-

The Top 5 Funding Reminders for Roth IRAs

By: Denise Appleby, MJ, CISP, CRC, CRPS, CRSP, APA

The rules of Roth IRAs create multiple tax-saving opportunities for Roth funding.

Many consider Roth IRAs a gold standard for retirement savings because they provide a source of tax-free income during retirement. This tax-free benefit includes tax-deferred earnings, which are tax-free for those eligible for qualified distributions. Taxpayers who choose to fund Roth IRAs instead of traditional IRAs pay taxes upfront in exchange for this benefit. However, the promise of tax-free income is only one of the factors that must be considered, and taxpayers who choose Roth must also consider various strategies and operational requirements. The following reminders are a good start.

1. After-tax 401(k) contributions: an opportunity for tax-free conversions

Once a plan participant is eligible to make withdrawals from their 401(k) or other type of employer plan account (401(k)), eligible amounts may be rolled over to an IRA or another eligible retirement plan. For those who want to continue tax deferral until they are ready to take distributions, a traditional IRA is a common choice for rolling over assets from 401(k)s. However, if the 401(k) account includes after-tax amounts, that after-tax balance is an opportunity for a tax-free conversion.

Unlike a conversion of pre-tax amounts, for which a suitability assessment is often recommended because it is taxable when converted, the conversion of an after-tax amount is tax-free. Therefore, no suitability assessment is needed. Further, any earnings on the after-tax amount would eventually become tax-free in a Roth IRA when you are eligible for a qualified distribution—a contrast with earnings that accrue in a traditional IRA, which would be taxable when distributed.

Essential Tip: If you want to roll over their 401(k) account to an IRA, and that 401(k) includes an after-tax amount, instruct the plan administrator to split the distribution and send the after-tax amount to your Roth IRA. Doing so helps to ensure that the after-tax amount is not sent to your traditional IRA.

2. Micro conversions for tax management

Roth conversions are included in income, with any pre-tax amount being taxable for the year the conversion occurs. However, converting small amounts over time can mitigate the tax impact. For example, an individual who wants to convert $500,000 could make $50,000 yearly conversions over ten years instead of converting the entire $500,000 all at once. This strategy is commonly referred to as micro-conversions.

This strategy can also be used to stay within a tax bracket in cases where a conversion could cause some of the individual’s income to be taxed at a higher tax bracket.

Ideally, you would consult with your tax advisor to project the tax impact of the conversion and help them determine how much would be an ideal amount to convert each year.

3. Tax withholding is not conversion

If you want to have taxes withheld from the requested conversion amount, the withholding tax is not included in the conversion. As a result, the amount withheld for taxes will be subject to the (10% additional tax) 10% early distribution penalty unless an exception applies.

Example 1: 45-year-old Sean’s Traditional Number 12345 had a balance of $100,000—all of which is pre-tax amounts. He instructed his IRA custodian to convert Traditional IRA Number 12345 to his Roth IRA Number 67890 and withhold 20% for federal taxes. Based on his instructions:

- $20,000 was sent to the IRS for federal tax withholding.

- $80,000 was deposited to Roth IRA #64890 as a Roth conversion.

The result:

- $100,000 is included in Sean’s income for the year.

- $100,000 is taxable.

- $80,000 is not subject to the 10% early distribution penalty.

- $20,000 is subject to the 10% early distribution penalty because it is not part of the Roth conversion.

If Sean had funds in a regular savings account (not a tax-deferred account), he could pay the income tax from that account instead of his traditional IRA.

Consideration: An analysis should be done to determine if it makes good tax sense for Sean to perform a Roth conversion if it requires paying the income tax from his IRA.

4. Roth conversion amounts must be rollover eligible

A Roth IRA conversion is a two-part transaction:

- A distribution from the traditional IRA, and

- A rollover to the Roth IRA- which is treated as a conversion.

Consequently, like a rollover, only eligible amounts can be included in the amount credited to the Roth IRA.

An example of an amount that is not eligible to be rolled over is a required minimum distribution (RMD). If you are at least 73 this year, you must take RMDs due from your traditional IRA before any Roth conversion.

