-

5 Things You Need To Know To Ride Out A Volatile Stock Market

This article, written by Franklin Distributors, LLC, provides great insight on how to approach today’s investment environment.

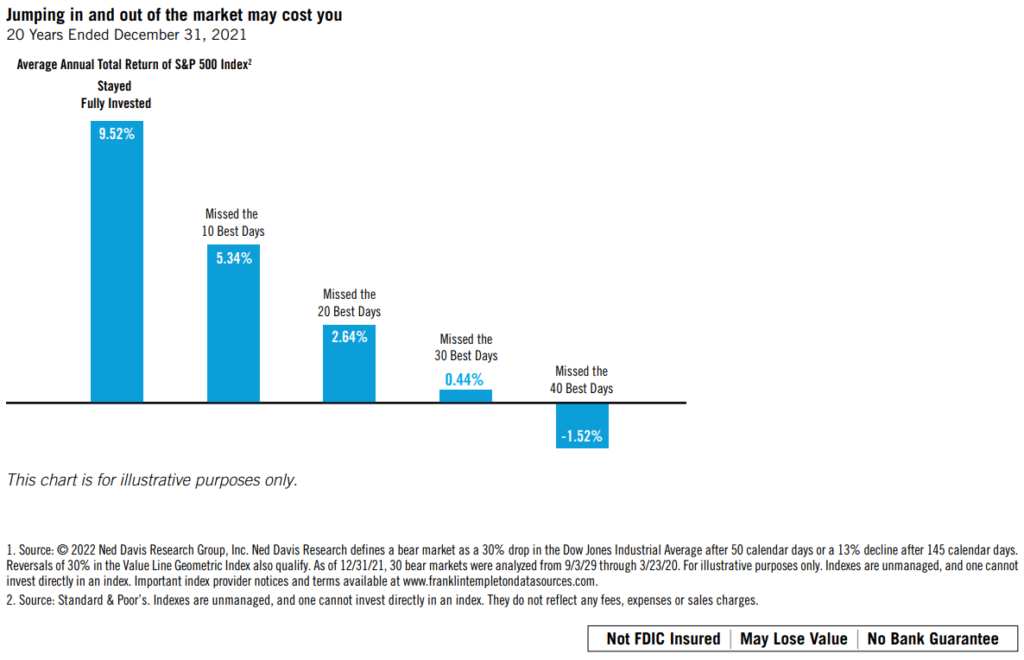

1. Watching from the sidelines may cost you

When markets become volatile, a lot of people try to guess when stocks will bottom out. In the meantime, they often park their investments in cash. But just as many investors are slow to recognize a retreating stock market, many also fail to see an upward trend in the market until after they have missed opportunities for gains. Missing out on these opportunities can take a big bite out of your returns. Consider that on average, for the 12 months following the end of a bear market, a fully invested stock portfolio had an average total return of 38.3%. However, if an investor missed the first six months of the recovery by holding cash, their return would have been only 8.0%¹. The chart below is a hypothetical illustration showing the risk of trying to time the market. By missing just a few of the stock market’s best single-day advances, you could put a real crimp in your potential returns.

2. Dollar-cost averaging makes it easier to cope with volatility

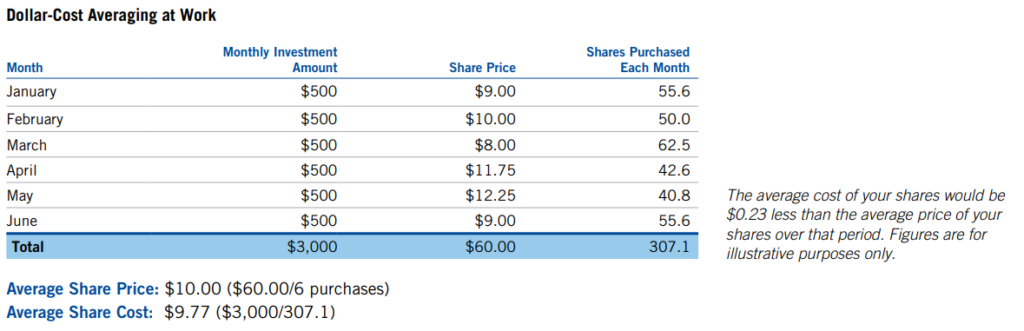

Most people are quick to agree that volatile markets may present buying opportunities for investors with a long-term horizon. But mustering the discipline to make purchases during a volatile market can be difficult. You can’t help wondering, “Is this really the right time to buy?”

