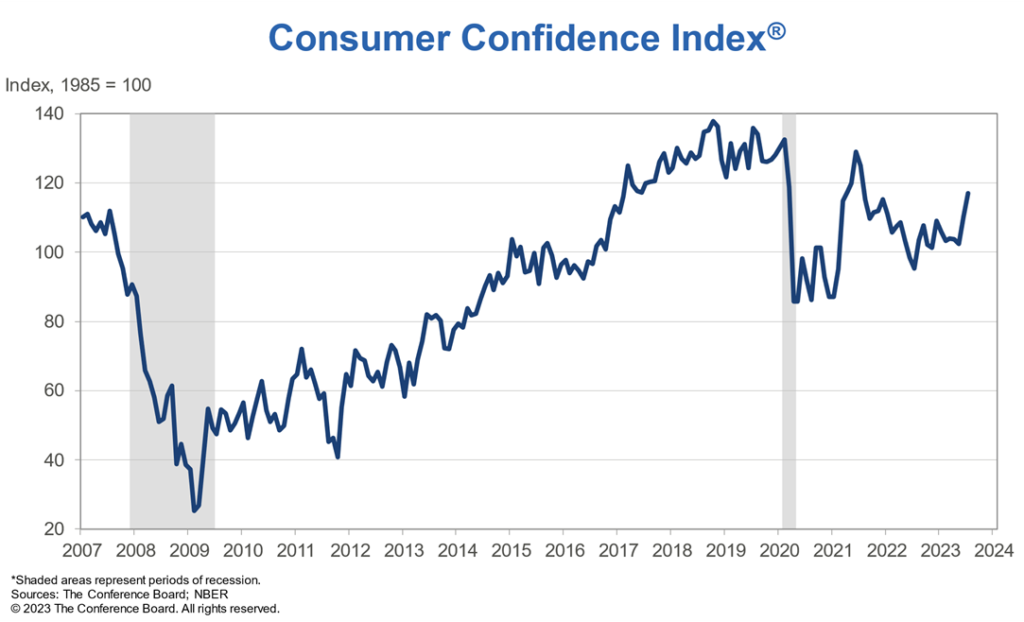

The Consumer Confidence Survey from the Conference Board “reflects prevailing business conditions and likely developments for the months ahead.”

This monthly Consumer Confidence report details consumer attitudes, buying intentions, vacation plans, and consumer expectations for inflation, stock prices, and interest rates. Data are available by age, income, 9 regions, and top 8 states.

On Tuesday, it was announced that the Conference Board Consumer Confidence Index rose again in July to 117.0 (1985=100), up from 110.1 in June.

Further:

- “The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – improved to 160.0 (1985=100) from 155.3 last month.

- The Expectations Index – based on consumers’ short-term outlook for income, business, and labor market conditions – improved to 88.3 (1985=100) from 80.0 in June.

- Importantly, Expectations climbed well above 80 – the level that historically signals a recession within the next year. Despite rising interest rates, consumers are more upbeat, likely reflecting lower inflation and a tight labor market. Although consumers are less convinced of a recession ahead, we still anticipate one likely before year end.

Consumer confidence rose in July 2023 to its highest level since July 2021, reflecting pops in both current conditions and expectations. Headline confidence appears to have broken out of the sideways trend that prevailed for much of the last year. Greater confidence was evident across all age groups, and among both consumers earning incomes less than $50,000 and those making more than $100,000.”

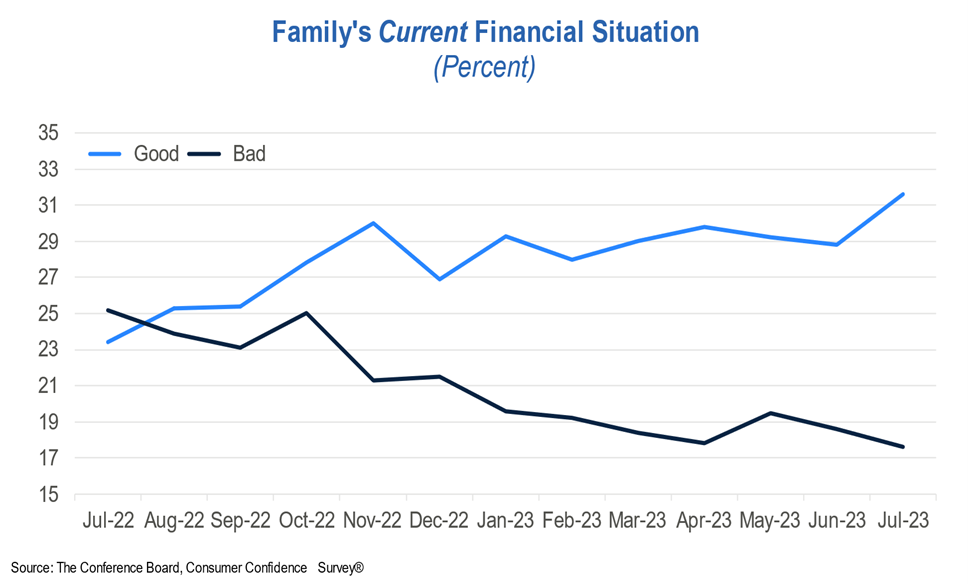

Family’s Current Financial Situation

Consumers’ assessment of their Family’s Current Financial Situation signals still-healthy family finances in July.

- 31.6% of consumers say their current family financial situation is “good,” up from 28.8% in June.

- 17.6% say their current family finances are “bad,” down from 18.6%.

Sources: conference-board.org