Reminder: If the funds are in an employer plan and you are still employed by the plan sponsor, you should check with the plan administrator to determine if you must take an RMD for the year.

5. Let conversion amounts sit and stay for at least 5-years

A Roth IRA conversion is not subject to the 10% early distribution penalty, regardless of the age at which it occurs. However, distribution from a Roth conversion amount is subject to the 10% early distribution penalty if it occurs before it has aged in the Roth IRA for at least five years.

Example 2: Using the facts from Sean’s example above, assume that the conversion was done in 2024. If Sean withdraws any amount from that $80,000 conversion before January 1, 2029, it would be subject to the 10% early distribution penalty unless he qualifies for an exception.

Reminder: The 10% early distribution penalty does not apply if you are at least age 59 ½ when the distribution is made or if the distribution qualifies for an exception to the penalty.

Note: Under the ordering rules, any regular Roth IRA contribution or conversions done in previous years would be drawn before Sean’s 2024 Roth conversion.

Disclaimer

The tips provided in this article are generally operational in nature. The decision of which to choose—Roth IRAs vs. traditional—is more complex and requires a suitability analysis. However, using some of the strategies mentioned in this article can lessen any immediate tax effect. Except for the tax-free conversion of after-tax funds from a 401(k), the assistance of a tax professional should be engaged to help determine suitability.

Original Post by Horsesmouth, LLC.: https://www.savvyira.com/article.aspx?a=99588

-

Your Financial Reset Checklist: Moves to Make as We Approach Mid-Year

Strategic Adjustments for Enhanced Financial Health: A Mid-Year Review Guide

As we approach the midpoint of the year, it’s an ideal time to review and potentially reset your financial strategies. This period allows you to assess your progress towards your annual goals, adjust your budgets, and fine-tune your investment strategies, too. Here’s a practical mid-year financial reset checklist to guide you through your mid-year financial review.

1. Review Your Budget

Start with a thorough review of your current budget:

- Examine Spending Habits: Compare your planned expenses against actual spending. Look for areas where you’ve overspent and identify categories where you can cut back.

- Adjust Budgets: Based on your spending review, make the necessary adjustments to your budgets for the rest of the year. Consider any changes in your income or expenses since the beginning of the year.

2. Evaluate Your Emergency Fund

An emergency fund is crucial for financial security, providing a buffer against unexpected expenses:

- Assess Fund Adequacy: If you don’t have one already, work toward an emergency fund that covers at least three to six months of living expenses. If you aren’t near your goal yet, plan how you can bolster this fund in the second half of the year.

- Replenish If Needed: If you’ve had to dip into your emergency fund, it’s alright! That’s why you have it. However, now you need to make a plan to replenish it. Prioritize this to avoid potential financial strain going forward.

3. Reassess Your Financial Goals

Mid-year is a perfect time to reassess and refine your financial goals:

- Goal Progress: Evaluate how close you are to achieving the goals you set at the beginning of the year. This could be saving for a down payment, paying off debt, building a plan to pay for healthcare in retirement, or investing more of your retirement savings.

- Adjust Goals as Necessary: Life circumstances change, and so may your financial goals. Adjust your strategies to better align with your current situation and future aspirations.

If you neglected to set goals at the start of the year, it’s not too late! There is nothing magical about January 1, so get started setting your goals now with the S.M.A.R.T. goals framework.

Related: New Year, New Goals: Planning Your Money Moves for 2024

4. Check Credit Reports

Regular checks on your credit report can help you catch and rectify any inaccuracies that might affect your financial health, not to mention helping you spot identity theft:

- Request Credit Reports: You can obtain a free credit report from each of the three major credit bureaus once per year at AnnualCreditReport.com.

- Review for Accuracy: Look for any discrepancies or fraudulent activities. Promptly report any errors to the credit bureau for correction.

5. Review Insurance Coverages

Insurance needs can evolve, so it’s important to periodically review your policies:

- Assess Coverage Needs: Consider changes in your life that might affect your insurance needs, such as buying a new home, changing marital status, or adding a family member.

- Shop for Better Rates: Compare your current policies with what’s available on the market to see if you can find better rates or more comprehensive coverage for the same price.

