-

Understanding the Fed’s Pause on Rate Hikes

Remain vigilant as we might see more rate hikes later this summer

The decision by the Federal Reserve to pause its upward trajectory of the federal funds rate – after 10 straight hikes over the past 14 months – has significant implications for investors. As the central bank of the United States, the Fed’s monetary policy decisions have a profound impact on financial markets and the investment landscape.

Let’s explore what this pause means for investors and explore potential strategies to navigate this new environment.

Understanding the Pause

To grasp the implications of the Fed’s pause, it is crucial to understand the underlying reasons for this shift in policy. The Federal Reserve’s primary mandate is to maintain price stability and support maximum employment. The decision to halt rate hikes suggests that the Fed believes inflationary pressures may be lessening or that the economy requires more time to fully recover. By pausing rate hikes, the central bank aims to provide ongoing support to economic growth.

Bond and Fixed-Income Investments

The Fed’s pause on rate hikes has immediate implications for bond and fixed-income investors. Typically, rising interest rates lead to declining bond prices. However, with the Fed indicating a pause in rate hikes, bond prices may stabilize or even experience modest gains. This is particularly relevant for long-term bondholders who were concerned about potential losses in a rising rate environment.

Nevertheless, investors should remain vigilant. While the pause in rate hikes may provide some relief, it is essential to monitor inflationary trends and the Federal Reserve’s future actions. Unexpected shifts in inflation expectations or the resumption of rate hikes could still impact fixed-income investments.

Equity Markets and Investment Strategies

The Fed’s pause on rate hikes can also have a significant impact on equity markets. Historically, low interest rates have been supportive of stock prices, as they reduce borrowing costs for businesses and increase the present value of future earnings. Investors should consider the potential for continued strength in equity markets as long as the pause in rate hikes persists.

However, it is crucial to exercise caution and avoid complacency. Market conditions can change rapidly, and investors should remain attentive to both global economic developments and the possibility of future rate hikes. Adopting a diversified investment strategy that balances exposure across sectors and geographies can help mitigate risks associated with potential market volatility.

Related Report: Charles Schwab’s Mid-Year Outlook

Sector Rotation and Asset Allocation

The pause in rate hikes offers an opportunity for investors to reassess their sector allocations and asset mix.

Certain sectors, such as utilities and real estate, tend to perform well in a low-interest-rate environment.

These sectors often exhibit stable cash flows and attractive dividend yields, making them appealing to income-focused investors.

Conversely, sectors like financials and banking may face challenges due to narrower interest rate spreads. Investors may consider rotating their investments into sectors that could benefit from the pause in rate hikes, while also maintaining a long-term perspective and keeping diversification in mind.

International Considerations

The Fed’s decision to pause rate hikes also has implications beyond the United States. Lower interest rates in the U.S. can lead to a weaker U.S. dollar, potentially benefiting international investments and exporters. Investors should consider the potential impact on currency valuations and diversify their portfolios by allocating a portion of their investments to international markets.

What Investors Should Do

The Federal Reserve’s pause on rate hikes represents a significant development for investors. The decision suggests that the central bank is carefully monitoring economic conditions and adjusting its policies accordingly. Bond and fixed-income investors may find some respite, while equity investors should remain attentive to potential shifts in market dynamics.

To navigate this evolving landscape, investors should adopt a diversified approach, reassess sector allocations, and consider the potential benefits of international investments.

Staying informed, monitoring economic indicators, and seeking professional advice can help investors make well-informed decisions in this environment of paused rate hikes. Even if it only lasts for a month.

