-

5 investment ideas for small-business owners struggling to keep their finances liquid

Three local financial experts share their advice.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/YJPKYC62CJFITAB5DO2ZNXQAWU.jpg)

Andrew Hipple has advice on how small business owners (and individuals) can take advantage of the rish in interest rates. (photo credit: Steven M. Falk / Inquirer Staff Photographer) Written by Gene Marks

Even as commercial lending rates have more than doubled in the last year, interest rates earned on checking, money market and savings accounts remain stubbornly low as banks seek to maintain their profitability.

That’s not helpful for business owners, who need to earn money on their cash reserves while keeping enough liquidity to meet faily working capital needs. Options remain limited, but the environment is slowly changing, and a number of investment choices with minimal risks are emerging.

Click here to read full article from the Philadelphia Inquirer, featuring Andrew Hipple CFP®, Partner at Lane Hipple Wealth Management Group.

-

Conference Board Leading & Coincident Economic Indicators Pointing to a Recession

The Conference Board was founded in 1916 by a group of CEOs “concerned about the impact of workplace issues on business, and with a desire for greater cooperation and knowledge sharing among businesses.”

Every month, the Conference Board compiles a composite of economic indexes designed to signal peaks and troughs in the business cycle. The leading, coincident, and lagging economic indexes are essentially composite averages of 10 individual indicators and help smooth out some of the volatility of individual components.

The ten components include:

- Average weekly hours, manufacturing

- Average weekly initial claims for unemployment insurance

- Manufacturers’ new orders, consumer goods and materials

- ISM Index of New Orders

- Manufacturers’ new orders, nondefense capital goods excluding aircraft orders

- Building permits, new private housing units

- Stock prices, 500 common stocks

- Leading Credit Index

- Interest rate spread, 10-year Treasury bonds less federal funds

- Average consumer expectations for business conditions

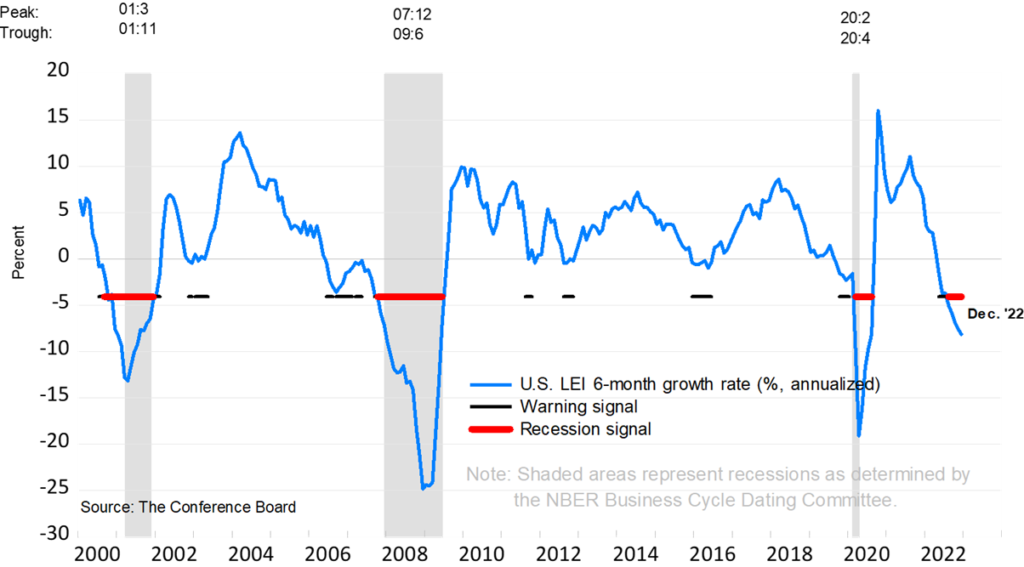

Leading Indicators Signaling a Recession

On January 23rd, the Conference Board announced that its Leading Economic Index for the U.S. decreased by 1.0% in December 2022 to 110.5 (2016=100), following a decline of 1.1% in November.