6. Optimize Your Investments

Market conditions change, and so should your investment strategies:

- Portfolio Review: Assess the performance of your investments and consider rebalancing if your asset allocation has drifted from your target, which happens to many investors over time.

- Tax-Saving Strategies: Consider tax implications of any buy or sell actions in your portfolio and explore opportunities like tax-loss harvesting to offset gains.

7. Plan for Tax Liabilities

You may be breathing a sigh of relief with tax season behind you, but working all year round to understand your potential tax liabilities can help you manage your finances more effectively:

- Estimate Taxes: Use your current earnings and expenses to estimate your tax liability for the year.

- Adjust Withholdings: If you anticipate a major tax bill or a significant refund, adjust your tax withholdings accordingly to better manage your cash flow.

8. Reflect on Your Financial Well-Being

This step is a subjective addition to your mid-year financial reset checklist because financial well-being means different things to different people. So, decide what it means to you and take a moment to reflect on how you’re feeling about your finances:

- Financial Stress Test: Consider how you would handle a financial emergency. Do you feel confident about your financial situation?

- Educational Opportunities: Look for ways to improve your financial literacy. Engaging with financial news, books, or seminars can provide valuable insights and enhance your financial decision-making skills.

Concluding Thoughts on Using a Mid-Year Financial Review Checklist

A mid-year financial review checklist is a practical tool that can help you take proactive steps to stay on track with your financial objectives. This checklist serves as a guide to help you assess various aspects of your finances, from budgeting and savings to investments and taxes. By taking the time to review and adjust your financial plan now, you can improve your financial health and approach the rest of the year with a solid strategy in place.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

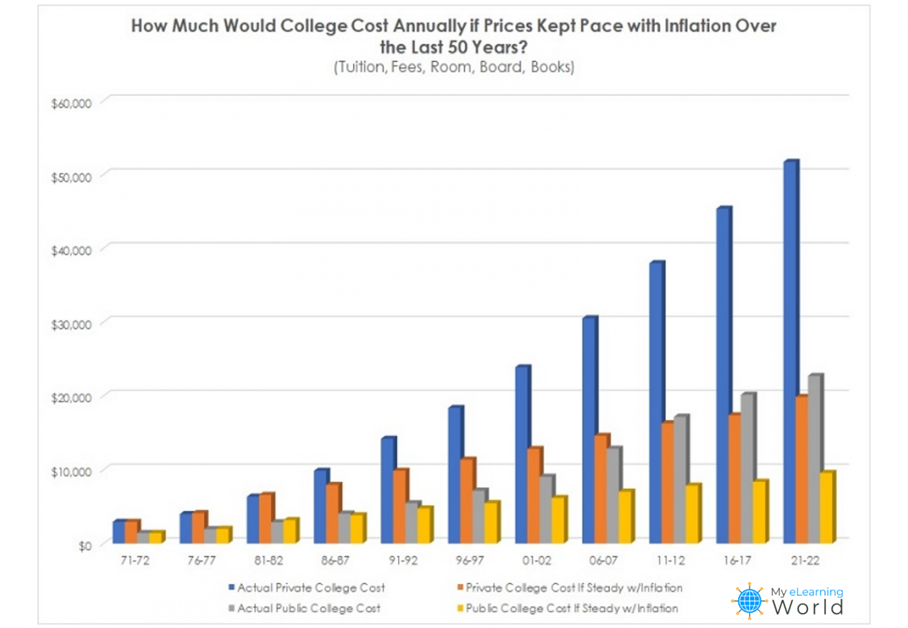

College Costs Are Rising 5X Faster Than Inflation

The vital role of inflation in financial planning for children’s college expenses

In today’s rapidly changing economic landscape, proper financial planning has become more critical than ever. When it comes to saving for children’s college costs, accounting for inflation is a fundamental aspect that cannot be overlooked.

Inflation, the gradual increase in the cost of goods and services over time, has the potential to erode the purchasing power of your money if not factored into your financial strategy.

Rising College Costs vs. Inflation

Did you know that in 1980, the price to attend a four-year college full-time was $10,231 annually – including tuition, fees, room and board, and adjusted for inflation – according to the National Center for Education Statistics? By 2019-20, the total price increased to $28,775. That’s a staggering 180% increase.