-

Markets Mixed as Growth and Tech Names Jump on Hopes That the Fed Might Have Reached an Inflection Point on Hiking Rates

- This week was dominated by banking worries that started with the collapse of Silicon Valley Bank last week and spread to Signature Bank of New York and a few others this week

- But before markets opened on Monday, Wall Street learned through a joint statement from the Federal Reserve, Treasury, and the FDIC that all depositors at SVB and Signature Bank would be able to access deposits on Monday, despite being taken over by regulators

- When Friday’s final Wall Street bell rung, equity returns were mixed, as the small-cap Russell 2000 lost 2.6%, pushing it into the red for the year (YTD: -2.0%) and the mega-cap DJIA lost 0.1%, pushing it further into the red for the year (YTD: -3.9%)

- The tech-heavy NASDAQ, on the other hand, leapt an astonishing 4.4%, as investors hoped that the Fed’s rate hiking might slow down or be over for the year

- The large-cap S&P 500 inched up 1.4% and is positive for the year (YTD: +2.0%)

- Of the 11 S&P 500 sectors, 6 were positive, with the growth sectors, especially Communication Services (+6.9%) and Information Technology (+5.7%), outpacing the defensive sectors like Utilities (+3.9%) and Consumer staples (+1.3%)

- The 2-year Treasury yield sank 77 basis points to 3.82% and the 10-year Treasury note yield fell 29 basis points to 3.40%

- Oil prices dropped 13.5% this week to $66.33/barrel, the lowest level since December 2021

Weekly Market Update – March 17, 2023

Close Week YTD DJIA 31,862 -0.1% -3.9% S&P 500 3,917 +1.4% +2.0% NASDAQ 11,631 +4.4% +11.0% Russell 2000 1,726 -2.6% -2.0% MSCI EAFE 1,986 -3.5% +2.2% Bond Index* 2,090.71 +1.75% +2.04% 10-Year Treasury 3.41% -0.29% -0.5% *Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD.

This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future resultsMarkets Mixed as Bank-Failure-Worries Ease

It was another volatile week for equity markets around the world, as pressures mounted on the banking sector as concerns grew after the failures of Silicon Valley Bank and Signature Bank and worries at First Republic Bank and Credit Suisse.

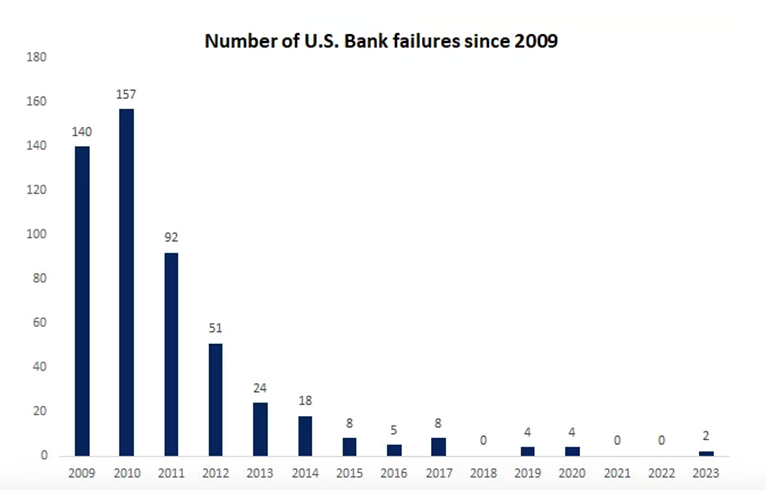

And while pundits were quick to call attention to the big bank failures of 2008/2009, this week was different as governments (including the Fed, the Federal Deposit Insurance Corporation, and the Treasury Department) and other well-capitalized banks stepped in quickly to put worries at ease.

Source: FDIC Then as bond yields dropped swiftly, equities rebounded, giving investors a good case of whiplash. When the week ended, the major U.S. equity indices finished mixed, as the current banking worries might ultimately end up as an inflection point where the Fed slows down or even pauses future rate hikes this year.

Not surprisingly, the 11 S&P 500 sectors varied markedly, with 5 of the 11 ending the week in the red. Specifically, Communication Services (+6.9%) and Information Technology (+5.7%) made big weekly jumps and Financials (-4.9%) and Energy (-6.9%) struggled with big losses. The range in sector returns was further underscored as Large Growth outperformed Large Value by almost 6%.

