-

Conference Board Leading & Coincident Economic Indicators Pointing to a Recession

The Conference Board was founded in 1916 by a group of CEOs “concerned about the impact of workplace issues on business, and with a desire for greater cooperation and knowledge sharing among businesses.”

Every month, the Conference Board compiles a composite of economic indexes designed to signal peaks and troughs in the business cycle. The leading, coincident, and lagging economic indexes are essentially composite averages of 10 individual indicators and help smooth out some of the volatility of individual components.

The ten components include:

- Average weekly hours, manufacturing

- Average weekly initial claims for unemployment insurance

- Manufacturers’ new orders, consumer goods and materials

- ISM Index of New Orders

- Manufacturers’ new orders, nondefense capital goods excluding aircraft orders

- Building permits, new private housing units

- Stock prices, 500 common stocks

- Leading Credit Index

- Interest rate spread, 10-year Treasury bonds less federal funds

- Average consumer expectations for business conditions

Leading Indicators Signaling a Recession

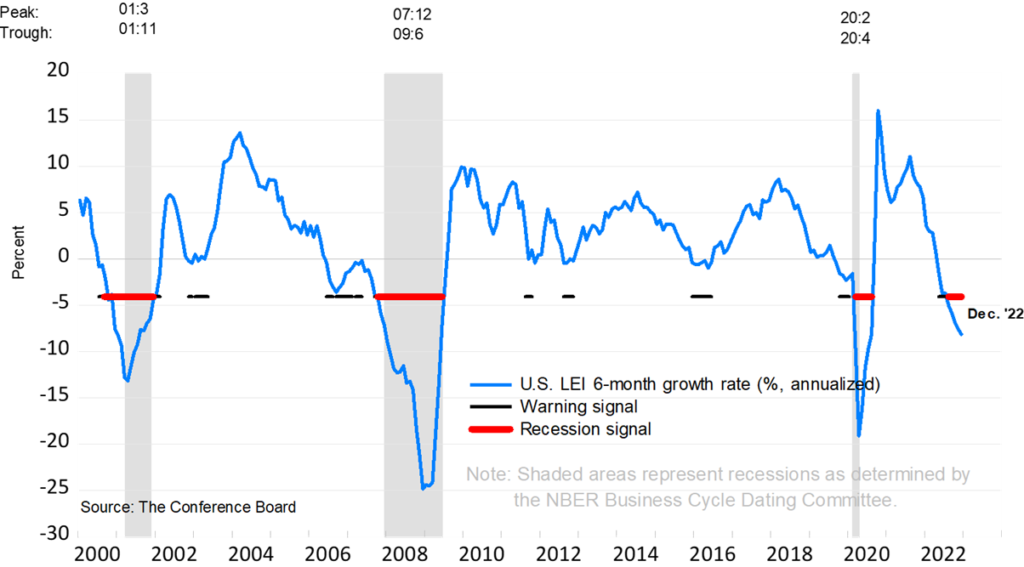

On January 23rd, the Conference Board announced that its Leading Economic Index for the U.S. decreased by 1.0% in December 2022 to 110.5 (2016=100), following a decline of 1.1% in November.

The LEI is now down 4.2% over the six-month period between June and December 2022 – a much steeper rate of decline than its 1.9% contraction over the previous six-month period (December 2021–June 2022).

“The US LEI fell sharply again in December – continuing to signal recession for the US economy in the near term. There was widespread weakness among leading indicators in December, indicating deteriorating conditions for labor markets, manufacturing, housing construction, and financial markets in the months ahead.

Meanwhile, the coincident economic index (CEI) has not weakened in the same fashion as the LEI because labor market related indicators (employment and personal income) remain robust. Nonetheless, industrial production – also a component of the CEI – fell for the third straight month.

Overall economic activity is likely to turn negative in the coming quarters before picking up again in the final quarter of 2023.”