Dollar-cost averaging can help reduce anxiety about the investment process. Simply put, dollar-cost averaging is committing a fixed amount of money at regular intervals to an investment. You buy more shares when prices are low and fewer shares when prices are high. And over time, your average cost per share may be less than the average price per share. Dollar-cost averaging involves a continuous, disciplined investment in fund shares, regardless of fluctuating price levels. Investors should consider their financial ability to continue purchases through periods of low price levels or changing economic conditions. Such a plan does not guarantee a profit or eliminate risk, nor does it protect against loss in a declining market.

3. Now may be a great time for a portfolio checkup

Is your portfolio as diversified as you think it is? Meet with your financial professional to find out. Your portfolio’s weightings in different asset classes may shift over time as one investment performs better or worse than another. Together with your financial professional, you can re-examine your portfolio to see if you are properly diversified. You can also determine whether your current portfolio mix is still a suitable match with your goals and risk tolerance.

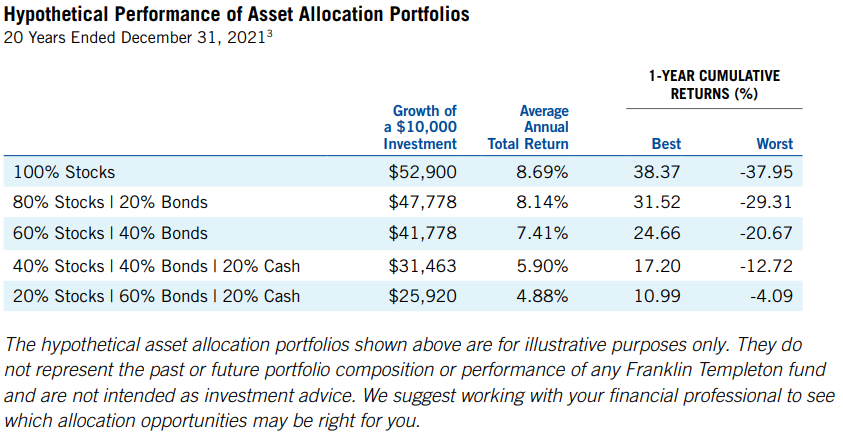

4. Tune out the noise and gain a longer-term perspective

Numerous television stations, websites and social media channels are dedicated to reporting investment news 24 hours a day, seven days a week. What’s more, there are almost too many financial publications to count. While the media provides a valuable service, they typically offer a very short-term outlook. To put your own investment plan in a longer-term perspective and bolster your confidence, you may want to look at how different types of portfolios have performed over time.

- Source: © 2022 Morningstar, Inc., 12/31/21. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results. Stock investments are represented by equal investments in the S&P 500 Index, Russell 2000® Index, and MSCI EAFE Index, representing large U.S. stocks, small U.S. stocks, and foreign stocks, respectively. Bonds are represented by the Bloomberg Barclays U.S. Aggregate Index. Cash equivalents are represented by the FTSE 3-Month U.S. Treasury Bill Index. Portfolios are rebalanced annually. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges.

5. Believe your beliefs and doubt your doubts

There are no real secrets to managing volatility. Most investors already know that the best way to navigate a choppy market is to have a good long-term plan and a well-diversified portfolio. But sticking to these fundamental beliefs is sometimes easier said than done. When put to the test, you sometimes begin doubting your beliefs and believing your

doubts, which can lead to short-term moves that divert you from your long-term goals.To keep a balance perspective, we recommend that you contact your financial professional before making any changes to your portfolio.

