-

Mortgage Applications Drop as Mortgage Rates Increase

Mortgage Applications Drop as Mortgage Rates Increase

On Wednesday, the Mortgage Bankers Association announced that mortgage applications decreased 13.2% from two weeks earlier (and include adjustments to account for the holidays).

- The Market Composite Index, a measure of mortgage loan application volume, decreased 13.2% on a seasonally adjusted basis from two weeks earlier.

- On an unadjusted basis, the Index decreased 39.4% compared with the two weeks ago.

- The holiday adjusted Refinance Index decreased 16.3% from the two weeks ago and was 87% lower than the same week one year ago.

- The seasonally adjusted Purchase Index decreased 12.2% from two weeks earlier.

- The unadjusted Purchase Index decreased 38.5% compared with the two weeks ago and was 42% lower than the same week one year ago.

“The end of the year is typically a slower time for the housing market, and with mortgage rates still well above 6% and the threat of a recession looming, mortgage applications continued to decline over the past two weeks to the lowest level since 1996. Purchase applications have been impacted by slowing home sales in both the new and existing segments of the market. Even as home-price growth slows in many parts of the country, elevated mortgage rates continue to put a strain on affordability and are keeping prospective home buyers out of the market.”

- The refinance share of mortgage activity increased to 30.3% of total applications from 28.8% the previous week.

- The adjustable-rate mortgage (ARM) share of activity decreased to 7.3% of total applications.

- The FHA share of total applications increased to 14.0% from 13.1% the week prior.

- The VA share of total applications increased to 13.4% from 12.0% the week prior.

- The USDA share of total applications remained unchanged at 0.6%.

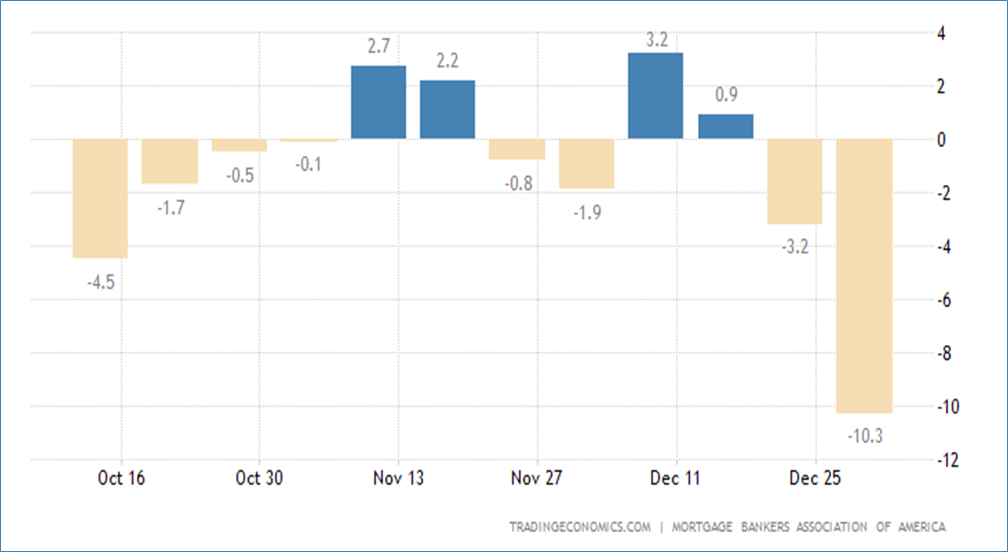

MBA Mortgage Applications Over the Past Year

Increases to Mortgage Rates

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 6.58% from 6.42%, with points increasing to 0.73 from 0.65 (including the origination fee) for 80% loan-to-value ratio (LTV) loans. The effective rate increased from last week.

- The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $647,200 ) remained at 6.12%, with points increasing to 0.45 from 0.37 (including the origination fee) for 80% LTV loans. The effective rate increased from last week.

- The average contract interest rate for 15-year fixed-rate mortgages increased to 6.06% from 5.97%, with points increasing to 0.70 from 0.57 (including the origination fee) for 80% LTV loans. The effective rate increased from last week.

Sources: mba.org

- The Market Composite Index, a measure of mortgage loan application volume, decreased 13.2% on a seasonally adjusted basis from two weeks earlier.