Even with a rebound, retirees such as Holly face risks such as longevity that could eventually drain her portfolio, inflation that could strain her budget, and a need for costly long-term care. Threats to cut back on Social Security benefits add to Holly’s dilemma.

Mitigating Retirement Risks

Savvy planning can help take these key retirement risks off the table, or at least reduce them to the point where retirees are comfortable. Fixed Index Annuities (FIAs) can help mitigate these concerns to the extent that exceeds what other sources of retirement income can provide for retirees.

An FIA is funded either through a single lumpsum payment or a series of periodic contributions from a consumer to an insurance company. In exchange, the consumer receives a contract that may deliver tax-deferred buildup, principal protection in a down market, and growth potential. Increases to the annuity value, termed interest, are credited to the contract annually, tied to a market index such as the S&P 500. FIA dollars are not directly invested in the index components but are pegged to the results.

Generally, FIAs offer protection against market losses. In return, they usually provide lower upside potential than being invested directly in the market. With a crediting rate of 70% of the S&P 500, for example, a hypothetical 12-month index gain of 10% would generate a 7% crediting rate to the annuity value of an FIA with that provision. The tax-deferred nature of an FIA allows money to compound over time without having to pay ordinary income taxes on the growth until funds are withdrawn. Consumer have the choice of turning on a reliable income stream from an FIA for a period of time or for a lifetime to supplement other sources of income in retirement.

Related Article: Passing an Inheritance to Your Children: 8 Important Considerations

Bountiful Benefits

On the plus side, considering a fixed index annuity when building a retirement income strategy has several advantages which include:

Tax deferral. Any gains inside an FIA avoids immediate income tax, allowing the annuity owner to take advantage of pre-tax compound growth during the accumulation phase. FIA owners also benefit from flexibility in creating retirement income drawdown strategies by controlling when and how to take income from the annuity.

Asset allocation alternative. Conventional wisdom holds that a 60-40 split, stocks to bonds, combines the growth potential of equities with the stability of fixed income. However, both stocks and bonds suffered double-digit losses in 2022, as previously mentioned. Concerns of ongoing inflation may lead to hesitation regarding investing in bonds.

An income stream that retirees can’t outlive. Americans are living longer than ever. That generally equates to more time spent in retirement and pressure on retirement assets to last longer. Even with Social Security and perhaps other sources of dependable cash flow, there still may be a gap between actual income and desired annual outflow. An FIA can fill that gap, generating income that will last as long as the retiree (and perhaps a spouse) may live.

Principal protection against possible market losses. As explained above, sequence-of-returns risk occurs when financial markets drop early in retirement while a retiree is tapping his or her investment portfolio. That can cause lifelong savings to deplete more rapidly than would have been the case if those market corrections occur later in retirement. An FIA can protect retirement assets by offering a source of cash flow that is not exposed to this risk during a market downturn.

Income to allow deferral of Social Security benefits. Waiting to claim Social Security benefits, perhaps to as late as age 70, can increase lifelong payouts substantially and often increase payments to a surviving spouse. In order to finance such a delay while avoiding additional stress on other assets, an FIA can play a key role. A retiree might start tapping into an FIA at, say, age 62 to bridge income so that Social Security claiming occurs later. Seniors can make their accumulated retirement assets work smarter, not harder.

Support for a surviving spouse. When one spouse dies, the Social Security income benefit of the lower-earning spouse goes away, and the higher benefit is payable to the survivor. Loss of a spouse generally means a decline in income—going from two Social Security benefits to one survivor benefit—so depending on an FIA to replace lost income may be a strategy that can help the survivor maintain the same standard of living.

A hedge against unanticipated long-term care expenses in retirement. Standalone LTC insurance policies can be costly. Data from the American Association for Long-Term Care Insurance put the average premium for a 55-year-old couple on a $165,000 initial policy with a 3% annual growth in maximum coverage at approximately $5,025 per year³. That can be an unnecessary expense if the policy benefits are never used.

Nevertheless, LTC coverage may be necessary, because Medicare does not cover custodial LTC and the average cost nationwide for a private room in a nursing home is about $9,000 a month, according to Seniorliving.org⁴. Adding a long-term care rider to an FIA can provide an additional layer of protection, offsetting the potential expense of a need for LTC.