-

7 Investment Trends for 2022

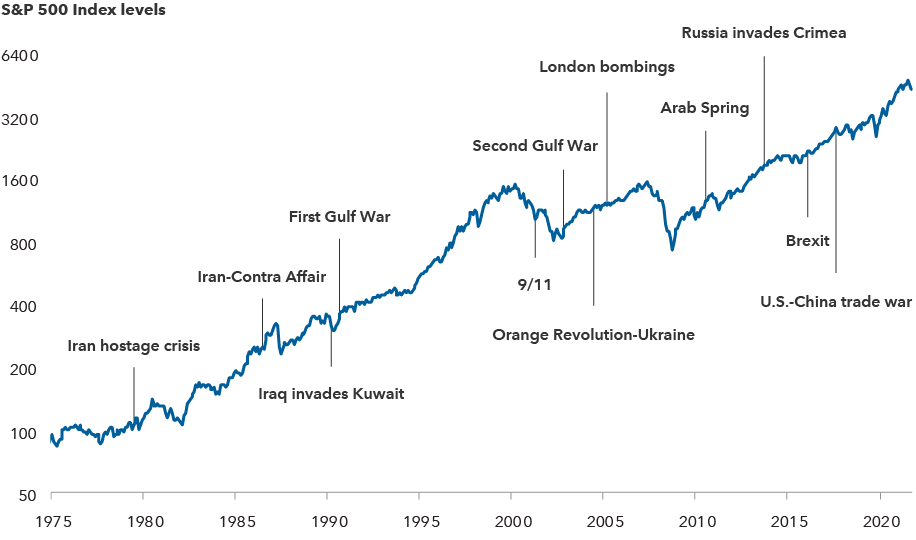

Equity markets have historically powered through geopolitical events

Sources: Capital Group, Refinitiv Datastream, Standard & Poor’s. Index levels reflect price returns, and do not include the impact of dividends. Chart shown on logarithmic scale. As of 2/28/22. Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

It may be easy to feel overwhelmed by news headlines and stock tickers on a daily basis, however, it is important to pause, take a breath, and gain some perspective to the long-term trends that are driving companies and markets. Historically, economic and geopolitical turmoil have not be able to outlast patient, strategic financial planning. In other words, in any market condition, there are always investment opportunities. You just need to know where to look. That is why we have summarized for you a recent article from Capital Group to provide some insights into 7 investment trends for 2022.- Pricing Power – With inflation hitting record levels, investors should be looking at companies that can sustain their profit margins by passing the increased cost of goods sold along to customers. Certain industries have an easier ability to accomplish this. Pharmaceutical and biotech companies like Pfizer and UnitedHealth will always be in high demand. Business with strong brand recognition, like Keurig Dr Pepper and Coca-Cola, carry less risk of losing customers over increased prices.

- Technology – While many consumers are complaining about supply chain issues, chipmakers like Advanced Micro Devices, Samsung, and ST Microelectronics are benefiting from sky-high demand. Many businesses are turning to cloud technology to power their operations, making semiconductors, legacy software, and software-as-a-service (SaaS) one of the fastest growing industries of the last decade. That does not look to be slowing down any time soon.

- The Return of Dividends – During the pandemic, some companies – particularly in Europe – suspended dividends primarily due to political or regulatory pressure. As a result, many of them have surplus capital to redeploy as regular and catch-up dividends. Don’t be so fast to snatch up the highest yields because research conducted by Capital Group shows that since 2007, the highest yielding quintile of stocks had the lowest overall returns. It is still wise to find companies focused on sustained, earnings-based dividend growth over the long-term because it offers a measure of resilience against inflation and interest rate hikes – two events the United States is currently experiencing.

- Healthcare – Although it’s satisfying to refer to the pandemic in past tense, we are not out of the woods yet, which means innovation in health care remains a top priority. The speed at which Pfizer and Moderna developed and deployed their vaccines is an indication of the strength and commitment to discovering new drugs, therapies, and improved diagnostics. According to the Food and Drug Administration, in the last 5 years the FDA has approved, on average, 75% more novel drugs than in the previous nine years. In addition, as technology improves, remote patient monitoring and home diagnostics are becoming part of the continuum of care.

- Transportation – This sector is moving faster in favor of electric vehicles (EVs), due mostly to government incentives and more strict emissions standards for gas-burning cars. Companies are competing for market share with lower prices, better performance, and longer range. The inclusion of software has given vehicles the ability to learn and improve over time through wireless updates. Most exciting (or unnerving, depending on who you ask) is the advancements in the autonomous vehicle industry. Alphabet’s Waymo operates a fully functional robotaxi service in Arizona open to the public. General Motors’ Cruise intends to launch their fully driverless robotaxi service in San Francisco before the end of this year. Self-driving truck startup TuSimple completed an industry first 80-mile autonomous truck ride on public roads with no human in the cab and zero interventions required.

