-

Job Openings Decline in July

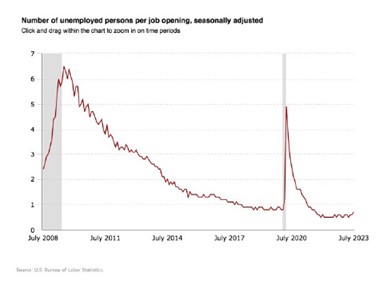

The U.S. Bureau of Labor Statistics reported that job openings lowered to 8.8 million

On Tuesday, the number of job openings edged down to 8.8 million on the last business day of July, the U.S. Bureau of Labor Statistics reported. Over the month, the number of hires and total separations changed little at 5.8 million and 5.5 million, respectively. Within separations, quits (3.5 million) decreased, while layoffs and discharges (1.6 million) changed little.

Job Openings

- On the last business day of July, the number of job openings edged down to 8.8 million (-338,000), while the rate changed little at 5.3%.

- Over the month, job openings decreased in professional and business services (-198,000); health care and social assistance (-130,000); state and local government, excluding education (-67,000); state and local government education (-62,000); and federal government (-27,000).

- By contrast, job openings increased in information (+101,000) and in transportation, warehousing, and utilities (+75,000).

Separations

Total separations include quits, layoffs and discharges, and other separations. Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. Other separations include separations due to retirement, death, disability, and transfers to other locations of the same firm.

The number and rate of total separations in July were little changed at 5.5 million and 3.5%, respectively. Over the month, the number of total separations decreased in accommodation and food services (-132,000).

In July, the number of quits decreased to 3.5 million (-253,000), while the rate changed little at 2.3%. The number of quits declined in accommodation and food services (-166,000); wholesale trade (-27,000); and arts, entertainment, and recreation (-17,000). The number of quits increased in state and local government education (+18,000).

In July, the number of layoffs and discharges changed little at 1.6 million, and the rate held at 1.0%. The number of layoffs and discharges changed little in all industries.

The number of other separations was little changed in July at 378,000.

Establishment Size Class

In July, establishments with 1 to 9 employees saw little change in all data elements. Establishments with more than 5,000 employees had decreases in their quits rates and total separations rates.

-

New Data from the NFIB Small Business Optimism Index

Small Businesses Feeling More Optimistic But This is the 17th Month in a Row Below the 49-Year Average

There are over 30 million small businesses in the United States, according to the Small Business Administration and small businesses comprise about 99% of all U.S. businesses. Further, about half of all Americans – 48% – are employed by small businesses, meaning almost 60 million employees in the U.S. work for a smaller company.

Small Businesses Feeling More Optimistic

On June 13th, “the NFIB Small Business Optimism Index increased 0.4 points in May to 89.4, which is the 17th consecutive month below the 49-year average of 98. The last time the Index was at or above the average was in December 2021. Small business owners expecting better business conditions over the next six months declined one point from April to a net negative 50%. Twenty-five percent of owners reported that inflation was their single most important problem in operating their business, up two points from last month and followed by labor quality at 24%.

Key findings include:

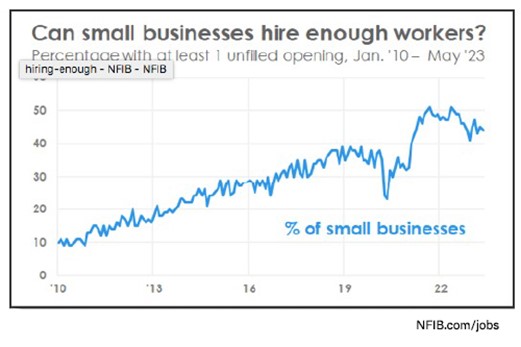

- Forty-four percent of owners reported job openings that were hard to fill, down one point from April and remaining historically very high.

- The net percent of owners raising average selling prices decreased one point to a net 32% (seasonally adjusted), still an inflationary level but trending down.

- The net percent of owners who expect real sales to be higher deteriorated two points from April to a net negative 21%.”

Job Openings Still Hard to Fill

Further, as reported in the NFIB’s monthly jobs report:

- Owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 19% planning to create new jobs in the next three months.

- Overall, 63% of owners reported hiring or trying to hire in May, up three points from April.

- Of those hiring or trying to hire, 89% of owners reported few or no qualified applicants for their open positions.

In addition:

- A net 41% of owners reported raising compensation, up one point from April.

- A net 22% plan to raise compensation in the next three months, up one point.

- Ten percent of owners cited labor costs as their top business problem.

- 24% said that labor quality was their top business problem.