The trajectory of the US LEI continues to signal a recession

Sources: conference-board.org

-

Passing an Inheritance to Your Children: 8 Important Considerations

Choosing to Leave an Inheritance Can Impact Many Other Financial Planning Decisions

If you have worked hard and planned properly, you may be well situated to leave an inheritance to your children. It can feel very meaningful to be able to provide a financial legacy for your loved ones, but it’s important to be practical, too, and to go about your estate planning in the right way. This single decision can impact all of your financial decisions, such as how much you put into savings, the types of retirement accounts you utilize, and your strategy for taking distributions.

Make sure you’ve covered all your estate planning bases by reading through these eight considerations for passing an inheritance to your children.

1. Your Personal Income Needs

Generosity feels good, but it must be wise, too. Don’t make the mistake of giving away more of your retirement savings than you’re truly able to. While the decision to provide for your children can be a very emotional one, it’s important to be financially savvy about it. Determine your own monthly or annual income needs, then use a retirement calculator like this one to help you develop a savings and withdrawal plan.

2. Rising Healthcare Costs

It’s important to remain vigilant about planning to pay for an unexpected illness or injury – and the medical bills that come with them. These costs pose a risk to your retirement and to your heirs’ inheritance, and there’s no good way to predict how much you could need. It’s also risky to rely on government programs like Medicare and Medicaid because they don’t cover everything. One potential option to explore is long-term care insurance. It offers protection for your assets in the event of catastrophic illness. However, policies can be quite expensive and aren’t wise investments for everyone.

3. Outliving Your Nest Egg

One of the most common retiree fears is running out of money in retirement. Make sure you have a plan to manage your savings and withdrawals appropriately so you can avoid depleting your assets while you’re still alive. If your goal in estate planning is to leave an inheritance for your children, the last thing you want is to saddle them with paying your bills as you age.

4. Tax Liability

When you leave an inheritance to your children, consider how best to protect them from significant tax liability. The choices you can make now can help them to enjoy more favorable tax treatment when you’re gone. For example, inherited stocks and mutual funds are eligible for a step-up in basis that could lead to significant savings.

Be mindful, too, about the rules for inheriting IRAs, such as the requirement that non-spousal beneficiaries take full distribution of the amount inherited within ten years. Formerly, heirs could take advantage of a “stretch IRA” that allowed them to stretch distributions over their entire lives. However, the stretch IRA was eliminated by the Setting Every Community Up for Retirement Enhancement (SECURE) Act in 2019. Some exceptions to this remain for a child who is not yet 18, for those who are disabled or chronically ill, and for heirs who are less than ten years younger than the owner of the IRA

SECURE Act 2.0: What It Means For Your Retirement

5. The Advantages of a Trust

Some estate planning tools can allow you more control when you want to leave an inheritance. A trust, for instance, will control distributions on behalf of your estate. This can help you ensure that specific assets pass to the children you designate them to. For this reason, a trust can be particularly useful for blended families where one or both spouses have children from previous relationships.

6. Wise Investment Decisions

You should always choose your investments wisely, whether you hope to leave an inheritance or not. However, if it is your goal to pass inherited assets to your children, then you need to design a portfolio that will last for several generations. You want your investment portfolio to continue to grow, preserve capital, and generate income. You should also do everything you can to avoid dipping into the principal for withdrawals. When you’re estimating the amount that you’ll be able to use to leave an inheritance to your children, don’t neglect to consider both compound interest and inflation.

7. Options for Carrying Out Your Legacy

Estate planning isn’t one-size-fits-all, and there are several options to choose from to leave an inheritance:

Gifts

If you choose to, you can gift assets to your children and allow to make use of your money before you die. If they qualify as annual exclusion gifts, they won’t be subject to the gift tax. This makes them completely tax-free and not subject to IRS filing. This strategy is also advantageous in that you can use a separate annual exclusion for each person to whom you make a gift. While your recipients won’t receive the step-up in cost basis, any capital gains will be taxed at their rate (rather than yours) which may be higher.