But let’s look at it another (and more sobering way):

If the cost of going to college increased consistently with the U.S. inflation rate over the last 50 years, students today would be paying between $10,000 to $20,000 per year to attend public or private universities.

The Inflation Challenge

Inflation is a natural economic phenomenon that affects virtually every aspect of our lives. From groceries to healthcare to college costs, the cost of living tends to rise over time.

If not addressed in your financial planning, inflation can have a profound impact on your savings’ ability to cover future expenses. This is particularly relevant when it comes to saving for children’s college education, given the long-term nature of the goal.

Preserving Purchasing Power

Imagine you start saving for your child’s college education when they are born. Over the next 18 years, you diligently save a significant amount. However, if inflation averages around 3% per year, the cost of college education could easily double during that time. Without accounting for inflation, you might find that the money you’ve saved falls way short of covering the actual expenses when your child is ready to enroll.

By accounting for inflation, you ensure that the purchasing power of your savings remains intact.

You are essentially future-proofing your investments, allowing them to maintain their value over time. This safeguards your ability to meet rising expenses without compromising the quality of your child’s education.

Related Article: Financial Planning for Recent College Graduates

Realistic Goal Setting

Incorporating inflation into your financial planning helps set realistic goals. When planning for a future expense like college, it’s essential to understand the true cost. Ignoring inflation can lead to underestimating the required savings amount, potentially causing stress and financial strain in the long run.

When you accurately account for inflation, you gain a more accurate understanding of the amount you need to save to cover college expenses. This empowers you to allocate your resources effectively, thereby minimizing the risk of falling short and maximizing the chances of achieving your goals.

The Power of Compounding

Compound interest is a powerful force in wealth accumulation. When you invest your savings, they have the potential to grow over time. However, if you fail to account for inflation, your investment returns might not keep pace with rising costs.

Inflation-adjusted returns are crucial to ensure that your investments genuinely generate wealth and provide the returns you need to meet your financial goals.

Mitigating Financial Stress

One of the primary purposes of financial planning is to alleviate financial stress and provide peace of mind. Inflation, when unaccounted for, can disrupt this objective. Unexpectedly high costs can lead to last-minute financial scrambling, potentially forcing you to compromise on the quality of your child’s education or take on substantial debt.

By accounting for inflation, you are adopting a proactive approach to financial planning. You are preparing for the future’s uncertainties and ensuring that your child’s educational aspirations are not compromised due to financial constraints.

Planning Matters

Financial planning is a holistic process that requires careful consideration of various variables, with inflation being a critical one. When saving for children’s college expenses, it’s vital to factor in inflation to preserve the purchasing power of your money, set realistic goals, harness the power of compounding, and mitigate potential financial stress.

By incorporating inflation into your financial strategy, you are taking a proactive step toward securing your child’s education and your family’s financial future. Remember, time is on your side, and early, informed financial decisions can make all the difference in achieving your goals.

-

What They Don’t Teach in School: Financial Literacy Lessons for Kids of All Ages

Guiding Your Children Towards a Prosperous Financial Tomorrow

With the start of a new school year, the fall season can be an exciting time for parents and children alike. And while you can be sure your kids will learn about math, science, and history, there is a significant subject that is often skipped, regardless of grade level: financial literacy. Even when schools do offer this practical subject, it’s not usually a requirement. This means the majority of children and young adults are lacking in knowledge, experience, and skills related to personal finance. If you’re a parent wanting to help teach your children about financial literacy but you’re unsure where to start, read on to learn more about the significance of nurturing financial awareness in youngsters and discover actionable suggestions for their financial education.

Start Early with the Basic Concepts

Begin teaching financial literacy as early as possible – and start simply. Even preschoolers can learn basic concepts like counting money, recognizing different coins and bills, and understanding the concept of saving. Use real coins or play money to make learning engaging and practical.

Normalize Conversations Around Money

This is a big one, because many people still feel money topics are taboo and to be avoided. Normalize this topic in your home by incorporating discussions about money into everyday conversations. Whether it’s shopping, budgeting for a family activity, or explaining the value of items, these conversations help demystify money matters and make kids comfortable discussing finances.

Use Allowances to Teach About Budgeting

As your kids get older, give them a small allowance, and guide them on how to manage it. Encourage them to allocate a portion to savings, a portion for spending, and perhaps even a portion for charitable giving. This hands-on approach helps them understand the concept of budgeting and gives them confidence in their ability to make smart money choices.

Set Savings Goals

Teach children about setting goals and saving towards them. Whether it’s buying a toy, a gadget, or saving for a future trip, having a goal encourages discipline while also teaching them delayed gratification. Sitting down with your kids and drawing up visual aids like progress charts can make the process more tangible and exciting for them.

It’s back to school time: Does Your Retirement Savings Plan Earn a Passing Grade?

Involve Kids in Family Decisions

Here’s a question to ask yourself: if your children don’t hear you discuss money matters, how are they going to learn what managing money in real life should look like? As your kids grow older, involve them in appropriate family financial discussions. This could include decisions about family vacations, major purchases, or even basic bill-paying routines. These experiences will provide practical insights into financial decision-making, while also helping them gain more confidence in their abilities to contribute.

Introduce Banking Concepts

As your children become teenagers, take some time to teach them the basics of banking. Open a checking and savings account in their name, and explain concepts like interest, deposits, and withdrawals. You’re also going to want to be sure that you teach them about the pitfalls of debt. Explain how credit cards work, the concept of interest rates, and the consequences of excessive borrowing. These lessons will help provide a real-world understanding of how banks work, the benefits of saving money over time, and help prepare kids to make wise decisions about credit and debt.

Explore Investments

Investing can be complicated even for adults to understand, but to the best of your ability, be sure that you teach the concept of investing to your older teens. Explain the difference between saving and investing, and touch on basic investment options like stocks and bonds. This early exposure can spark an interest in long-term financial planning and help pave the way to a solid financial future.

Promote and Encourage Critical Thinking

Promoting critical thinking in kids is an essential aspect of teaching financial literacy. Encourage kids to think critically about advertisements, deals, and spending choices. Teach them to evaluate whether a purchase is a want or a need, and to consider the long-term value of their choices. By encouraging them to question, analyze, and evaluate financial choices, you’re equipping your kids with valuable skills that extend far beyond the realm of money.

Lead by Example

A lot of the financial literacy knowledge your children will pick up will come from observing your own behavior. So, be sure that you’re modeling responsible financial habits, such as budgeting, saving, and making thoughtful spending decisions. Your actions will have a lasting impact on their financial attitudes and behaviors.

Giving Your Children the Gift of Financial Literacy

Gaining a strong grasp of financial literacy is an essential skill for young minds, enabling them to make well-informed choices and construct a stable economic foundation for their future. By starting this learning process early and seamlessly integrating practical teachings into their daily experiences, you can cultivate a positive and enduring comprehension of effective money management.

If you’d like to discuss financial literacy and financial educational resources further, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

-

Bridging The Retirement Income Gap With FIAs

Authored By: Heather L. Schreiber, RICP® NSSA®

What do retirees fear most?

According to a GoBankingRates survey, 66% of Americans worry that they will run out of money during retirement. That’s ahead of the 50% who were concerned about a steep healthcare outlay¹.

How can seniors and their financial advocates address this worry? Many are choosing to do so with a fixed index annuity (FIA). LIMRA reports that FIA sales were $79.4 billion in 2022, up 25% from 2021, and 8% higher than the record set in 2019²’³. What’s so appealing about FIAs? Before the big reveal, let’s set the stage.

Shaky Stool

During the 20th century, a so-called 3-legged stool provided an underpinning for retirees’ finances. That is, cash flow could come from 3 sources: Social Security, pensions from former employers, and personal savings. However, employer pensions have become the exception rather than the rule for many retirees. Pensions are still common for long-term government workers but are relatively rare in the private sector.

