-

Understanding New Jersey’s Senior Freeze Program

Navigating Property Tax Relief in the Garden State

Understanding the importance of financial planning for seniors, the State of New Jersey offers the “Senior Freeze” Program, a property tax relief initiative designed to stabilize property taxes for eligible residents. This program is specifically for those aged 65 and older, providing them with the opportunity to freeze the amount of property taxes they pay at a level established in a base year, protecting them from future tax increases due to rising property values or rates.

Eligibility Criteria: To qualify for the Senior Freeze Program, applicants must meet several criteria:

- Age – Must be 65 years or older on December 31, 2022, or receive Social Security disability payments on December 31, 2022, and also on December 31, 2023.

- Home Ownership – Must have owned and lived in or leased a site in a mobile home park for a manufactured or mobile home that they owned since December 31, 2019, or earlier.

- Taxes – Must have paid all 2022 property taxes by June 1, 2023, and all 2023 property taxes by June 1, 2024.

- Income Limit – Have an annual household income of $150,000 or less in 2022 and $163,050 or less in 2023. With some exceptions, all income must be taken into account, including things such as Social Security and pensions.

Click here to find out if you are eligible

Benefits: The primary benefit of the Senior Freeze Program is the ability to lock in the amount of property taxes paid at the level of a designated base year. This means that even if property tax rates increase, eligible seniors will continue to pay the amount they paid in their base year, effectively freezing their property tax burden. This can provide significant financial relief and stability for seniors living on fixed incomes.

The program also includes provisions for reimbursement of the difference between the amount of property taxes paid in the base year and the amount paid in the current year, subject to the program’s rules and limitations. Here are some Frequently Asked Questions.

Application Process: Interested seniors can apply for the Senior Freeze Program by completing an application form available here on the New Jersey Department of Treasury’s website. It is important to apply within the specified deadlines and provide all required documentation, including proof of age, residency, home ownership, and income. The deadline for submitting the 2023 application is October 31, 2024.

The Senior Freeze Program is a testament to New Jersey’s commitment to supporting its senior residents, ensuring they can enjoy their retirement years without the worry of increasing property taxes. For more detailed information and assistance with the application process, seniors are encouraged to visit the official New Jersey Department of Treasury website or contact their local tax office.