Trusts

Trusts are advantageous when you choose to leave an inheritance because they avoid probate, maintain privacy, and protect your heirs’ interests. You can select an individual or a company to act as your trustee to manage distributions according to your wishes. A revocable trust allows you to maintain control of the assets during your lifetime, while an irrevocable trust is treated as a gift that you cannot control or take back into your possession. Examine which type might benefit your estate planning goals.

Deferred Income

Certain retirement accounts, including IRAs and 401(k) plans, defer taxes on capital gains, interest, and dividends until the funds are withdrawn. When they are, they’re taxed as ordinary income. If you believe you will be in a higher tax bracket in retirement than you are in currently, you might look into using a non-deductible IRA. It’s a tool that allows earnings to grow tax-free, and there won’t be any taxes upon withdrawal either.

Life Insurance

Life insurance offers several estate planning benefits if your goal is to leave an inheritance to your children. If you have a policy, your beneficiaries receive the money tax-free. They won’t be required to go through probate, and there are no concerns about market fluctuations impacting the dollar amount. If life insurance is an attractive option for you, you might also consider fixed or variable annuities. They allow you to invest in the stock market through mutual funds, but they also have a life insurance component. Many times, they also carry hidden fees, so be cautious before taking this route. It’s usually best to discuss your options with a trusted financial advisor before you purchase an annuity product.

8. Estate Planning Legal Details

After you determine the mechanics of your estate plan, work with an estate attorney or a financial planner who specialized in estate planning to ensure you have everything in writing. This also gives you a chance to ask questions about beneficiary changes, probate laws in your state, and whether you’ve included all necessary items in your will. You should feel comfortable and confident in the estate plan you’ve created to leave an inheritance to your children, so be diligent and intentional in getting all the information you need from the professional you’re working with.

If you think you would benefit from a conversation about estate planning and how best to leave an inheritance to your children, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-406-5120, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. I have been granted a license in perpetuity to publish this article on my website’s blog and share its contents on social media platforms. I have no right to distribute the articles, or any other content provided to me, or my Firm, by Illuminated Advisors in a printed or otherwise non-digital format. I am not permitted to use the content provided to me or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.

-

The Importance of Having a Business Succession Plan

Regardless of your business, at some point, in order for the business to successfully continue, the owners must decide who will take over future ownership of the business in the event of the retirement, disability, or death of current ownership. This video serves as a primer for making the decision as to whom will become the heir apparent.

-

Social Security Gets Biggest Boost Since 1981

The Cost of Living Adjustment, or COLA, from the Social Security Administration (SSA) is announced every fall and has major implications for the 66 million people who receive benefit checks. With inflation surging, retirees need help maintaining purchasing power. The agency announced its 2023 COLA will be 8.7%, the highest since 1981.

For those concerned about medical costs eating into this increase, Medicare – the health insurance plan for older Americans – said last month it would drop its premiums next year by about 3% for its Medicare Park B Plan.

For more information and context, please read this article from CBS News.

For instructions on how to sign up for a “my Social Security” account with the SSA, which is the fastest way to find out when and how much you will receive, watch the video below:

-

Five Charitable Giving Strategies that Come with Tax Advantages

Enjoy the Financial Benefits of Your Philanthropic Efforts

Charitable giving tax advantages are probably not the first thing on your mind when you decide to make a philanthropic gift. After all, deciding to give to an organization or cause that you care about is a personal decision reflective of your values, passions, and hopes for the future. Your philanthropy helps those in need, and maybe even satisfies something deep in your soul. However, those are not the only benefits. When you use the right charitable giving strategies, you can also minimize your tax burden. Below, we’ll discuss five such strategies to help you maximize the positive benefits of your giving.

1. Whenever possible, itemize.

In 2017, Congress passed the Tax Cuts and Jobs Act (TCJA), which almost doubled the standard deduction you’re allowed to take on your taxes due to charitable giving. Now, you can deduct cash gifts you make throughout the year, up to 60% of your adjusted gross income. Despite this increase, or perhaps because of it, less than 10% of taxpayers are itemizing their deductions now. If you’re among the majority failing to itemize your deductions, you may be missing out on some of the advantageous tax benefits that your philanthropy makes possible.