Instead of pensions, private sector employers offer employees the opportunity to put wages into defined contribution plans such as 401(k)s. Generally, those dollars go into funds holding stocks and bonds. Recently, though, market

volatility has been in the headlines.Down Year

The Morningstar U.S. Market Index lost 19.4% in 2022, the biggest annual loss since 2008…when it lost a 38.4%. Bonds are supposed to offer stability when stocks sag, but the Morningstar U.S. Core Bond Index lost 12.9% in 2022, its biggest annual loss since inception of the index in 1993³.

To demonstrate the potential effect of such results on an approaching retirement, suppose a hypothetical Holly Smith retired in early 2022. At the start of that year, Holly had managed to accumulate $600,000 in retirement savings, evenly divided between stock funds and bond funds.Assume Holly’s investments matched the broad equity and fixed-income markets. At the start of 2023, her holdings would have been down to $241,800 in stocks and $261,300 in bonds—from $600,000 for retirement to just over $500,000. After such a loss, Holly would need almost a 20% gain just to get back to where she had been. Moreover, our Holly had retired in 2022, taking 4% of her savings ($24,000) to supplement Social Security last year. Now, Holly bears sequence-of-return risk, which impacts people whose retirement coincides with a bear market.

Holly’s choices might be taking that same $24,000 this year, from the $479,100 left in her portfolio. That’s a 5% withdrawal rate, which could lead to depletion while Holly is still alive. Or, Holly might stick to her 4% strategy, withdrawing only $19,164 (4% of $479,100) in 2023, which could mean cutting back on her lifestyle in retirement.

Financial markets have bounced back in the past, and that could be the case again, helping Holly’s portfolio last longer. Even with a rebound, retirees such as Holly face risks such as longevity that could eventually drain her portfolio, inflation that could strain her budget, and a need for costly long-term care. Threats to cut back on Social Security benefits add to Holly’s dilemma.

Mitigating Retirement Risks

Savvy planning can help take these key retirement risks off the table, or at least reduce them to the point where retirees are comfortable. Fixed Index Annuities (FIAs) can help mitigate these concerns to the extent that exceeds what other sources of retirement income can provide for retirees.

An FIA is funded either through a single lumpsum payment or a series of periodic contributions from a consumer to an insurance company. In exchange, the consumer receives a contract that may deliver tax-deferred buildup, principal protection in a down market, and growth potential. Increases to the annuity value, termed interest, are credited to the contract annually, tied to a market index such as the S&P 500. FIA dollars are not directly invested in the index components but are pegged to the results.

Generally, FIAs offer protection against market losses. In return, they usually provide lower upside potential than being invested directly in the market. With a crediting rate of 70% of the S&P 500, for example, a hypothetical 12-month index gain of 10% would generate a 7% crediting rate to the annuity value of an FIA with that provision. The tax-deferred nature of an FIA allows money to compound over time without having to pay ordinary income taxes on the growth until funds are withdrawn. Consumer have the choice of turning on a reliable income stream from an FIA for a period of time or for a lifetime to supplement other sources of income in retirement.

Related Article: Passing an Inheritance to Your Children: 8 Important Considerations

Bountiful Benefits

On the plus side, considering a fixed index annuity when building a retirement income strategy has several advantages which include:

Tax deferral. Any gains inside an FIA avoids immediate income tax, allowing the annuity owner to take advantage of pre-tax compound growth during the accumulation phase. FIA owners also benefit from flexibility in creating retirement income drawdown strategies by controlling when and how to take income from the annuity.

Asset allocation alternative. Conventional wisdom holds that a 60-40 split, stocks to bonds, combines the growth potential of equities with the stability of fixed income. However, both stocks and bonds suffered double-digit losses in 2022, as previously mentioned. Concerns of ongoing inflation may lead to hesitation regarding investing in bonds.

An income stream that retirees can’t outlive. Americans are living longer than ever. That generally equates to more time spent in retirement and pressure on retirement assets to last longer. Even with Social Security and perhaps other sources of dependable cash flow, there still may be a gap between actual income and desired annual outflow. An FIA can fill that gap, generating income that will last as long as the retiree (and perhaps a spouse) may live.

Principal protection against possible market losses. As explained above, sequence-of-returns risk occurs when financial markets drop early in retirement while a retiree is tapping his or her investment portfolio. That can cause lifelong savings to deplete more rapidly than would have been the case if those market corrections occur later in retirement. An FIA can protect retirement assets by offering a source of cash flow that is not exposed to this risk during a market downturn.

