-

The One-Day Trade Settlement: What It Means for Investors

Introduction

On May 28th, 2024, a seemingly inconspicuous trade settlement change swept through the financial markets in the United States. While it might have gone unnoticed by many, this update holds significant implications for investors, both individual and institutional. Let’s delve into the details of what transpired and explore its impact on the world of investing.

The Trade Settlement Period: A Crucial Aspect

Before we dive into the recent change, let’s understand the concept of trade settlement. When you buy or sell a security (such as stocks, bonds, or exchange-traded funds), the actual transfer of ownership and funds doesn’t happen instantaneously. Instead, there’s a lag between the trade execution and the settlement—the moment when ownership officially changes hands and funds are exchanged.

Traditionally, the settlement period for U.S. and Canadian securities traded on U.S. exchanges was two business days after the trade date. In other words, if you sold a stock on Monday, the settlement would occur on Wednesday. This delay allowed time for various administrative processes, including verifying the trade details, transferring shares, and ensuring the funds were available.

The Latest Update

As of May 28th, 2024, the trade settlement period for U.S. and Canadian securities traded on U.S. exchanges was shortened to one day after the trade date.

The Impact on Individuals

- Faster Processing Time – For individual investors, this change translates into speed. When you sell a security, you’ll receive the proceeds in half the time. No more waiting for two days; your cash will be available sooner. Whether you’re reallocating your portfolio, taking profits, or rebalancing, the reduced settlement period enhances your agility.

- Reduced Transaction Risk – Imagine you’re selling a stock to fund an important life event—a down payment on a house, your child’s education, or retirement expenses. With the shorter settlement window, there’s less exposure to market fluctuations. The risk of unexpected price movements impacting your transaction diminishes significantly.

The Institutional Perspective

Institutions—brokerages, mutual funds, and pension funds—also benefit. The streamlined settlement process reduces operational complexities. It simplifies back-office tasks, minimizes reconciliation efforts, and enhances overall efficiency. For large-scale trading operations, this adjustment is a game-changer.

Conclusion

The seemingly subtle shift from a two-day settlement to a one-day settlement is anything but trivial. It aligns with the digital age’s need for speed, efficiency, and risk reduction. As investors, we welcome this change—one that empowers us to act swiftly and confidently. So, the next time you execute a trade, remember that behind the scenes, the wheels are turning faster than ever.

For a more detailed analysis of the institutional impact, you can explore the SEC’s fact sheet. Additionally, if you have any questions or need personalized guidance, our team at Lane Hipple is here to assist you.

-

5 Things You Need To Know To Ride Out A Volatile Stock Market

This article, written by Franklin Distributors, LLC, provides great insight on how to approach today’s investment environment.

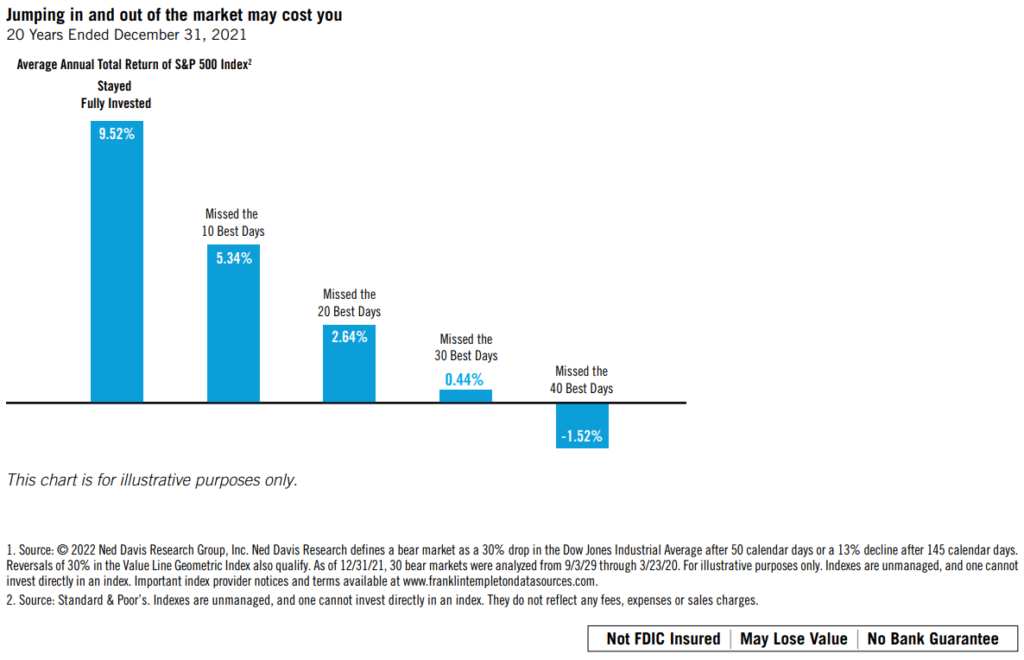

1. Watching from the sidelines may cost you

When markets become volatile, a lot of people try to guess when stocks will bottom out. In the meantime, they often park their investments in cash. But just as many investors are slow to recognize a retreating stock market, many also fail to see an upward trend in the market until after they have missed opportunities for gains. Missing out on these opportunities can take a big bite out of your returns. Consider that on average, for the 12 months following the end of a bear market, a fully invested stock portfolio had an average total return of 38.3%. However, if an investor missed the first six months of the recovery by holding cash, their return would have been only 8.0%¹. The chart below is a hypothetical illustration showing the risk of trying to time the market. By missing just a few of the stock market’s best single-day advances, you could put a real crimp in your potential returns.

2. Dollar-cost averaging makes it easier to cope with volatility

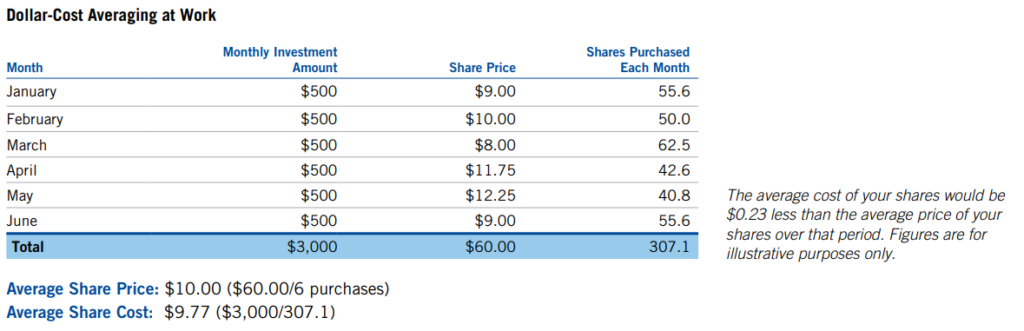

Most people are quick to agree that volatile markets may present buying opportunities for investors with a long-term horizon. But mustering the discipline to make purchases during a volatile market can be difficult. You can’t help wondering, “Is this really the right time to buy?”

Dollar-cost averaging can help reduce anxiety about the investment process. Simply put, dollar-cost averaging is committing a fixed amount of money at regular intervals to an investment. You buy more shares when prices are low and fewer shares when prices are high. And over time, your average cost per share may be less than the average price per share. Dollar-cost averaging involves a continuous, disciplined investment in fund shares, regardless of fluctuating price levels. Investors should consider their financial ability to continue purchases through periods of low price levels or changing economic conditions. Such a plan does not guarantee a profit or eliminate risk, nor does it protect against loss in a declining market.

3. Now may be a great time for a portfolio checkup

Is your portfolio as diversified as you think it is? Meet with your financial professional to find out. Your portfolio’s weightings in different asset classes may shift over time as one investment performs better or worse than another. Together with your financial professional, you can re-examine your portfolio to see if you are properly diversified. You can also determine whether your current portfolio mix is still a suitable match with your goals and risk tolerance.

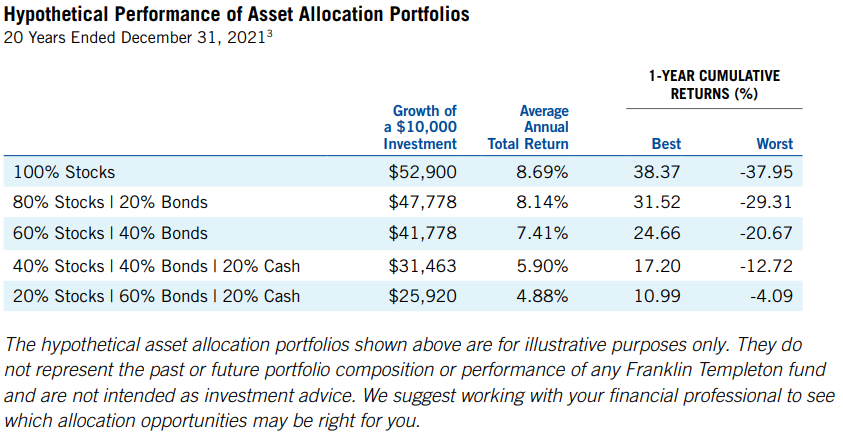

4. Tune out the noise and gain a longer-term perspective

Numerous television stations, websites and social media channels are dedicated to reporting investment news 24 hours a day, seven days a week. What’s more, there are almost too many financial publications to count. While the media provides a valuable service, they typically offer a very short-term outlook. To put your own investment plan in a longer-term perspective and bolster your confidence, you may want to look at how different types of portfolios have performed over time.

- Source: © 2022 Morningstar, Inc., 12/31/21. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results. Stock investments are represented by equal investments in the S&P 500 Index, Russell 2000® Index, and MSCI EAFE Index, representing large U.S. stocks, small U.S. stocks, and foreign stocks, respectively. Bonds are represented by the Bloomberg Barclays U.S. Aggregate Index. Cash equivalents are represented by the FTSE 3-Month U.S. Treasury Bill Index. Portfolios are rebalanced annually. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges.

5. Believe your beliefs and doubt your doubts

There are no real secrets to managing volatility. Most investors already know that the best way to navigate a choppy market is to have a good long-term plan and a well-diversified portfolio. But sticking to these fundamental beliefs is sometimes easier said than done. When put to the test, you sometimes begin doubting your beliefs and believing your

doubts, which can lead to short-term moves that divert you from your long-term goals.To keep a balance perspective, we recommend that you contact your financial professional before making any changes to your portfolio.

-

Elon Musk’s Twitter Takeover

It has been a busy month for the richest man in the world, Elon Musk. The CEO of SpaceX and Tesla, Inc. has an estimated net worth of around $252 billion and a penchant for free speech, specifically on social media. A Twitter user since June 2010, Musk has faced some controversy through his choice of Tweets over the years. In August 2018, he claimed in a tweet that he was taking Tesla private at $420 per share. The SEC fined Musk and Tesla $20 million each, concluding that the tweets had no basis in fact and hurt investors.

This time around, Musk moved more deliberately and was almost compliant in his quest to acquire Twitter for $44 billion and take it private.

For Twitter shareholders, they will receive $54.20 per share in cash once the deal meets regulatory approval and other closing considerations. Even if you don’t hold Twitter stock, the changes Musk could bring to Twitter may impact how other social media and tech companies operate, like Facebook or Apple. As a private company, Twitter won’t have to report their financials in the same way as other competing companies, which means less transparency overall in the space. The following article outlines how exactly we got here in such a short time frame:

Click to Read Article