The LEI is now down 4.2% over the six-month period between June and December 2022 – a much steeper rate of decline than its 1.9% contraction over the previous six-month period (December 2021–June 2022).

“The US LEI fell sharply again in December – continuing to signal recession for the US economy in the near term. There was widespread weakness among leading indicators in December, indicating deteriorating conditions for labor markets, manufacturing, housing construction, and financial markets in the months ahead.

Meanwhile, the coincident economic index (CEI) has not weakened in the same fashion as the LEI because labor market related indicators (employment and personal income) remain robust. Nonetheless, industrial production – also a component of the CEI – fell for the third straight month.

Overall economic activity is likely to turn negative in the coming quarters before picking up again in the final quarter of 2023.”

The trajectory of the US LEI continues to signal a recession

Sources: conference-board.org

-

Midterm Elections – What Do They Mean For Markets?

Studying the history of stock market returns relative to midterm elections will give you a sense of how impactful they are to your own portfolio’s potential gain or loss.

This article was written by Dimensional Fund Advisors and can be found HERE.

It’s almost Election Day in the US once again. For those who need a brief civics refresher, every two years the full US House of Representatives and one-third of the Senate are up for reelection. While the outcomes of the elections are uncertain, one thing we can count on is that plenty of opinions and prognostications will be floated in the days to come. In financial circles, this will almost assuredly include any potential for perceived impact on markets. But should long-term investors focus on midterm elections?

Markets Work

We would caution investors against making short-term changes to a long-term plan to try to profit or avoid losses from changes in the political winds. For context, it is helpful to think of markets as a powerful information-processing machine. The combined impact of millions of investors placing billions of dollars’ worth of trades each day results in market prices that incorporate the aggregate expectations of those investors. This makes outguessing market prices consistently very difficult.¹ While surprises can and do happen in elections, the surprises don’t always lead to clear-cut outcomes for investors.

The 2016 presidential election serves as a recent example of this. There were a variety of opinions about how the election would impact markets, but many articles at the time posited that stocks would fall if Trump were elected.² The day following President Trump’s win, however, the S&P 500 Index closed 1.1% higher. So even if an investor would have correctly predicted the election outcome (which was not apparent in pre-election polling), there is no guarantee that they would have predicted the correct directional move, especially given the narrative at the time.

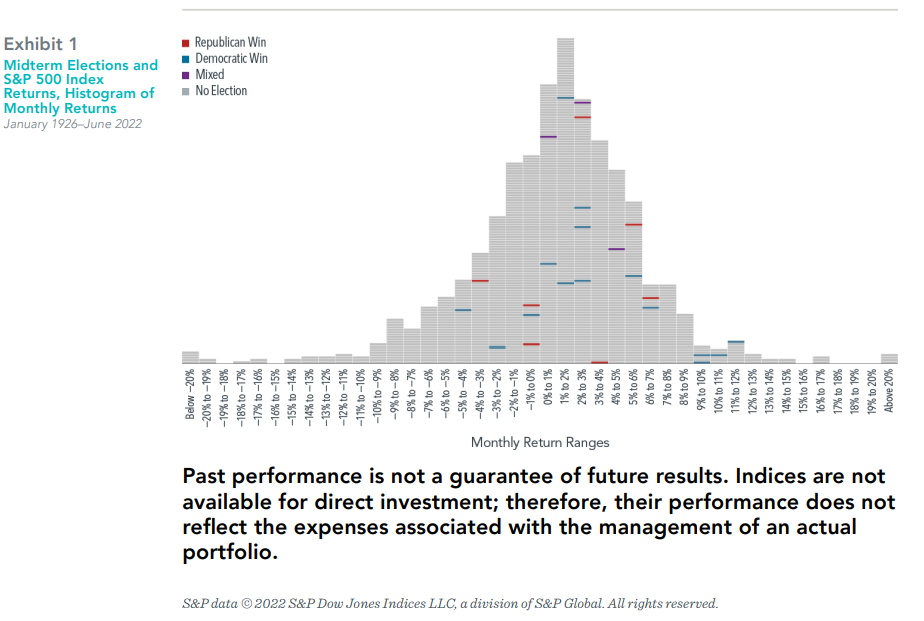

But what about congressional elections? For the upcoming midterms, market strategists and news outlets are still likely to offer opinions on who will win and what impact it will have on markets. However, data for the stock market going back to 1926 shows that returns in months when midterm elections took place did not tend to be that different from returns in any other month.

Exhibit 1 shows the frequency of monthly returns (expressed in 1% increments) for the S&P 500 Index from January 1926–June 2022. Each horizontal dash represents one month, and each vertical bar shows the cumulative number of months for which returns were within a given 1% range (e.g., the tallest bar shows all months where returns were

between 1% and 2%). The blue and red horizontal lines represent months during which a midterm election was held, with red meaning Republicans won or maintained majorities in both chambers of Congress, and blue representing the same for Democrats. Striped boxes indicate mixed control, where one party controls the House of Representatives, and the other controls the Senate, while gray boxes represent non-election months. This graphic illustrates that election month returns were well within the typical range of returns, regardless of which party won the election. Results similarly appeared random when looking at all Congressional elections (midterm and presidential) and for annual returns (both the year of the election and the year after).

In It For The Long Haul

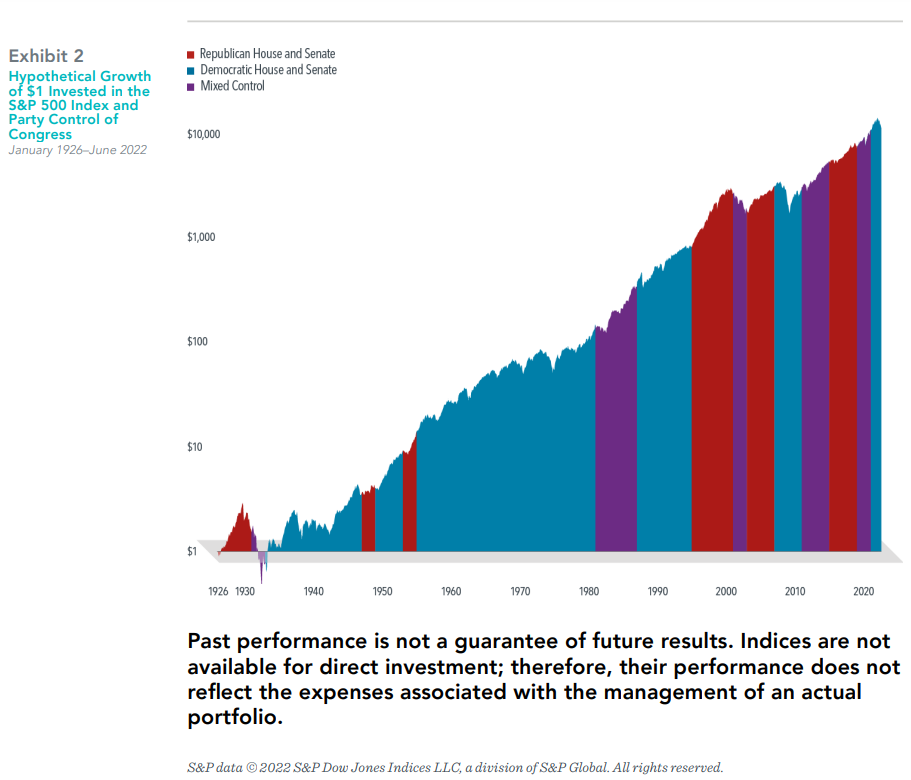

While it can be easy to get distracted by month-to-month or even one-year returns, what really matters for long-term investors is how their wealth grows over longer periods of time. Exhibit 2 shows the hypothetical growth of wealth for an investor who put $1 in the S&P 500 Index in January 1926. Again, the chart lays out party control of Congress over

time. And again, both parties have periods of significant growth and significant declines during their time of majority rule. However, there does not appear to be a pattern of stronger returns when any specific party is in control of Congress, or when there is mixed control for that matter. Markets have historically continued to provide returns over the long run irrespective of (and perhaps for those who are tired of hearing political ads, even in spite of) which party is in power at any given time.