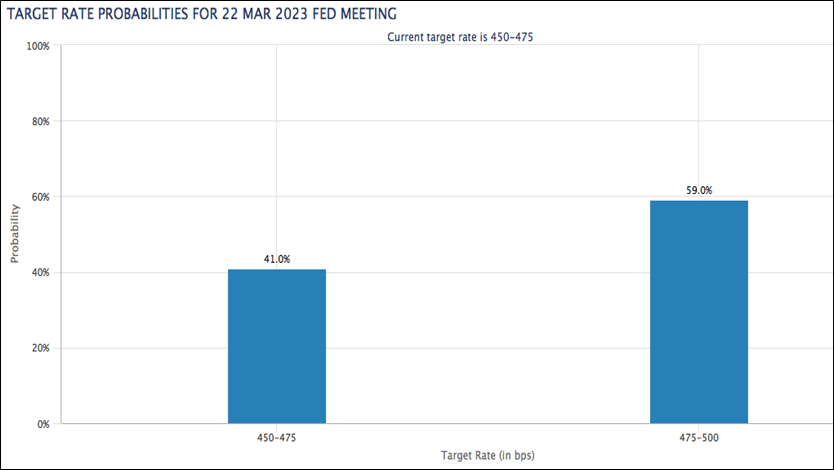

While the bank failures were unpleasant, glass-half-full investors were hopeful that the Fed might adjust its monetary policy and not raise rates by as much. By the end of the week, the fed fund futures markets were pricing in zero likelihood of a 50-basis-point hike versus a 40% chance just one week ago and an almost 40% chance of no rate hike at the Fed’s upcoming meeting on March 21st.

While it seemed everyone was focused on the latest banking news, there was a lot of economic data this week too, including:

- The Consumer Price Index was was up 0.4% month-over-month in February, and up 6.0% year-over-year, which was the smallest 12-month increase since September 2021

- Core CPI, which excludes food and energy, was up 0.5% month-over-month and up 5.5% year-over-year, which was the smallest 12-month increase since December 2021

- The February NFIB Small Business Optimism Index came in at 90.9

- Weekly MBA Mortgage Applications Index were up 6.5%

- February Retail Sales were down 0.4%

- February Retail Sales ex-autos were down 0.1%

- February PPI was down 0.1%

- February Core PPI was flat at 0.0%

- January Business Inventories were down 0.1%

- Weekly Initial Claims came in at 192,000

- February Import Prices were down 0.1%

- February Export Prices were up 0.2%

- Leading Indicators fell 0.3% in February

- The preliminary University of Michigan Consumer Sentiment Index for March dropped to 63.4

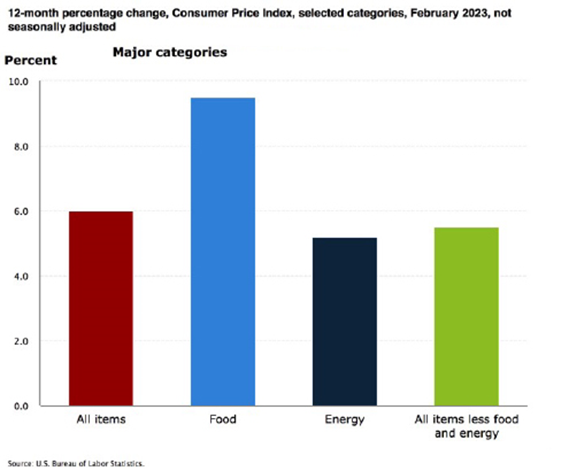

Consumer Price Index Records Smaller Increase, But Food Index is Up 9.5% Over the Last Year

On Tuesday, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers rose 0.4% in February, after increasing 0.5% in January. Over the last 12 months, the all items index increased 6.0% before seasonal adjustment.

Specifically:

- The index for shelter was the largest contributor to the monthly all items increase, accounting for over 70% of the increase, with the indexes for food, recreation, and household furnishings and operations also contributing.

- The food index increased 0.4% over the month with the food at home index rising 0.3%.

- The energy index decreased 0.6% over the month as the natural gas and fuel oil indexes both declined.