- Media Disruption – The fast-growing segment of the media sector is gaming. Interactive video game companies like Microsoft and Sony are big reasons why this $200 billion industry has surpassed the movie industry in terms of annual gross revenue. In another segment, Netflix continues to get punished by investors for its massive subscriber loss. In Q1, Netflix loss over 200,000 subscribers – the first quarter they have lost subscribers since 2011. For those hoping for a bounce back, the streaming entertainment company anticipates losing 2 million more subscribers in the 2nd quarter!

- Flexible Fixed Income – As mentioned earlier, inflation can lead to increased profits for companies able to pass the additional cost of goods sold to customers. The economy is doing well because more people have jobs and cash they’ve been sitting on throughout the pandemic. Consumer demand is very high and that bodes well for companies with strong balance sheets and a comprehensive growth plan. That is why corporate bonds may be a worthwhile venture and, more specifically, high yield and securitized debt bonds because of their shorter interest duration and the economy’s overall strength.

Don’t allow short-term events around the world derail your financial plan. Focus on your long-term objectives and speak with your Certified Financial Planner to strengthen your portfolio. Perhaps it will result in following one of these trends of 2022.

- Pricing Power – With inflation hitting record levels, investors should be looking at companies that can sustain their profit margins by passing the increased cost of goods sold along to customers. Certain industries have an easier ability to accomplish this. Pharmaceutical and biotech companies like Pfizer and UnitedHealth will always be in high demand. Business with strong brand recognition, like Keurig Dr Pepper and Coca-Cola, carry less risk of losing customers over increased prices.

-

How Annuities React to Rising Interest Rates

On March 16th, the Federal Reserve increased its federal funds rate from 0.25% to 0.50%, the first increase since 2018. This rate matters because it has a ripple effect on every aspect of consumers’ financial lives, from the annual percentage rate (APR) on credit cards to investment returns. While some investments, like bonds, react negatively to an increase in the benchmark interest rate, others thrive – like annuities. Keep in mind, there are hundreds if not thousands of annuities to choose from and they are not for everyone. Make sure to speak to your financial professional before considering adding an annuity to your portfolio.

Different Types of Annuities

- Fixed Annuity – The initial premium invested in a fixed annuity grows at a specific rate of interest for a specific time period. When the Federal Reserve raises its benchmark rate, the interest rate of fixed annuities typically follows suit, which results in better payouts for investors.

- Fixed-Indexed Annuities – Similar to fixed annuities, this investment credits interest as well, however, the yield is calculated based on the performance of a market index, such as the S&P 500. When the interest rate environment inches up, like it is doing now, the growth potential of this investment increases. Akin to fixed annuities, there is no loss of principal – even when the market index it is following loses value.

- Variable Annuities – These investments are more closely tied to equity markets because, traditionally, they hold contract assets in mutual-fund-like subaccounts. In this case, the operative term is “variable” because when equity markets fluctuate, so do the returns of variable annuities. Where the Fed Interest rate becomes important is if the contract owner adds, for a fee, a guaranteed living benefit rider that secures a separate income payout. Rising rates will give insurance companies more flexibility to increase payout rates on living benefits.

What’s Next for the Fed?

Federal Reserve policymakers will meet again in May to decide whether or not to increase the federal funds rate again. Since 2008, the rate has failed to get past 2.50% before tapering back down to zero. Prior to the Great Recession, the rate once approached 20 percent, as shown in the chart below.

With inflation at its highest point in four decades (7.9%), the Federal Reserve is projecting to counter aggressively through seven total rate hikes this year that would reach 2.00%.

If you are considering adding an annuity to your portfolio, an increasing interest rate environment should help bolster the balance sheets of the insurance companies who offer them, resulting in more competitive products with higher crediting rates.

- Fixed Annuity – The initial premium invested in a fixed annuity grows at a specific rate of interest for a specific time period. When the Federal Reserve raises its benchmark rate, the interest rate of fixed annuities typically follows suit, which results in better payouts for investors.