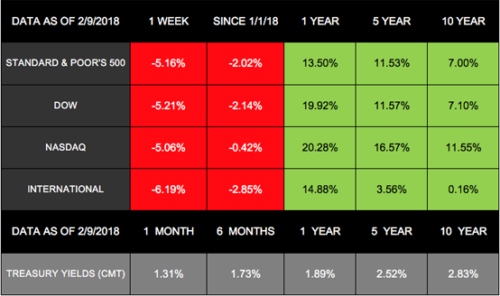

After months of relative calm, market fluctuations are causing many investors to wonder what is happening to the economy. Last week, the S&P 500 lost 5.16%, the Dow dropped 5.21%, and the NASDAQ declined 5.06%. The MSCI EAFE also gave back 6.19%. These losses pushed all four indexes into negative territory for the year.[1] In addition, the weekly performance included significant volatility, as stocks had large fluctuations both within days and from one day to the next. The Dow, for example, lost over 1,000 points twice during the week—and also twice gained over 300 points.[2]

During times like these, viewing events in their proper context is imperative. This week, we are going beyond our typical market update in an effort to provide you with clarity and perspective.

Our Analysis of the Recent Market Turbulence

The markets started 2018 with the wind in their sails, and investors watched as indexes continued their nearly straight-up trajectory from 2017. Then, after the S&P 500’s best January performance since 1997, stocks took a dive at the beginning of February.[3] On Monday, February 5, the Dow and S&P 500 each lost more than 4%, and the NASDAQ’s drop was nearly as significant.[4] The next day, all 3 indexes posted positive returns.[5] The volatility continued throughout the week. On Friday, February 9, the indexes recovered some of their losses, but each still ended the week down more than 5%.[6]

We understand how unnerving these fluctuations can feel—especially as headlines shout fear-inducing statistics. Our goal is to help you better understand where the markets stand today and how to apply this knowledge to your own financial life.

Putting Performance Into Perspective

When markets post dramatic losses or whipsaw back and forth, many people wonder what causes the turbulence and may assume negative financial data is to blame. However, the recent selloff and volatility don’t have the culprits you might expect.

No negative economic update or geopolitical drama emerged to spur the selloff February 5–6. Instead, emotion-driven investing may have combined with computer-generated trading to fuel the decline. In particular, after the latest labor report showed wage growth picking up more than expected, some investors began to worry about increasing inflation.[7] Higher wages can mean companies have to raise their prices to support their labor costs, a cycle that can cause inflation to grow.[8]

While concerns about inflation and interest rates may be to blame for the market fluctuations, it may not be the only detail to focus on. Another key point is important to remember as an investor: Volatility is normal.

Volatility Facts

Knowing Where to Go From Here

Over short periods of time, the market trades on fear, anxiety, greed, and emotion. Over the long term, however, economic fundamentals drive the markets.

Thankfully, a variety of data indicates that the economy continues to grow:

- Labor Market: The economy added 200,000 new jobs in January and beat expectations. Average hourly wages also increased, bringing 2.9% growth in the past 12 months—the largest rise since 2008–2009.[17]

- Corporate Earnings: The majority of S&P 500 companies who have reported their 4th quarter results have beaten their earnings estimates.[18]

- Service Sector: The latest reading of the ISM Non-Manufacturing Index (which tracks performance and expectations for service-sector businesses) hit its best level since 2005.[19]

- Consumers: The most recent data indicates that personal income and spending are on the rise.[20]

As investors try to determine whether inflation is on the rise and higher interest rates are imminent, volatility could continue. After last year’s smooth sailing in the markets, these fluctuations may feel harder to withstand. The reality is that equities don’t move in a straight line.

Even if volatility is here to stay, we know that price changes can provide new market opportunities. We agree with the economists at First Trust who assert that, “More economic growth will ultimately be a tailwind for equities, not a headwind.”[21]

We encourage you to focus on your long-term goals, rather than short-term fluctuations. As you do, avoid allowing emotions to derail your plans. We also want you to feel comfortable in your financial journey. If your thoughts on risk have changed, call us so we can help you find the best path forward.

As always, we are here to provide you with clarity, perspective, and support during every market environment. Thank you for the confidence you place in our abilities. We consider it a privilege to be good stewards of the assets you entrust to our care.

ECONOMIC CALENDAR

Monday: Treasury Budget

Wednesday: Consumer Price Index, Retail Sales

Thursday: Jobless Claims, Industrial Production, Housing Market Index

Friday: Housing Starts, Import and Export Prices, Consumer Sentiment

Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5-year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

“If we command our wealth, we shall be rich and free.

If our wealth commands us, we are poor indeed.”