-

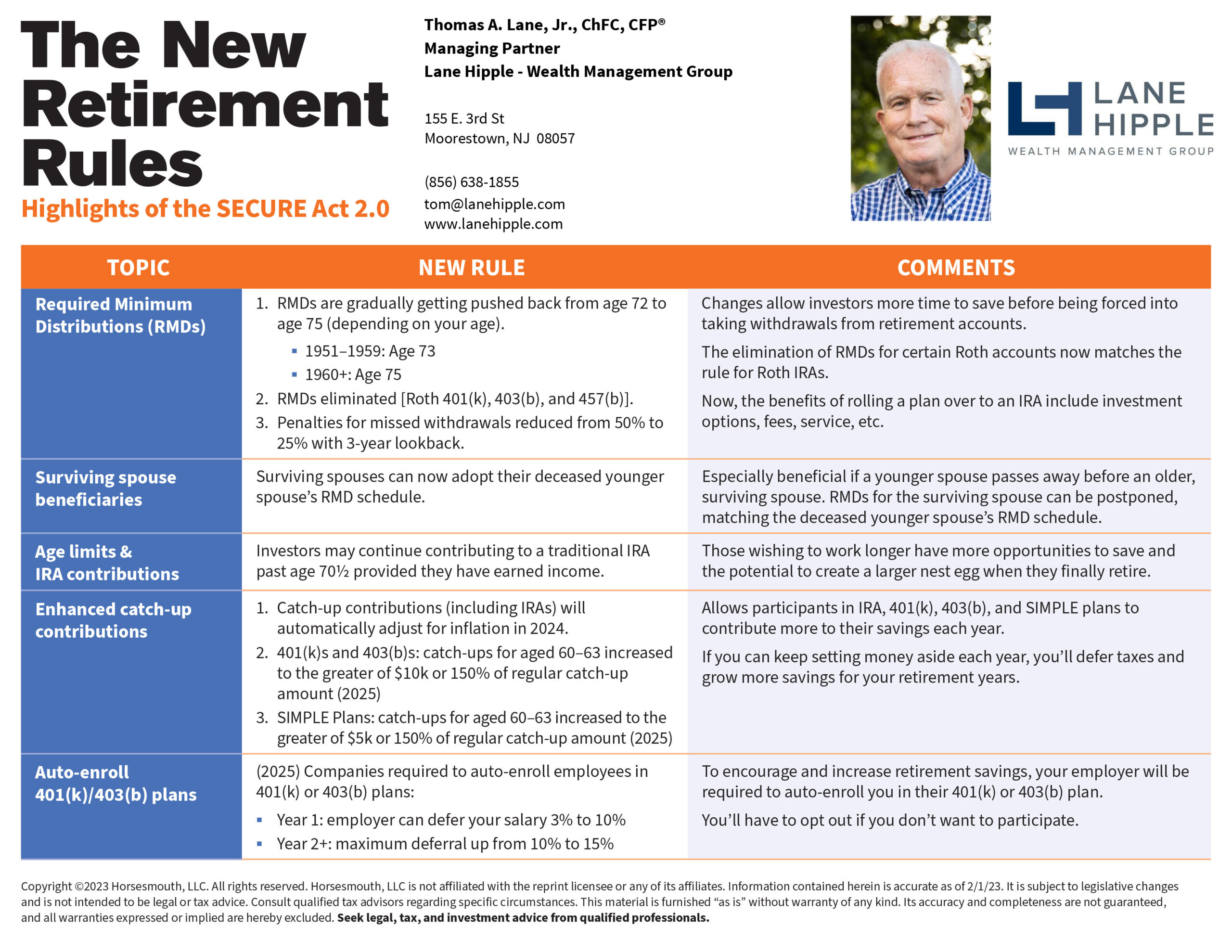

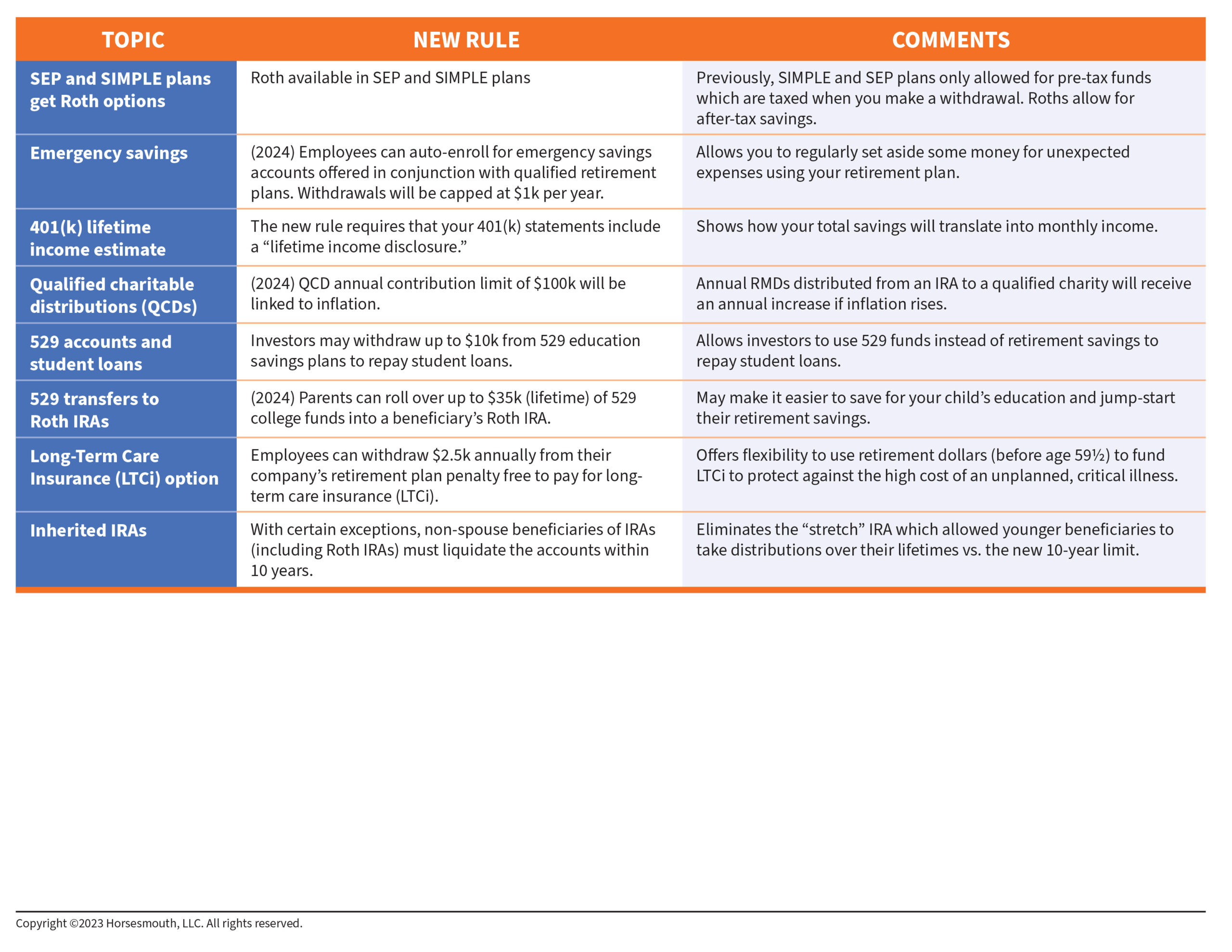

The New Retirement Rules

Highlights of the SECURE Act 2.0

-

Social Security Gets Biggest Boost Since 1981

The Cost of Living Adjustment, or COLA, from the Social Security Administration (SSA) is announced every fall and has major implications for the 66 million people who receive benefit checks. With inflation surging, retirees need help maintaining purchasing power. The agency announced its 2023 COLA will be 8.7%, the highest since 1981.

For those concerned about medical costs eating into this increase, Medicare – the health insurance plan for older Americans – said last month it would drop its premiums next year by about 3% for its Medicare Park B Plan.

For more information and context, please read this article from CBS News.

For instructions on how to sign up for a “my Social Security” account with the SSA, which is the fastest way to find out when and how much you will receive, watch the video below: