-

Conference Board Leading & Coincident Economic Indicators Pointing to a Recession

The Conference Board was founded in 1916 by a group of CEOs “concerned about the impact of workplace issues on business, and with a desire for greater cooperation and knowledge sharing among businesses.”

Every month, the Conference Board compiles a composite of economic indexes designed to signal peaks and troughs in the business cycle. The leading, coincident, and lagging economic indexes are essentially composite averages of 10 individual indicators and help smooth out some of the volatility of individual components.

The ten components include:

- Average weekly hours, manufacturing

- Average weekly initial claims for unemployment insurance

- Manufacturers’ new orders, consumer goods and materials

- ISM Index of New Orders

- Manufacturers’ new orders, nondefense capital goods excluding aircraft orders

- Building permits, new private housing units

- Stock prices, 500 common stocks

- Leading Credit Index

- Interest rate spread, 10-year Treasury bonds less federal funds

- Average consumer expectations for business conditions

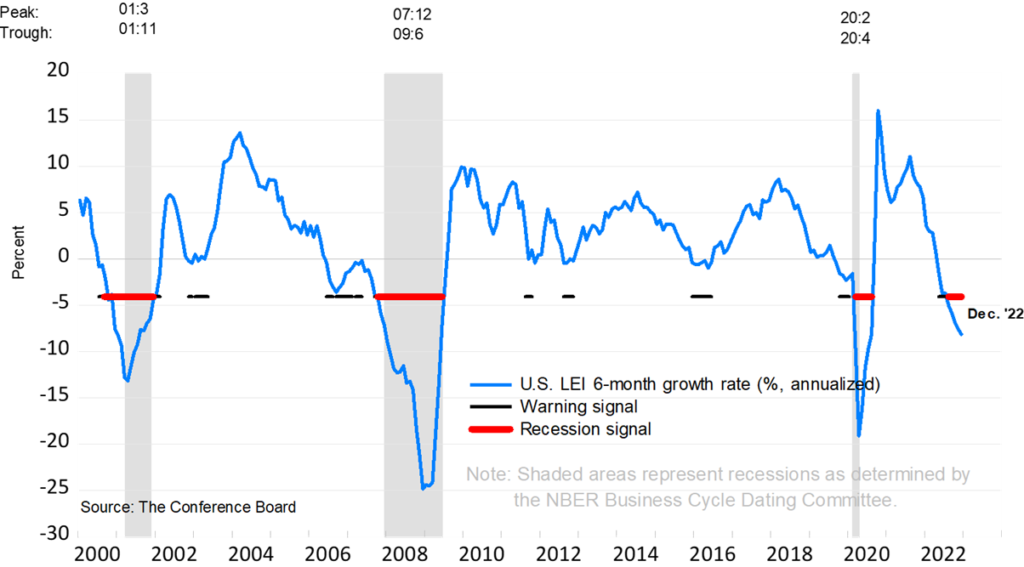

Leading Indicators Signaling a Recession

On January 23rd, the Conference Board announced that its Leading Economic Index for the U.S. decreased by 1.0% in December 2022 to 110.5 (2016=100), following a decline of 1.1% in November.

The LEI is now down 4.2% over the six-month period between June and December 2022 – a much steeper rate of decline than its 1.9% contraction over the previous six-month period (December 2021–June 2022).

“The US LEI fell sharply again in December – continuing to signal recession for the US economy in the near term. There was widespread weakness among leading indicators in December, indicating deteriorating conditions for labor markets, manufacturing, housing construction, and financial markets in the months ahead.

Meanwhile, the coincident economic index (CEI) has not weakened in the same fashion as the LEI because labor market related indicators (employment and personal income) remain robust. Nonetheless, industrial production – also a component of the CEI – fell for the third straight month.

Overall economic activity is likely to turn negative in the coming quarters before picking up again in the final quarter of 2023.”

The trajectory of the US LEI continues to signal a recession

Sources: conference-board.org