–Edmund Burke

Lemony Salmon Piccata

Serves 4

Ingredients:

4 (6-oz) skinless salmon fillets

½ teaspoon coarse salt

½ teaspoon pepper

3 tablespoons all-purpose flour

2 tablespoons olive oil

3 garlic cloves, minced

¼ cup dry white wine, such as sauvignon blanc

¼ cup lemon juice (from about 2 lemons), plus lemon slices for garnish

2 tablespoons rinsed and drained capers

2 tablespoons chopped parsley

2 teaspoons unsalted butter

Directions:

- Season the salmon with the salt and pepper.

- Coat the salmon with the flour in a shallow bowl. Shake off excess.

- Heat the olive oil at medium-high in a large cast iron or nonstick skillet.

- Cook the salmon for about 2 minutes until golden, turning once.

- Lower the heat to medium. Add garlic and cook for about another minute.

- Add the wine, lemon juice, capers, and parsley and let simmer 5-6 minutes on medium-low heat until fish fillets are cooked through.

- Add butter after removing the pan from the heat. Stir for about 30 seconds until the butter is melted.

- Garnish with the lemon slices and add the sauce.

Recipe adapted from Good Housekeeping[22]

Is The IRS Knocking on My Door?

“Knock, knock.”

“Who’s there?”

“An IRS agent.”

It may sound like a joke, but the IRS warns taxpayers of potential scammers posing as representatives of the taxing agency in person, on the phone, and by email.

Before opening the door, first read these 5 facts about how or when the IRS makes in-person contacts.

- The agency initiates most of its taxpayer contacts by regular mail.

- The IRS will only visit your home or business when you have an overdue tax bill, when the agency must secure a delinquent tax return or employment tax payment, to tour a business as part of an audit, or to conduct a criminal investigation.

- IRS revenue officers carry 2 forms of identification with serial numbers.

- Private collection agencies contracted by the IRS to collect a debt will never visit your home or business.

- The IRS will not ask you to make payments to anyone except the U.S. Department of Treasury.

If you believe you’ve been visited by someone impersonating an IRS agent, visit IRS.gov for information about reporting the incident.

*This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Adapted from IRS.gov[23]

Fixing Your Golf Swing

It’s the single most important part of golf: the swing. Besides learning to hold a club, it’s the first lesson you learned about the game. But occasionally something goes awry—even among seasoned players.

It may be minor or something so outrageous as missing the ball altogether. How do you fix your swing?

Here are 2 ways to get you back into the swing of things:

First things first: Golfers occasionally make adjustments over time to develop power, to add more distance, or to achieve other game goals. While the changes may feel subtle and produce other desirable gains, other parts of your game begin to deteriorate, sometimes very slowly. You change your shoulder positioning, for example, to gain lift or to obtain some other objective.

What should you do to regain that initial finesse? Go back to square 1. Do what you did in the beginning; return to the same parallel-shoulder-to-target-line stance you learned at first.

Get a grip: How are you holding your club? If you’re squeezing your club too tightly, you’re going to lose the club release or not produce adequate club speed. Pros recommend holding the club at a force of 4 out of 10 with 10 being the strongest.

Restoring your game to full potential (or its former luster) can be as easy as returning to the basics and adopting a few simple techniques.

Adapted from Golfweek[24]

The Scoop on Food Poisoning

Jean Anthelme Brillat-Savarin is credited with saying: “You are what you eat.” But the 19th century French physician’s observation provides little comfort when you find yourself suffering from food poisoning.

More than 3 million Americans suffer from food poisoning every year, which is considered an extremely common ailment. Symptoms vary from mild intestinal discomfort to severe dehydration and bloody diarrhea. Treatment involves drinking plenty of fluids and close monitoring of symptoms.

Stay away from sports drinks, fruit juices, and soda, which have too much sugar and lack adequate electrolyte levels.

Medical authorities recommend returning to your normal diet when you’re able to tolerate solid foods, which will help restore adequate nutrition levels.

Tips adapted from WebMD[25]

Go Green at Home and on the Road

Becoming conservation minded doesn’t necessarily mean buying an electric car or riding a bicycle everywhere. But a few simple steps can save you thousands of dollars and help preserve the environment.

Here are some environmentally friendly tips you can take to the open road:

- Buy or rent a home or apartment within walking or biking distance to your work, stores, and restaurants.

- Use public transportation when available.

- Join a carpool. You can even coordinate carpooling with nearby businesses.

- See if car sharing is an option that would work for you.

- If you do buy a car, go with a very fuel-efficient and low-emission one.

- Fill up your car during evenings to reduce pollution levels.

- Combine and map errands for the shortest route.

- Keep your tires properly inflated.

- Maintain timely vehicle maintenance.

- If you own 2 cars, use the one with the best gas mileage more frequently.

A few minor lifestyle adjustments can make all the difference in the world. Literally.

Tip adapted from Global Stewards[26]

Share the Wealth of Knowledge!

Please share this market update with family, friends, or colleagues.

We love being introduced!