- Categories which increased in February include shelter, recreation, household furnishings and operations, and airline

fares. - The index for used cars and trucks and the index for medical care were among those that decreased over the month.

Inflation Over the Past 12-Month

The all items index increased 6.0% for the 12 months ending February; this was the smallest 12-month increase since the period ending September 2021.

- The all items less food and energy index rose 5.5% over the last 12 months, its smallest 12-month increase since December 2021.

- The energy index increased 5.2% for the 12 months ending February.

- The food index increased 9.5% over the last year.

Food Index

- The food index increased 0.4% in February, and the food at home index rose 0.3% over the month. Five of the six major grocery store food group indexes increased over the month. The index for nonalcoholic beverages increased 1.0% in February, after a 0.4% increase the previous month. The indexes for other food at home and for cereals and bakery products each rose 0.3% over the month. The index for fruits and vegetables increased 0.2% in February, and the index for dairy and related products rose 0.1%.

- In contrast, the meats, poultry, fish, and eggs index fell 0.1 percent over the month, the first decrease in that index since December 2021. The index for eggs fell 6.7% in February following sharp increases in recent months.

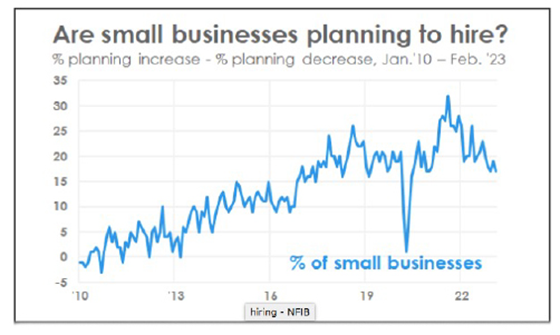

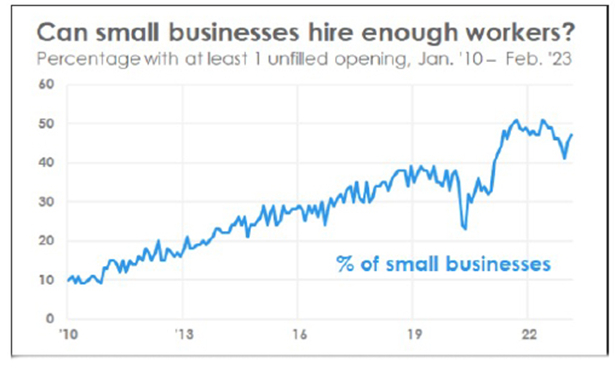

Nearly Half of Small Businesses Have Job Openings They Can’t Fill

Early in the week, the National Federation of Independent Businesses reported that 47% of small business owners reported job openings they could not fill in the current period.

Specifically, “[t]he percent of small business owners reporting labor quality as their top small business operating problem remains elevated at 21%, down three points from January. Labor cost reported as the single most important problem to business owners increased two points to 12%, down one point below the highest reading of 13% reached in December 2021.

A seasonally adjusted net 17% of owners are planning to create new jobs in the next three months, down two points from January and 15 points below its record high reading of 32 reached in August 2021, showing that the trend in planned hiring is on the decline.

Sixty percent of owners reported hiring or trying to hire in January, up three points from January. Of those hiring or trying to hire, 90% of owners reported few or no qualified applicants for the positions they were trying to fill. Thirty percent of owners reported few qualified applicants for their open positions.

Further:

- 46% of owners reported raising compensation, unchanged from last month.

- 23% plan to raise compensation in the next three months, up one point from January.

- 38% of owners have job openings for skilled workers.

- 19% have openings for unskilled labor.

Sources: bls.gov; nfib.com; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com

- This week was dominated by banking worries that started with the collapse of Silicon Valley Bank last week and spread to Signature Bank of New York and a few others this week

-

5 Ways a Financial Advisor Can Help You Prepare for Tax Season

A Strong Tax Strategy is Part of a Thoughtful, Comprehensive Financial Plan

Tax season is upon us and, while not every financial advisor is a Certified Public Accountant (CPA), that doesn’t mean they can’t be helpful. Your financial advisor can assist you with making strategic tax moves throughout the year to help reduce your overall tax burden. As you read below, keep in mind that the sooner you begin having these conversations with your advisor about your tax strategy, the better off you’ll be at tax time.