Income to allow deferral of Social Security benefits. Waiting to claim Social Security benefits, perhaps to as late as age 70, can increase lifelong payouts substantially and often increase payments to a surviving spouse. In order to finance such a delay while avoiding additional stress on other assets, an FIA can play a key role. A retiree might start tapping into an FIA at, say, age 62 to bridge income so that Social Security claiming occurs later. Seniors can make their accumulated retirement assets work smarter, not harder.

Support for a surviving spouse. When one spouse dies, the Social Security income benefit of the lower-earning spouse goes away, and the higher benefit is payable to the survivor. Loss of a spouse generally means a decline in income—going from two Social Security benefits to one survivor benefit—so depending on an FIA to replace lost income may be a strategy that can help the survivor maintain the same standard of living.

A hedge against unanticipated long-term care expenses in retirement. Standalone LTC insurance policies can be costly. Data from the American Association for Long-Term Care Insurance put the average premium for a 55-year-old couple on a $165,000 initial policy with a 3% annual growth in maximum coverage at approximately $5,025 per year³. That can be an unnecessary expense if the policy benefits are never used.

Nevertheless, LTC coverage may be necessary, because Medicare does not cover custodial LTC and the average cost nationwide for a private room in a nursing home is about $9,000 a month, according to Seniorliving.org⁴. Adding a long-term care rider to an FIA can provide an additional layer of protection, offsetting the potential expense of a need for LTC.

Spousal benefits. FIAs, when jointly owned, can create income streams over the course of two lives for a married couple. This can be extremely important because widow(er)s typically become single taxpayers, owing increased income tax. What’s more, a surviving spouse may not have much experience handling the couple’s finances. An FIA offering continued contract ownership to the survivor may provide tax deferral and market risk-free cash flow to an aging widow(er) in need of stable income.

Legacy planning: Non-qualified annuities, with properly named beneficiaries, may be utilized as an estate planning opportunity to permit non-spousal beneficiaries, such as the owner’s children, to stretch post-death withdrawals over decades, based upon their life expectancy. That’s because non-qualified annuities are not covered by SECURE Act’s 10-year rule.

Due Diligence

No financial product is perfect for every consumer in every situation, and that’s true for FIAs, too. These annuities may deliver exceptional results, but there are risks as well. For starters, any guarantees are backed by the issuer, so it’s necessary to evaluate the insurer’s financial strength; therefore, due diligence is vital. A knowledgeable financial professional can provide real value here.

In addition, FIAs may have costs, just as is the case with any financial product, such as an additional fee for an income rider. Again, a financial professional can help by determining the actual cost of buying a specific FIA to ensure that the product and associated costs meets the specific needs of the investor. The more that is known before buying an FIA, the greater the chance of enjoying the multiple benefits listed above.

Retirement Action Plan:

- Prepare early. Determine a realistic retirement timeline that considers income needs in retirement, source of retirement income, family history, and current investor health.

- Develop a plan that includes guaranteed income sources for predicable and necessary expenses. This plan should aim to fill any projected gaps.

- Recognize the various risks that come with any financial plan, including market risk, healthcare risk, inflation, loss of employment, or death of a loved one. Adjust the approach to minimize such concerns.

- Schedule a plan review at least annually with a knowledgeable financial professional and make needed changes.

- Consider including a fixed index annuity as part of a retirement income plan, to provide needed lifelong income without exposure to possible market weakness.

Sources

² www.morningstar.com/articles/1131213/just-how-bad-was-2022s-stock-and-bond-market-performance

³ www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2022.php#2022costs

⁴ www.seniorliving.org/nursing-homes/costs/

Not affiliated with the Social Security Administration or any other government agency. This information is being provided only as a general source of information and is not intended to be the primary basis for financial decisions. It should not be construed as advice designed to meet the needs of an individual situation. Please seek the guidance of a professional regarding your specific financial needs. Consult with your tax advisor or attorney regarding specific tax or legal advice. ©2023 BILLC. All rights reserved. #23-0432-053024