While itemizing your charitable giving can be a smart tax strategy, it’s not necessarily the right move for everyone. To determine if itemizing is right for you, you’ll want to first add up the total of your allowable deductions. This should include deductions such as any mortgage interest and property, state, and local income tax. You’ll then want to consider what the standard deduction for that tax year is. (See 2022 standard deductions here.) If your total amount of deductions are greater than the standard deduction, then itemizing is likely the right move for you.

2. Bunch your gifts.

If you’re committed to giving back on an annual basis, one of the charitable giving tax advantages you may benefit from is bunching your donations. Bunching is when you prefund your charitable gifts into one tax year rather than spreading them out among multiple years. This is typically done by donating appreciated securities or by putting your gifts into a donor-advised fund (more on this below). By doing so, you’re able to make your itemized deductions exceed the standard deduction threshold, and ultimately, minimize your tax bill for the current year.

3. Think “out of the box” with your charitable giving.

While giving cash is great, there are ways that you can give to charities you love outside of simply writing them a check. A great way to give back while also being tax-savvy is to give stocks, bonds, or other appreciated securities directly to the charity. By gifting an appreciated stock directly, rather than selling it for a profit, both you and the charity will be able to avoid capital gains tax on the appreciation. What’s more? You may be eligible to receive a tax deduction equal to the fair market value of the shares you donate. So, you’ll be able to maximize your impact while also enjoying significant tax advantages.

4. Create a donor-advised fund.

Establishing a donor-advised fund (DAF) is another tax-savvy way to give back – and not just where bunching gifts is concerned, as mentioned above. DAFs are personal charitable investment accounts that you can fund with assets such as cash, stocks, or bonds. With a DAF, you get to strategize how you want your gifted (but not yet granted) dollars to be invested, and from there you can recommend when you wish for the money to be given to any qualified charitable organization you choose, on a timetable that works with your financial plans. As your money sits in a DAF, the funds are invested and, therefore, growing tax-free, which may allow you to give even more money to causes you’re passionate about.

Related Article: Financial Goal-Setting Tips to Help Achieve Your Money Goals

5. Gift your Required Minimum Distribution.

At the age of 72, you’re required to begin taking Required Minimum Distributions (RMDs) from your retirement accounts, whether you need the additional income or not. Typically, when this is done, you are then required to pay income tax on these distributions. However, if you gift your distribution to a charity instead, the IRS allows the distribution to remain tax-free. So, if you don’t need your RMD to support your lifestyle, you may want to consider donating some or all of it to a qualified non-profit instead.

Gifting your RMD should be considered as one of your charitable giving strategies when possible because it allows you to accomplish four things: satisfying your RMD requirement, supporting a charity that you care about, avoiding having to pay the taxes that come with your distribution, and mitigating the risk that your distribution may have pushed you into a higher tax bracket.

Are You Maximizing Your Charitable Giving Tax Deductions?

Philanthropy is a meaningful way to enrich lives – both your own and those that are impacted by the charities you choose to support. Giving back not only helps to immediately address critical needs in your local community and across the globe, but it creates ripple effects for the future, too. By giving yourself, you can inspire those around you to take up philanthropy and make a difference, too. While there’s no “one size fits all” charitable giving strategy to accomplish this, there are a plethora of ways that you can choose to give back while also personally benefitting from charitable giving tax advantages.

If seeking to create impact beyond yourself is a priority for you, contact Lane Hipple Wealth Management Group at our Moorestown, NJ office by calling 856-638-1855, emailing info@lanehipple.com, or to schedule a complimentary discovery call, use this link to find a convenient time.

Illuminated Advisors is the original creator of the content shared herein. We have been granted a license in perpetuity to publish this article on our website’s blog and share its contents on social media platforms. We have no right to distribute the articles, or any other content provided to our Firm, by Illuminated Advisors in a printed or otherwise non-digital format. We are not permitted to use the content provided to us or my firm by Illuminated Advisors in videos, audio publications, or in books of any kind.