Finding Ways to Maximize Your Tax Savings

There are many financial moves you can make throughout the year that will result in paying lower taxes, and a financial advisor will be educated about them. For example, some investment accounts let you make tax-deferred contributions, which can offer you the opportunity to save money on taxes while working to build your retirement savings. Take a company-sponsored 401(k), for instance. If you max out your contributions to this account, all of the money going in is pre-taxed, so you’ll be putting money away for retirement while reducing your tax bill in the present.

Keeping Record of Your Capital Gains and Losses

When filing your taxes, you’ll have to know how much you earned and lost from your investments for that year. A financial advisor will have an accurate and consistent record of your investments, which they can give to your accountant on your behalf. This will save you time and energy, and help you ensure you’re paying appropriate capital gains tax, without over-paying.

Developing a Tax-Savvy Gifting Strategy

There’s a lot to be gained when we gift our money to others. Not only do you get the intrinsic rewards associated with the joy and meaning that comes from helping others, but you can enjoy valuable tax benefits, too. Sit down with your financial advisor and discuss how you can gift your money in ways that ultimately help lower your tax bill, too. And this isn’t just for charities; if you want to give money to your family members for any reason, there are plenty of gifting strategies that let you transfer your wealth without a tax penalty. Check-in with your financial advisor before making any gifts so you can be sure to maximize the opportunity.

8 Considerations For Passing an Inheritance To Your Children

Minimizing the Tax Burden that RMDs Bring

Once you reach the age of 73, you’ll have to begin taking out Required Minimum Distributions (RMDs) from any IRA or 401(k) accounts that you have. While this comes as no surprise, often the uptick in your tax bill from having to pay income tax on those distributions does come as a surprise to retirees. A financial advisor will be able to provide you with management strategies so that you can lower your tax liabilities and be more prepared when the time comes to begin taking distributions.

Determining Tax-Efficient Investment Strategies

Although a financial advisor can’t necessarily protect you from capital gains tax, they will be able to help you by implementing strategies such as tax-loss harvesting, offsetting gains with losses, and avoiding issues such as “phantom tax,” which limit your overall tax liability. So, they’ll not only be able to help you manage and balance a portfolio, but they’ll be able to ensure you’re following the best investment strategies to benefit you the most when it comes time to file your taxes.

Do You Need a Financial Advisor to Assist with a Tax Strategy?

The world of taxes can be incredibly confusing, especially considering they’re constantly changing depending on the economy and new legislation. Having a financial advisor you trust is an important addition to your tax planning arsenal. A financial advisor can guide you throughout the year to ensure you’re making the best financial choices to help boost your tax strategy, with the ultimate goal of allowing you to save more of your hard-earned dollars.

If you think you would benefit from a conversation about your tax strategy, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

5 Things You Need To Know To Ride Out A Volatile Stock Market

This article, written by Franklin Distributors, LLC, provides great insight on how to approach today’s investment environment.

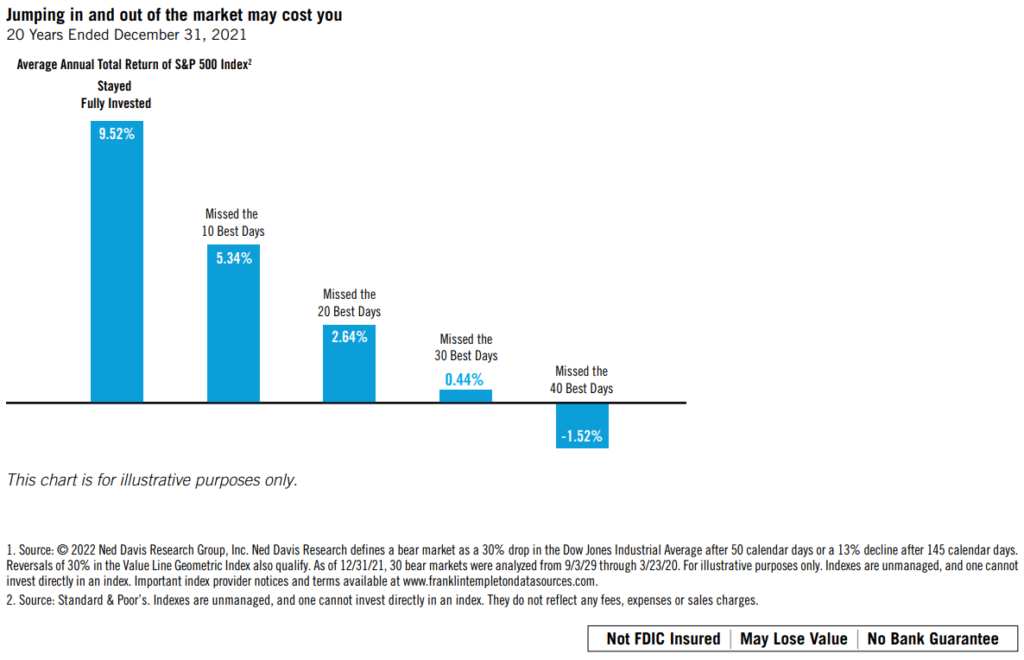

1. Watching from the sidelines may cost you

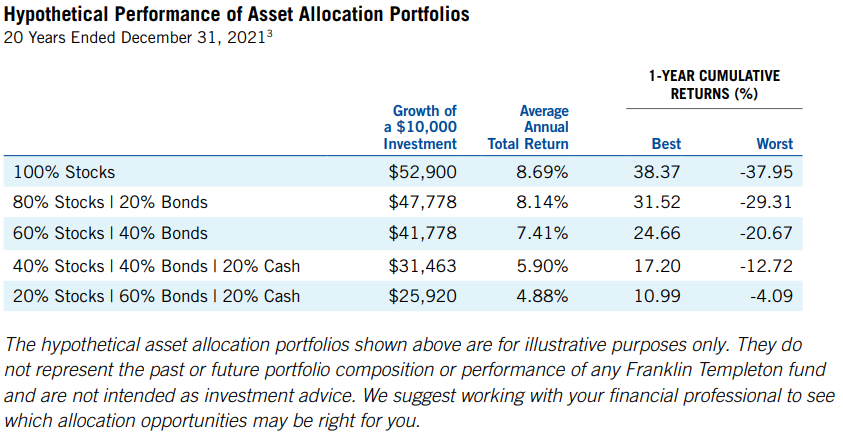

When markets become volatile, a lot of people try to guess when stocks will bottom out. In the meantime, they often park their investments in cash. But just as many investors are slow to recognize a retreating stock market, many also fail to see an upward trend in the market until after they have missed opportunities for gains. Missing out on these opportunities can take a big bite out of your returns. Consider that on average, for the 12 months following the end of a bear market, a fully invested stock portfolio had an average total return of 38.3%. However, if an investor missed the first six months of the recovery by holding cash, their return would have been only 8.0%¹. The chart below is a hypothetical illustration showing the risk of trying to time the market. By missing just a few of the stock market’s best single-day advances, you could put a real crimp in your potential returns.

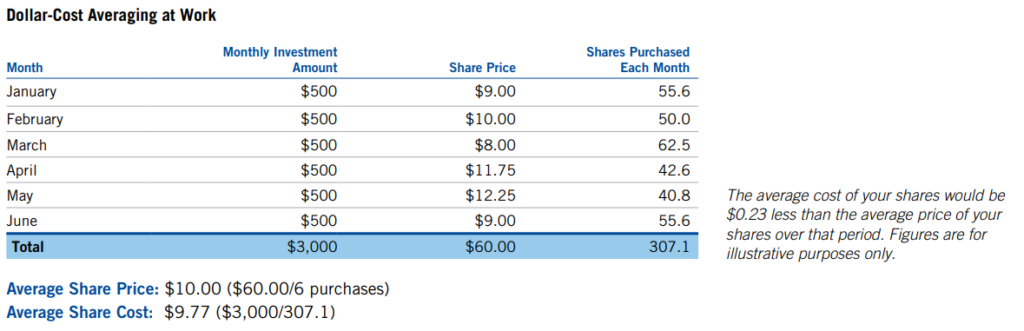

2. Dollar-cost averaging makes it easier to cope with volatility

Most people are quick to agree that volatile markets may present buying opportunities for investors with a long-term horizon. But mustering the discipline to make purchases during a volatile market can be difficult. You can’t help wondering, “Is this really the right time to buy?”

Dollar-cost averaging can help reduce anxiety about the investment process. Simply put, dollar-cost averaging is committing a fixed amount of money at regular intervals to an investment. You buy more shares when prices are low and fewer shares when prices are high. And over time, your average cost per share may be less than the average price per share. Dollar-cost averaging involves a continuous, disciplined investment in fund shares, regardless of fluctuating price levels. Investors should consider their financial ability to continue purchases through periods of low price levels or changing economic conditions. Such a plan does not guarantee a profit or eliminate risk, nor does it protect against loss in a declining market.

3. Now may be a great time for a portfolio checkup

Is your portfolio as diversified as you think it is? Meet with your financial professional to find out. Your portfolio’s weightings in different asset classes may shift over time as one investment performs better or worse than another. Together with your financial professional, you can re-examine your portfolio to see if you are properly diversified. You can also determine whether your current portfolio mix is still a suitable match with your goals and risk tolerance.

4. Tune out the noise and gain a longer-term perspective

Numerous television stations, websites and social media channels are dedicated to reporting investment news 24 hours a day, seven days a week. What’s more, there are almost too many financial publications to count. While the media provides a valuable service, they typically offer a very short-term outlook. To put your own investment plan in a longer-term perspective and bolster your confidence, you may want to look at how different types of portfolios have performed over time.

- Source: © 2022 Morningstar, Inc., 12/31/21. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results. Stock investments are represented by equal investments in the S&P 500 Index, Russell 2000® Index, and MSCI EAFE Index, representing large U.S. stocks, small U.S. stocks, and foreign stocks, respectively. Bonds are represented by the Bloomberg Barclays U.S. Aggregate Index. Cash equivalents are represented by the FTSE 3-Month U.S. Treasury Bill Index. Portfolios are rebalanced annually. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges.

5. Believe your beliefs and doubt your doubts

There are no real secrets to managing volatility. Most investors already know that the best way to navigate a choppy market is to have a good long-term plan and a well-diversified portfolio. But sticking to these fundamental beliefs is sometimes easier said than done. When put to the test, you sometimes begin doubting your beliefs and believing your

doubts, which can lead to short-term moves that divert you from your long-term goals.To keep a balance perspective, we recommend that you contact your financial professional before making any changes to your portfolio.

-

Focus on Your Financial Freedom this Independence Day

Five Steps to Declare Your Financial Independence

Are you ready to revolutionize your fiscal plan and attain financial freedom?

In 2019, an AARP study found that 53% of adult households in the United States did not have an emergency savings account. The pandemic applied even more pressure to struggling Americans, exacerbating that anxiety. The fear of not having financial security can feel overwhelming, but you can take this moment to embrace the nation’s ethos of “land of the free and home of the brave” and apply it to your money management plan. Read on for five steps to follow to reach your personal money goals and achieve financial independence.

1. Expect the Unexpected with an Emergency Fund

It’s always been a smart idea to set aside some money in a savings account for the unexpected. The COVID-19 pandemic, and the economic and employment downturn it spurred, turned that theoretical possibility into a reality for many Americans. Having emergency cash in the bank can give you back the financial freedom that comes from having peace of mind. In the event of a global issue, the loss of your employment, or even an unexpected car repair or medical bill, an emergency fund is there to help. Though we’re all hopeful to soon put the pandemic and its effects fully behind us, one of the lasting lessons we can take away is that an emergency fund is a critical financial strategy.