Equity markets can help investors grow their assets, and we believe investing is a long-term endeavor. Trying to make investment decisions based on the outcome of elections is unlikely to result in reliable excess returns for investors. At best, any positive outcome based on such a strategy will likely be the result of random luck. At worst, it can lead to

costly mistakes. Accordingly, there is a strong case for investors to rely on patience and portfolio structure, rather than trying to outguess the market, to pursue investment returns.

- This is known as the efficient market theory, which postulates that market prices reflect the knowledge and expectations of all investors and that any new development is instantaneously priced into a security.

- Examples include: “A Trump win would sink stocks. What about Clinton?” CNN Money, 10/4/16, “What do financial markets think of the 2016 election?” Brookings Institution, 10/21/16, “What Happens to the Markets if Donald Trump Wins?” New York Times, 10/31/16.

In USD. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of

an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss.

There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Investors should

talk to their financial advisor prior to making any investment decision. There is always the risk that an investor may lose money. A long-term

investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an

offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. - This is known as the efficient market theory, which postulates that market prices reflect the knowledge and expectations of all investors and that any new development is instantaneously priced into a security.

-

Social Security Gets Biggest Boost Since 1981

The Cost of Living Adjustment, or COLA, from the Social Security Administration (SSA) is announced every fall and has major implications for the 66 million people who receive benefit checks. With inflation surging, retirees need help maintaining purchasing power. The agency announced its 2023 COLA will be 8.7%, the highest since 1981.

For those concerned about medical costs eating into this increase, Medicare – the health insurance plan for older Americans – said last month it would drop its premiums next year by about 3% for its Medicare Park B Plan.

For more information and context, please read this article from CBS News.

For instructions on how to sign up for a “my Social Security” account with the SSA, which is the fastest way to find out when and how much you will receive, watch the video below:

-

Every Woman Needs Her Own Financial Strategy

Ahead of National Women’s Equality Day on August 26th, this article shares key data points highlighting why women must take a different approach to their financial strategy than men.

Women continue to earn less

Despite an increased presence in the workforce, the average woman working full-time earns $0.82 for every $1 earned by her male counterpart.¹

Women live longer

A man reaching age 65 today can expect to live, on average, until age 84, while a woman the same age can expect to live almost 87 years.² As a result, women generally need to rely on retirement income for a longer span. They also face higher health care costs than men during their retirement years.³

Women are more likely to be single later in life

In 2020, 70% of men age 65 and older were married, compared to just 48% of women.⁴ Single women don’t have the opportunity to capitalize on the resource pooling and economies of scale accompanying a marriage or partnership.

Women are time-starved

In their many roles as workers, wives, mothers, and daughters, women are responsible for more than three-quarters of unpaid domestic work.⁵ This includes housekeeping duties and care-taking responsibilities for children, aging parents or disabled family members.

Women are paying the price for going back to school

American now hold over $1.75 trillion in outstanding student loan debt with women holding almost two-thirds of that debt.⁶

For many women, financial independence is the number one concern. But what steps can a woman take to help her achieve this throughout her life? Here are a few key action steps you can take to help create financial confidence in your retirement years:

1. Keep Money In Your Name

Every woman needs a pot of money to call her own. This means that in addition to joint financial accounts you may have, you should consider keeping some financial accounts in your name only. Also, make sure you maintain an individual credit history. You can do this by holding a credit card or personal loan issued just to you.

2. Confront Your Fears

Are you controlling you money, or is it controlling you? Are your ideas about money and money management keeping you from becoming financially confident? As women increase education levels and continue to take on expanded roles in the workforce, they control more wealth. As a result, traditional views about finances need to be redefined, and women need to face financial decisions head-on.