Spousal benefits. FIAs, when jointly owned, can create income streams over the course of two lives for a married couple. This can be extremely important because widow(er)s typically become single taxpayers, owing increased income tax. What’s more, a surviving spouse may not have much experience handling the couple’s finances. An FIA offering continued contract ownership to the survivor may provide tax deferral and market risk-free cash flow to an aging widow(er) in need of stable income.

Legacy planning: Non-qualified annuities, with properly named beneficiaries, may be utilized as an estate planning opportunity to permit non-spousal beneficiaries, such as the owner’s children, to stretch post-death withdrawals over decades, based upon their life expectancy. That’s because non-qualified annuities are not covered by SECURE Act’s 10-year rule.

Due Diligence

No financial product is perfect for every consumer in every situation, and that’s true for FIAs, too. These annuities may deliver exceptional results, but there are risks as well. For starters, any guarantees are backed by the issuer, so it’s necessary to evaluate the insurer’s financial strength; therefore, due diligence is vital. A knowledgeable financial professional can provide real value here.

In addition, FIAs may have costs, just as is the case with any financial product, such as an additional fee for an income rider. Again, a financial professional can help by determining the actual cost of buying a specific FIA to ensure that the product and associated costs meets the specific needs of the investor. The more that is known before buying an FIA, the greater the chance of enjoying the multiple benefits listed above.

Retirement Action Plan:

- Prepare early. Determine a realistic retirement timeline that considers income needs in retirement, source of retirement income, family history, and current investor health.

- Develop a plan that includes guaranteed income sources for predicable and necessary expenses. This plan should aim to fill any projected gaps.

- Recognize the various risks that come with any financial plan, including market risk, healthcare risk, inflation, loss of employment, or death of a loved one. Adjust the approach to minimize such concerns.

- Schedule a plan review at least annually with a knowledgeable financial professional and make needed changes.

- Consider including a fixed index annuity as part of a retirement income plan, to provide needed lifelong income without exposure to possible market weakness.

Sources

² www.morningstar.com/articles/1131213/just-how-bad-was-2022s-stock-and-bond-market-performance

³ www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2022.php#2022costs

⁴ www.seniorliving.org/nursing-homes/costs/

Not affiliated with the Social Security Administration or any other government agency. This information is being provided only as a general source of information and is not intended to be the primary basis for financial decisions. It should not be construed as advice designed to meet the needs of an individual situation. Please seek the guidance of a professional regarding your specific financial needs. Consult with your tax advisor or attorney regarding specific tax or legal advice. ©2023 BILLC. All rights reserved. #23-0432-053024

-

Understanding the Fed’s Pause on Rate Hikes

Remain vigilant as we might see more rate hikes later this summer

The decision by the Federal Reserve to pause its upward trajectory of the federal funds rate – after 10 straight hikes over the past 14 months – has significant implications for investors. As the central bank of the United States, the Fed’s monetary policy decisions have a profound impact on financial markets and the investment landscape.

Let’s explore what this pause means for investors and explore potential strategies to navigate this new environment.

Understanding the Pause

To grasp the implications of the Fed’s pause, it is crucial to understand the underlying reasons for this shift in policy. The Federal Reserve’s primary mandate is to maintain price stability and support maximum employment. The decision to halt rate hikes suggests that the Fed believes inflationary pressures may be lessening or that the economy requires more time to fully recover. By pausing rate hikes, the central bank aims to provide ongoing support to economic growth.

Bond and Fixed-Income Investments

The Fed’s pause on rate hikes has immediate implications for bond and fixed-income investors. Typically, rising interest rates lead to declining bond prices. However, with the Fed indicating a pause in rate hikes, bond prices may stabilize or even experience modest gains. This is particularly relevant for long-term bondholders who were concerned about potential losses in a rising rate environment.

Nevertheless, investors should remain vigilant. While the pause in rate hikes may provide some relief, it is essential to monitor inflationary trends and the Federal Reserve’s future actions. Unexpected shifts in inflation expectations or the resumption of rate hikes could still impact fixed-income investments.

Equity Markets and Investment Strategies

The Fed’s pause on rate hikes can also have a significant impact on equity markets. Historically, low interest rates have been supportive of stock prices, as they reduce borrowing costs for businesses and increase the present value of future earnings. Investors should consider the potential for continued strength in equity markets as long as the pause in rate hikes persists.

However, it is crucial to exercise caution and avoid complacency. Market conditions can change rapidly, and investors should remain attentive to both global economic developments and the possibility of future rate hikes. Adopting a diversified investment strategy that balances exposure across sectors and geographies can help mitigate risks associated with potential market volatility.