Exactly how much you should set aside is a personal equation based on what you can afford today and your cost of living, but a good rule of thumb is to put away three to six months of expenses. You can sock it away in any savings account, but an FDIC- (or NCUA-) insured account at your bank or credit union is ideal. Set a monthly goal for how much you can contribute to savings and look for ways to automate the process.

Looking for a way to level up your emergency fund? Once you build it up to a certain amount, you may want to consider having your money work for you. If you exceed your emergency fund goals, keep saving and set aside some to invest in a low-risk fund to maximize yield.

Deciding to save into an emergency fund is a great way to regain control over your financial wellness and boost your overall well-being. Financial freedom can give you peace of mind that’s truly priceless.

2. Curb Spending and Increase Calm

Feeling financially free isn’t about being able to spend whatever you want today. It’s about knowing that you’ve saved enough that you don’t have to worry in the future. Setting a budget does force you to curb spending in the short term but setting up those fiscal guardrails is one of the surest paths to financial independence.

Having a realistic budget gives you a deep sense of calm and reassurance. Once you know how much money is coming in and how much you can spend, you have a holistic picture of where your money is going. Think of a budget as a road map. You wouldn’t set out on a cross-country trip without any idea of which road to follow. Living without a budget is like driving blind. Setting targets, defining priorities, and giving every dollar a job can help you get to where you need to go by putting you in the driver’s seat. What better way is there to achieve financial freedom?

Related Article: Financial Goal-Setting Tips to Help Achieve Your Money Goals

3. Make a Debt-Free Declaration

Being debt-free is one of the best markers of financial freedom. Getting out of debt and staying out permanently can help you save the money you need to have a stable future.

However, not all debt is created equal. There’s a difference between good debt and bad debt—the former can help you complete your education or buy a dream home, while the latter can bog you down with high-interest rates and unnecessary monthly payments. A 2020 Experian report showed that the average American owes approximately $92,727 in total debt—the highest amount ever recorded. If you’re in debt, you’re not alone. There are several strategies and steps that can help, but whichever path you take, make sure it’s both attainable and sustainable.

Before you buy something that will come with a high-payment plan, ask yourself if you a) need it and b) can actually afford it. Using an auto loan calculator or mortgage calculator can help you determine what fits into your budget.

4. Retirement Plan to Brighten Your Future

What is the ultimate financial freedom goal? For many people, it’s being able to have a secure, comfortable retirement in your later years. Here are a few simple things you can do today to help prepare for a great tomorrow:

- Maximize contributions to any tax-advantaged retirement savings accounts, like an IRA or a 401(k) plan

- Take advantage of any employer matching contributions so you can receive the full amount offered

- Diversify your investment portfolio with a mix of asset classes

It can be difficult to make short-term sacrifices in the name of a more comfortable future but keep your eye on the ball and remember you’re giving yourself the gift of financial independence.

5. Pay it Forward and Let Freedom Ring

If you’ve already accomplished all the items on this list and feel secure in your financial freedom, consider celebrating this July 4th holiday by helping others. Determine how much you can set aside for charitable giving and help support the missions and people who are important to you.

If you have younger loved ones, you can help set up or fund their 529 college savings account. It’s a great way to promote financial independence for the next generation, and maybe even help yourself along the way—some states let you claim a tax deduction for that kind of donation.

If you don’t have relatives that need help, consider donating to a child-focused charity, particularly one with a focus on education. Investing in the next era of earners can help us all enjoy more financial freedom in the years ahead.

Financial Independence on July 4th and Beyond

Freedom means many things for many different people, but on the fourth day of the seventh month of the year, we all come together to celebrate how lucky we are to be able to have the opportunities associated with independence. Financial security can help you feel more confident, in control, at peace, and, of course, free to live the life of your dreams.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.