3. Share the Decisions

If you share finances with someone else, you need to start talking. This way, you’ll know if you share the same goals and dreams for the future, as well as whether you are on track to meet those goals. Also, remember that disagreements are bound to happen; good communication is key to working through those disagreements and getting you back on track financially as a couple.

4. Maintain Access To All Financial Documents

Keep your financial records accessible and easy to gather when you need them. This could include brokerage accounts, insurance policies, retirement plan statements, tax returns and other important documents. Keep a record of who owns each account. Be sure to notify the person responsible for handling your estate where all your documents are and whom to contact in the event of your passing.

5. Pay Yourself First

Fund your IRA, 401(k) or other retirement account to the maximum. This will reduce your taxable income and allow you to benefit from tax-deferred compounding. When you leave a job, working with a Certified Financial Planner™ can help you determine if rolling your 401(k) funds into an IRA is right for you. An IRA account balance can continue to grow tax-deferred, and you will gain the ability to choose from a broader array of investments than what is likely available in your employer’s plan.

6. Choose The Right Financial Professional For You

It’s important to work with a Certified Financial Planner™ you trust. Ask for referrals and interview several to find rapport. Don’t be shy about asking for references, and check their credentials. An experienced Certified Financial Planner™ can help you look for the right solutions at every stage of your life and help you build confidence in your ability to take control of your finances.

7. Put Your Strategy In Writing

Ask your Certified Financial Planner™ to help you create a formal, written, long-term retirement income strategy. A written strategy will provide the framework for defining your financial goals and shaping your decisions. It also will help you set your sights on those goals in the long-term and help you keep on track regardless of economic conditions or unexpected life events.

8. Have A Backup Plan

Speaking of life events, don’t let a critical life change – such as marriage, divorce, widowhood or illness – derail your goals. Your Certified Financial Planner™ can work with you to create a strategy to address the unexpected and keep you moving toward your goals.

9. Understand What You Own

Although working with a Certified Financial Planner™ is vital, you must also know and make sense of the financial products you hold. Educate yourself on basic financial principles by taking classes, reading books or financial trade journals, and doing research.

10. Plan For Your Family’s Future

When planning your estate, you can create a strategy designed to take care of your heirs while optimizing your retirement income. Work with a qualified estate planner and Certified Financial Planner™ to design a strategy for passing on wealth to your loved ones while enjoying the fruits of what you’ve worked hard to earn throughout your lifetime.

Financial independence starts with determining your financial goals and putting in place a strategy designed to help you reach them. By implementing the steps outlined here, you can be well on your way to creating financial confidence for yourself, both now and in your retirement years.

¹ Payscale. March 15, 2022. “The State of the Gender Pay Gap 2022.” https://www.payscale.com/research-and-insights/gender-pay-gap/. Accessed May 17, 2022.

² Social Security Administration. “Important Thins to Consider When Planning for Retirement: What is Your Life Expectancy?” https://www.ssa.gov/benefits/retirement/planner/otherthings.html. Accessed May 17, 2022.

³ RegisteredNusing.org. Dec. 28, 2021. “Here’s How Much Your Healthcare Costs Will Rise as You Age.” https://www.registerednursing.org/articles/healthcare-costs-by-age/. Accessed May 17, 2022.

⁴ Administration for Community Living. May 2021. “2020 Profile of Older Americans.” Page 6. https://acl.gov/sites/default/files/Aging%20and%20Disability%20in%20America/2020ProfileOlderAmerican.Final_.pdf. Accessed May 17, 2022.

⁵ Free Network. Dec. 20, 2021. “Global Gender Gap in Unpaid Care: Why Domestic Work Still Remains a Woman’s Burden.” https://freepolicybriefs.org/2021/12//20/gender-gap-unpaid-care/. Accessed May 17, 2022.

⁶ AAUW. “Deeper in Debt: Women & Student Loans 2021 Update.” https://www.aauw.org/app/uploads/2021/05/Deeper_In_Debt_2021.pdf. Accessed May 17, 2022.

Content provided by Advisors Excel. © 2022 Advisors Excel, LLC