Related Report: Charles Schwab’s Mid-Year Outlook

Sector Rotation and Asset Allocation

The pause in rate hikes offers an opportunity for investors to reassess their sector allocations and asset mix.

Certain sectors, such as utilities and real estate, tend to perform well in a low-interest-rate environment.

These sectors often exhibit stable cash flows and attractive dividend yields, making them appealing to income-focused investors.

Conversely, sectors like financials and banking may face challenges due to narrower interest rate spreads. Investors may consider rotating their investments into sectors that could benefit from the pause in rate hikes, while also maintaining a long-term perspective and keeping diversification in mind.

International Considerations

The Fed’s decision to pause rate hikes also has implications beyond the United States. Lower interest rates in the U.S. can lead to a weaker U.S. dollar, potentially benefiting international investments and exporters. Investors should consider the potential impact on currency valuations and diversify their portfolios by allocating a portion of their investments to international markets.

What Investors Should Do

The Federal Reserve’s pause on rate hikes represents a significant development for investors. The decision suggests that the central bank is carefully monitoring economic conditions and adjusting its policies accordingly. Bond and fixed-income investors may find some respite, while equity investors should remain attentive to potential shifts in market dynamics.

To navigate this evolving landscape, investors should adopt a diversified approach, reassess sector allocations, and consider the potential benefits of international investments.

Staying informed, monitoring economic indicators, and seeking professional advice can help investors make well-informed decisions in this environment of paused rate hikes. Even if it only lasts for a month.

-

Summer Vacation Budgeting

Tips for Saving Money While Traveling

How You Can Enjoy the Season without Breaking the Bank

Summer is the perfect time to take a break from the daily grind and go on a vacation. However, if you’re not careful, the cost of travel can quickly add up and leave you with a hefty bill. The good news is that with some careful planning and budgeting, you can enjoy a memorable vacation without breaking the bank. Here are some summer vacation budgeting tips for saving money while traveling this summer.

Summer Vacation Budgeting Tip #1: Choose Your Destination Wisely

The first step in saving money on your summer vacation is to choose your destination wisely. Consider destinations that are less popular or off the beaten path, as these are often more affordable. Look for deals on airfare and accommodations and consider traveling during the week instead of on weekends, as this can also save you money.

Summer Vacation Budgeting Tip #2: Set a Budget

Before you start planning your vacation, it’s important to set a budget. Determine how much you can afford to spend on airfare, accommodations, food, and activities, and stick to this budget as closely as possible. Keep in mind that unexpected expenses can arise, so it’s a good idea to set aside some extra money for emergencies.

Summer Vacation Budgeting Tip #3: Look for Deals and Discounts

There are many ways to save money on travel, such as using travel reward points, booking early, and looking for deals and discounts. Consider using a travel rewards credit card to earn points that can be redeemed for airfare or hotel stays. Check with your employer, school, or membership organizations for any travel discounts that may be available. If you’re a veteran, you may qualify for special travel discounts, too.

Related Article: Financial Planning For Recent College Graduates

Summer Vacation Budgeting Tip #4: Plan Your Meals

Eating out at restaurants can be a major expense while traveling. To save money, plan your meals in advance and look for affordable dining options, such as street food or local markets. Consider staying in accommodations that have a kitchen so you can cook some meals yourself.

Summer Vacation Budgeting Tip #5: Choose Free or Low-Cost Activities

One of the best ways to save money while traveling is to choose free or low-cost activities. Look for outdoor activities, such as hiking or biking, that don’t cost anything. Visit local museums or parks that offer free admission or take a self-guided walking tour of the city.

Summer Vacation Budgeting Tip #6: Be Flexible

Finally, be flexible with your travel plans. If you’re willing to travel during off-peak times or stay in less expensive accommodations, you can save a significant amount of money. Consider taking a road trip instead of flying or staying in a vacation rental instead of a hotel.

Are You Financially Prepared for the Summer Season?

For many people, summer is the time to enjoy travel and time off with family and friends. With some careful planning and budgeting, you can enjoy a memorable summer vacation without breaking the bank or veering off the path to achieving your financial goals. By choosing your destination wisely, setting a budget, looking for deals and discounts, planning your meals, choosing free or low-cost activities, and being flexible with your plans, you can save money and have a great time on your summer vacation.

If you’d like to discuss more personal finance tips or create a financial plan, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-249-4342, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.