-

Optimism Among Small Business Owners Declined in August

According to the NFIB’s Small Business Economic Trends data

The National Federation of Independent Business was founded in 1943 and is the largest small business association in the U.S. The NFIB collects data from small and independent businesses and publishes their Small Business Economic Trends data on the second Tuesday of each month. The Index is a composite of 10 components based on expectations for: employment, capital outlays, inventories, the economy, sales, inventory, job openings, credit, growth and earnings.

Here is what the NFIB released on September 12th:

“NFIB’s Small Business Optimism Index decreased 0.6 of a point in August to 91.3, the 20th consecutive month below the 49-year average of 98. Twenty-three percent of small business owners reported that inflation was their single most important business problem, up two points from last month. The net percent of owners raising average selling prices increased two points to a net 27% (seasonally adjusted), still at an inflationary level.

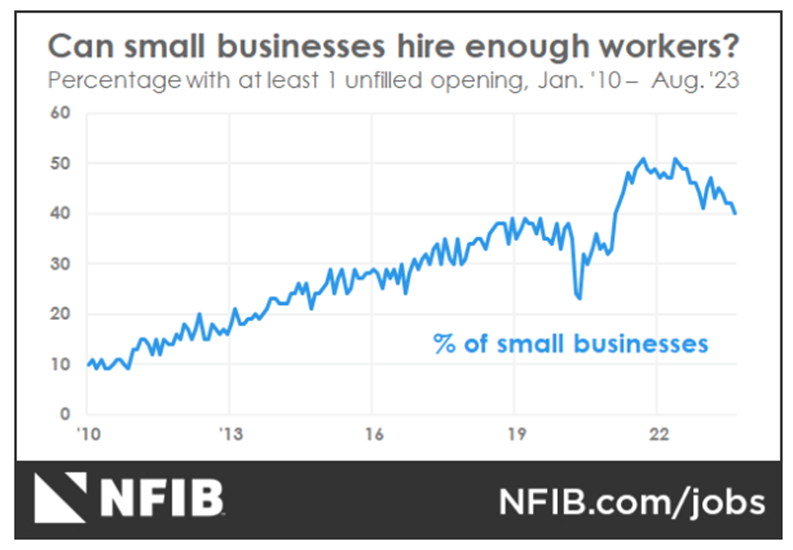

As reported in the NFIB monthly jobs report, 40% (seasonally adjusted) of all owners reported job openings they could not fill in the current period. Owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 17% planning to create new jobs in the next three months.

Related Article: Job Openings Decline in July

Sales Trends

A net negative 14% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, the lowest reading since August 2020. The net percent of owners expecting higher real sales volumes declined two points to a net negative 14%.

The net percent of owners reporting inventory gains declined four points to a net negative 7%. Not seasonally adjusted, 11% reported increases in stocks and 16% reported reductions. A net negative 5% of owners viewed current inventory stocks as “too low” in August, down one point from July. By industry, shortages are the most frequent in retail (9%), finance (7%), manufacturing (7%), and services (7%).

The net percent of owners raising average selling prices increased two points from July to a net 27% (seasonally adjusted). Twenty-three percent of owners reported that inflation was their single most important problem in operating their business, up two points.

Unadjusted, 12% reported lower average selling prices and 38% reported higher average prices. Price hikes were the most frequent in finance (52% higher, 7% lower), construction (51% higher, 6% lower), retail (45% higher, 11% lower), and wholesale (36% higher, 20% lower). Seasonally adjusted, a net 30% plan price hikes.

Raising Compensation

A net 36% reported raising compensation, down two points from July. A net 26% of owners plan to raise compensation in the next three months, up five points.

80% of owners cited labor costs as their top business problem, down two points from July. 24% percent said that labor quality was their top business problem.

-

5 investment ideas for small-business owners struggling to keep their finances liquid

Three local financial experts share their advice.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/YJPKYC62CJFITAB5DO2ZNXQAWU.jpg)

Andrew Hipple has advice on how small business owners (and individuals) can take advantage of the rish in interest rates. (photo credit: Steven M. Falk / Inquirer Staff Photographer) Written by Gene Marks

Even as commercial lending rates have more than doubled in the last year, interest rates earned on checking, money market and savings accounts remain stubbornly low as banks seek to maintain their profitability.

That’s not helpful for business owners, who need to earn money on their cash reserves while keeping enough liquidity to meet faily working capital needs. Options remain limited, but the environment is slowly changing, and a number of investment choices with minimal risks are emerging.

Click here to read full article from the Philadelphia Inquirer, featuring Andrew Hipple CFP®, Partner at Lane Hipple Wealth Management Group.